happyphoton/iStock via Getty Images

Introduction

Alibaba (NYSE:BABA) (OTCPK:BABAF) is one of the most contentious holdings in my portfolio. For starters, Alibaba is the only Chinese stock I own [having initiated a small position in mid-November 2021]. Secondly, I believe that Alibaba’s stock is ridiculously cheap based on its business fundamentals. However, I am still not entirely convinced about this investment due to macroeconomic and regulatory headwinds in China. The consensus noise in broader investment media is very bearish for Chinese tech stocks, and I don’t think the sentiment will improve anytime soon. Before I share my bull-bear arguments with you today, I would suggest you read my past work on Alibaba so that we are on the same page for today’s exercise:

After analyzing Alibaba’s Q4 numbers, I performed an exercise to nail down the bullish and bearish arguments for a long-term investment in Alibaba. In today’s note, we will be discussing five reasons to buy and two reasons to sell Alibaba’s stock at current levels. Here we go.

5 Reasons To Buy Alibaba

- Solid Business Fundamentals

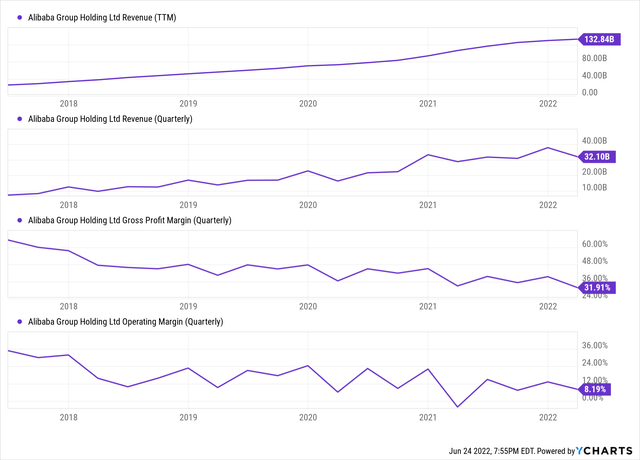

In Q4, Alibaba reported an earnings miss; however, revenue came in stronger-than-expected at $32.1B (vs. analyst estimates of ~$31B). As you may know, the Chinese economy is still suffering from draconian lockdowns, inflation, and slowing consumer demand. Despite all the noise around its business, Alibaba’s fundamentals remain robust. After experiencing a pull forward in demand during the first wave of COVID, the fact that Alibaba is still growing its revenues is heartening. With inflation causing intense margin pressures, Alibaba’s gross and operating margins declined considerably in Q4; however, these numbers are still very healthy. As the Chinese economy opens up and resumes growth, I think Alibaba’s revenues and margins will start expanding once again.

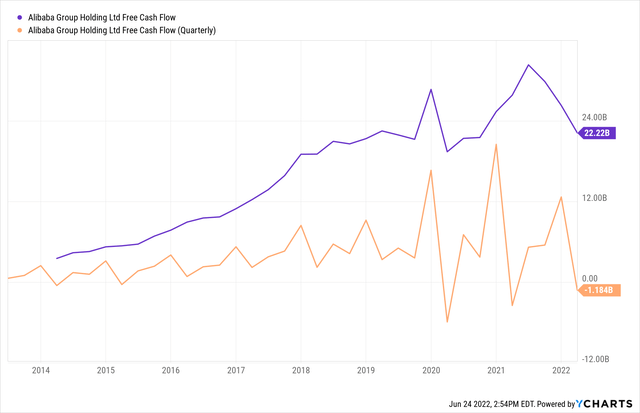

In recent quarters, Alibaba’s margins have come under pressure, which in turn has led to compression in free cash flow generation. For Q4, Alibaba reported a negative free cash flow of -$1.18B; however, if you look at historical trends, Alibaba has burnt cash in Q4 for the last three years, and this year’s burn is the smallest. At the end of the day, Alibaba is still a free cash flow machine.

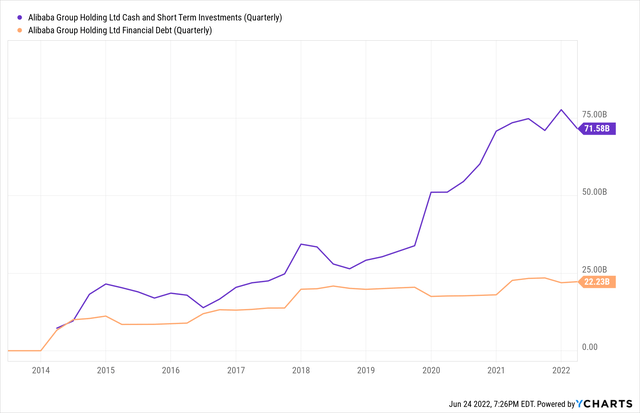

With roughly $50B of net cash, Alibaba has little to no liquidity or bankruptcy risk. Due to a violent valuation reset in its stock, Alibaba’s management has adopted a more aggressive capital return program (upsizing its share buyback authorization to $25B in March 2022).

According to Alibaba’s Deputy CFO, Toby Xu –

The upsized share buyback underscores our confidence in Alibaba’s long-term, sustainable growth potential and value creation. Alibaba’s stock price does not fairly reflect the company’s value given our robust financial health and expansion plans.

I agree with Toby. Let’s find out why.

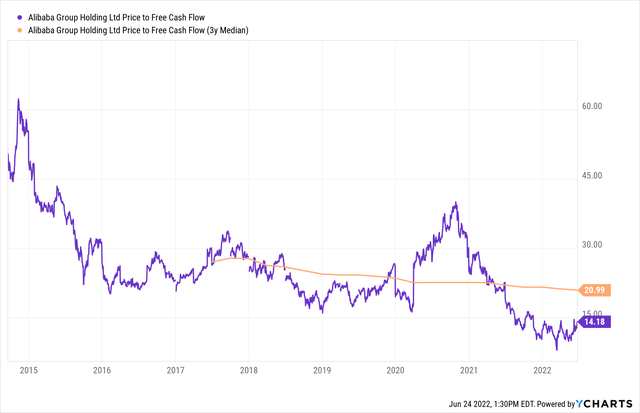

When I rated Alibaba a strong buy before its earnings report, the stock was trading at a ridiculously low P/FCF multiple of ~8.55x. I must reiterate that I had no clue as to what Alibaba would report in Q4 or how the stock would react to these numbers. However, the valuation made Alibaba a no-brainer, and it still is a no-brainer (despite the +40% move in Alibaba’s stock). Today, Alibaba is trading at ~14x P/FCF (well below the 3-yr median P/FCF of ~21x).

Honestly, I don’t think Alibaba’s Q4 numbers justify the quick 40% bounce we have seen in its stock over the last few days; however, Alibaba’s valuation remains depressed, and the upside move may continue in the near future (quantitative factor data and technical charts suggest so).

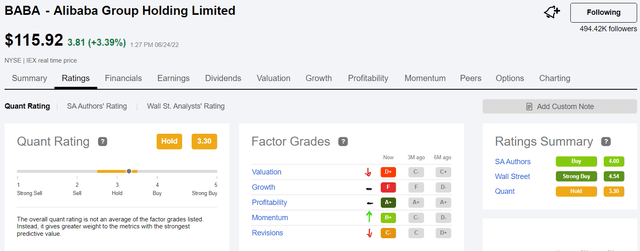

- Improving Quant Factor Grades

After the recent run-up in Alibaba’s stock, its momentum factor grade has improved from “C-” to “B+”. I previously highlighted the positive trend in Alibaba’s momentum factor grade as a potential sign of a turnaround in the stock. While momentum may continue to carry the stock higher towards the $140-$150 range, Alibaba’s factor grades for valuation and (earnings) revisions are getting weaker.

With profitability and growth factor grades holding up, Alibaba’s stock could ride the momentum train higher. Furthermore, Alibaba’s fundamentals are likely to rebound in the coming 4-8 quarters. Hence, I view the current quantitative factor grades for Alibaba favorably, despite an overall rating of ‘Hold’ [3.30] on SA’s Quant Rating System.

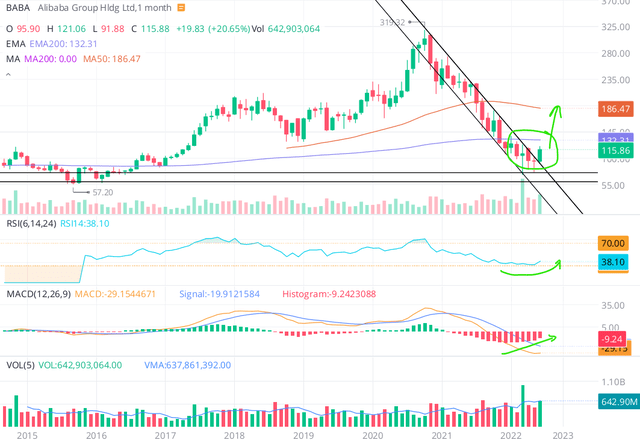

- A Trend Reversal On The Technical Charts

Alibaba’s technical chart is showing signs of a major trend reversal with a breakout from its downward falling wedge pattern. While I don’t expect Alibaba’s stock to go up in a straight line, I will be looking for the stock to recapture its 200-EMA of ~$130 to confirm the trend reversal.

On 25th May 2022, I wrote the following:

As of today, Alibaba is still stuck in the downward wedge pattern; however, there are signs of RSI divergence, and the MACD is also moving up slowly as the stock hovers above a demand zone (shown on the chart). While I do not see a trend reversal just yet, I think the technical setup is improving. A breakout to the upside could send Alibaba back up to $140-$150 in quick order.

Today, the RSI and MACD divergence that we observed a month ago is far more evident. While this bounce may yet fizzle out in the coming weeks and months, I think the technical setup is favorable for bulls (especially for ones with a long-term investment horizon).

- Signs of regulatory policy relaxation

Over the past few months, the Chinese government has been seemingly easing up on its ongoing technology crackdown. While I understand that regulatory policy risk in China remains high, the government may not have much wiggle room here, considering the growth slowdown in the world’s second-largest economy. Out of the five reasons I laid out in support of buying Alibaba, I think policy relaxation is probably the weakest one due to its abstract nature. However, if we do see a policy reversal from the Chinese government or even an easing of its technology crackdown, Alibaba could get rid of a major overhang on its stock, and if the negative sentiment abates, the stock could re-rate higher to a normalized valuation multiple.

2 Reasons To Sell Alibaba

Considering Alibaba’s healthy fundamentals, dirt-cheap valuation, improving quant factor grades, and bullish technical setup, I don’t think there is a straightforward, data-driven bear thesis against Alibaba. However, if I had to look for reasons to sell Alibaba at this throwaway price, they would have to be extrinsic reasons.

- Poor Macroeconomic Environment

Like most businesses, Alibaba is exposed to macroeconomic factors. With most of its revenues coming from China, Alibaba’s sales growth and margins could remain unimpressive for the foreseeable future due to the ongoing economic slump in China. If Alibaba’s free cash flows were to contract further in the event of a recession, the stock could go lower even if multiples were to return to normalized levels.

- Potential Delisting in the US

While Alibaba has not been named as a (potential) violator of the HFCAA (Holding Foreign Companies Accountable Act) by the US SEC, the risk of potential delisting from US exchanges is non-zero for Alibaba. Institutional investors like Blackrock have exited Alibaba’s ADRs and invested in Alibaba directly on Hong Kong exchanges. In my view, a potential delisting of ADRs is not a significant risk for Alibaba, but if you wish to get ahead of this risk, you should look to sell Alibaba ADRs [and consider investing in Alibaba on Hong Kong exchanges].

Bottom Line

Even after a rapid 40%+ move off its lows, fundamental, quantitative, and technical data render Alibaba’s stock a “Buy”. As we saw today, the good in Alibaba (reasons to buy) far outweighs the bad (reasons to sell). Hence, I continue to be bullish on Alibaba.

Key Takeaway: I rate Alibaba a strong buy at $117.

Thanks for reading, and happy investing! Please share your thoughts, questions, and/or concerns in the comments section below.

Be the first to comment