metamorworks

It has been some time since we looked at MiX Telematics (NYSE:MIXT), a worldwide provider of advanced telematics solutions for fleets and assets with a presence in 120 countries, based on a SaaS subscription business model.

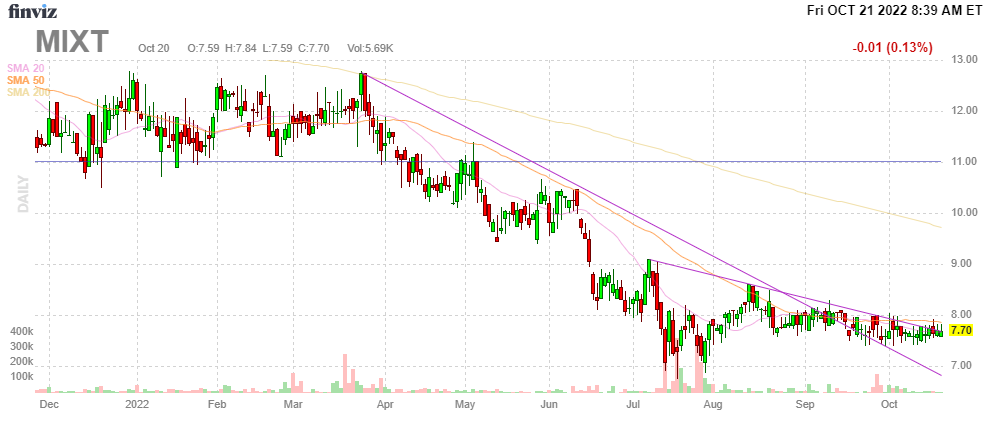

Given the number of headwinds the company has been facing, they have actually been doing quite well, but the shares have suffered with the rest of small growth stocks.

FinViz

Quick introduction

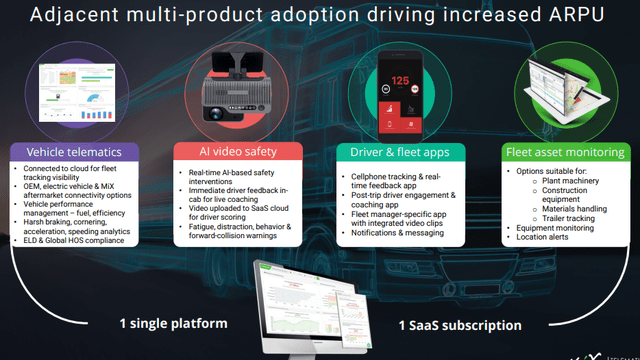

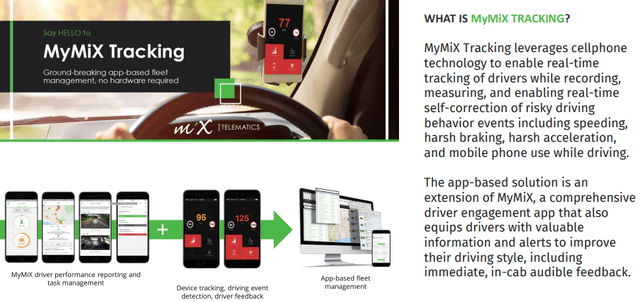

Here is a little overview of the types of services the company offers, they are quite a sophisticated telematics player (company IR presentation):

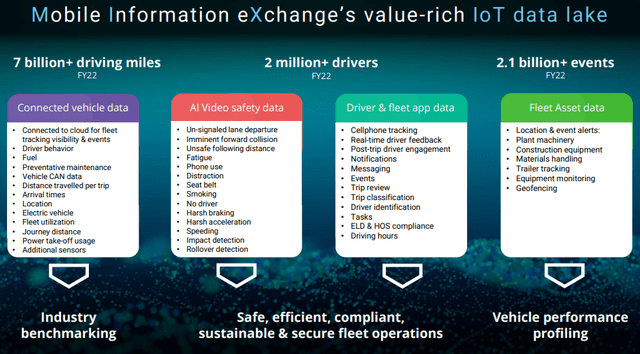

The company integrates these in its SaaS platform, a highly attractive business model. These services generate a host of data which is the basis of analytics, solving a host of problems like (10-K):

to reduce fuel and other operating costs, improve efficiency, enhance regulatory compliance, enhance driver safety, manage risk and mitigate theft. Our solutions mostly rely on our proprietary, highly scalable technology platforms, which allow us to collect, analyze and deliver information based on data from our customers’ vehicles.

The company’s offerings solve a host of solutions for customers (10-K):

For example, for fleet efficiency, we offer vehicle tracking and analysis, fuel consumption and mileage analysis; for regulatory compliance, we offer compliance monitoring, hours of service tracking and fuel tax reporting; for driver improvement, we offer in-vehicle video monitoring and in-cab real-time driver feedback; for risk management, we offer driver scoring and analysis and journey management; and for safety and security, we offer vehicle and asset tracking, crash notifications and vehicle theft recovery.

And there is more, like BI (business intelligence), from the 10-K:

Our fleet management software is designed to provide our customers with insightful, actionable business intelligence on demand. For example, our premium fleet solution, MiX Fleet Manager, includes data reporting and analysis tools with more than 110 standard reports and the ability for customers to request custom fleet, vehicle and driver reports. We also offer a premium web-based business intelligence engine with enhanced analytics, reporting and data visualization tools for those customers seeking to perform highly granular analyses of large quantities of historical and real-time data and make the data available to customers in the format of their choice.

Last year, the company launched MiX Vision AI in order to serve the video telematics market, a relatively new addition to the industry.

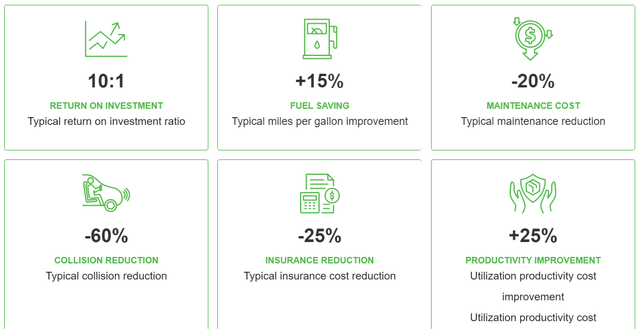

Management argues that this, in combination with in-vehicle telematics, generates a strong ROI for users:

They even have their own phone app:

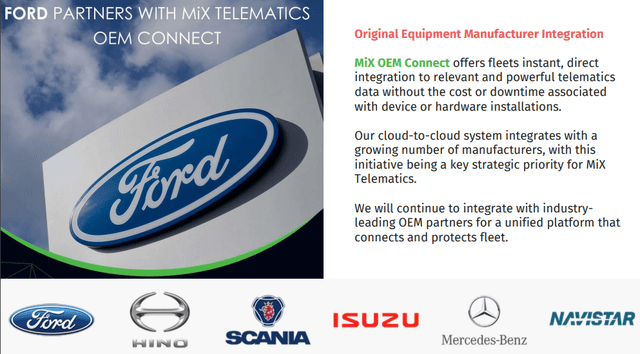

This breadth of services generates significant upselling opportunities which are interesting for instance in the OEM deals the company has with a number of car manufacturers:

Isuzu was the latest of these, a win in Q1/23 and they will even install the MiX devices on their production lines and as a result, they will pay MiX subscription revenues. From the Q1CC:

The agreement will see MiX’s fleet and asset tracking technologies installed on their production line on all vehicles in 3 commercial ranges produced in South Africa. Branded locally as Isuzu insights. The solution will be used by Isuzu to provide value-added services to their clients and also presents a significant upsell opportunity for MiX.

Headwinds

- Pandemic

- Supply issues

- Inflation

- Russia

- Customer slip

- Currencies

FY21 was the only year of subscriber contraction (minus 73.8K) due to the pandemic but the pandemic has generated a host of additional issues like supply chain bottlenecks and rising costs.

Supply chain issues at customers keep backlog high and the company has pre-emptively started to buy critical parts in order to deal with supplier price gouging and scarcity.

A new customer from South Africa was expected to start generating revenues in Q1 but this now has moved to Q2.

There is also a significant currency headwind, especially as most new subscribers (23.2M in Q1) came from South Africa where the rand tumbled 10% against the US dollar and the currency problems are general as the US dollar has strengthened against most world currencies.

The currency headwinds alone shaved $10M+ from net income in Q1. Then there is Russia as MiX withdrew from the country which declined ARR by $200K, which is a pity as this was a high ARPU customer.

The company is also facing increased costs but long-term contracts prevent immediate cost pass-through (in South Africa, which is a main market for the company, contracts are indexed so they are relatively safe from inflation).

There was also a huge flooding in South Africa which totaled 400 cars of a customer, delaying some revenue streams.

Growth

The company has a huge market opportunity as the telematics industry is still in the early innings:

MIXT IR presentation

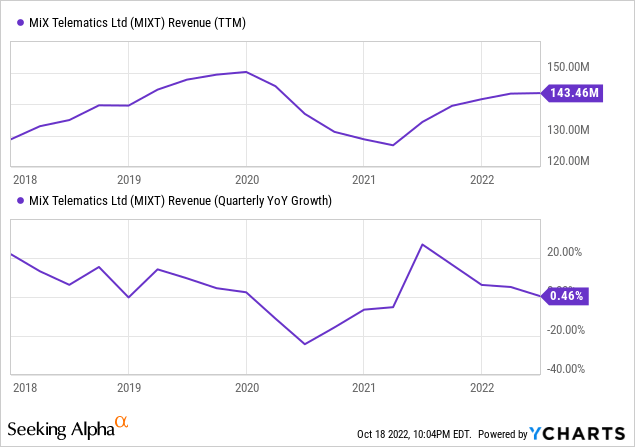

While the company is now over the pandemic dip:

YCharts

But the company has been doing reasonably well the last couple of quarters with 20K+ subscriber wins in each of the last three quarters. The company had a total of 838.3K subscribers at the end of Q1/21 adding 11% or 23.2K subscribers in Q1 (y/y).

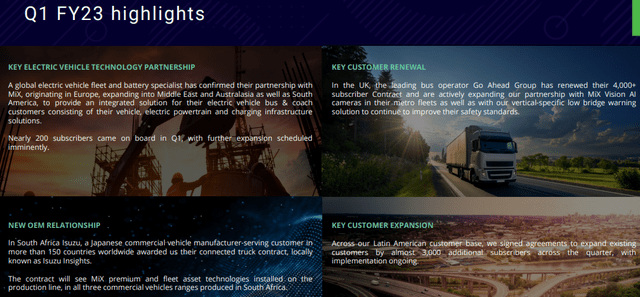

Total revenue came in at $35.1M (of which subscription revenues at $31M), representing constant currency increases of 7.3% and 6.3% respectively. ARR was $123.2M, up 1% q/q and 7% y/y on a constant currency basis. There were quite a few new customer wins in Q1:

And more after the quarter closed.

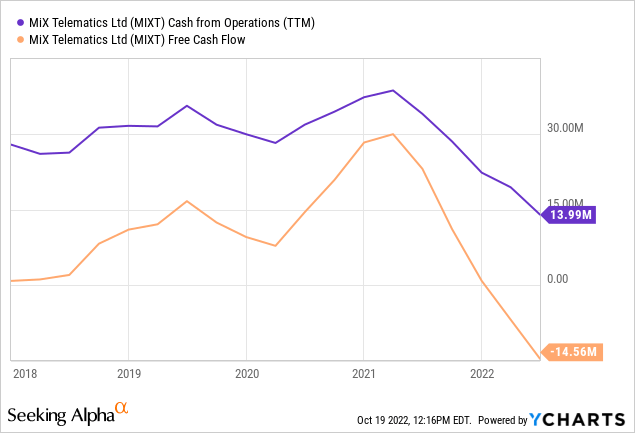

Adjusted EBITDA declined to $6M (17.1% of revenue) from $8.3M (23.8% of revenue) last year as OpEx increased 4.3% to $19.3M and revenue was relatively flat at $35M, not all that surprising given the above-mentioned headwinds. Cash flow has come crashing down:

YCharts

But it isn’t as bad as it might seem at first sight as they invested $4.9M in in-vehicle devices, building a bit of inventory and Q1 also sees year-end bonus payments, which were $2M.

Outlook

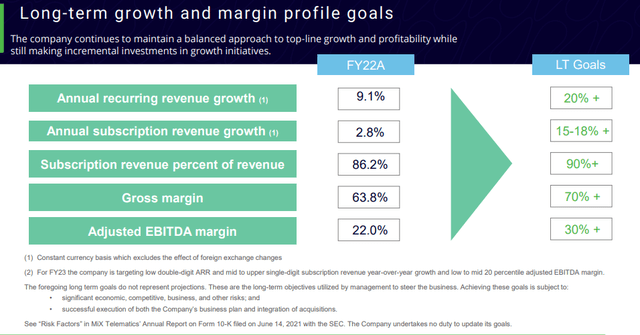

The outlook for FY23 (which started in April 2022) involves mid to high single-digit constant currency subscription revenue growth and high single to low double-digit ARR growth and AEBITDA margin in the mid-20s. Management has a longer-term outlook (Q2CC):

We continue to believe that we are in a position to generate mid to high single-digit constant currency subscription revenue growth and high single to low double-digit ARR growth for the fiscal year in addition to adjusted EBITDA margins in the low to mid-20s.

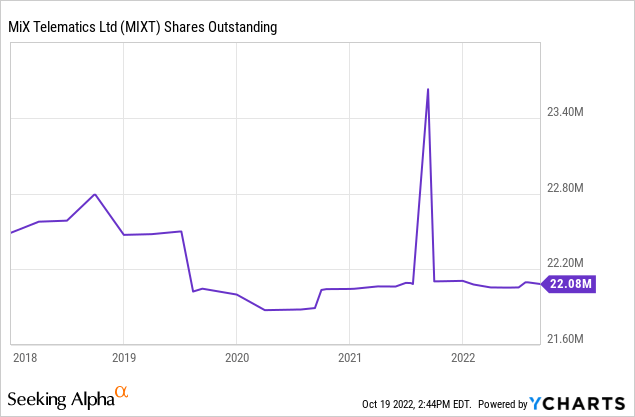

The company had $28.1M in net cash and manages some buybacks and dividends (the yield is 3.26% at the point of writing).

YCharts

Valuation

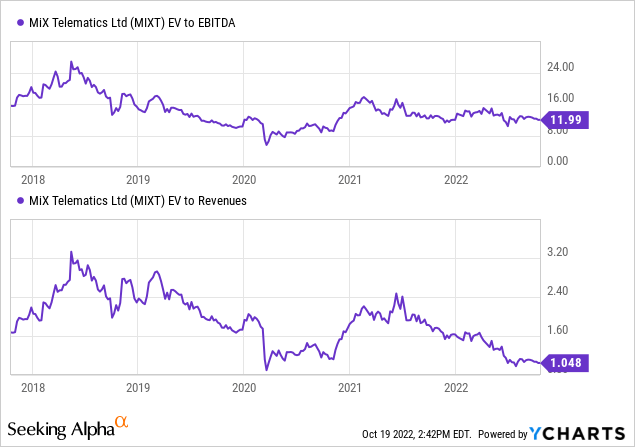

YCharts

1x EV/S for a SaaS company producing 60%+ gross margin is really quite cheap.

It’s not surprising valuation multiples have come down given the slower growth and profitability decline and a difficult market for a stock like this.

Analysts expect an EPS 0f $0.34 this year rising to $0.54 next year which makes the shares reasonably priced, especially given the dividend.

Conclusion

We don’t think the shares will be too much affected by a world recession as the ROI for fleets on their solutions is considerable, so this is mostly an efficiency-enhancing investment for customers.

But some effect there can very well be and continued currency headwinds are also likely. Still, we think the shares are reasonably priced and the company is well placed in what is still the early innings of a large market.

The company keeps winning new important customers and its products are sophisticated and varied, producing significant upselling opportunities.

The shares are really quite cheap already, especially on a sales basis, given its SaaS business model and 60%+ gross margin.

Be the first to comment