Alexandre Schneider

Summary

Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) is an integrated oil company controlled by the Brazilian state. It has often seen government interference in domestic gas & diesel prices and has even been the source of political funding and corruption.

This national champion mentality and motto “The oil belongs to all Brazilians” has led to plenty of volatility, financial risk, and an undervalued equity. However, a miracle occurred in the last three years, Petrobras sold assets, cut capex, improved production, reduced debt and paid out massive dividends.

This miracle could be about to end with the probability that the PT (workers party) regains control on the Oct 30th 2022 presidential election. The PT will likely stop asset sales, especially in refining capacity, and drive capex higher in production, renewables, refining and wherever a Petrobras investment injection can boost jobs. The idea is to make Brazil gasoline and diesel self-sufficient, not necessarily make Petrobras a better company. This strategy requires cutting dividends and increasing debt.

The Miracle

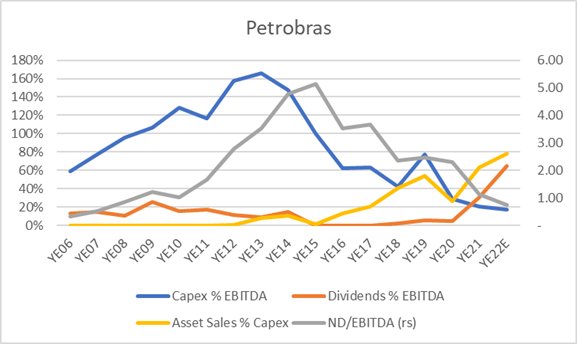

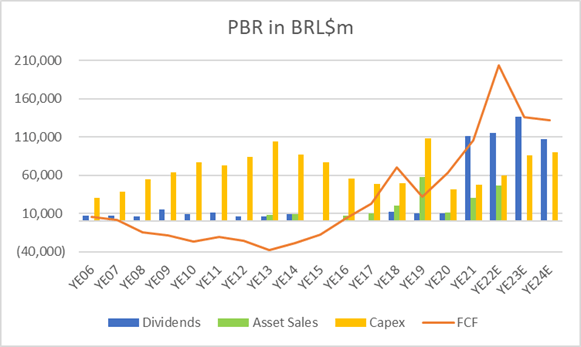

Higher oil prices, production and productivity all helped drive results at Petrobras but where not enough to cut debt and payout huge dividends. The main source of this significant cash flow was a sharp cut in capex and asset sales.

Since 2018 the company has focused on asset sales, reduced capex, reducing debt and paying out significant cash flow to shareholders. It generated over US$100bn by selling no core assets while capex fell to 20% of EBITDA. The result was decline in leverage, net debt to EBITDA fell from 5x in 2018 to under 1x in 2022. This culminated in monster dividend payments of over US$70bn.

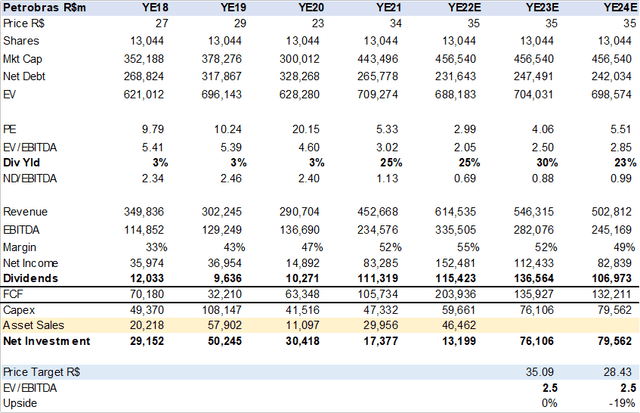

Today Petrobras is in fantastic shape to grow its exports, harvest cashflow and continue large dividends. So why is the stock at 2.5x EV/EBITDA on 2023 estimates or 45% below average? This is due to the threat that the miracle is over if the PT wins presidential control, in my view.

PBR Cuts Capex and Sells Assets (Created by author with data from PBR) PBR Free Cash Flow boosted by asset sales and lower capex (Created by author with data from PBR)

Return to National Champion

The PT led by Lula Ignacio da Silva is the likely winner of the Oct 30th presidential elections. Petrobras will then return to national champion status and strategy. The PT wants a Petrobras that can provide Brazil with oil, gasoline, and diesel self-sufficiency. This means no more asset sales and even building refining capacity as well as renewable electric energy.

Reverting refining assets sales and adding refining capacity is the key market negative. This is where the government can and has interfered with market prices. As an integrated oil company, Petrobras “sells” crude to its refining plants that then sells gasoline and diesel at lower prices, even at losses to meet government policy. A Petrobras with less refining capacity would export more and avoid this dilemma.

Lower margins, higher capex and increased debt would necessitate cutting the dividend, most likely back to a 3% range.

Valuation

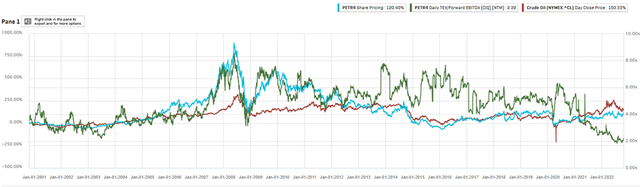

The risk of a return to business as usual is a key factor in keeping the share valuation discounted and when or if Petrobras changes strategy, expect further share price pressure. PBR has traded around 4.5x EV/EBITDA in the last 20 years through up and down oil cycles and Brazil macro/political risk.

Fair value under a return to lower margin higher capex/debt would be 2.5x in my view with a dividend yield back to 3% vs 30%.

If Bolsonaro wins, the shares would rally and the miracle may continue. However, I prefer to wait.

PBR Forward EV/EBITDA since 2001 (Created by author with data from Capital IQ) PBR Summary Financial Estimates and Valuation (Created by author with data from PBR)

Peer Comps

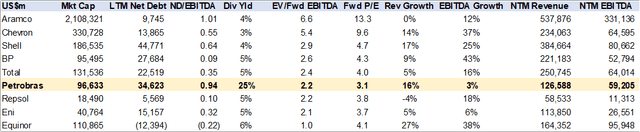

As can be seen in the table below the global oil sector is full of cheap high yielding stocks with good growth. Why take the Brazil pre-election risk?

Major oil stock valuation comparison. (Created by author with data from Capital IQ)

Conclusion

A change in government will change Petrobras’s strategy from high free cash flow and dividends back to a national champion seeking oil, gasoline & diesel self-sufficiency for Brazil. This would require higher capex and lower dividends plus add margin risk on increased government pricing politics. PBR is not worth the pre-election risk.

Be the first to comment