DNY59

Introduction

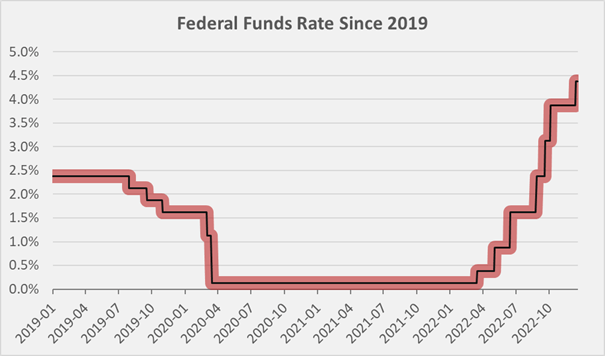

When the Fed speaks, the market listens – this was impressively demonstrated once again last Wednesday, December 14, when Federal Reserve officials announced further rate hikes in 2023 and stock prices fell as a result. Market participants expected a more dovish tone given the aggressive rate hikes for most of 2022 (Figure 1), but were surprised by Chairman Powell’s adherence to his hawkish stance.

Figure 1: Federal funds rate since January 2019 (own work, based on the data found on https://www.forbes.com/advisor/investing/fed-funds-rate-history/)

However, rising interest rates affect the valuation of stocks and bonds not only through the inherent change in the discount rate – which is particularly important for ultra-long duration investments like growth stocks (see my article). The decisions made by Jerome Powell and his advisors affect society as a whole, all over the world. The Federal Reserve clearly has no easy task. It is trying to contain inflation by raising interest rates, knowing full well that in doing so it risks a more or less severe recession. As interest rates rise, the short-term insolvency risk of so-called zombie companies increases, which can have a significant negative impact on society as a whole (see my article).

But the Federal Reserve’s decisions also have major implications for foreign countries with U.S. dollar debt and their ability to refinance their upcoming maturities. Developing countries, in particular, cannot simply “inflate themselves out of their debt” like countries or regions whose debt is denominated in their own currency, such as the U.S., the Eurozone, or the United Kingdom.

A closer look at individual sectors reveals that some benefit from higher interest rates, while others suffer.

Clearly, banks and insurance companies benefit greatly from higher interest rates. Insurance companies invest their float to a large extent in fixed-income securities with solid ratings. The higher the interest rates, the greater the profit an insurance company can make. Banks benefit as the spread between interest paid on the liability side and interest received on the asset side widens. Of course, the existing assets in the portfolios of banks and insurance companies are sensitive to changes in interest rates. The price of a bond adjusts so that the current yield adequately reflects the interest rate environment, default risk, reinvestment risk, and other factors.

However, the sensitivity of banks’ and insurance companies’ portfolios to interest rates should not be overstated, as risks are usually hedged for example through interest rate swaps, balance sheet hedges (corresponding positions on both sides of the balance sheet), or a combination of both. On the other hand, as interest rates rise, the number of corporate defaults increases as debt becomes more expensive to service. It is therefore worth taking a close look at a bank’s loan portfolio when assessing the possible negative impact of higher interest rates on existing business.

Real estate typically suffers from a high interest rate environment, in part because the spread between rental income and debt service costs is narrowing. This is especially true in the low to zero interest rate environment of recent years, which has led investors to accept increasingly lower yields on seemingly risk-free assets. The rise in the cost of capital makes investing in real estate less attractive as other, more fungible asset classes such as stocks and bonds become cheaper. In addition, the effects of a recession, which usually follows an environment of rising interest rates, also negatively affect real estate valuations indirectly through, for example, higher unemployment rates.

Other sectors can be net beneficiaries but can also suffer in a rising interest rate environment. As diversified investors, we simply have to live with the fact that interest rates rise and fall and the economy expands and contracts.

I am not a market timer and believe that it is pointless to continuously adjust the portfolio to the prevailing interest rate environment and thus constantly chase the market. Rather, as a long-term investor, I am careful not to own companies that suffer greatly in a rising interest rate environment and that are appropriately financed so that they can weather a prolonged downturn and a prolonged higher interest rate environment.

In this article, I take a look at the balance sheets of three different companies and explain how I determine a company’s fitness for an environment that I believe could be characterized by higher interest rates for an extended period of time.

The Home Depot, Inc. (HD)

I covered home improvement giant The Home Depot earlier this year, highlighting in particular its strong free cash flow growth, monopolistic tendencies, and management’s shareholder-friendly stance. However, I also pointed out that the company engaged in fairly aggressive share repurchases in 2021 and that the quality of its balance sheet deteriorated accordingly. For this reason, and given the somewhat cyclical nature of the company’s earnings, I believe a discussion of HD’s current debt levels is warranted in light of a potential recession and prevailing interest rates.

The upcoming maturities of the company’s debt as of January 30, 2022 (the end of fiscal 2021) are shown in Figure 2 in three-year buckets, along with three times the average after-dividend free cash flow for fiscal 2019 through 2021, normalized with respect to working capital movements and stock-based compensation expense. In this way, it is easy to understand that the seemingly alarmingly high debt of $37.5 billion is actually very manageable. I chose to subtract dividend payments from free cash flow because I view HD as a shareholder-friendly company with a management team that places a high value on dividends. After all, HD is looking at 12 straight years of dividend increases, according to MarketBeat.

Of course, average free cash flow for fiscal 2019 through 2021 could be a bit optimistic due to strong sales growth during the COVID-19 pandemic. Also, in a recession that impacts the housing market, free cash flow is expected to be much lower. However, HD is managed very efficiently, and I am not overly convinced that a slowdown in new home sales will actually have a significant impact on HD’s earnings. After all, the company is largely focused on home improvement. As disposable income declines, people may actually increasingly choose to renovate their existing homes rather than move into new ones.

Figure 2: The Home Depot’s [HD] after-dividend free cash flow and debt maturity profile. (Own work, based on the company’s fiscal 2021 10-K)![Home Depot [HD] after-dividend free cash flow and debt maturity profile](https://static.seekingalpha.com/uploads/2022/12/21/49694823-16716246986638987.png)

With fiscal 2022 coming to a close soon, it is important to also consider HD’s latest 10-Q report for the quarter ended October 30, 2022, especially since management announced another $15 billion buyback program in August. Since January, debt has increased by about 15%, but current maturities are definitely not a problem at only 3% of total debt.

Even though free cash flow will be lower in the near future, assuming a recession and lower disposable income due to inflation, HD’s overall debt level does not appear to be a concern. It should also be kept in mind that large companies maintain a leverage level that they are comfortable with and that is in compliance with the debt covenants, so they typically refinance debt as it matures. As interest rates rise, refinancing debt naturally leads to higher interest expense.

In my own due diligence, I determine a company’s interest coverage ratio under one “normal” and two “stressed” scenarios. Let’s assume that interest rates remain elevated for five years, i.e., through 2027. This is, of course, an overly pessimistic scenario and would likely lead to the bankruptcy of many zombie companies, which in turn would have a pretty negative impact on the economy. In my opinion, however, there is no point in seeing the world through rose-colored glasses, and I therefore prefer to stick to my conservative view.

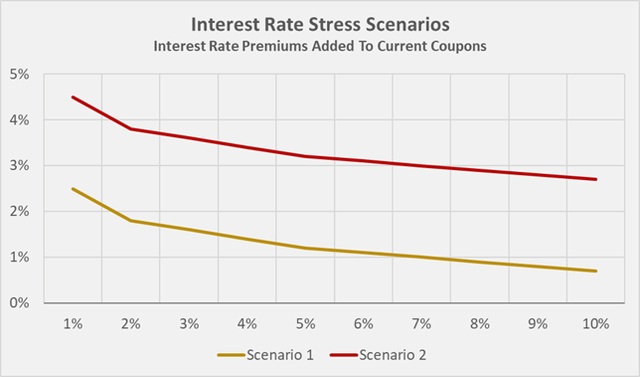

In determining a company’s interest coverage ratio in a stress scenario, I have assumed that debt maturing between 2022 and 2027 will be refinanced at a coupon rate that is higher than the current interest rate. Since it is extremely difficult (if not impossible) to determine a company’s individual refinancing terms, I resort to an interest rate premium that is inversely correlated with the current coupon. This is certainly not accurate, but it is a good first guide, in part because I manually review each company’s short-term maturities to account for specific circumstances. Figure 3 shows the two stress scenarios I used to calculate the data presented in this article.

Figure 3: Interest rate stress scenarios used for obtaining refinancing rates as a function of the current coupon rate (own work)

The Home Depot’s current weighted average interest rate (as of the end of fiscal 2021) is 3.4%. Stress scenario 1 would increase the company’s weighted average interest rate to 3.9%, and scenario 2 to 4.4%. These percentages correspond to a 1.1 and 1.3-fold increase in interest costs, respectively, which is by no means unsustainable. In other words, HD’s current interest coverage ratio of 11.5 times pre-interest normalized free cash flow would drop to 10.2x and 8.9x, respectively. And even when dividends are included, the ratios are still very comfortable at 5.7x and 5.0x, respectively. And even if HD’s three-year average free cash flow fell by 50%, the company would still be able to pay its dividend and pay interest on its bonds, although that would be a tight squeeze. Of course, these estimates (as well as the following ones) do not take into account a beneficial tax shield effect, which I consider a small hidden reserve in terms of interest coverage.

V.F. Corporation (VFC)

I have covered fashion and outdoor equipment company V.F. Corporation several times in the past, most recently in September 2022. The stock continues to trend downward, largely due to repeated downward revisions to guidance, failure to reignite growth in key brands, working capital issues, and exposure to China, which has only recently signaled a relaxation of its very strict COVID-19 policy. The recent announcement that the CEO was leaving the company put further pressure on the stock. For the purposes of this article, however, I will focus on the company’s debt, which, along with the fast-moving nature of the apparel industry, is the main reason I have refrained from investing in the stock so far.

Figure 4 shows VFC’s debt maturity profile at the end of fiscal 2022 (end of March 2022). Two quarters have passed since the 10-K was published, but VFC’s debt has not increased significantly. However, it should be noted that short-term maturities account for more than 40% of the company’s total financial debt. In terms of free cash flow, VFC was hit particularly hard by the 2020 lockdowns, which continued in some parts of the world in 2021 and 2022. The company suffers from supply chain disruptions, which are reflected in a significant increase in inventory levels. When the inventory is sold, the cash tied up will naturally be converted into operating cash flow, but in the fast-moving apparel industry, significant markdowns are to be expected.

At the September 2022 investor day event, management presented its plan to return to growth and provided a forecast for free cash flow over the next five fiscal years. Free cash flow after dividends has been negative for the last three fiscal years, but since we are looking at the company’s future debt servicing ability, I used three times average free cash flow for fiscal years 2023 through 2025 according to management’s (in my opinion optimistic) expectations and based on my current expectations for fiscal 2023 (see my September article). Figure 4 illustrates that VFC’s after-dividend debt servicing ability is extremely limited even if free cash flow improves significantly in the future (management assumes a compound annual growth rate of 17%).

Figure 4: V.F. Corporation’s [VFC] after-dividend free cash flow (fiscal 2023 to 2025 expectation, hence semi-transparent red) and debt maturity profile. (Own work, based on the company’s fiscal 2022 10-K and the September 2022 investor presentation)![V.F. Corporation [VFC] after-dividend free cash flow](https://static.seekingalpha.com/uploads/2022/12/21/49694823-1671624723499491.png)

The voices that the company will have to cut its dividend are getting louder, and the current dividend yield of almost 8% signals that the market no longer believes in the company’s dividend aristocrat status. A dividend cut seems likely if the world enters a recession. However, while I personally believe that the U.S. is in a relatively good position, I am uneasy about the situation in Europe and, to some extent, China, which are both significant markets for VFC. Certainly, in assessing the company’s ability to pay dividends going forward, investors should also review the debt covenants listed on page F-28 and subsequent pages of the fiscal 2022 10-K and on page 39 of the most recent 10-Q. It should also be remembered that while the company’s long-term debt is still rated Baa1 (BBB+ S&P equivalent) by Moody’s, the rating agency issued a negative outlook in mid-October 2022.

VFC will certainly have to refinance its upcoming maturities, probably at rather unfavorable interest rates, which would be exacerbated by a downgrade – probably too pessimistic – to junk level. VFC currently benefits from a very low weighted average interest rate of only about 2.1% because it refinanced some of its debt in 2020, when interest rates were at historic lows. Refinancing the 2022 through 2027 maturities at rates consistent with the stress levels in Figure 3 would increase the company’s weighted average rate to 3.2% and 4.4%, respectively. If VFC were to generate free cash flow of $750 million, $850 million, and $1,000 million over the next three fiscal years, which I believe is unlikely, the interest coverage ratios of 15.6x and 11.5x pre-interest free cash flow, respectively, would be very comfortable under the two stress scenarios. Including the dividend, the ratios would drop to 2.5x and 1.8x, respectively, underlining VFC’s high payout ratio.

All in all, I am far from optimistic about VFC’s future, especially because management’s free cash flow expectations seem very optimistic and short-term maturities are significant at over 40% of total debt. However, it should not be forgotten that the company refinanced a significant portion of its debt not too long ago at very favorable interest rates and therefore still benefits from a rather low weighted average interest rate. However, as I expect a fairly deep recession in Europe and the company is significantly leveraged and has a rather cyclical business model, I am not looking to invest in VFC at the moment, even though the valuation is compelling.

Altria Group, Inc. (MO)

Cigarette manufacturer Altria is another interesting case for examining financial leverage. I have reported on the company several times in the past, most recently in October 2022, appreciating the extremely high profitability of the industry and the inelasticity of the product. Although smokers are turning to low-cost brands in the face of significant inflation and major tobacco companies around the world continue to face steadily declining sales volumes, they still manage to generate healthy profit and cash flow growth.

In this article, I discuss Altria for two reasons: On the one hand, the company is popular with investors because of its high dividend and clockwork-like increases. On the other hand, Altria is confronted with high debt that it has taken on in its effort to diversify its core business into reduced-risk products or other ventures such as JUUL and Cronos Group. One could argue that the company is increasingly dependent on creditors and poorly positioned for the prevailing interest rate environment. Altria’s debt has virtually doubled since 2017, from $14 billion to $28 billion at the end of 2021, but to be fair, the company has already deleveraged slightly, as its long- and short-term debt was over $29 billion at the end of 2020. At the end of the last quarter (end of October 2022), total debt was around $26 billion – even better than nine months ago, but still very high.

Figure 5 compares Altria’s after-dividend normalized free cash flow for 2019 through 2021 with upcoming debt maturities. Altria is obviously in a much less comfortable position than The Home Depot, but it is important to remember that the former’s cash flows are not really sensitive to economic cycles. This is nicely illustrated by the fact that Altria’s management increased its quarterly dividend by 10.3% in the third quarter of 2008, right in the middle of the Great Financial Crisis (p. 2, 2008 10-K).

It seems unreasonable to expect Altria to pay down its debt as it comes due with free cash flow, since its current leverage is anything but worrisome. However, given the recent deal with Philip Morris International (PM) related to the commercialization of IQOS in the U.S., which resulted in $2.7 billion pre-tax proceeds for Altria, and the expected sale of its stake in Anheuser-Busch InBev (BUD) sooner or later, debt reduction seems likely to some extent.

Figure 5: Altria Group’s [MO] after-dividend free cash flow and debt maturity profile. (Own work, based on the company’s fiscal 2021 10-K)![Altria Group [MO] after-dividend free cash flow and debt maturity profile](https://static.seekingalpha.com/uploads/2022/12/21/49694823-16716247409321878.png)

A look at Altria’s interest coverage under current and stress conditions suggests that the company is quite comfortably positioned, even if its debt in absolute terms suggests otherwise. Its current weighted average interest rate of about 4.0% would rise to 4.5% in scenario 1 and to 5.1% in scenario 2. In this way, the company’s interest coverage ratio would fall from the current eight times normalized free cash flow before interest to 7.2x and 6.4x, respectively. Taking into account the generous dividend, Altria’s stressed interest coverage ratio would drop to 2.2x and 1.9x, respectively. In other words, Altria would have to refinance its maturities from 2022 to 2027 at coupon rates consistent with scenario 2, and free cash flow would have to decline by 15-20% for the dividend to no longer be fully covered.

Key Takeaways

A large proportion of companies have increased leverage since the Great Financial Crisis, thereby benefiting from lower borrowing costs while increasing their reliance on creditors. This is particularly important for smaller companies such as V.F. Corporation.

The three companies discussed in this articles used leverage for somewhat different purposes:

- Home Depot aggressively reduced its shares outstanding by repurchasing shares with borrowed money, thereby increasing earnings per share and reducing the cost of dividends while increasing the cost of debt.

- V.F. Corporation used leverage to buy back shares and acquire other companies such as streetwear company Supreme, at a high valuation of 3.7 times sales. Overly optimistic growth expectations and an increase in interest rates forced the company to take a $300 million to $450 million impairment charge in the second quarter of fiscal 2023. This shows that the change in the discount rate does not stop at equity and bond valuations. Assets with high durations – such as the Supreme cash-generating unit – are especially vulnerable to impairment charges. Investors in companies that are growing through acquisition should therefore be particularly vigilant, as the current environment could have a twofold impact on the valuation of their stocks.

- Altria used leverage to fund – so far unsuccessful – diversification efforts in the reduced-risk segment. However, while the debt burden may seem daunting at first glance, it is important to consider the reliability of cash flows and the cyclicality of the business.

In the context business model cyclicality and cash flow reliability, VFC is a notable negative example, as management has increased leverage to rather uncomfortable levels to fund an overly expensive acquisition and share buybacks at inopportune times. As a cyclical company, entering an economic downturn in this financial state is certainly far from ideal, even if the company’s interest coverage is still very modest due to the timely debt refinancing in 2020. On the other hand, HD stands out as a positive example, even though the company’s management has spent large amounts of borrowed money on (rather expensive) share buybacks. The company’s free cash flow is extremely strong, and even in the event of a significant economic downturn and refinancing of upcoming maturities at much higher interest rates, HD should be able to maintain its dividend.

In closing, I want to reiterate the importance of looking beyond a company’s debt. A review of upcoming maturities quickly reveals potential near-term challenges or clears up false negative first impressions.

Thank you very much for taking the time to read my article.

If you want to learn even more about my research process and what stocks I like, please stay tuned because I am launching a subscription marketplace service with Seeking Alpha in the near future and the first wave of subscribers will get a lifetime discount.

More details coming soon, so please keep following and reading my work.

Be the first to comment