Leestat

The flow of Russian natural gas via the Nord Stream 1 pipeline has been shut down indefinitely. Russian officials have stated that the gas flows will not resume unless all western sanctions against Russia are lifted and/or Nord Stream 2 is activated.

For purposes of this article we take as our base case scenario that gas flows will not resume during the remainder of the 2022-2023 winter season, if ever. What does this mean for global investors, including US-based investors?

In this article, I provide key facts, review important estimates and offer my own insights on what investors should expect going forward. Although the breadth of relevant subjects covered in this article is extensive, the coverage of each topic has been kept as succinct as possible.

How Critical is the Situation in Germany?

In this section of the report we look at the specific impact of the shutdown of the Nord Stream shut down on Germany’s economy, with particular emphasis on Germany’s manufacturing sector.

1. Natural gas storage levels in Germany are currently fairly high, at roughly 83% of capacity. However, this represents only about 2.0 months of consumption. Without further flows from Russia, and assuming a normal winter, Germany faces severe natural gas shortages.

2. What is the extent of the shortfall expected? Assuming a normal winter, it is estimated by Econtribute that natural gas consumption must forcibly or voluntarily fall by approximately 25% during the winter months, relative to “normal” levels of consumption.

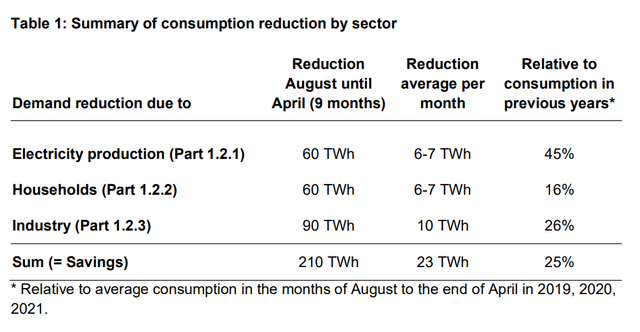

German Natural Gas: Necessary Reductions in Consumption (Econtribute)

3. As can be appreciated in the table above, German industry will be forced to curtail its direct consumption of natural gas by approximately 26%. Furthermore, electricity production is expected to decline significantly due to the need to cut natural gas consumption by electricity producers by roughly 46%. This means that German industry will also ultimately be forced to cut direct electricity consumption. The upshot of this is that overall industrial consumption of energy in Germany will be significantly curtailed through combination of price-induced demand destruction and government mandated rationing.

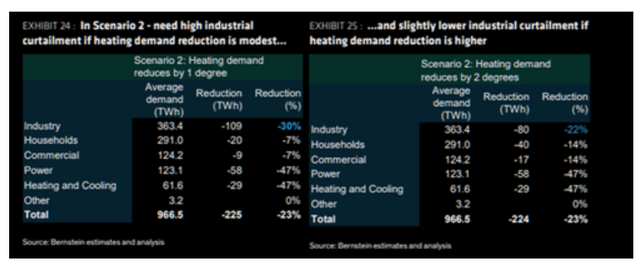

4. According to estimates by Bernstein, under their base case scenario (which assumes average winter temperatures), total gas demand by German industry needs to be cut by 23% — only slightly less of a cut than the above estimate by Econtribute. Under Bernstein’s base-case scenario, a 30% cut in demand from industry will be required — assuming a base-case -7% reduction in demand from households. This base-case scenario assumes a 1 degree Celsius temperature cut by households during winter. Under a scenario in which households sustain a drop of 2 degrees Celsius, a cut of -22% in demand from industry will be required. Either way, the projected cut in industrial consumption of energy – and hence the contraction in industrial production itself – can be expected to be severe.

Scenarios for European industrial curtailments. (Bernstein)

5. The German economy is highly dependent on its manufacturing sector. The value added of the German manufacturing sector represents roughly 18%-20% of GDP. This is almost twice the similar figure in the US. We estimate that the direct and indirect (upstream and downstream) impact of manufacturing on the overall German economy is probably no less than 40%. Therefore, as a result of the contraction in manufacturing activity, the German economy is likely to experience a very severe contraction in its overall economy (estimates below).

6. The German economy will simultaneously be hard hit from the supply side and demand side. On the supply side, production will be severely curtailed, as explained above. On the demand side, consumers’ available funds for non- energy consumption will decline. Furthermore, consumers may cut consumption of non-energy goods above and beyond the increase in energy expenditure, as the marginal propensity to consume declines and precautionary saving behavior rises.

7. Energy cannot be “printed” into existence via monetary and/or fiscal policy. Therefore, there is little the German government can do to alleviate the problems on the supply side, caused by the energy crisis. On the demand-side, the government will attempt to boost consumption of non-energy goods via various forms of fiscal and monetary stimulus. However, subsidizing consumers with printed money at the same time that the production of goods is being curtailed risks stoking inflation.

How Critical is the Situation in the Rest of Europe?

In this section we look at how the energy crisis is impacting the rest of Europe.

1. Outside of Germany, the rest of Europe faces a severe energy crisis as well. Scarcity of natural gas, and increased cost of all imported fuels has been compounded by a heat wave and drought conditions in many European countries. Hot and dry conditions have lowered hydroelectric energy output, caused curtailments in nuclear energy output and simultaneously increased demand for energy for cooling.

2. To cite one specific example, according to Bloomberg, a recent survey has found that 6 in 10 British manufacturers may be forced out of business due to rising energy costs. Roughly half of British manufacturers have experienced increases of 100% or more in the electric energy bills. 13% of UK manufacturers have already reduced production.

3. In another set of examples, in Spain, the viability of various manufacturing industries is threatened. For example, the price of cement has risen by 400% in two years. The ceramic inputs for tile manufacturing have risen 1,047% in the past year. Various Spanish factories have already shut down or cut production of various goods.

4. Almost every single country in Europe faces a recession-inducing energy shock to both producers and consumers. Furthermore, the magnitude of this energy shock is unprecedented in the past 70 years.

Economic Crisis in Europe. How Bad Will it Be?

Global markets are currently underestimating – very badly – the extent of the economic devastation that can be wrought by the current energy crisis in Europe. In this section, we review estimates of the magnitude of the energy shock and the likely impact of the shock on European economies

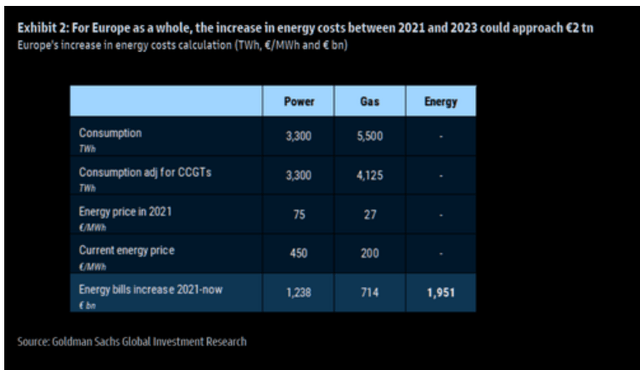

1. Goldman Sachs estimates, using current forward prices, that for European consumers, the increase in energy bills could represent a massive energy shock equivalent to roughly 15% of GDP between 2-2021 and 2023.

European energy shock to consumption. (Goldman Sachs)

2. Based on the magnitude of the above shock to consumption, an extremely severe recession in Europe can be expected. Furthermore, the estimates above do not contemplate the impact of the energy shock to the supply side. On the supply side, skyrocketing energy prices, which have generally risen between 100% and 500%, threaten to completely shut down production at a large number of firms.

3. Fiscal and monetary policies in Europe will attempt to cushion the blow. Germany has already announced a fiscal package worth 3% of GDP. More fiscal stimulus is almost certainly forthcoming.

4. Based on the considerations above, including the likelihood of major fiscal and monetary stimulus packages, we believe that a “conservative” estimate is that Germany’s GDP will experience a contraction of roughly 4% during the next four quarters. A recession of much greater magnitude is likely if the winter is colder-than-normal.

5. The rest of Europe also faces a severe recession. We believe that a conservative estimate of the contraction in overall economic activity is on the order of a 2%-3% of GDP, during the next four quarters.

6. It is highly likely that a severe recession in Europe will create troubles for their overvalued real-estate markets and the European financial system.

7. European banks are less capitalized and systemically more vulnerable than in the US. Thus, risks of a European financial crisis are high.

8. The magnitude of the prospective recession in Europe will fundamentally depend on weather. Quite literally, the fate of the European economy during the next six months depends on the weather. A cold winter would allow less energy savings to be obtained from households, as greater household energy consumption would be required to simply achieve the baseline 1 or 2 degree reduction in average household temperature.

9. We estimate that a cold winter could trigger the deepest recession in Europe since World War 2. On the other hand, a mild winter could result in a recession that is merely in line with the average of European recessions since World War 2. In other words, the best-case scenario is that Europe will experience a recession of “normal” intensity. In a base-case scenario, the recession will be very severe. In a scenario of a winter that is in the 10th to 20th percentile range in terms of average winter temperatures, we believe Europe is likely to experience the worst recession in post WW2 history.

Global Impacts

In this section we look at the potential impacts of a severe recession in Europe on the global economy and financial system.

1. According to the “base case” estimates above, Europe will likely be experiencing a recession during the next 4 quarters that is similar to or greater than the one that the US experienced from 2007-2009. It should be recalled this recession in the US sparked a global financial crisis.

2. The European economy is roughly large as the US economy. Furthermore, the European economy is arguably more globally inter-linked than the US economy. Therefore, the risk of a global and economic crisis, on the scale of the one experienced in 2007-2009 — although far from certain — is quite high.

3. The global financial system is intricately linked. A financial system crisis sparked by severe recession in Europe would reverberate around the world through the global financial system.

4. Global liquidity can quickly dry up on the mere suspicion that major European banks are distressed.

5. An economic crisis in Europe is likely to produce significant further appreciation of the US Dollar. A strong US Dollar would tend to act as a financial “wrecking ball” around the world, as the world has high levels of USD-denominated debt. USD debtors outside the US will have difficulty accessing USD liquidity to make increasingly burdensome loan payments and to roll-over debt.

6. The shockwaves of the US financial crisis in 2007-2009 reverberated around the world for roughly 4 years. For example, the sovereign debt crisis in Europe from 2010-12 was initially triggered by the crisis in the US.

Long-Term Effects & Prospects for Recovery

The impact of the energy crisis on financial asset prices depends to a large extent on its long-term effects and the long-term prospects for recovery.

1. The productivity and competitiveness of the European economy will remain severely constrained for many years, until relatively inexpensive alternative sources of energy (both traditional and “green’) are developed. This transition process will take at least five years.

2. Because corporate profitability will be depressed for many years, the threat to European equity valuations and corporate debt valuations is exceedingly large. Not only can equity values be expected to decline severely, availability of credit and liquidity in European markets will be severely limited.

Investment Implications

In this section we consider the investment implications of a severe recession in Europe.

1. For reasons detailed above, due to the depth of the recession and the likely nature and length of the subsequent recovery, European equity markets face many years of poor profitability and earnings growth. For these reasons, we expect the trough in major European equity indexes such as Germany (EWG), and France (EWQ) and the overall STOXX (VGK) to be 30% or more below current levels.

2. The performance of US equity markets from this point will depend, to a large extent, on the magnitude of the economic crisis in Europe as well as its spill-over effects on global markets. The range of outcomes is exceedingly wide. However, it is possible to outline the following considerations: First of all, European sales account for 20%-35% of profits of the largest US multinational firms, including Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOG). Second, a severe global economic and financial crisis can be expected to adversely impact domestic US economic growth and therefore profits earned in the US market. Third, a severe global economic and financial crisis would dramatically increase risk premia for equities and corporate bonds. In sum, based on the likely decline in overall earnings during the next year plus the increase in risk premia, we believe that US equity investors can expect further downside of 20% to 30% in major indexes such as the S&P 500 (SPY) and Dow Jones Industrials (DIA) below current levels. In our base case scenario, the S&P 500 index will ultimately fall to roughly to the 3,000 level. Even though it is not our base case at this time, even greater downside, is becoming increasingly likely.

3. We do not necessarily expect an immediate crash in response to the economic and financial risks highlighted above. Indeed, we believe that global markets will, as they have in the past, prove very slow and inefficient in discounting the massive risks posed by the prospective recession in Europe. We believe that there could potentially be substantial rallies in equities prior to and during the major declines we expect in coming months. These rallies will provide excellent opportunities for positioning portfolios to achieve massive absolute and relative (alpha) gains during the coming weeks and months.

What Should Investors Do?

The conventional “wisdom” that has been promoted by Wall Street and the investment industry is that investors should just “hold tight” and absorb losses indefinitely until each and every crisis presumably “blows over.” Wall Street investment firms have promoted the ideology of passive investment because they profit from perpetually charging investors fees for uncritically being “fully invested” in their funds. We believe that this is not a “strategy” at all and that it is an exceedingly bad way to manage one’s personal finances, particularly in these radically changing times.

As an example of a contrasting approach, our primary portfolio in Successful Portfolio Strategy has managed to avoid every single decline of 10% or more during the past four years. This has allowed us to greatly reduce risk in the portfolio and also greatly increase returns relative to our benchmark. On a risk-adjusted basis, this portfolio has massively outperformed. Similarly, in our complimentary trading portfolio, we have been able to attain spectacular returns by capitalizing on large market drawdowns as well as by making highly selective factor allocations using options strategies.

The point of highlighting the above specific example is to dispel market myths about “market efficiency” and show that investors need not passively sit back and pretend to be indifferent to the risk of large market-wide draw-downs and/or passively absorb massive losses in their portfolios. There is a much better way to manage your portfolios than blindly holding on to your stocks and funds during a crisis and “hoping for the best.” We believe that the best strategy in the current environment is to become pro-active by understanding global macroeconomic trends, getting out in front of those trends and radically rearranging portfolios to account for a radically changing world.

The lazy approach of passive investing — and/or buy & hold investing more generally — not only produces mediocre returns, at best; it greatly increases stress. Furthermore, by increasing stress, it ironically greatly increases the risk of selling out at the wrong time when a crisis hits. Laziness and passivity do not work anymore in investing than it works in any other area of endeavor in life.

We encourage investors to become well educated about major macroeconomic trends that will greatly disrupt global markets in coming years and to proactively manage their portfolios accordingly.

Conclusion

The shutdown of natural gas flows through the Nord Stream 1 pipeline has kicked off a new and perilous economic era for Europe’s economies, with potentially wide-reaching global implications.

As a result of the severe recession that we expect to develop in Europe, it is our view that global investors, including US investors, face potentially very large losses on both equity and debt investments in the coming year. The extent of these losses will depend on various factors that are difficult to predict, including the severity of winter in Europe and the extent of global spill-over effects from a severe European recession.

Due to the extraordinarily large risks involved, and the very wide range of possible outcomes, this is a time which urgently calls for active portfolio management to mitigate risk and take advantage of emerging opportunities. In particular, expertise in global macroeconomics and global finance will be essential during the next year. In Successful Portfolio Strategy, as an example, we have been positioning aggressively to take advantage of various global opportunities, in various asset classes around the world. We believe that many of these opportunities that will develop in the next twelve months will prove to be generational in nature.

Be the first to comment