Charday Penn/E+ via Getty Images

Investment Thesis

While Rogers Communications has seen a significant recovery as a result of wireless revenue growth and the upcoming Shaw acquisition, a stall in growth or regulatory hurdles could place downward pressure on the stock.

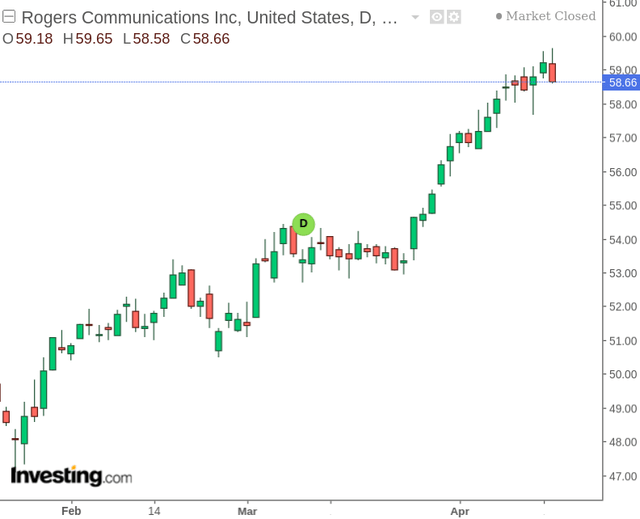

In a previous article back in February, I made the argument that Rogers Communications Inc. (NYSE:RCI) could see potential upside on the basis of significant expected growth in Wireless and Media revenues as a result of the Shaw acquisition.

Since February, the stock is up by just over 12%.

With the company set to report Q1 2022 earnings tomorrow – 4/20 – the purpose of this article is to assess more broadly whether we could expect to see further potential upside on the back of the upcoming acquisition of Shaw Communications (SJR).

Performance

After having seen a significant recovery across the Wireless segment, the upcoming earnings release will demonstrate more clearly whether such growth might be seeing a plateau at this point.

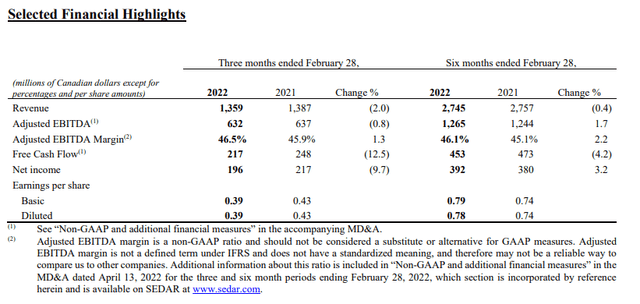

With that being said, Shaw Communications released its second quarter and year-to-date 2022 earnings last week – and overall revenue growth was down by 2% from the same period last year on a three-month ended basis, along with free cash flow down by over 12%.

Shaw Communications Q2 and Full Year Fiscal 2022 Results

Specifically, while wireless service revenue was up by 9.2% as a result of an increased subscriber base – wireless equipment revenue was down by 28% due to a lower number of devices sold. Overall, wireless revenue was down by 3.9% to $323 million.

With the acquisition of Shaw Communications by Rogers expected to close in the first half of this year – the recent results are of relevance as: 1) Rogers will need to reignite growth across the newly acquired wireless segment as a whole; and 2) the recent decline in wireless revenue may be indicative of industry trends as a whole at this time, and Rogers might also see a decline in wireless revenue in the upcoming earnings release.

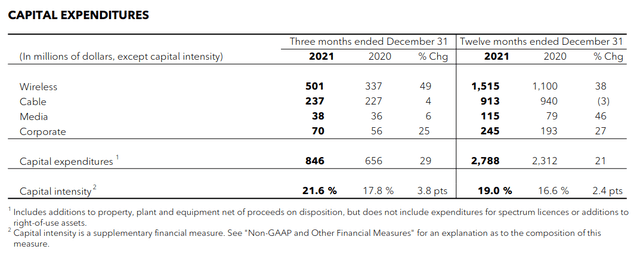

Moreover, when looking at Rogers’ financial results for the previous quarter, we can see that capital expenditures across the Wireless segment increased significantly, and also accounted for over half of overall capital expenditure.

Rogers Communications: Fourth Quarter and Full Year Fiscal 2021 Results

In this regard, the Shaw acquisition could be expected to further increase capital expenditures across this segment – as it will cost Rogers more to maintain and upgrade existing wireless facilities for a broader customer base.

Looking Forward

To date, Rogers Communications has been seeing its stock rise as a result of a significant rebound in wireless growth – as well as investor optimism over the upcoming acquisition of Shaw.

However, while the acquisition has cleared the first regulatory hurdle with the approval of the companies’ broadcast services by the CRTC – federal regulators still need to approve the takeover of the wireless, internet and home phone services by Rogers. Such an acquisition still raises significant concerns as regards to competition and fair consumer pricing. The decision by both the Competition Bureau and ISED (Innovation, Science and Economic Development Canada) is not expected until later in the year.

Moreover, cable and wireless prices in Canada are reportedly amongst the highest in the world already, which could further add to concerns regarding fair competition in the marketplace.

From this standpoint, while investor optimism regarding the acquisition has been propelling the stock higher – the acquisition is not a done deal, and potential resistance in the months ahead might place downward pressure on the stock.

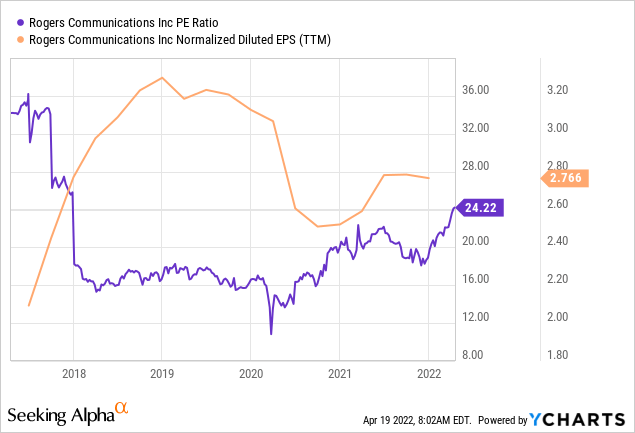

From a valuation perspective, an analysis of the 5-year P/E ratio shows that while EPS (normalized diluted) is yet to return to the highs as seen just before 2020 – the P/E ratio is still significantly higher than pre-2020 levels.

ycharts.com

This would seem to indicate that the stock is trading at a premium relative to pre-pandemic levels, and investors are betting on further earnings growth led by the wireless sector as well as the benefits from the acquisition of Shaw Communications.

In this regard, should we see earnings across the wireless segment start to dip in the upcoming quarter or signs that the Shaw acquisition may potentially hit a roadblock, then this could place downward pressure on the stock going forward.

Conclusion

To conclude, Rogers Communications has been seeing significant upside recently. However, the upcoming earnings report will be a significant telling point as to whether we can expect wireless growth to continue.

Moreover, with the stock appearing to trade at a premium along with the Shaw acquisition still having to clear regulatory hurdles – this may place some downside on the stock in the short to medium-term.

Be the first to comment