With the right strategy, Antero can start delivering a steady flow of outperformance for one’s portfolio. imaginima

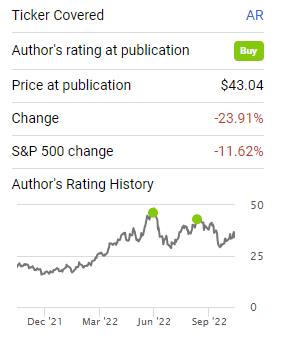

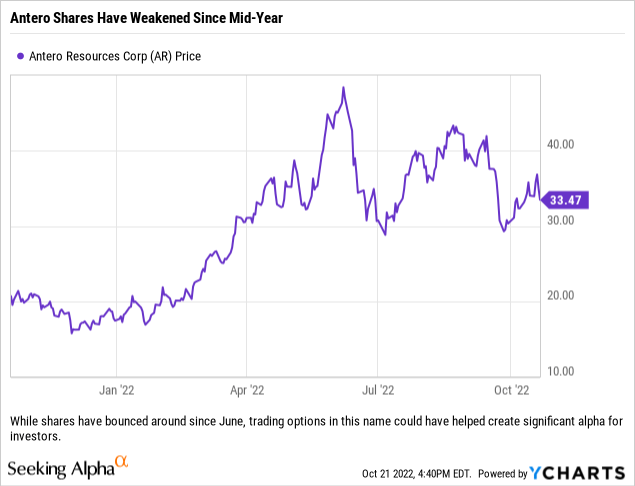

Over the course of this year, we have been buyers of various energy names, including Antero Resources (NYSE:AR). We have covered Antero on two occasions, back in early June and then again in mid-August. While we have had success trading and also utilizing buy-and-hold strategies in some of our energy names, Antero is a holding that is a tale of two strategies.

We like the name, we like the sector, and we really like everything about the company. Honestly, Antero checks all of the boxes for us on a resource play. It is our belief that the thesis we previously discussed is still playing out and even with energy prices pulling back during the year, we think that management is making prudent moves on the operating side, as well as the financial side. All of this will help moving forward, especially if there is a strong pullback in energy prices due to recession, or energy flows resuming from Russia to the EU.

A Tale Of Two Strategies…

Rather than getting into all of the trades in our portfolio, if we simply look at the two trades we wrote about here on Seeking Alpha (which were two of the worst entry points), then we can highlight what we mean by a tale of two strategies.

Our first article had us purchasing shares if they were put to us, and we were hit with both put contracts, one with a strike price at $42/share and one with a strike price at $40/share. Our average cost was just around $39.40/share on those purchases when factoring in the initial put premium received. This account’s strategy was shifted in the month and now generally does not utilize options to trade a name, but rather set up entries and final exits. Meaning now it generally does not trade options to generate income and instead focuses on long-term holding periods. So this forced the trade to become a buy-and-hold type of trade. We will call this trade the June chain, and use it as the equity benchmark, which is down 15.72% with no call option premium enhancers.

Looking at the trades in August, we sold one month puts with a strike price of $40/share for $2/share, or $200 per contract in options premiums. Our cost basis ended up being $38/share when we had the puts exercised on us. We then turned around and sold September 19th the October 28th Calls at a strike price of $40/share for $2.40/share, or $240 per contract. This week, when evaluating what we wanted to do ahead of earnings, we decided to repurchase the October 28 $40 Calls for $0.28/share, or about $28 per contract in order to reposition. Our logic was that we think that earnings will be fine, and this is a position that we do not mind owning for a while longer, but we think that the market is due for a pullback, so we wanted to grab more option premiums going out past earnings. We then sold the January 20, 2023 Calls with a strike price of $40 at $3/share, or $300 per contract. Yes, that does expose us to a scenario where we might be holding dead money for nearly three months, but we think that it is worth the risk in such a tough market.

We have two different prices highlighted by articles, however there are ways to turn a loser into a winner – even by holding the shares. (Seeking Alpha)

Why? Well, looking at the trading chain around the August entry point, if we had simply purchased the shares at $40/share, then we would have losses of nearly 16.35%. By utilizing options, we generated net options premiums of $7.17/share, which actually gives us a current net gain on the total trade of roughly 1.92%. Currently, the S&P 500 is down nearly 11.60% from that time, and although we still have to wait to see how the latest call plays out over the next 90+ days, we think that taking these option premiums are quite beneficial for one’s portfolio in this bear market.

See, even if we get called on the August trade at $40/share, it is not at all a trade where we simply broke even. Instead, because of the options, we would be able to lock in a significant profit of $7.17/share when called, which would be a gain of roughly 17.93% in a bear market. If we had not utilized options against this position, and instead purchased shares at $40/share to hold, then the loss would be 16.35% for the holding period rather than the current gain of 1.92%. The outperformance versus the underlying security is 18.27% for this trade!

Bear Market Alpha Generator

From the two trades above, there is one clear winner in this market. While one trade has the purchaser essentially recognizing all of the losses sustained in the recent price pullback, the other trade has enabled the purchaser to generate enough income to more than fully offset the losses the equity has sustained over the holding period and sets up the holder to profit handsomely even if the shares are called away at $40/share. The trade does not show a negative opportunity cost until shares rise above $47.17/share, and right now we only see that happening in the short-term under two scenarios; an extremely cold winter where supplies/inventories dwindle and/or a takeover offer emerging.

Risks To The Trade

The risks with these types of trades are minimal if structured to accept downside risk on one side. Once Antero shares moved far enough away from $40/share, we accepted the downside to the trade, while managing the upside to dig our position out from the losses. While we still retain that downside, each subsequent sell of a call (assuming we are not called) will allow us to add to our options premiums and give us some flexibility, especially if the shares head lower. If the energy market, or even stock market, were to turn sharply, scenarios exist whereby we could simply close out our positions and possibly even turn a profit.

While the downside risk is present, we think it is also important to recognize that the downside risk retained may be the same at any given time (to the equity), but because of the option premiums generated the total risk is actually less and does not exceed the downside of the buy-and-hold strategy on the equity only trade.

Final Thoughts

We still like Antero Resources and think that they have unrivaled assets; the actual energy assets, but also their management team. Long-term, we think that this can be a big winner, and we think that there are a few easy items that management can enact to boost the shares – and eventually they will. We hope that they wait until after our calls expire, or we are able to buy back at a nice profit, but we are happy to live with the profit we have structured if we are called on the trade which has utilized options. With earnings coming up after the market close on October 26th, we think that investors might be served well by exploring the use of options with their positions, or for establishing positions, within their portfolios.

One can take their beating from the bear when being long during a bear market, or can be proactive and generate alpha using options. We really do like the options strategy to help improve our returns during this tough trading environment.

Be the first to comment