porcorex

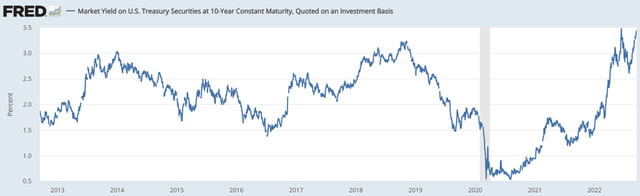

Most investors know of the acronym, T.I.N.A., which stands for the ‘There Is No Alternative’ environment we had been living in for over the past decade plus. During this time, the 10-year treasury rate hovered around all-tie lows, generally trending from 1.5% to 2.5% over this time frame.

10-Year Treasury Rate (FRED)

This had a great effect on buoying the stock market, since the market applies the “risk-free” treasury rate as the discount rate on the future cash flows of a company. As one can imagine, a lower discount rate (i.e. treasury rate) results in a higher net present value for the company’s worth, translating into a higher stock price. Many sky high tech valuations were supported by this phenomenon.

All this has changed since the start of this year, as the 10-year treasury rate has trended higher, with it now sitting at 3.45%. This has had a disastrous effect on tech valuations, as investors of Ark Innovation ETF (ARKK) have witnessed. As shown below, ARKK is down 64% over the past 12 months.

ARKK Stock (Seeking Alpha)

Given the dynamic of higher rates, I believe the era of T.I.N.A. is over, as investors do have plenty of choices besides plowing more and more money into stocks with unsustainable valuations. For those who want to stay invested in the stock market, I highlight various income sectors that present great options for higher and growing income, so let’s get started.

Goodbye T.I.N.A. – Hello Income

One of the asset classes that I like are REITs. However, not all REIT sectors are created equal, with some being more vulnerable to an inflationary environment. Net lease REITs are perceived to be the most vulnerable to inflation, due to their long-weighted average lease terms. Perhaps that’s STORE Capital (STOR) recently agreed to be acquired by GIC and Blue Owl, as I recently highlighted here.

As such, investors may want to consider those REIT classes that have shorter lease terms, making them better positioned to raise rents in line with rising rates. Self-storage and Apartment REITs first come to mind, as they have the lowest lease terms among REITs.

Public Storage (PSA) is the 800 lb. gorilla in the self storage space, and is down 11% so far this year. It trades at a reasonable 20x forward P/FFO and pays a 2.6% dividend yield that’s well-covered by a 68% payout ratio. Moreover, it carries an A rated balance sheet and analysts anticipate 21% FFO/share growth this year, followed by 8.5% growth next year.

For those seeking a higher yield, AvalonBay Communities (AVB) may be a better choice. It’s share price has fallen by 20% since the start of the year. It carries a higher 3.2% dividend yield that’s protected by an A- rated balance sheet and a 65% estimated payout ratio (based on forward FFO/share of $9.86). Like PSA, analysts also estimate robust FFO per share growth of 19% this year, and 10% next year.

AVB Stock Price Performance (Seeking Alpha)

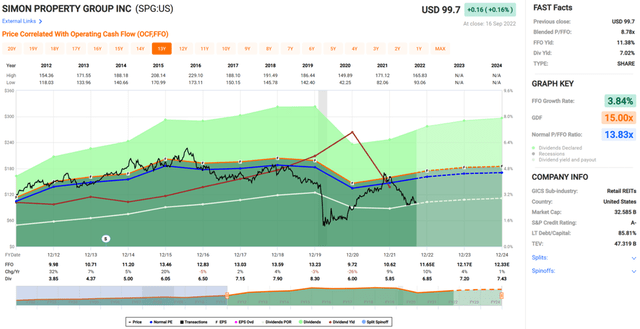

Lastly in the REIT segment, I favor Simon Property Group (SPG) for its very high dividend yield of 7%. SPG is well positioned for an inflationary environment, as its leases are generally 5 years or less. Over the past 2 years, SPG has taken on more short-term leases as tenants test the waters in a post-pandemic era.

This gives SPG higher capacity to raise rents as renewals come due. Like AVB, SPG also sports an A- rated balance sheet. Its dividend is well on its way to the pre-pandemic level, and comes with a safe 60% payout ratio based on forward FFO/share of $11.66. As shown below, SPG trades at a blended P/FFO of 8.8, sitting well below its normal P/FFO of 13.8 over the past 10 years.

SPG Valuation (FAST Graphs)

Outside of the REIT segment, I see value in BDCs as they offer the best of both words – high yield with low valuations, while set to benefit from a rising rate environment. That’s because most BDCs have high exposure to floating rate debt investments while having comparatively lower exposure to floating rate balance sheet debt, as in the case of New Mountain Finance Corp (NMFC), as I noted here.

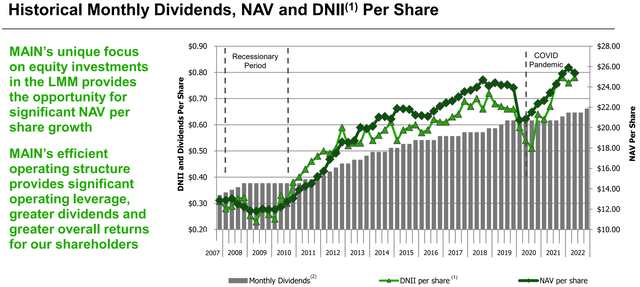

A top choice in this sector is Main Street Capital (MAIN), which is once again trading under $40. It has the lowest operating cost structure amongst its peers and sports an attractive 6.6% dividend yield. MAIN comes with a reasonable 13.2 PE, considering its durable track record of shareholder returns, and with analysts anticipating 13.5% EPS growth this year followed by 5.5% EPS. As shown below, MAIN has an impressive track record of shareholder returns through both NAV and dividend increases.

MAIN Historical Performance (Investor Presentation)

Those who prize a higher yield may want to consider Ares Capital (ARCC), which is backed by the leading asset manager, Ares Management (ARES). ARCC comes with a far higher yield of 9% while carrying a lower PE of 10.1. Some of its discount relative to MAIN is deserved, considering that ARCC is externally-managed with a higher cost structure.

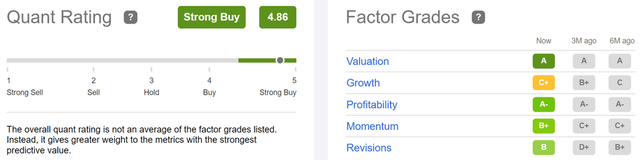

However, I believe ARCC is deserving of a higher valuation considering the higher interest rate environment from which it’s set to benefit. Sell side analysts have a consensus Strong Buy rating with an average price target of $21.54, implying a potential one-year 23% total return including dividends. ARCC also carries a Strong Buy rating from the Quant system, with strong marks for valuation, profitability, and upward analyst revisions, as shown below.

ARCC Quant Rating (Seeking Alpha)

Last but not least, the pipeline MLP segment remains an attractive asset class for tax-deferred returns (note that they issue schedule K-1s to investors for tax purposes). They are also well-positioned for rising rates as they are able to raise tariffs in line with inflation. Enterprise Products Partners (EPD) is the quality play in the sector with its natural gas focus.

EPD currently yields 7.2% and had an impressive 1.9x distribution coverage ratio during the second quarter. Management has strong alignment of interest with unitholders, owning around 32% of the outstanding units and appears committed to capital returns, including two distribution raises this year, putting it on track for 23 consecutive years of distribution increases.

For those who prize a higher yield, Magellan Midstream Partners (MMP) presents a solid option, with an 8.1% distribution yield that’s protected by a 1.25x coverage ratio. MMP has lower distribution coverage than EPD. However, it also doesn’t have capital intensive projects to invest in, as it’s focused on petroleum and refined liquids transportation, a sector that’s mature and longer growing.

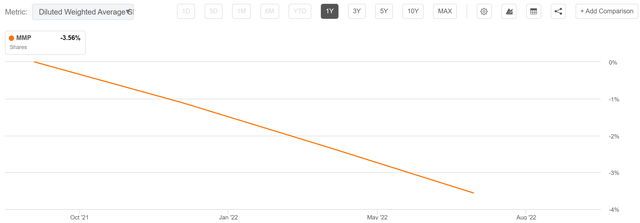

MMP’s asset base enjoys one of the highest returns on invested capital among MPL peers, and face little to no competition in its geographies. This monopoly-like business model enables MMP to deploy capital returns to unitholders at a faster rate. As shown below, MMP has repurchased 3.6% of its outstanding units this year alone, making it an attractive choice for total returns.

MMP Shares Outstanding (Seeking Alpha)

Investor Takeaway

With the T.I.N.A. environment of the past 10+ years behind us, it’s a prudent move for investors to rotate into segments that are set to benefit from rising rates. I believe the above stocks and segments provide investors with just that. While I fully expect the market to remain turbulent at least in the near term, I believe these stocks are well-positioned for potential market beating returns over the next 3 to 5 years, and beyond.

Be the first to comment