Byjeng

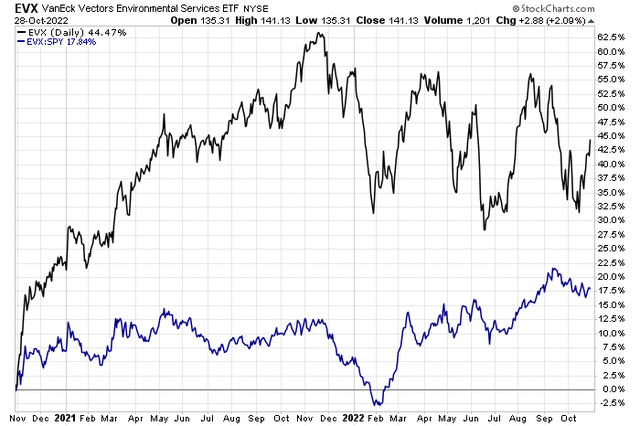

Trash stocks have been impressive plays during and after COVID. The VanEck Vectors Environmental Services ETF (EVX) is up about 45% total return in the past two years, outperforming the S&P 500 ETF (SPY) by nearly 18 percentage points. One of its biggest holdings has long-run tailwinds, but I see mixed fundamentals and technicals.

While No Treasure Trove, Trash Stocks Holding Up Well

According to BofA Global Research, Republic Services (NYSE:RSG) is the second largest non-hazardous waste operator, servicing commercial, industrial, municipal, and residential customers across 41 states and Puerto Rico. The company is vertically integrated, owning 340 collection operations, 198 transfer stations, 189 active solid waste landfills, and 60 recycling centers. Republic has significant economies of scale, with 68% of the waste it collects disposed at its own landfill.

The Arizona-based $42.1 billion market cap Commercial Services & Supplies industry company within the Industrials sector trades at a high 29.1 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.5% dividend yield, according to The Wall Street Journal.

The firm is positioned well for the long-term theme of environmentally friendly waste trends. Changes in recycling methods, renewable energy generated from landfill gas, and waste area pricing should all help RSG generate earnings in the future. Moreover, the industry could see further consolidation trends, so there’s M&A potential. While there’s upside to free cash flow via margin expansion, there are downside risks – weaker inflation would hurt business. Unfavorable regulatory issues regarding environmental policies is also a potential risk.

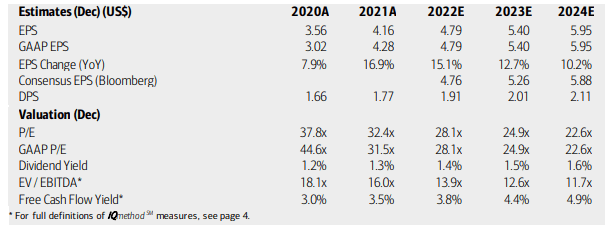

On earnings, analysts at BofA see earnings having grown sharply in 2022, a rare site in this economy. EPS growth looks to remain robust through 2024, and the Bloomberg consensus forecast agrees. Moreover, dividends are expected to increase steadily through the next few years. RSG’s operating and GAAP P/Es are quite high, however, and its EV/EBITDA multiple is pricey.

With robust growth and a high earnings multiple, I like to see what the PEG ratio shows. Currently, it is 2.3 using forecast figures, below its long-term average. Shareholders should benefit from strong the company’s free cash flow – potentially fueling buybacks or an acquisition. Overall, while Seeking Alpha grades Republic’s valuation with a poor “D-,” I think the valuation is reasonable given the growth outlook, but it’s certainly not a value stock.

Republic Services: Earnings, Valuation, Dividend Forecasts

BofA Global Research

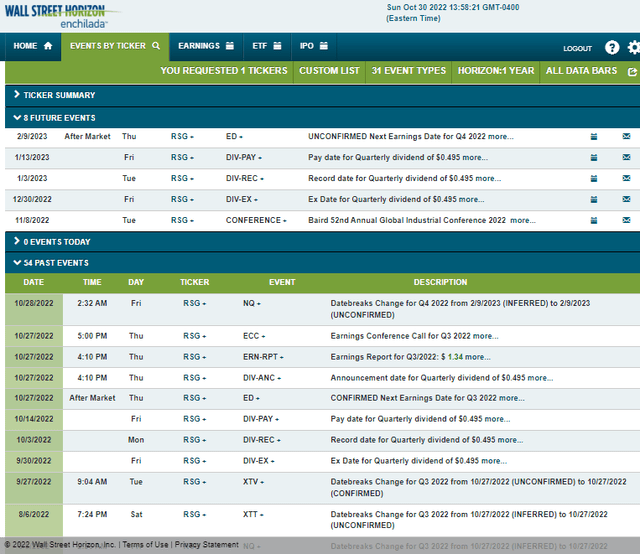

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2022 earnings date of Thursday, Feb. 9 AMC. Before that, though, the company’s management team is slated to speak at the Baird 52nd Annual Global Industrial Conference 2022 from Nov. 8 through 10 in Chicago. Often at these events, key industry trends are described, which can result in share price volatility.

Corporate Event Calendar

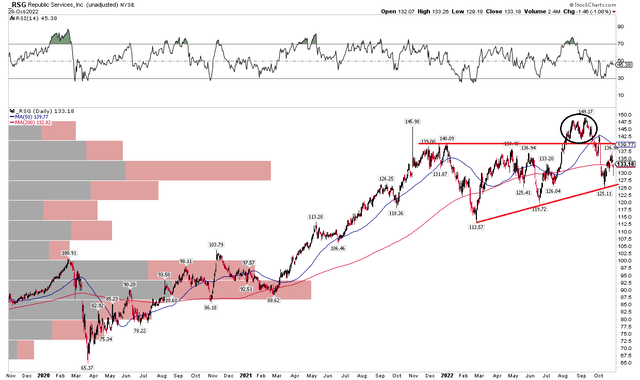

The Technical Take

RSG has held up well as the market has turned south over the past 12 months. Notice in the chart below that there’s an ascending triangle taking shape. The presumption is that this consolidation pattern will resolve in the trend of larger degree – higher. Unfortunately, the stock attempted to rally above the key $140 level, but that appears to be a bearish false breakout. Shares quickly retreated to support. But the stock is now making another run for a breakout. I would like to see shares close above $150 to help confirm a resumption of the uptrend.

Also take note of the long-term 200-day moving average, which is now flat after being upward-sloping. That’s a sign that the uptrend has lost steam. Overall, the technical picture, like the valuation, is mixed.

RSG: A Failed Breakout Attempt. Patience Needed.

The Bottom Line

I’m a hold on RSG. It is a solid growth name, but the valuation has priced in significant EPS advancement over the coming years. The technicals, meanwhile, also show a bit of exhaustion after a stellar run from March 2020 through a year ago. Despite relative strength this year, give this stock more time to generate steam for another leg higher.

Be the first to comment