Justin Sullivan/Getty Images News

Dell Technologies (NYSE:DELL) has held up better than most tech stocks amidst the sell-off (crash might be a better description). That might be because it is different from most tech stocks, as this is a company generating robust GAAP profits, carrying ample leverage, with a stock trading at a single-digit multiple of earnings. DELL continues to make progress against reducing leverage all while repurchasing stock. I would not be surprised if the company gets even more aggressive with share repurchases next year after it reaches its leverage targets. DELL remains a buy for those looking for a value stock in the tech sector.

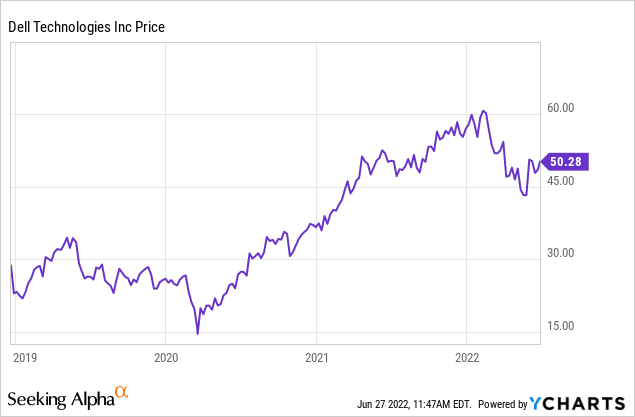

DELL Stock Price

After peaking above $60 earlier this year, DELL finds itself trading around $50 per share.

That kind of price action suggests that DELL has been trading more like a typical value stock and less like a tech stock, the latter of which has been undergoing a generational crash. I last covered DELL in early April when I rated the stock a buy on account of the free cash flow generation. That thesis remains intact and as the company continues to execute towards its deleveraging plans, the likelihood of multiple expansion remains as high as ever.

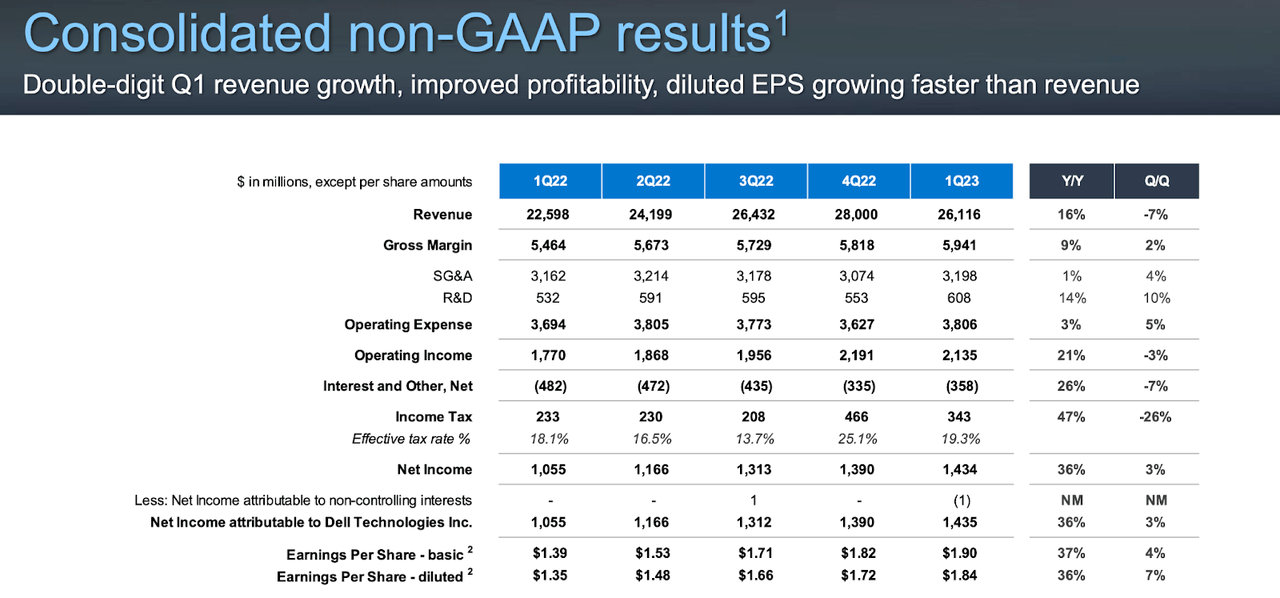

DELL Stock Key Metrics

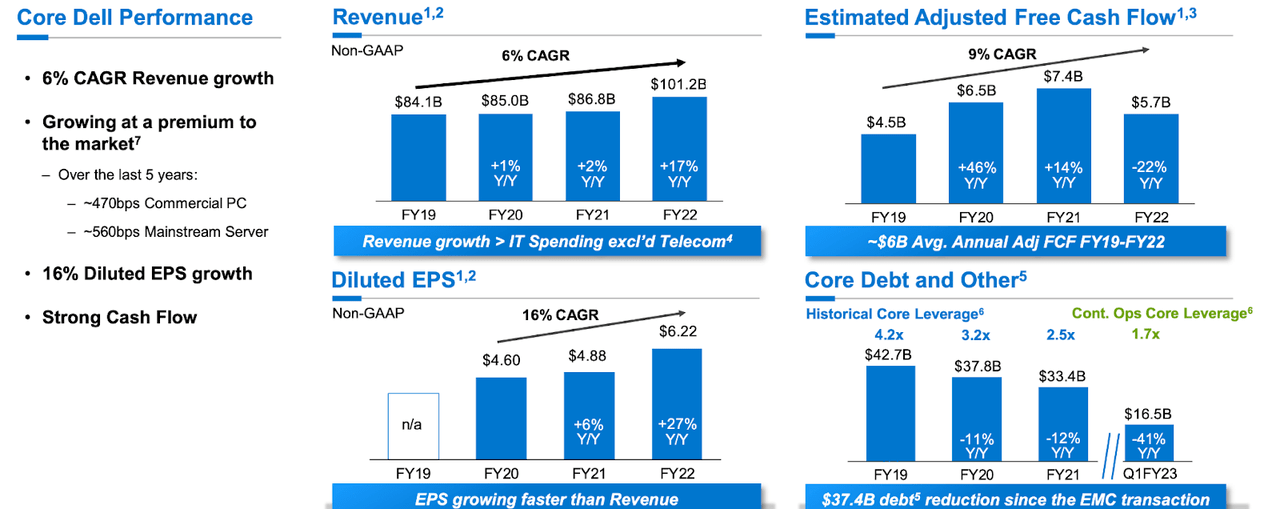

In the latest quarter, DELL reported solid 16% year over year revenue growth with even stronger 36% earnings per share growth.

FY23 Q1 Slides

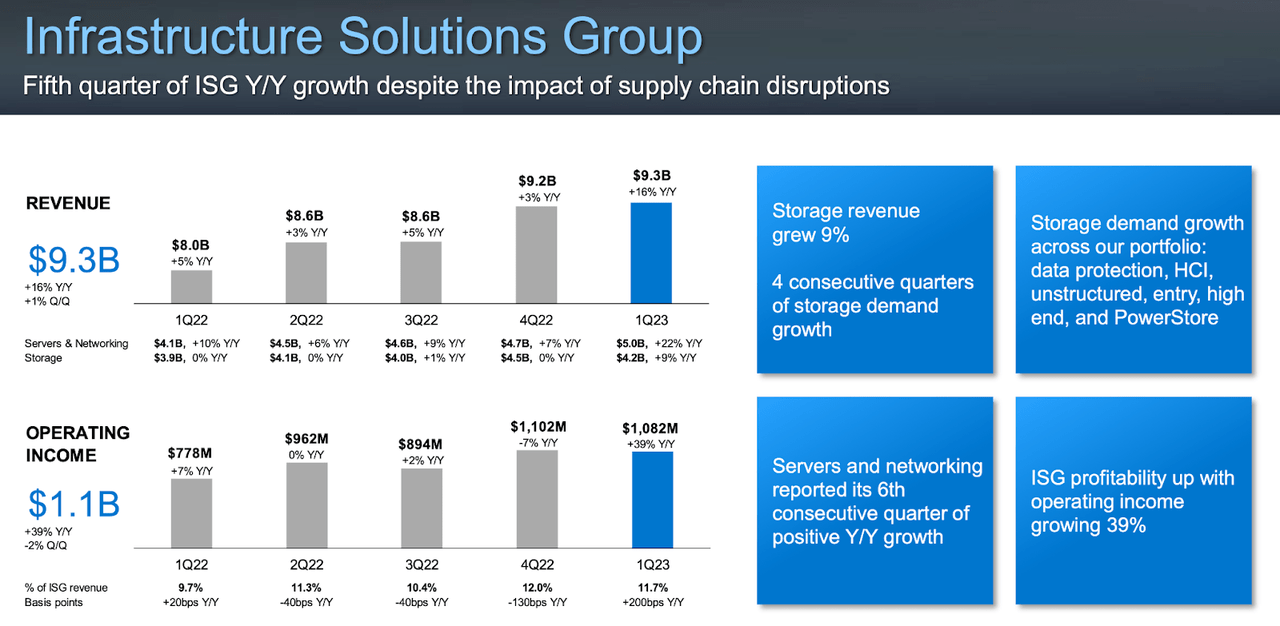

At this stage in its life, DELL is a story with two faces. On the one hand, its server and storage solutions continue to generate impressive top and bottom line growth.

FY23 Q1 Slides

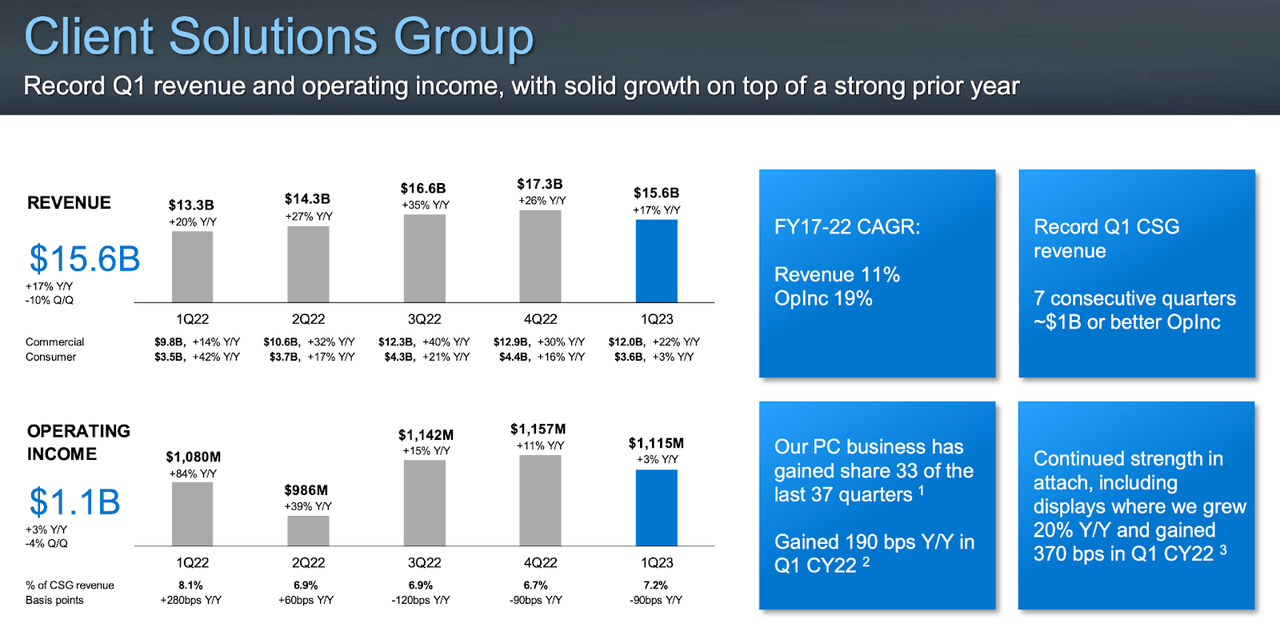

On the other hand, it appears to have reached signs of a peak in its PC business.

FY23 Q1 Slides

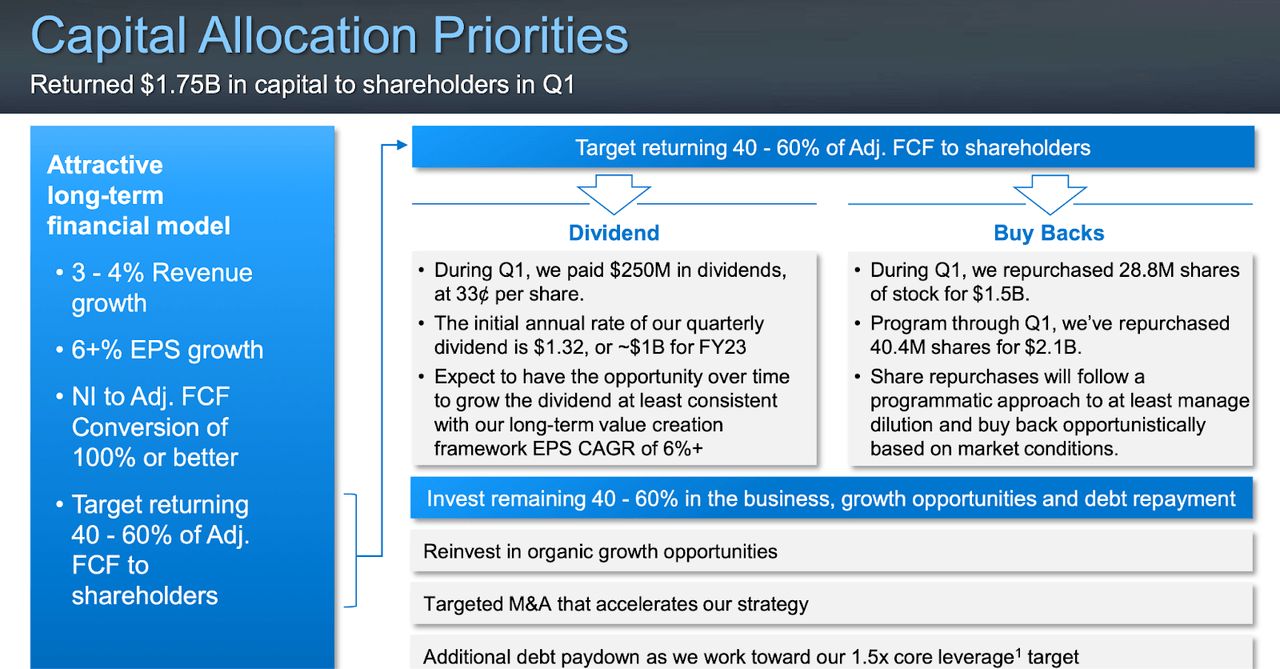

Yet at current prices, DELL isn’t priced for high-growth and thus shouldn’t be judged for it. Instead, this is a legitimate value stock which is paying a 2.6% forward dividend yield and repurchased $1.5 billion of stock in the latest quarter.

FY23 Q1 Slides

The current market cap stands around $37 billion, so the reader might be excited seeing that $1.5 billion quarterly share repurchase number. Unfortunately, you shouldn’t get your hopes up too much. On the conference call, management stated the following:

“Look, Toni, I mean if you think about what we did in Q4, Q1, it was all around, we had a significant amount of dilution coming through the VMware spin transaction. And since we weren’t in the market for last year given the beam we’re spend. We thought it was appropriate, and part of our goal with the share buyback is to control dilution. And so that — so that focus, plus the fact that share price did obviously evolve through the quarter was impotence to continue to be into the market a bit.

I think what we’re trying to balance as we go through the remainder of the year is the cash balance has obviously come down as we spent a fair amount of cash in Q1 on share buyback. So my point of view on this right now is that we’re going to continue to be programmatic, and I will be opportunistic where it makes sense. But I don’t think that pace that you saw in Q1 should be how you model the whole year, so that’s how we’re thinking about it right now.”

Regarding leverage, management has targeted 1.5x debt to EBITDA. Leverage stood around 1.7x as of the latest quarter.

FY23 Q1 Slides

At a Bank of America investment conference, management stated the following:

“I also would be remiss if I didn’t mention, we do expect to have some additional debt pay down this year towards the second half of the year as we want to be able to hit that 1.5x leverage target that we set.”

Once DELL reaches their leverage target, I could see the company aggressively ramping up its share repurchase program. With the stock trading at around 7x forward earnings, that could be precisely the catalyst for strong shareholder returns.

Why Are Tech Stocks Falling?

We have just seen that DELL did not fall in line with other tech stocks. This may be because of the primary drivers of the tech crash. In my view, tech stocks are falling due to severe multiple contraction and an overall lack of appetite for unprofitable names. Because DELL traded at value multiples prior to this crash and is generating robust earnings, it is easy to understand why the name has been more or less immune to the ongoing crash.

Is Dell Stock Overvalued?

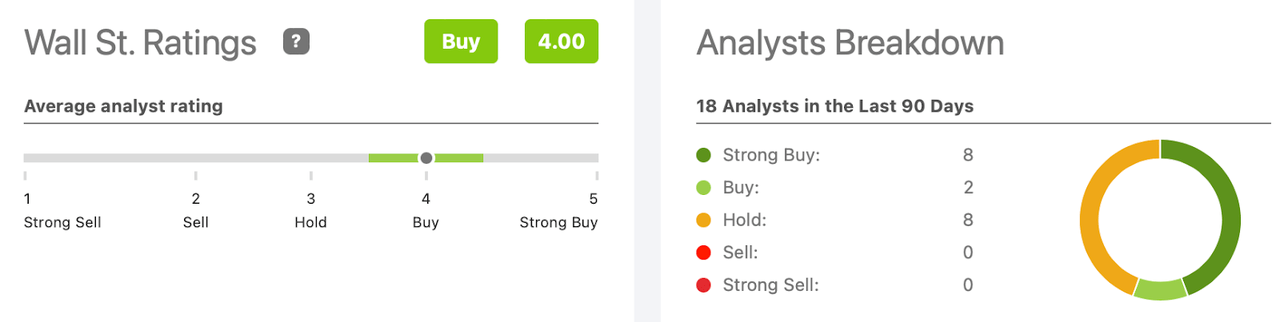

Wall Street analysts remain quite bullish on the stock, with an average 4 out of 5 rating.

Seeking Alpha

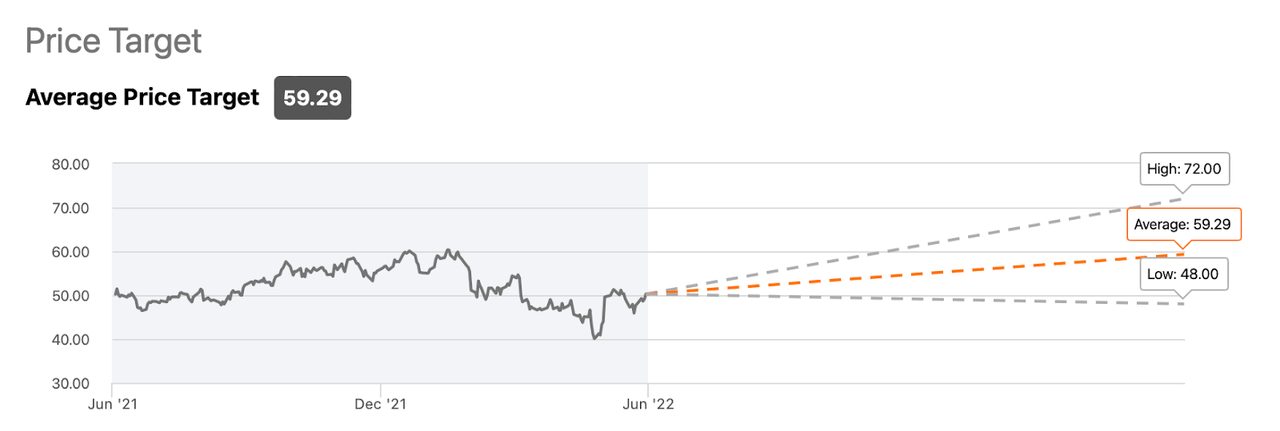

The average price target of $59.29 per share represents just under 20% upside.

Seeking Alpha

It is difficult to call the stock overvalued when it is trading at 7x forward earnings. I note that equity-based compensation makes up only 16% of non-GAAP earnings – even excluding equity-based compensation, the stock is trading at around 8x forward earnings.

Is Dell Stock Expected To Rise Further?

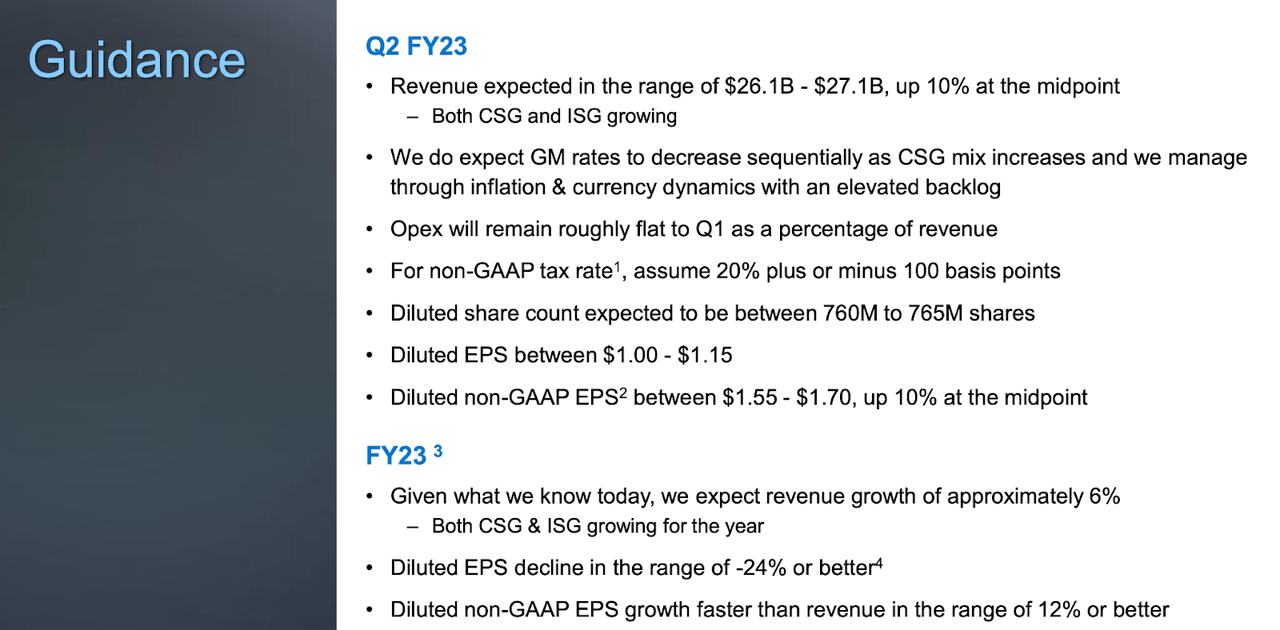

Looking forward, DELL has guided for at least 12% growth of non-GAAP EPS.

FY23 Q1 Slides

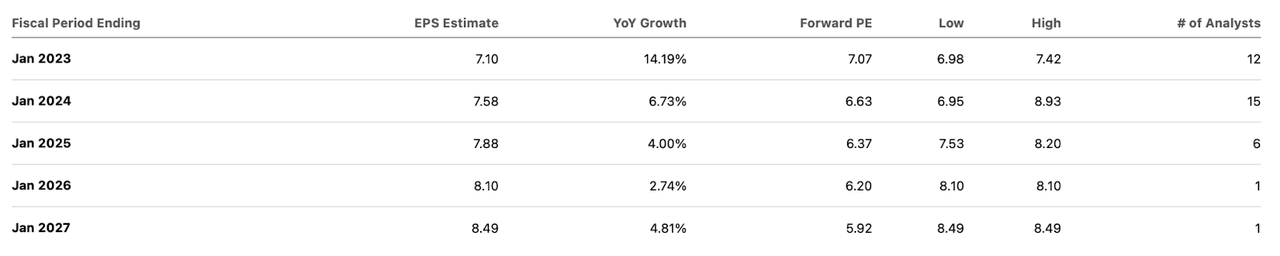

Wall Street is expecting 14% growth with growth slowing down in subsequent years.

Seeking Alpha

I suspect that consensus estimates are not factoring in share repurchases, let alone the potential for aggressive share repurchases beginning as early as next year when the company would have already reached its leverage target.

Is DELL Stock A Buy, Sell, or Hold?

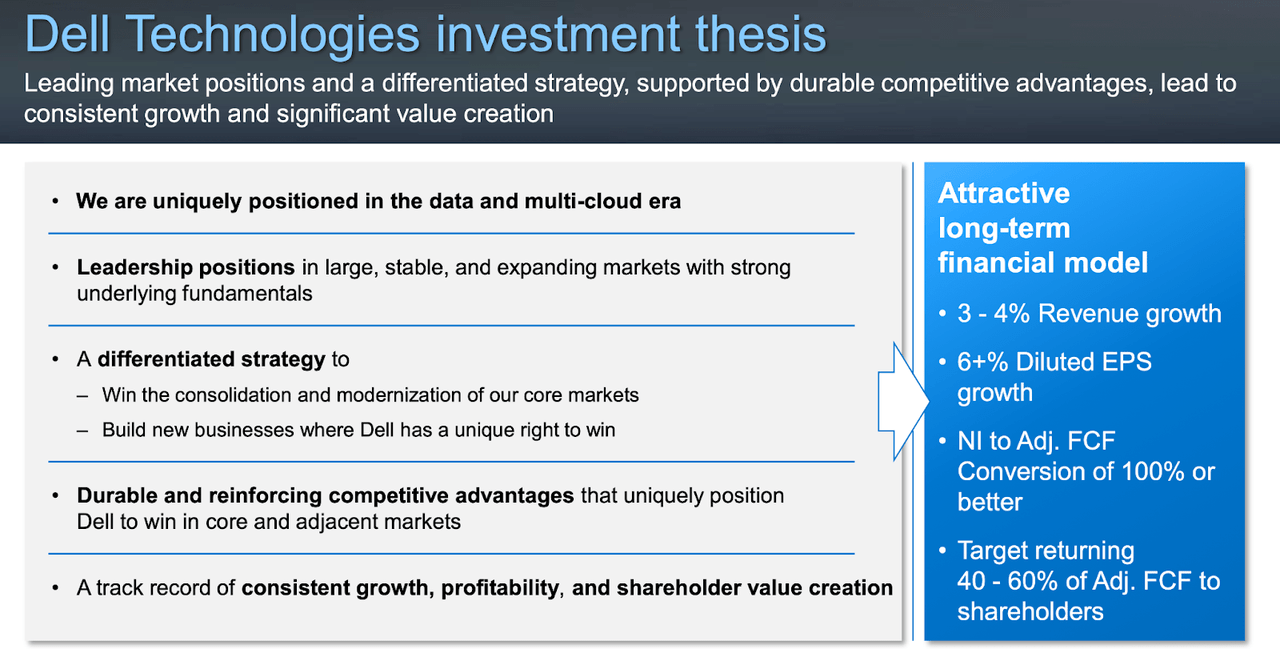

DELL stock looks very attractive here. Management has guided for around 3% to 4% revenue growth and 6% EPS growth over the long term.

FY23 Q1 Slides

The target of returning up to 60% of free cash flow to shareholders suggests that investors can expect a roughly 8.5% shareholder yield at current prices. Throw in the projected growth and this looks like a stock that can return around 12% to 15% over the long term.

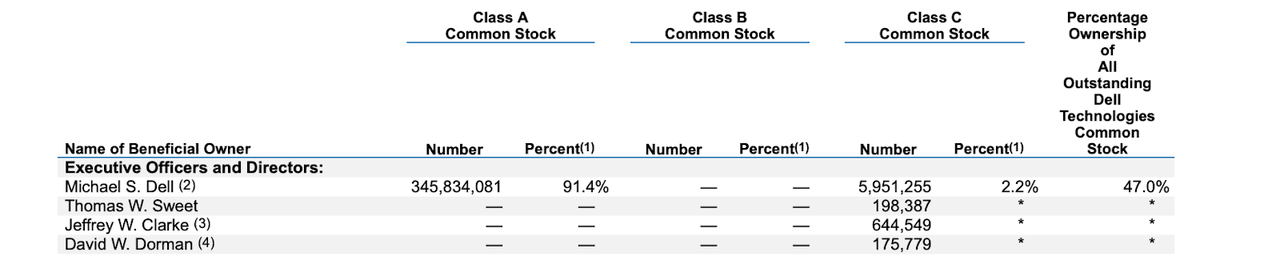

I note that CEO Michael Dell owns a sizable stake in the company.

2022 DEF 14a

The high level of insider ownership could reflect strong alignment of management with shareholders. The biggest question here is what might be the catalyst for multiple expansion? I find it doubtful that growth accelerates in a meaningful way. Instead, the most obvious catalyst will be a more aggressive implementation of the share repurchase program. With the stock trading at only 7x forward earnings, the company could theoretically repurchase as much as 12% of its stock every year, though based on its shareholder return target, it is not clear if the company would prefer some M&A instead. I would find it concerning if the company decides to embark on M&A instead of more aggressive share repurchases. The other key risk to consider is for growth to turn negative. The stock certainly appears to be pricing in secular earnings decline instead of secular earnings growth. I could see the stock trading up to 10x to 12x earnings, representing as much as 70% upside, but I could also see the stock trading down to 3x to 4x earnings in a bearish scenario, representing as much as 57% downside. I rate the stock a buy due to the prospects for more aggressive share repurchases.

Be the first to comment