Torsten Asmus/iStock via Getty Images

Introduction

We are currently witnessing the highest inflation in decades and the figures look even worse if you calculate the inflation rate according to the 1980 methodology – it stands at 19.5%. More and more of my friends are asking me how to protect their savings during these turbulent times and my usual answer is treasury inflation-protected securities (OTCPK:TIPS). However, those investing in the stock market are wondering how to improve the performance of their portfolios in this high-inflation environment. Well, I’ve looked into inflation data for the past century and my top pick at the moment is silver. If I had to choose one company from this sector, that would be Silvercorp Metals (NYSE: SVM). Let’s review.

Performance of different asset classes during periods of high inflation

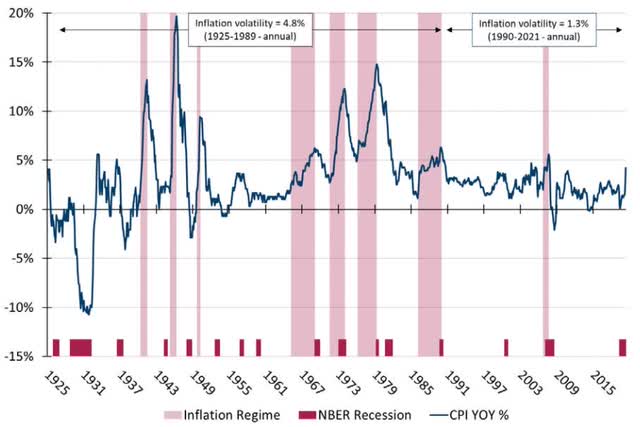

There have been a total of 8 inflationary regimes in the USA since the start of World War II during which annual inflation averaged above 5%. The performance of different assets has been researched extensively and perhaps the best publication I’ve read so far is a 2021 study by researchers from Man Group (OTC:MNGPF) and Duke University titled “The Best Strategies for Inflationary Times”. You can read it here.

The Best Strategies for Inflationary Times

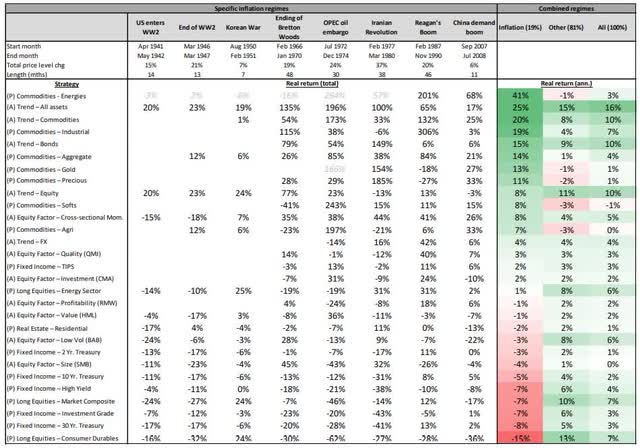

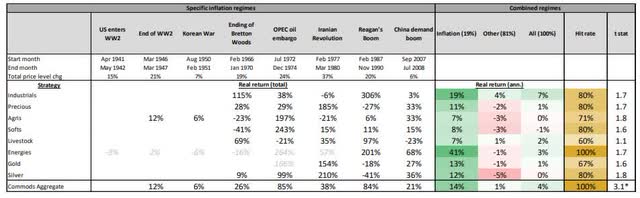

As you can see from the chart above, most of these inflationary regimes were followed by a recession, and many economists today fear we might be close to entering stagflation. So, let’s get right into it – where should investors put their money? Well, it’s complicated as there are many factors at play and I like to tell my friends that making economic forecasts is a bit like predicting the weather. As you can see in the chart below, traded commodities have the best track record in a high-inflation environment as they have generated positive real returns during all of the 8 US inflationary regimes. They have an annualized real return of 14%. However, commodity prices today are near record highs and many analysts are arguing that inflation has been high lately precisely because the prices of commodities are soaring.

The Best Strategies for Inflationary Times

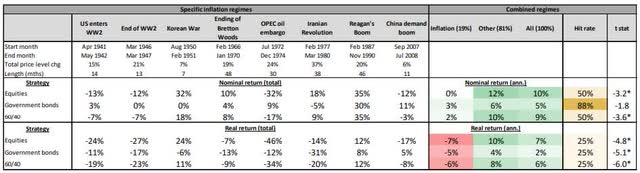

Stocks and real estate are also close to record highs at the moment and historically they have been lousy inflation hedges anyway. The annualized real return on U.S. stocks averaged -7% and real estate also provided negative real returns during the 8 inflationary regimes. In case you are considering a classical 60-40 equity-bond portfolio, the real annualized return of this strategy is –6%.

The Best Strategies for Inflationary Times

You might be thinking that there are new asset classes today that could shield you from inflation, such as cryptocurrencies. However, the price of Bitcoin (BTC-USD) has already lost 14.5% since the start of 2022 and it seems to have a high correlation with the US stock market. This means that cryptocurrencies could be viewed as a risk-on asset instead of a store of value. Gold is viewed by many as a traditional store of value but it has a checkered past in high-inflation environments. Sure, it has an average annualized return of 13% during the 8 inflationary regimes in the USA but it lost a whopping 41% during Reagan’s Boom. Silver and precious metals also performed poorly during that period. However, all of these three asset classes shined during the Iranian Revolution.

The Best Strategies for Inflationary Times

So, what am I trying to get to here? In my view, it’s crucial to determine which are the key factors behind an inflationary regime in order to make a good prediction for the performance of a certain asset class. There are a lot of moving parts but I think that most analysts would agree that among the main reasons behind today’s high inflation rates across the world are strong economic activity after lifting COVID-19 restrictions, supply chain issues, the Russian invasion of Ukraine, and last but not least – record money printing by global central banks coupled with quantitative easing. In view of this, I think it’s likely that gold and silver will perform well over the next few years. So, why did I say in the introduction that my pick is silver and not gold? Well, this is because I think that the fundamentals of silver look better at the moment. According to data from The Silver Institute, silver demand is set to reach a record 1.112 billion ounces in 2022 thanks to strong silver industrial fabrication. With supply expected to increase by 7% to 1.092 billion ounces, we could have the first structural deficit in this market since 2015. This brings us finally to Silvercorp Metals

Why Silvercorp Metals is my top stock pick for the current high-inflation environment

I used to have a weekly series on SA named “Best Drill Interceptions In The Metals Mining Sector” and something I noticed was that exploration-stage mining companies with exciting projects tend to perform well when the metal they are digging for is hot. However, they usually need regular capital increases to keep the drills running and this often leads to significant stock dilution when the price of the metal crashes and their projects stall. How about silver producers then? Well, about two-thirds of silver is mined and produced as a co-product of lead, zinc, copper, and to a lesser extent, gold. There are few mining companies that generate over 50% of their revenues from silver and the major ones like Fresnillo (OTCPK:FNLPF) look pretty expensive at the moment from a net present value (NAV) perspective.

For me, the ideal investment in the silver space is a company that is in the production stage and has low all-in sustaining costs (AISC) in order to be able to weather low silver prices in case I’m wrong about the prospects for the metal. It also should have a low debt load as well as a good track record in regard to stock dilution and dividends. It would also be nice if it has investments in exploration-stage projects that could boost its NAV significantly if silver prices go higher. The only silver mining company that I’ve found that fits all of these criteria is Silvercorp Metals.

The company owns the Ying Mining District and GC Mine silver projects as well as the BYP Mine in eastern China.

Silvercorp Metals

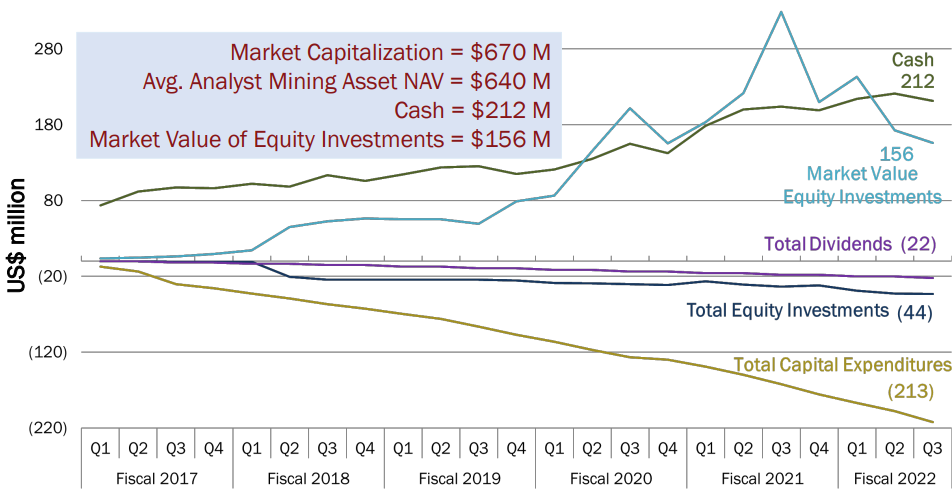

Silvercorp has issued almost no new shares since 2014 and it has been growing its operations organically. Its cash position stands at $212 million and the company currently has a $0.0125/share semi-annual dividend.

Silvercorp Metals

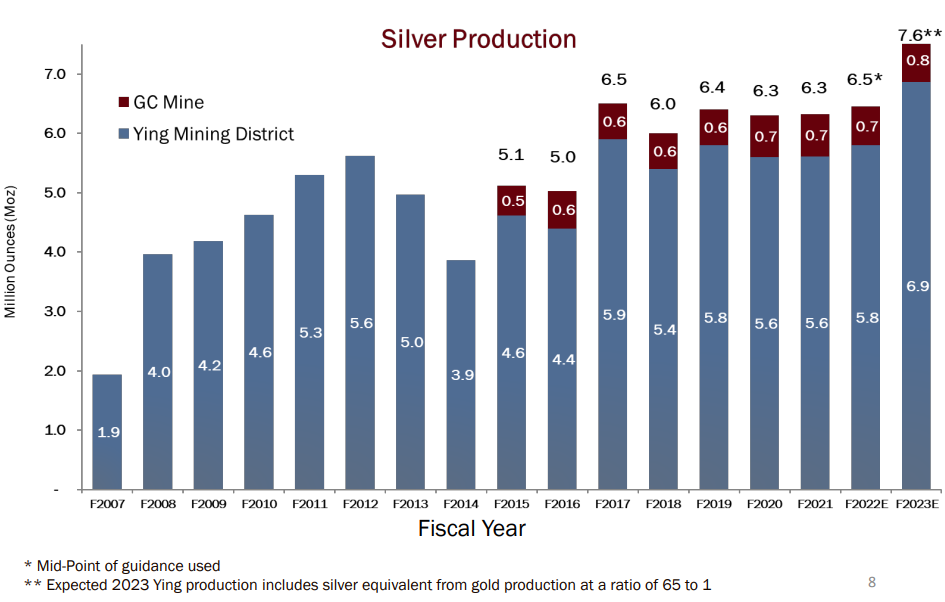

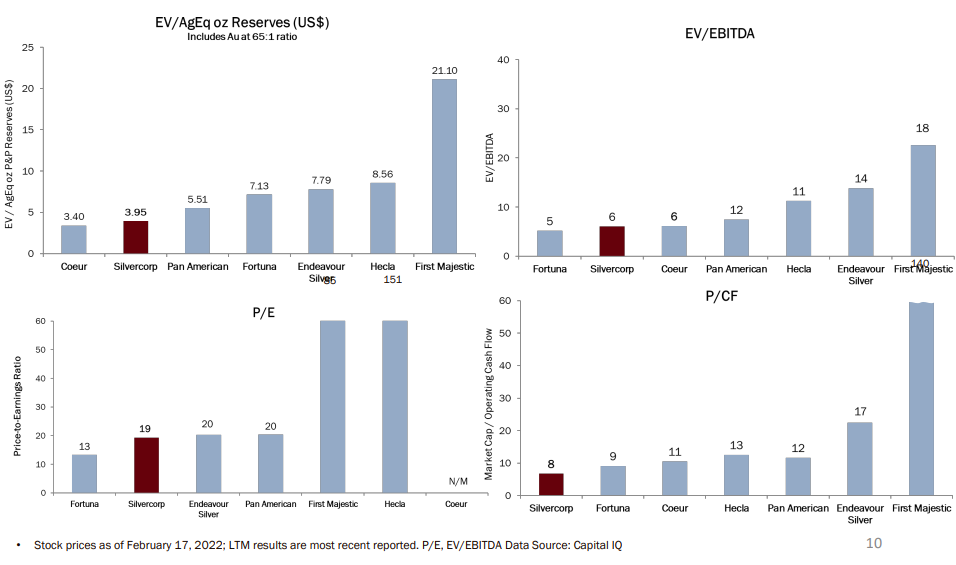

Turning our attention to the output, Silvercorp expects FY23 to be its best year ever with around 7.6 million ounces of silver production, and AISC are forecast to come in at $141.6 – $143.5 per tonne. The company is also among the cheapest silver producers by any key economic metric, including EV/Reserves, and EV/EBITDA.

Silvercorp Metals Silvercorp Metals

On top of that Silvercorp owns a 28.3% stake in New Pacific Metals (NYSE:NEWP), which owns several large silver deposits in Bolivia. The Silver Sand project alone has a measured and indicated resource of 155.9 million ounces of silver and there is a 30,000 m drill program currently underway at Carangas. In my view, this company could become a major silver producer in a few years and Silvercorp’s stake is valued at $162.3 million as of the time of writing.

New Pacific Metals

So, Silvercorp has $212 million in cash, the stake in New Pacific Metals is worth another $162 million and the average analyst mining NAV given to the company stands at $640 million. Considering that silver miners rarely trade below 1.2x NAV, I think that Silvercorp should be worth at least $1.1 billion, which translates into around $6.20 per share.

Looking at the risks or the bull case, you could argue that China isn’t considered to be a good mining jurisdiction and there are political and regulatory risks. If you agree with this assessment, then it would be prudent to apply a discount to the valuation of the company compared to peers in the Americas.

Investor takeaway

I expect inflation rates across the world to remain high in the foreseeable future and I think that silver stocks are likely to perform well during this period. This metal is a traditional store of value and its price has generally performed well during periods of high inflation. Also, the fundamentals for 2022 look well as demand is expected to surpass supply for the first time since 2015, which bodes well for prices.

I like Silvercorp because I think it’s among the best-run silver mining companies in the world and its track record reflects this. The company looks cheap at the moment and higher silver prices are likely to significantly boost its profits as well as the value of its stake in New Pacific Metals.

Be the first to comment