Justin Sullivan

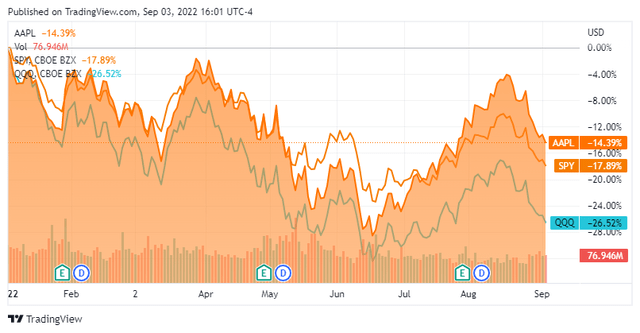

Wednesday’s Apple (NASDAQ:AAPL) event will occur at 10 a.m. Pacific, 1 p.m. Eastern. AAPL fans are expected to receive a new iPhone, Apple Watch, and AirPods. AAPL has traditionally introduced updated product lines at the September and October events, which starts its fiscal year out strong as Q1 revenue across the holiday season surges. Q1 revenue for AAPL has increased considerably YoY, and with technology being front and center in 2022, many individuals are ready to devour the latest and greatest technology. If the rumor mill is correct, Q1 2023 could easily top Q1 2022 revenue, setting the stage for another record-breaking year across the board in 2023 for AAPL. It’s almost a given at this point that AAPL will continue buying back shares each quarter, and as the topline grows, we could see substantial growth in EPS. AAPL is well off its 52-week lows of $129.04 and has held up better than the S&P and Nasdaq throughout 2022’s volatility. A refreshed product line may be just what AAPL needs to drive revenue and EPS higher in 2023.

Seeking Alpha

What AAPL has announced in 2022 and what’s speculated to be announced at the event

AAPL has hosted two events in 2022, one on March 8 and another on June 6. In March, AAPL announced a new Mac Studio, Studio Display, iPad Air, iPhone SE, and 2 new shades of green for the iPhone 13 and 13 Pro. At the June event, AAPL announced the new MacBook Air, 13-inch MacBook Pro, IOS 16, IPadOS 16, macOS Ventura, and watchOS 9. Going back to 2021, at the September event, AAPL introduced iPhone 13 Pro, iPhone 13m Apple Watch Series 7, and a new iPad mini, and iPad. To follow up the September 2021 event, AAPL delivered a new MacBook Pro with M1 Pro or M1 Max chips, new AirPods, and a HomePod mini just in time for the holidays.

The rumor mill has been working overtime going into the event as AAPL is projected to announce its iPhone 14, iPhone 14 Pro, Apple Watch Series 8, an Apple Watch Pro, and AirPods Pro 2. The iPhone 14 is projected to have a $799 starting price and be similar to the 13 with the same A15 chip, but it’s rumored to have an updated camera, 5G modem, and antenna system. The higher-tier iPhone 14 Pro and Max are expected to incorporate more significant changes than the base model. While the overall design is expected to remain, the Pro and Max versions are projected to have a faster A16 chip, updated 5G modem and antenna system, a 48-megapixel wide lens that supports 8K video recording, an upgraded front camera, and up to 2TB of storage.

The Apple Watch Series 8 is expected to receive an update that focuses on new features such as temperature sensing. The design will remain the same, and it will come in 41 and 45-mm sizes. There’s also projected to be an S8 chip compared to an S7 in the previous model. The Apple Watch Pro version is expected to be a refresh of the SE with an updated design with the possibility of a flat display but no flat edges. Durability will be a priority with a more durable titanium alloy casing and a shatter-resistant display. The display will be larger with a two-inch diagonal screen that provides 7% additional display area and a 410×502 resolution. There is also projected to be a new battery that could run for multiple days in low power mode.

The AirPods Pro 2 is rumored to have the same general design as the current Pro version, but there are some added features. AAPL will have improved the find my integration, and the charging cases are expected to have speaker holes that can play sounds when it’s lost. There’s an updated H1 chip with self-adaptive noise cancellation capabilities and AirPods 3 acoustics for improved sound.

The impacts of a growing product line and what it can mean for Apple for the 2023 Fiscal Year

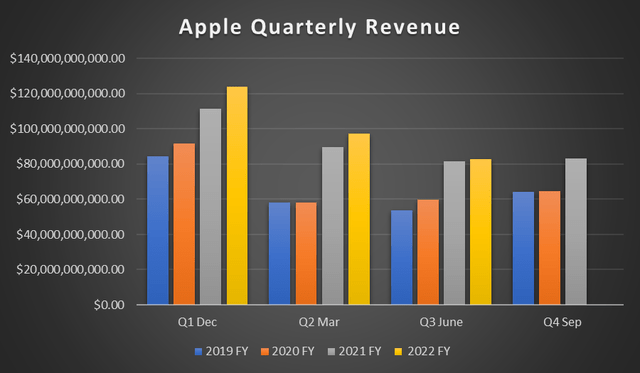

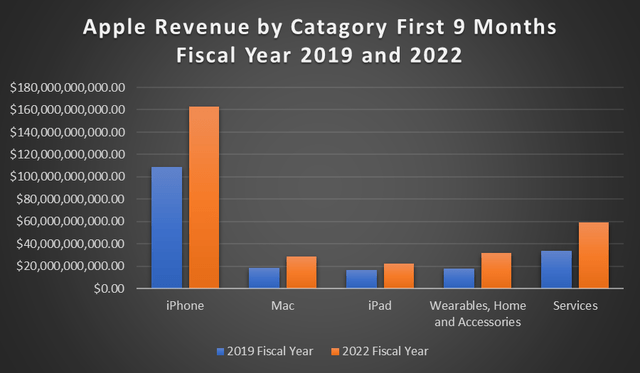

The days of AAPL being a one-trick pony are long gone as AAPL continues to diversify its revenue mix. While iPhone still represents 53.41% of AAPL’s total revenue in the first three quarters of 2022’s fiscal year, it’s slowly declining from the 63.21% it represented in the first nine months of 2018. AAPL’s Q4 and 2022 fiscal year ends 9/30, and we roll right into the holiday season, AAPL’s strongest quarter spanning Oct. 1 through Dec. 31. This year, AAPL’s revenue in Q1 grew 11.22% ($12.51 billion) YoY compared to 2021, and in 2021 Q1’s revenue grew 21.37% ($19.62 billion) YoY compared to 2020. Each year AAPL delivers new products for the holidays, and in recent years, the elevated levels of revenue have continued in the following quarters.

Steven Fiorillo, Apple

AAPL’s largest growth has come from the Services and the Wearables, Home, and Accessories segments regarding AAPL’s revenue. In the first nine months of the fiscal year Wearables, Home and Accessories have grown by 75.88% ($13.63 billion), while Services have grown by 74.48% ($58.94 billion) from 2019 to 2022. In 2019 it would have seemed as if everyone had a smartphone, yet iPhone revenue grew 49.29% ($53.84 billion) over the next three fiscal years. Mac and iPad revenue has seen the least amount of growth from a dollar perspective, as their combined growth from 2019 – 2022 has been $15.41 billion, which is $1.79 billion more than wearables (13.1%).

Steven Fiorillo, Apple

The question becomes, what does a new product line do for AAPL’s top and bottom line in 2023? Previous history suggests we will see overall revenue growth. When more iPhone, Mac, iPad, and Wearable products sell, it correlates to growth in services which is the reoccurring revenue. I think a product refresh will only create additional momentum across Services, and if the new watch is more durable, it could become attractive to additional athletic segments.

Steven Fiorillo, Apple

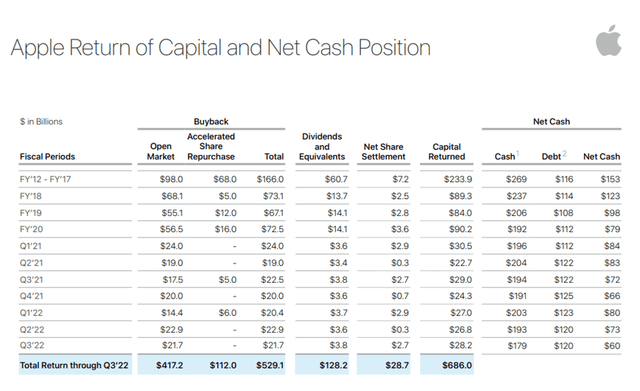

Regardless of what the market values shares of AAPL at, Tim Cook continues to buy back shares. There has never been a company as shareholder-friendly as AAPL. Since 2012, AAPL has returned $686 billion back to shareholders through buybacks and dividends. In Q3 alone, AAPL repurchased $21.7 billion worth of shares on the open market. Throughout Q3, there were 62 trading days, meaning that AAPL purchased the equivalent of $350 million worth of AAPL shares daily. In 2022 AAPL has already returned $82 billion back to shareholders through buybacks and dividends.

Apple

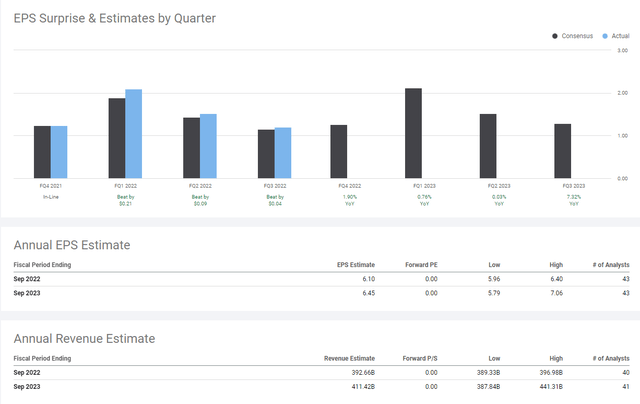

AAPL has continued its tradition of meeting or exceeding the street’s expectations on a quarterly basis. The street is expecting AAPL’s revenue to come in at $411.42 billion in the fiscal year 2023, with a YoY earnings increase each quarter. In 2021 AAPL generated $365.58 billion of revenue and $94.68 billion in earnings from operations which was a 25.88% earnings margin. In the TTM, AAPL has generated 387.54 billion of revenue and $99.63 billion in earnings from operations which is a similar earnings margin of 25.71%. If AAPL finishes 2022 with $392.66 billion in revenue, its current 25.71% margin will place its annual earnings from operations at $100.95 billion.

I think every year’s product refresh is equally important as AAPL makes it harder for competitors to convert its customer base. This year’s product launch sets the stage for AAPL’s first $400 billion revenue year in 2023. If AAPL can grow the top line to $411.42, as the analyst consensus suggests, while buying back shares at its current rate, we could see its 2023 earnings from operations exceed $105 billion and drive EPS higher every quarter.

Seeking Alpha

Conclusion

I’m interested to see what Tim Cook says at the event. I am not just interested in the rumored product refreshes, but I want to see if any clues are provided as to autonomous vehicles, AR, and VR. I still believe there’s never a bad time to purchase shares of AAPL if you’re a long-term investor. AAPL is the largest holding within most S&P index funds and the Invesco QQQ ETF (QQQ) at 13.29%. As money flows into retirement accounts every two weeks and shares of target date or index funds are purchased, a substantial amount of that capital flows toward AAPL. I think AAPL will lead the market higher in 2023, and the combination of $400 billion in annual revenue and over $100 billion in earnings from operations should provide top and bottom beats throughout 2023 and push shares higher.

Be the first to comment