Ian Tuttle

Thesis

Roblox (NYSE:RBLX) is one of the most popular gaming companies globally, but despite strong growth in user base and engagement, the company has struggled to monetize its business. But this could change soon. At the Roblox Developer Conference, the company announced to launch in-game advertising as early as 2023.

Although Roblox advertising push comes at a challenging time for digital advertisers, I believe the strategy could support a game-changing revenue contribution for the business – one that has yet to be priced into RBLX valuation.

Roblox shares are down approximately 60% YTD, versus a loss of almost 20% for the S&P 500 (SPX). Risk-seeking investors could view the share price weakness as a buying opportunity and accumulate a long-term equity stake at a reasonable risk/reward.

Roblox’s Push Into Advertising

Roblox said that the company will start testing certain ad formats with a selected number of developers as early as late 2022 and plans to launch a more comprehensive advertising push in early 2023.

Like Facebook (META) has led the push into social media advertising, which grew to be highly profitable for the company and shareholders alike, Roblox is poised to lead the push into immersive 3D-advertising. While the merit of this novel advertising strategy and format must yet be tested, I believe the risk/reward is very favorable.

Investors should consider that Roblox’s users spend about 50 billion hours a year on the platform (Source: Bloomberg Intelligence Primer). Considering that one hour of engagement could be monetized with three to five ‘impressions’, and an impression is valued at 0.7 cent (reference Facebook ads), then Roblox could generate between $1.05 billion and $1.75 billion of incremental revenues from advertising. Note that this calculation excludes any user growth, which could further expand Roblox’s advertising revenue potential.

Roblox’s advertisements could potentially be delivered in form of billboards, and portals, which can take users to immersive experience, such as Vans World, NIKELAND, or Spotify Island, that already exist today. Notably, Roblox has already tested a few advertising pilot projects – with Warner Bros. Discovery for example — and Roblox’s Chief Product Officer Manuel Bronstein commented that ‘(they) were fascinating by the results‘.

DAU Growth and Strong Engagement

The backbone of a successful advertising strategy is, without a doubt, a big and highly engaged community. here Roblox can definitely deliver. At Roblox’s latest investor conference, CEO David Baszucki has confirmed the company’s official target to achieve 1 billion monthly active users. This number would imply a user base expansion of about 4x as compared to current levels. And even though bookings and revenue growth has decelerated amidst macro-economic challenges, engagement remained very strong and daily active users grew by more than 20% YTD, reaching 52.2 million as of June 30. The number has since grown to about 58.8 billion.

Roblox’s long term target of 1 billion users is reasonable, in my opinion. As technology is improving to allow for immersive experiences (5G rollout and VR technology), communication will inevitably move to more immersive formats – here I perfectly agree with Mark Zuckerberg. And in my opinion, Roblox remains one of the best positioned businesses to take advantage of this technological and social shift. Or in other words, Roblox is poised to lead the exploration into the ‘the metaverse’.

Rich Valuation, But Reasonable

Trading at a one-year forward EV/Sales of about x9 and a EV/EBITDA of almost x80, Roblox is not trading cheap. But still, reflecting on Roblox’s potential and strong growth opportunities, I believe the premium is justified from a risk-reward perspective. Investors should consider that Roblox is truly a high-potential that could grow into its valuation.

First, I would like to highlight Roblox virtuous cycle of network effects, that have supported – and will likely continue to support – strong organic user growth. The idea is simple: the more developers on Roblox platform, the more players are attracted. And the more players are attracted, the more content will be developed. At the same time, Roblox also enjoys similar networks effects as social media companies, termed ‘social networks’.

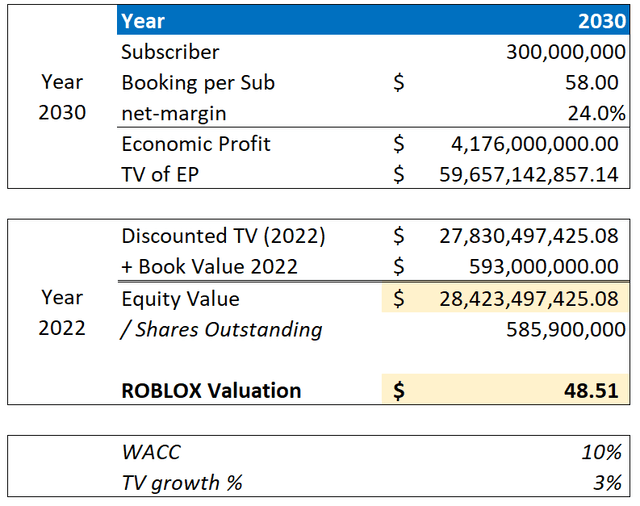

All that said, for my valuation I estimate that Roblox will have 300 million active users by 2030. Furthermore, I assume bookings and ad revenues of $58/DAU and a 24% profit margin (in line with tech and gaming companies). Accordingly, I calculate a $4.17 billion annuity, which I discount back to August 2022.

My target price is $48.11/share.

Downside Risk

Investing in Roblox is high risk and there are a few notable aspects to consider. First, Roblox shares are very volatile and have a 2.1 beta versus the S&P 500. If the technical relationship holds, then every time the market falls by a certain percentage, Roblox should fall twice as much. Second, despite strong engagement, Roblox’s monetization efforts struggle somewhat. Notably, bookings, which remain the company’s main revenue contribution, have decreased year over year. In addition, investors should note that Roblox ambitions to expand into advertising have yet to be tested. And accordingly, there is no guarantee that this monetization vertical will achieve a significant contribution to the business. Third, I would like to highlight the risk-averse investor sentiment towards stocks – and growth stocks in particular. As long as sentiment remains depressed, given rising interest rates and a slowing economy, I think it is unlikely that Roblox shares will enjoy strong buying pressure.

Investor Takeaway

Roblox is a high-quality growth company, and the platform has proven to attract a strong and highly engaged user-base. This user-base is poised to expand further on the backdrop of technological innovation and social trends that will cause the demand for immersive experiences to accelerate.

Until now, however, Roblox experience difficulties to monetize its business, with bookings showing a negative growth YTD. Accordingly, I welcome the company’s ambitions to push into digital advertising and I believe this will support a large revenue contribution for the business.

Roblox is trading expensive, no doubt. But below $45 share, I find the risk/reward attractive.

Be the first to comment