JJFarquitectos/iStock Editorial via Getty Images

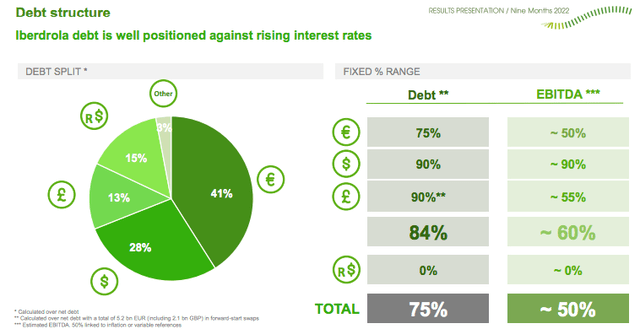

This week, Iberdrola reported a strong set of numbers (OTCPK:IBDSF) (OTCPK:IBDRY). As a recap, here at the Lab, we have a buy rating target for the following reasons: 1) a strong track record supported by a diversified GEO mix, 2) REPowerEU upside, 3) CAPEX diversification with a quality portfolio across the globe, 4) no exposure to Russia gas (and we see also support from our recent Enagas follow-up note), 5) 50% of Iberdrola’s EBIT margin “is protected from inflation“, and 6) almost 80% of the company’s total debt is at a fixed rate, protecting Iberdrola from the current raising in the interest rate environment.

In the Q2 analysis, we concluded that the next supportive catalyst was the company’s CMD day planned for the 9th of November. In the meantime, we were confident that the Spanish energy conglomerate was going to beat Wall Street analyst expectations, adding also that “Iberdrola’s main risk was linked to politics, and we highlighted that government intervention remains the major downside risk”. Indeed, this is exactly what happened.

Q3 results

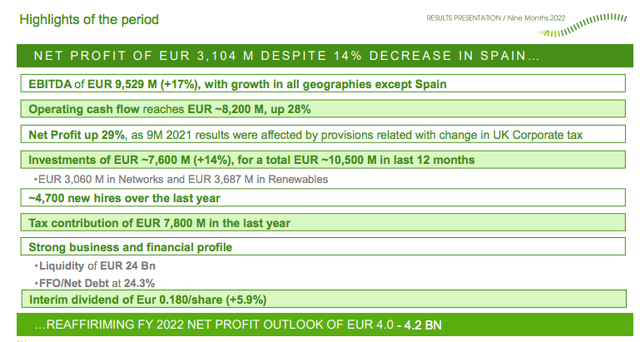

It was a broad-based beat in all the P&L lines. “All geographies are doing well, except Spain”, emphasized the president of the energy company at the analyst conference. This message is a common trend in the latest financial presentations. However, the earnings drop recorded largely corresponds to a one-time extraordinary tax impact of €206 million resulting from a court ruling affecting Iberdrola’s network business. During the Q&A, the CEO confirmed that they most likely go to court “to defend the company’s shareholders”. Looking at the results, the company delivered a net profit exceeding €3 billion in the first nine months, signaling a plus 28.9% compared to the last year period. Despite the Spain negative tax implication, Iberdrola recorded an improvement of 12.5% in its operating profit and 3.7 million new customers, including almost 900k electricity-only clients.

Cross-checking our buy rating key takeaways, we believe that the company is well on track to exceed its target (and most likely, Iberdrola will raise the bar in the CMD release in early November). More in detail:

- Geographical diversification is driving growth and is allowing Iberdrola to benefit from higher FX contribution in $ and the Brazilian Real;

- Diversified EBITDA supports the company to be less volatile, and network EBITDA offsets the marketing/production EBITDA contribution;

- CAPEX deployment is moving on with a plus of 14.2% in the first nine months. Almost 50% of Iberdrola’s investments were allocated to renewable energy generation;

- Thanks to Iberdrola’s newly installed capacity and good operating performance, wind & solar energy production has increased by 13%, boosting total renewable energy production to almost 55GWh, which has offset lower hydroelectric production;

- Higher investments require higher financing needs. Debt was up by more than €7 billion, reaching a total amount of €44 billion. Iberdrola has €24 billion in liquidity which corresponds to an amount sufficient to “cover 15 months of debt maturities in a stress scenario”. As a memo, the company fixed debt structure (and its duration) will protect Iberdrola from this rising interest rate environment.

Iberdrola debt/EBITDA structure

Conclusion and Valuation

CEO confirmed 2022 guidance and announced a complementary dividend of €0.18 per share for January, 5.9% more than a year ago. Ahead of the CMD day, we reaffirmed our buy rating target of €12 per share based on a 14x P/E 2023.

Be the first to comment