MarkgrafAve

Thesis

Leading business development company FS KKR Capital Corp.’s (NYSE:FSK) stock has outperformed the broader market in 2022, as it posted a YTD total return of 7.92%. Its robust dividend yields have continued to support its valuation, even though its stock has been consolidating since June 2021.

We deduce that the market has not battered FSK over the past year as it was not overvalued to begin with. Moreover, its underperformance over the past five years “insulated” FSK from further hammering as management continues its business transformation toward higher quality income-producing assets.

Despite that, FS KKR’s NAV per share is expected to face near-term headwinds, which could hinder its upward momentum in breaking out of its consolidation range.

However, the company has also been benefiting from a hawkish Fed, as its interest income has increased markedly, helping to mitigate its NAV impact. Hence, we are confident that the company’s capital structure and higher-quality, more defensive portfolio visibility should continue to provide confidence in underpinning buying sentiments at the current levels.

Therefore, we rate FSK as a Buy, given its interest rate tailwinds and a well-balanced valuation.

Interest Rate Tailwinds Drove Massive Growth

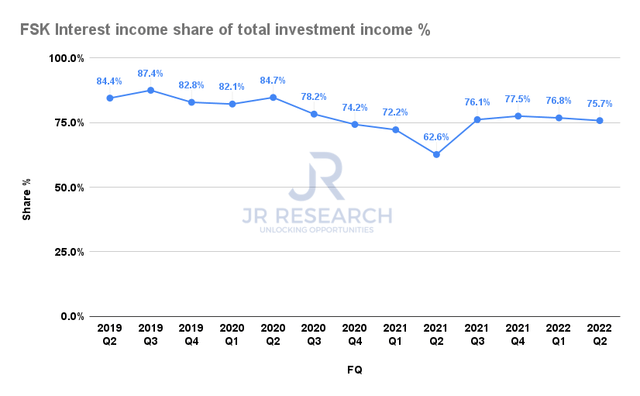

FSK interest income share of total investment income % (Company filings)

The company’s portfolio remains defensively configured, with first lien debt accounting for 61.9% of its portfolio fair value. Accordingly, interest income accounted for nearly 76% of its total investment income in Q2, providing a high level of visibility from the company’s income-producing assets.

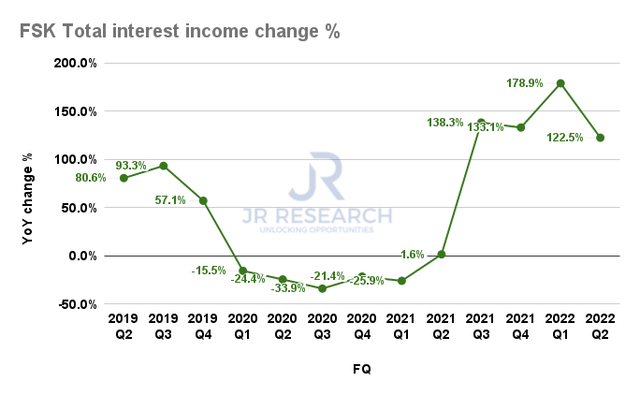

FSK total interest income change % (Company filings)

As a result, interest income has continued to drive significant investment income growth for the company. As seen above, FS KKR posted an uptick of 123% in interest income growth in Q2, down from Q1’s 179% increase. Its portfolio is configured to leverage a hawkish Fed, as 87.4% of its portfolio is based on floating rate debt.

Management also highlighted it expects interest income to continue supporting its net investment income (NII) growth in Q3, as existing contracts are repriced with higher rates. CFO Steven Lilly accentuated:

During the third quarter, we expect to benefit from the rising interest rate environment by approximately $0.04 per share as existing portfolio company interest rate contracts began resetting at higher levels. Our high-level view is that every 100 basis point move in short-term rates could increase our annual net investment income by up to $0.26 per share, which equates to approximately $0.06 per share per quarter.

But, It’s Prudent To Expect Some Normalization

Given the recent above-consensus CPI print, the market has priced in an 82% probability (as of September 16) of a 75 bps hike in the upcoming FOMC meeting. Even a 100 bps hike has not been ruled out, with an 18% probability attached. Therefore, the near-term momentum should continue to benefit FS KKR.

However, we think it would be unreasonable for investors to expect FS KKR to manage its distribution policy in accordance with the accretion to its NII due to the Fed’s rate hikes. We believe it’s essential for investors to expect FS KKR to manage its dividend strategy with the Fed’s expected neutral rate and not what its terminal rate would likely be in 2023/24. That would help provide more stability in its distribution.

Also, investors should not keep expecting “unusually large” rate hikes moving forward, as inflation rates have already shown signs of moderating. Coupled with signs of recession, we believe the growth cadence of the rate hikes should moderate moving forward.

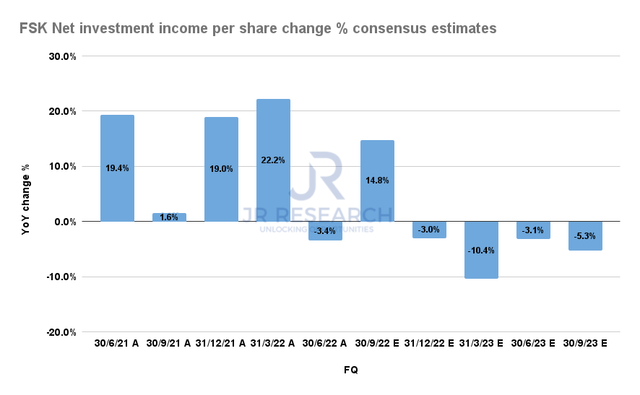

FSK NII per share change % consensus estimates (S&P Cap IQ)

Therefore, we believe the consensus estimates (bullish) are reasonable, suggesting its NII per share growth should moderate through FY23. We don’t think it would impact its distribution, given its high level of NII visibility. However, we believe investors need to temper their expectations of elevated NII per share growth rates moving ahead.

FS KKR’s Dividends Look Secured

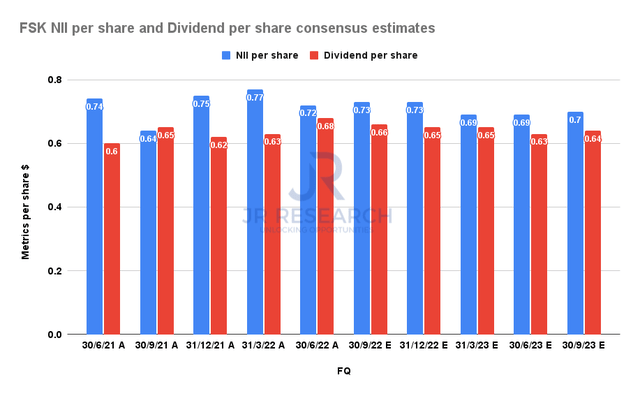

FSK NII per share and Dividend per share consensus estimates (S&P Cap IQ)

Hence, we are confident that its distribution is well covered by its forward NII per share, as seen above. Therefore, it should continue to support buying sentiments even though it has been moving within a tight consolidation zone, as it’s beneficial from a total return framework.

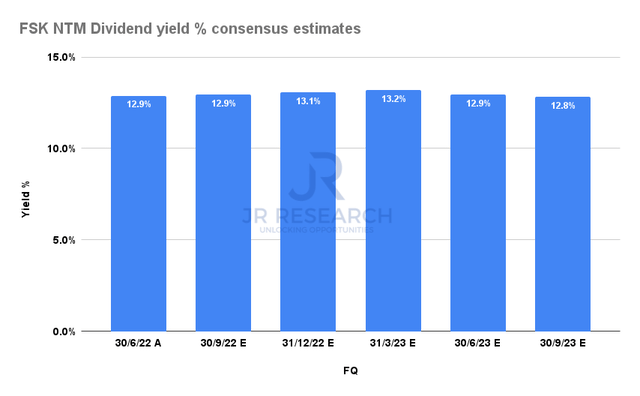

FSK NTM Dividend yield % consensus estimates (S&P Cap IQ)

With an NTM dividend yield of 12.9%, it’s easy to envisage why FSK has outperformed the market, despite not being able to break above its June 2021 highs. Hence, its robust distribution predicated on a defensive portfolio has helped instill investors’ confidence in its portfolio outlook.

Is FSK Stock A Buy, Sell, Or Hold?

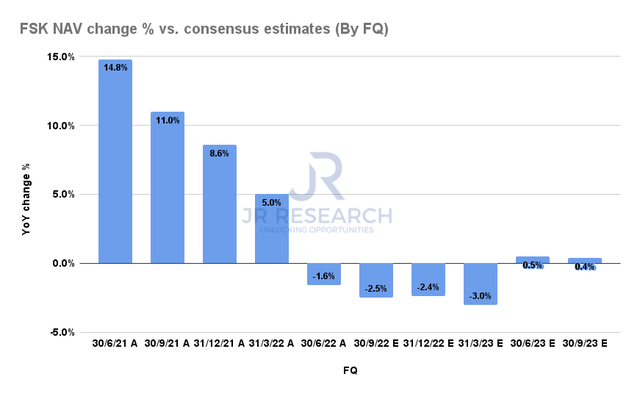

FSK NAV per share change % consensus estimates (S&P Cap IQ)

However, investors need to consider the growth in FS KKR’s NAV per share has moderated markedly from 2021, given the current market volatility. We believe value compression could continue to be a near-term headwind for its portfolio companies, impacting its NAV per share.

As a result, it could also affect the re-rating potential of FSK until the price discovery in the market stabilizes. Also, FS KKR’s investment activity slowed markedly in Q2, as its originations fell to $804M, down from Q1’s $2.07B.

Therefore, even though the company continues to benefit from a dislocated syndicated market, we believe its origination cadence has also been impacted by market volatility.

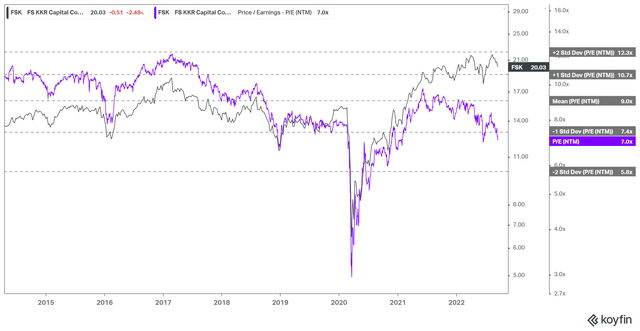

FSK NTM P/NII per share valuation trend (koyfin)

Also, we noted that the market had de-rated FSK’s valuation markedly as it has struggled to move above its mean since 2021. As a result, we urge investors to be wary of adding close to the mean of its NII multiple and should accord a generous discount.

FSK last traded below the one standard deviation zone below its mean. Therefore, we assess that its valuation seems pretty well-balanced. However, further downside should be expected, given the potential for value compression of its portfolio companies.

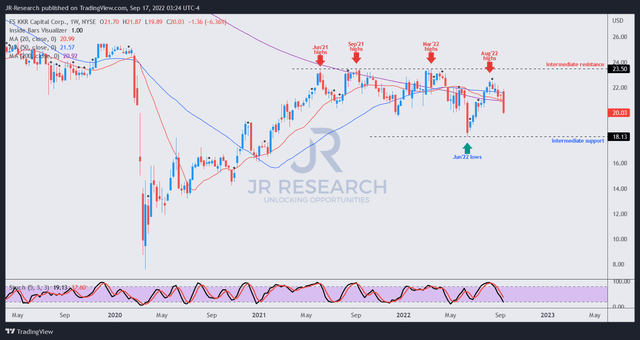

FSK price chart (weekly) (TradingView)

Notwithstanding, the market seems keen to support FSK at the one standard deviation zone. Moreover, we gleaned that the price action at its recent June lows was robust.

Therefore, even though FSK has been consolidating within a range since June 2021, its robust dividend yields have helped it significantly outperform the broader market.

We rate FSK as a Buy.

Be the first to comment