hocus-focus/iStock Unreleased via Getty Images

Netflix (NFLX) has morphed into a huge loser since November, falling 50% from $700 a share to $350 in late January. Believe it or not, Netflix’s low price in January was about the same as May 2018, wiping out three and a half years of gain! The Big Tech valuation bubble is one reason Netflix was susceptible to a huge price markdown. The other reason, getting more discussion on Wall Street, is mushrooming streaming competition means the company will have a tougher sled going forward. Guidance for subscriber numbers during 2022 was well below expectations in its Q4 earnings release. Lastly, rising inflation/interest rates should translate into much lower acceptable fundamental valuation multiples on the business going forward.

Netflix Investor Relations Website

My argument, which I have making for three years, is Netflix needs desperately to add to its content library, spend aggressively on new show production level, and expand beyond monthly streaming-only subscriptions into advertising-supported streaming and network/cable programming sent directly to your television. The single cheapest and most accretive option in this regard remains a merger deal for ViacomCBS (VIAC) (VIACA), particularly through an all-stock transaction.

First, some background on my streaming business suggestions and the changing industry landscape over the years. Way back in 2016, I wrote an article here recommending Disney (DIS) purchase Netflix, as a way to corner the streaming market for Disney. Basically, Mickey could have ruled the movie/TV industry in America far into the future. Unfortunately, then CEO Bob Iger refused to pay a high price for Netflix at that time, but later admitted his mistake when he acquired the 21st Century Fox library assets years later in 2019. Disney piled on nearly $30 billion in debt ($45 billion in extra liabilities) and its stock quote has languished since then from unnecessary interest expense during the pandemic closures of theme parks and stores. All of this an effort to beef up the Disney+ streaming play to compete with Netflix.

In 2019, with Disney+ rolling out, I further suggested Netflix make a countermove by purchasing ViacomCBS to gain new owned content through the Paramount and CBS libraries, plus a live network feed to create a more sticky Netflix product for consumers. And, I have been promoting such a merger ever since.

For Netflix specifically, streaming competition is hitting from all sides in 2021-22. The stock quote cratered after management admitted subscriber growth is slated to stall this year. In an effort to offset weaker-than-expected subscriber numbers, another large price increase is being pushed through to fund new film and show production. The open question is whether the 11% price hike further slows subscriber numbers, or even puts the total headcount in reverse during an eventual consumer recession (a reaction to rising interest rates in 2022). If consumers balk at Netflix’s higher-cost proposition for shows, and cancel in favor of competing streaming services at lower prices (PlutoTV and YouTube are free options for viewers), still rosy Wall Street projections for growth will not be reached.

In my view, Netflix management is failing to understand how damaging increased streaming competition will be for the company’s income and cash flow future. I am modeling today’s outsized price increase for subscribers will backfire and bring subscriber growth to a halt by the end of the year, with a stagnating stock quote. The only way to properly justify the cost jump for consumers is by offering far more content choice. Again, Netflix’s latest struggle fits perfectly with my recommendation it add streaming content offerings by purchasing ViacomCBS.

Why Merge with ViacomCBS?

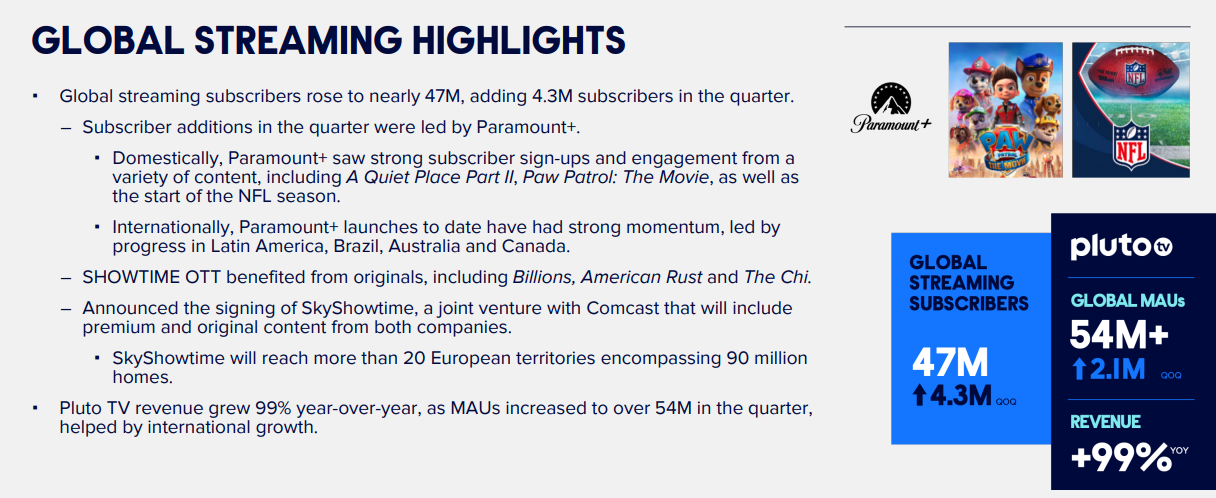

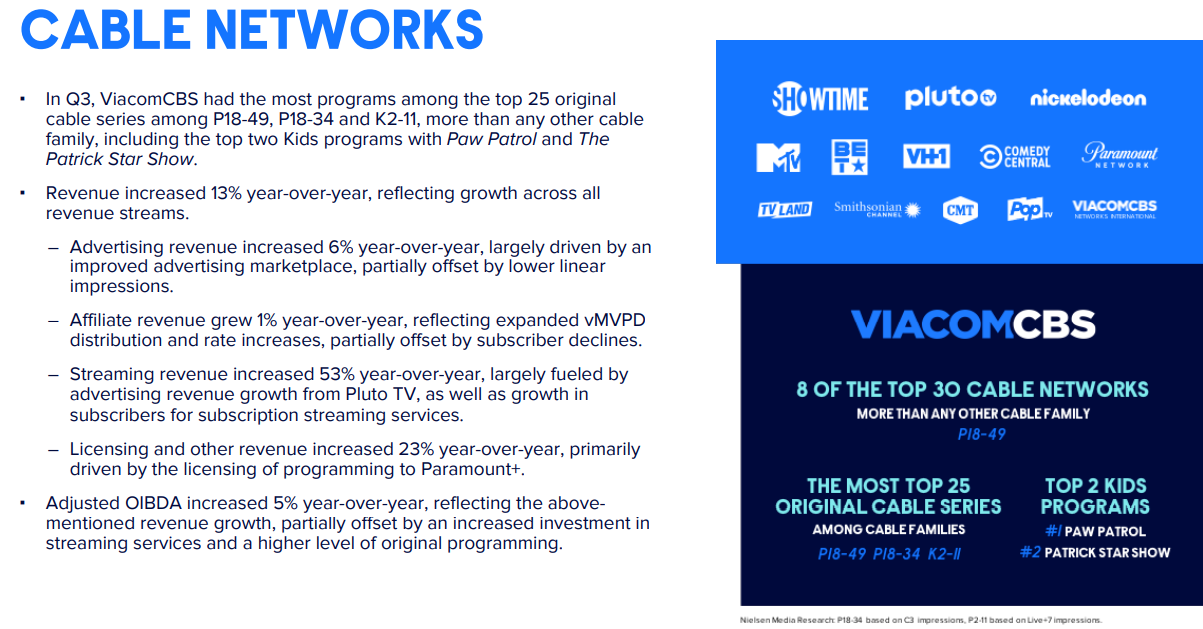

Besides holding the best program library for each buck invested, owning the most-viewed U.S. television network and the quickly expanding cable-tv killer service PlutoTV (totally ad supported and free to consumers) are the real catalysts for keeping and growing eyeball counts beyond the subscription streaming-only business model. Already, the number of video media streaming options is saturating the market. Whether competition from Disney+ or the Alphabet-Google (GOOG) (GOOGL) YouTube is considered, or offerings from Apple TV (AAPL) to Amazon Prime (AMZN), the Comcast (CMSCA) Peacock effort to a rebranded Paramount+ option, AT&T‘s (T) HBOMax and soon to be wed Discovery+ (DISCA) (DISCA) (DISCK) services, with smaller entries like AMC Networks (AMCX) and others, Netflix is far from guaranteed a growth path after 2022.

Q3 2021 ViacomCBS Report Q3 2021 ViacomCBS Report Q3 2021 ViacomCBS Report Q3 2021 ViacomCBS Report Q3 2021 ViacomCBS Report Q3 2021 ViacomCBS Report

The good news for potential suitors seeking to purchase ViacomCBS is Sumner Redstone‘s voting control has passed to his daughter, Shari Redstone. Viacom and CBS officially combined into a single company again in December 2019. Management has been trying to figure out how to kick-start the stock price, with stellar streaming media growth and debt reduction in 2020-21 failing to catch investor attention. Combining Netflix’s assets with ViacomCBS has all kinds of synergy and growth catalysts attached. And, if Shari and management can retain jobs or expand their titles in a married organization with Netflix, exchanging VIAC and VIACA shares for the recharged NFLX equivalent (including a nice upfront premium) might be an idea too powerful to pass up.

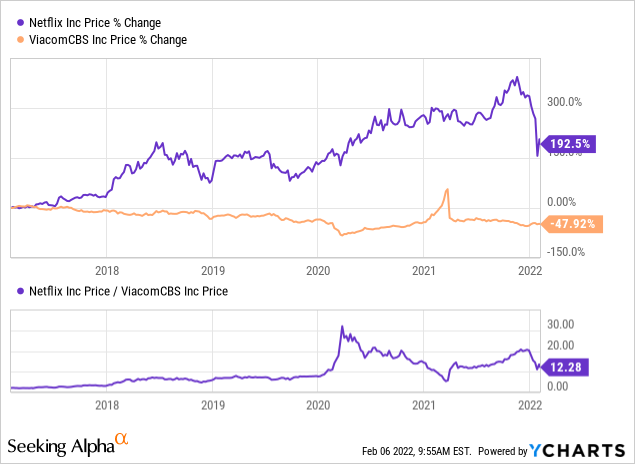

The bad news for Netflix shareholders is this deal could have been made at much better terms in April-May 2020 or even several months ago, when the Netflix share price spread to ViacomCBS was dramatically more advantageous. Below is a chart of the ratio of NFLX to VIAC stock pricing (including the old CBS before late 2019), over the last five years with price performance changes for each.

YCharts

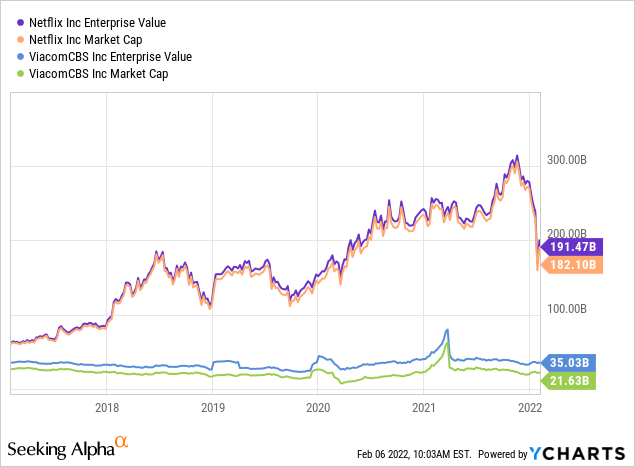

Netflix has a far larger equity market capitalization, so a straight all-stock purchase offer for ViacomCBS will not be very dilutive to existing owners in terms of control of the merged assets. Even including debt, Netflix is 5x the enterprise valuation size of ViacomCBS.

YCharts

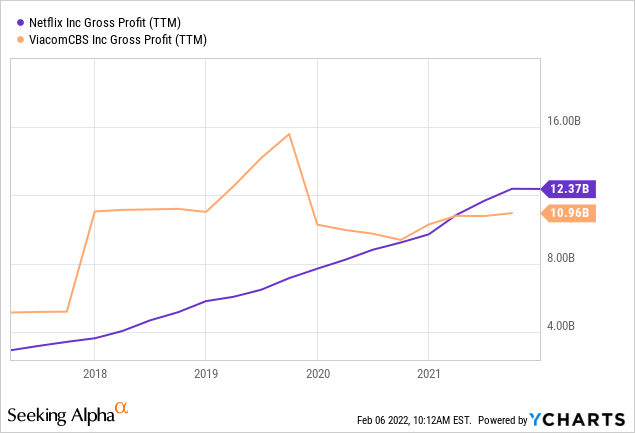

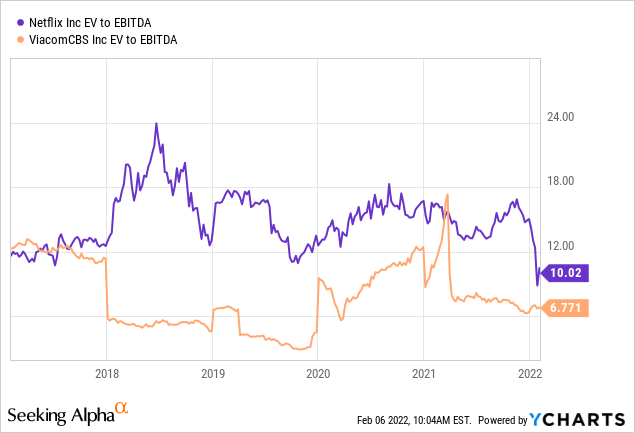

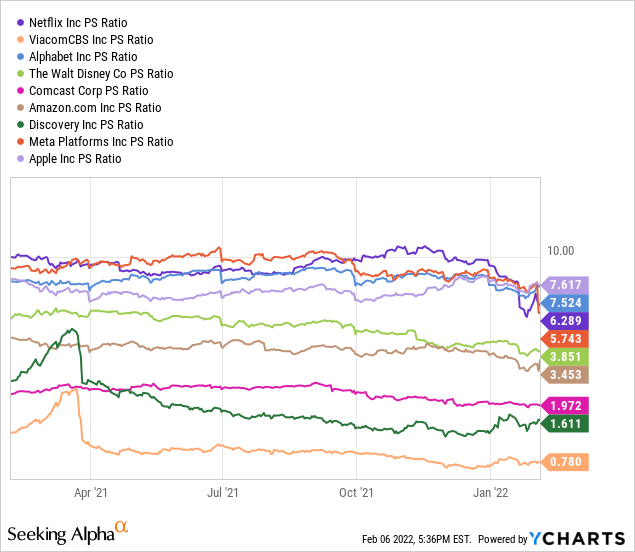

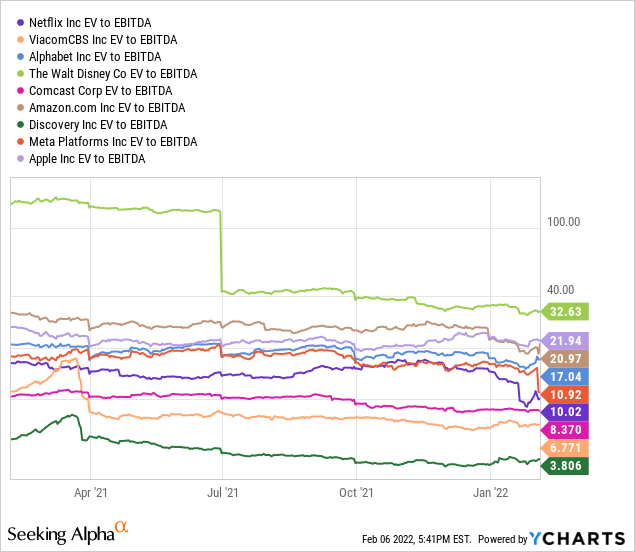

But, here’s the real upside story for intransigent Netflix shareholders wanting to stay the course and go it alone: ViacomCBS earns roughly the same amount of gross profit assuming all debt was repaid in the merger deal. Believe it or not, EV to EBITDA actually favors ViacomCBS by a wide margin.

YCharts YCharts

In addition, Netflix still does not generate free cash flow for owners, as it has to reinvest in new programming at ever alarming rates to stay relevant in the streaming wars.

YCharts

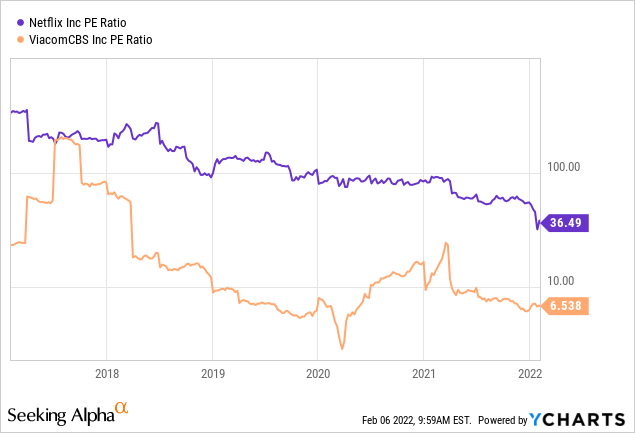

In the end, a fair premium bid around $50 per share for ViacomCBS would actually be resoundingly “accretive” to existing Netflix shareholders on nearly every financial metric. For example, I estimate the united NFLX/VIAC setup would be priced under 25x EPS for 2022 (depending on debt extinguishment and synergies), instead of the current Wall Street estimate of 33x for Netflix by itself.

YCharts

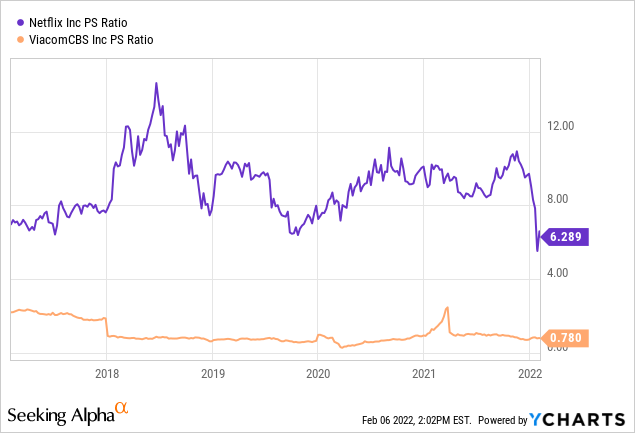

Price to sales changes would benefit and support Netflix’s long-term worth even more, in my opinion. I am modeling a drop from 6x sales for Netflix today to a reading closer to 4.2x using a $50 takeover price for ViacomCBS.

YCharts

Final Thoughts

Who wouldn’t want to own the new undisputed streaming and media king at a P/E around market multiples of 25x, and price to sales just slightly above the S&P 500’s 3x number today?

In my mind at least, combining the “value” streaming play in ViacomCBS with the richly-priced “growth” setup for Netflix would be a marriage made in heaven. Netflix would have so many new ways to expand subscription content, push PlutoTV on more consumers, and give the world a variety of avenues to access the leading U.S. television network. Netflix might eventually decide to launch an ad-supported reduced-content version of Netflix for the masses, diversifying its revenue generation into the media advertising world.

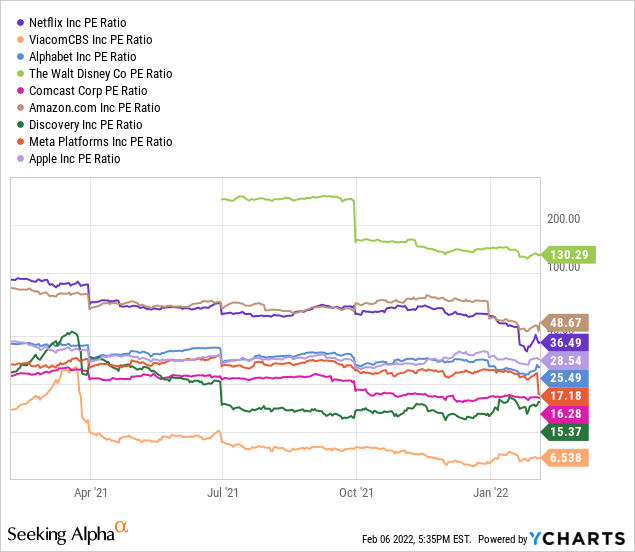

I can argue the two together, in all-stock combination with debts paid off, would have stronger growth and valuation characteristics than Disney, WarnerMedia/Discovery, Comcast or any other Big Tech media name such as Alphabet, Amazon, Apple and Meta Platforms-Facebook (FB).

YCharts YCharts YCharts

However, absent a merger I am in the Hold to Buy-on-Weakness camp for both Netflix and ViacomCBS. Their valuation pictures have improved over the last three months, solely as a function of declining stock prices. I would rate Netflix a solid Buy under $350, and ViacomCBS under $30. Note: both targeted buy zones are only 10% to 15% below current quotes.

I have been less than bullish on Netflix’s stock price for several years as competition heats up. I stubbornly suggested investors sell Netflix here a year ago when the quote was over $500. Rising expense requirements to produce new films/shows, stalling subscriber growth, and even pressure on monthly pricing for consumers are slowly becoming reality in a free-market economy. The biggest risk for Netflix in 2022 could come from an unexpected refusal by millions of subscribers to pay as much as $20 a month for access. Then, we could see a larger share quote drop, and yet worse exchange rate currency for content merger deals.

My view is the quicker Netflix management realizes it needs to expand programming to match monthly subscription price increases, the better off shareholders will be. Waiting for more operating business disappointment as competition becomes substantially more intense throughout 2022 is a recipe for trouble, just like 2021’s foot dragging. Take the initiative and buy out ViacomCBS, before the positive exchange math disappears.

Sometimes activist investor Bill Ackman of Pershing Square purchased a large 3.1 million share stake in Netflix during the January tank (for a top 20 shareholder position). Maybe he has a plan to encourage management to get serious about competitive threats and do a major content deal soon. We’ll see what happens in 2022.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment