Riska/E+ via Getty Images

Engineering company Limbach Holdings, Inc. (NASDAQ:LMB) reports a long business history, a lot of know-how accumulated, and activities in very different target markets. The current strategy that includes offering very different services to all clients will likely bring revenue generation. Also, taking into account the expectations of other financial analysts and stable FCF margins, I would say that a simplistic DCF model could bring a valuation close to $34.2 per share. Even considering risks from loss of contracts, changes in raw materials, or forecasting failures, I believe that the company is undervalued.

Limbach Holdings

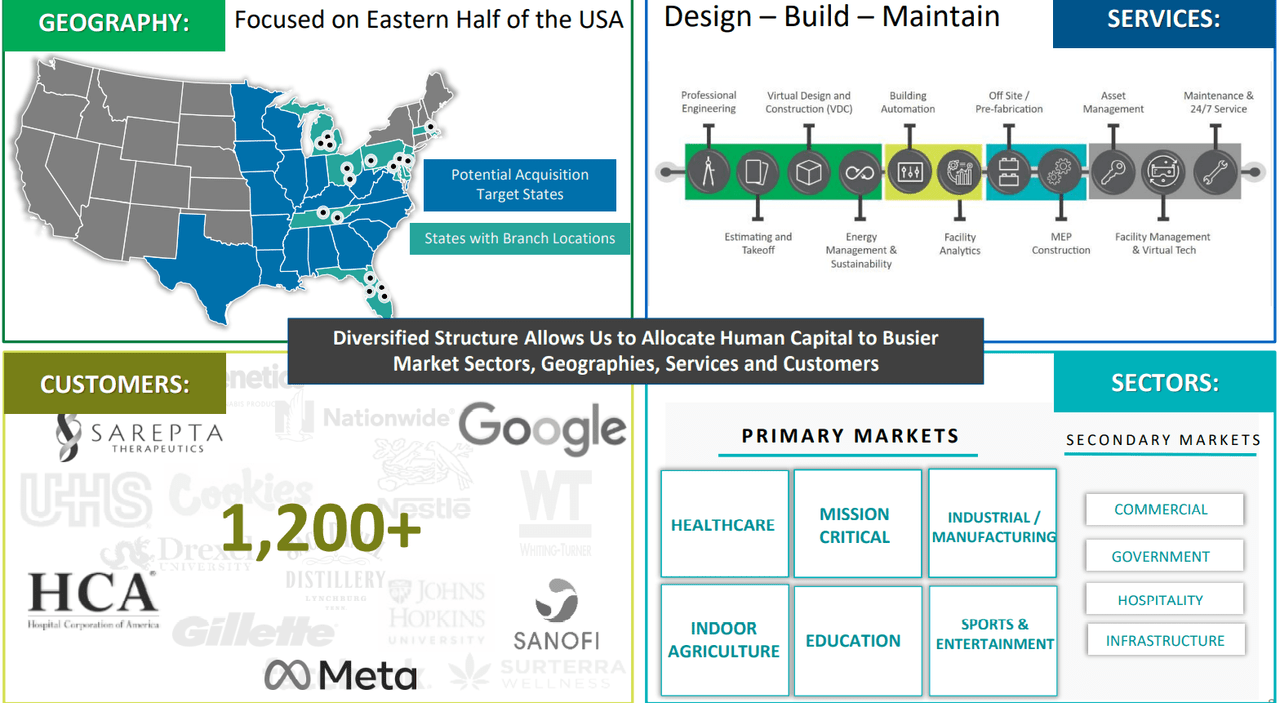

Limbach Holdings is a material handling and engineering company. This means that it not only provides the installation services, employees, and technical knowledge, but also draws up the design and development plans, and manages the entire project. It often implies the realization of a large number of plans on networks and large industrial facilities. The list of engineering specializations is quite impressive, and the number of target markets is also significant.

Presentation

With a history of more than a century, dating back to its founding in 1901 by a young metalworker in Pittsburgh, the company has not only survived the century of most global economic volatility in history but has also developed a model successful business that gives great returns today. Some important points in the historical line of the company are: the year 1953, in which for the first time it began to carry out activities outside of Pittsburgh; its recognition as one of the 10 largest contracting companies in the USA in 1964; and the year 2001, when it survived the bankruptcy of the corporation that had acquired it a decade earlier and was able to keep its business afloat. In my view, the accumulated know-how of Limbach Holdings is an asset for the company.

The last refoundation of the company dates back to 2016, also in Pennsylvania, Pittsburgh, under the name of Limbach Holdings Inc. At that time, it clearly stated the scope of its services, which include the design and implementation of maintenance networks for large establishments along with the management and administration of all phases of the process. This also includes the manufacture of modules, the cleaning and conditioning service of refrigeration or air conditioning systems, and the maintenance of mechanical and electrical plumbing systems. In my view, the company’s diversification will likely receive interest from investors.

Limbach Holdings has 1,600 employees, distributed at different locations throughout the United States, with a large presence in Michigan and Pennsylvania. These include technical employees as well as engineers and technology experts for project development.

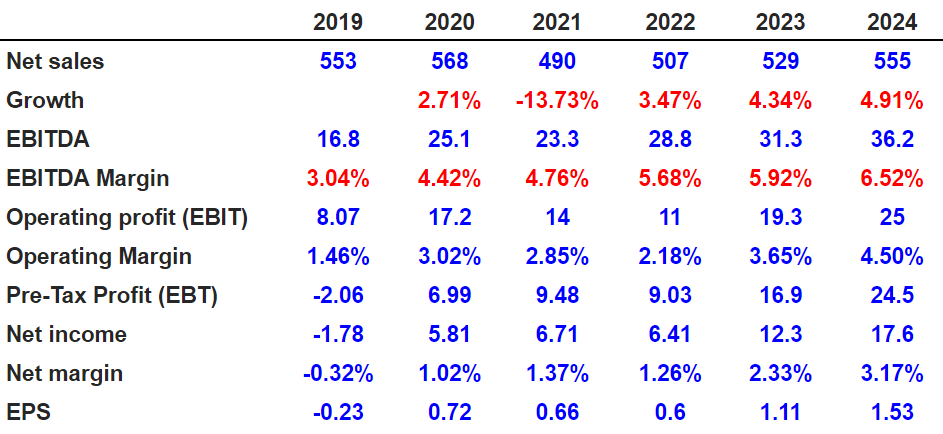

Analysts Expect Positive Net Income, 2024 EBITDA Margin Of 6.52%, And Growing EPS

Market analysts are expecting beneficial figures for 2023 and 2024. By 2024, analysts expect net sales of $555 million, with a net sales growth of 4.91%. In addition, expectations include an EBITDA of $36.2 million along with an EBITDA margin of 6.52%. The operating profit would be close to $25 million, with an operating margin of 4.50%. 2024 pre-tax profit would be $24.5 million, along with a net income of $17.6 million. 2024 net margin would stand at 3.17%, and the EPS would be close to $1.53.

Marketscreener.com

2023 FCF (free cash flow) and 2024 FCF would also grow. 2024 FCF would stand at $27.6 million, and the FCF margin would be 4.97%.

Marketscreener.com

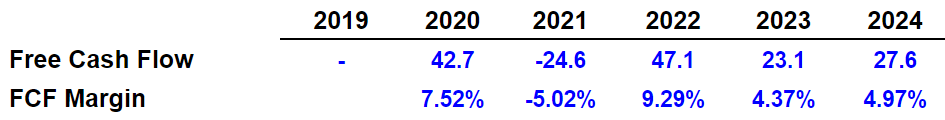

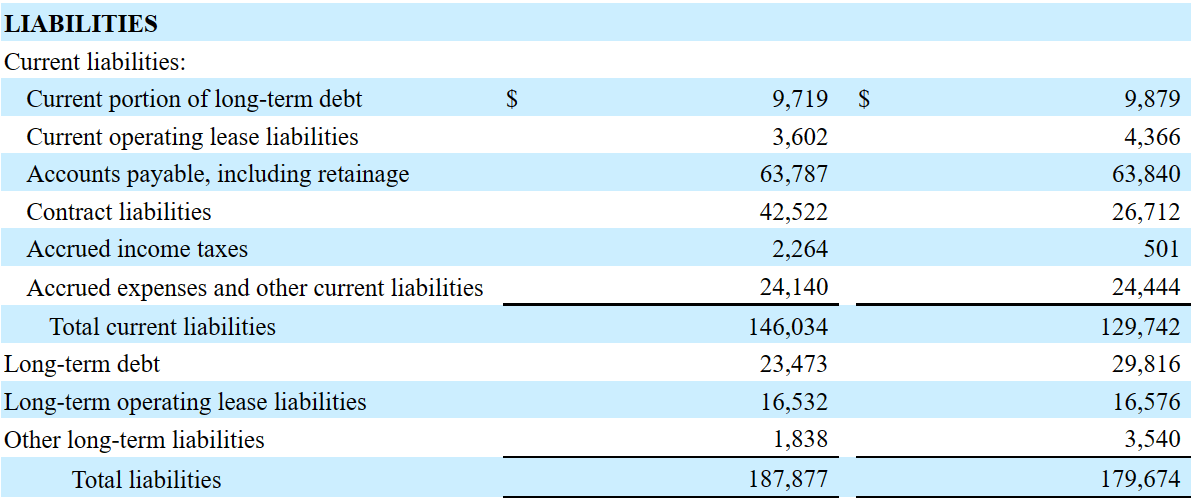

Balance Sheet

As of September 30, 2022, the company reported current assets worth $209 million, total assets of $280 million, and a decent amount of cash. The asset/liability ratio is over one, and liquidity does not seem to be a problem here.

10-Q

With total liabilities worth only $187 million and long-term debt of $23 million, I would say that the balance sheet appears solid.

10-Q

Under My Base Case Scenario, The New Strategy Would Bring Revenue Growth, And Would Imply A Valuation Of $34.2 Per Share

The company’s services are divided into two large modalities, GCR and ODR. One of them is for general contracting systems, and the other one is for contracting by direct owners.

The current strategy of straightening the course of its two business segments, which are showing great variations in their development and growth, involves offering its services to a broader portfolio of clients. For this, it is necessary to develop contact plans, besides developing more specific technologies aimed at the particularities of each of its clients. This is really essential for companies like Limbach Holdings, as it depends directly on its customers, having no other way to put its productive capacities into activity except through buildings, establishments, and industrial plants. Under this case scenario, I assumed that the current strategy would bring revenue growth and FCF margin expansion.

It is not only getting a greater number of customers, but also developing an infrastructure that allows meeting the needs of each one without losing quality levels, which leads to increasing the number of employees, having a greater amount of supplies available for maintenance, and developing better products that have less risk of damage or failure. Under normal conditions, I assumed that the headcount would increase, which would bring larger revenue growth.

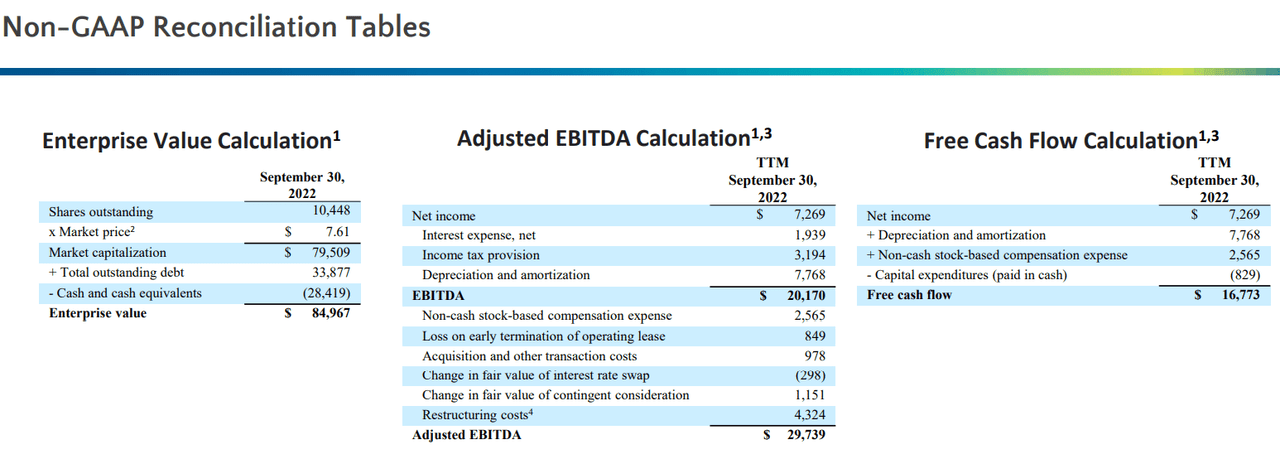

In a recent presentation to investors, management provided some financial figures, which I used for my financial models. As of September 30, 2022, total outstanding debt stood at $33.877 million with cash close to $28.419 million. Adjusted EBITDA would be close to $20 million, with an adjusted EBITDA close to $29 million and free cash flow of around $16.773 million. My figures are not that far from those given by Limbach Holdings.

Presentation

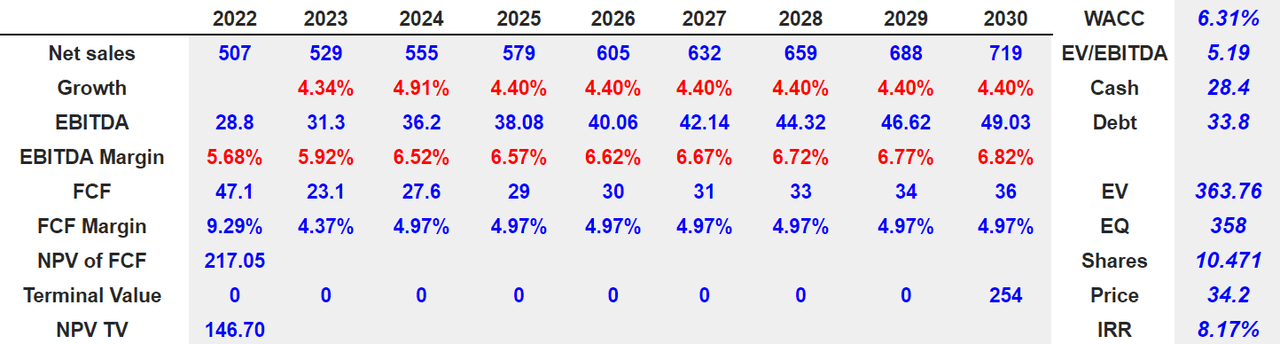

Under this case, I expect 2030 net sales of $719 million and sales growth of 4.40%. 2030 EBITDA will likely be $49.03 million, which would imply an EBITDA margin of 6.82%. In addition, the FCF would be around $36 million, together with an FCF margin of 4.97%.

With a WACC of 6.31%, I obtained an NPV of FCF of $217.05 million, with 2030 terminal value of $254 million and an NPV of a terminal value close to $146.70 million. Adding cash of $28.4 million, and subtracting debt of $33.8 million, the equity would be $358 million. Finally, with a share count of 10.471 million, I obtained a valuation of $34.2 per share and an IRR of 8.17%.

Chatool’s DCF Model

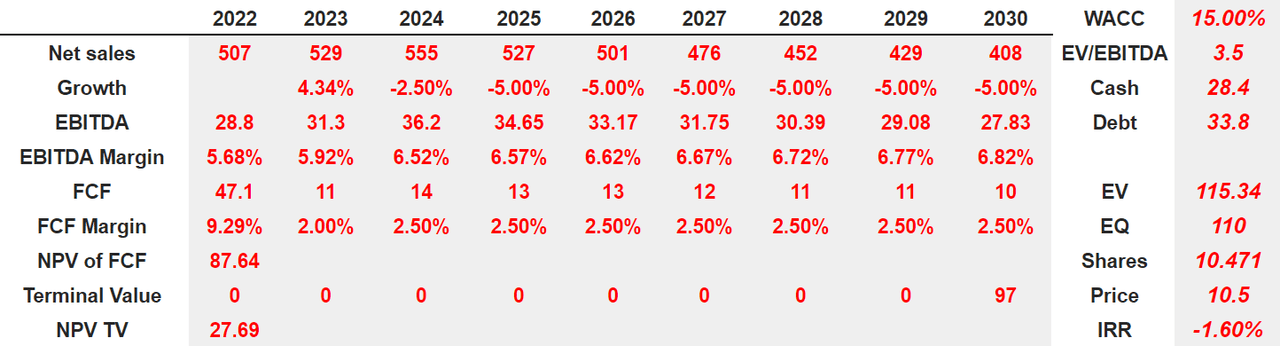

Several Risks Could Bring The Stock Price Down To $10.5 Per Share

Some risks to which the work of this company is exposed have to do directly with the condition of the establishments and facilities, in which the company provides its services. Drastic changes in the conditions specified in the contracts and the actual ones at the locations, or lack of access to equipment and materials depending on the time of year and the region, could happen.

Also, delays or failures in its suppliers and changes in legal requirements, contract conditions, or even weather conditions are risks that Limbach Holdings services is exposed to.

In the same way, the relationship with its employees and the unions, the variations in the prices and interest rates, including the price of inputs, materials, and gasoline for transportation, and relations of supply and demand according to the region in question are part of the complications that the company has to be aware of in order to maintain the growth and success of its productive part and financial part.

Under the previous conditions, I used 2030 net sales of $408.5 million together with net sales growth of -5%. I also assumed an EBITDA of $27.83 million and an EBITDA margin of 6.82%. 2030 FCF would be $10 million with an FCF margin of 2.50%.

With a WACC of 15% and an EV/EBITDA multiple of 3.5x, my results would include an NPV of FCF of $87.64 million, 2030 terminal value of $97 million, and an NPV of a terminal value of $27.69 million. If we add cash of $28.4 million, and subtract debt of $33.8 million, the implied equity would be $110 million. Finally, with a share count of almost 10.5 million, the implied fair price would be $10.5 per share, and the internal rate of return would be -1.60%.

Chatool’s DCF Model

Conclusion

Limbach Holdings reports a substantial amount of know-how and expertise in many different specialties and target markets. In my view, the current strategy that includes offering a wide range of services to all clients in the portfolio would most likely bring revenue growth. It is also worth noting that most analysts are expecting stable EBITDA margins and free cash flow generation. I believe that justifying a valuation of more than $34.2 per share would make a lot of sense, considering the expected free cash flow. I do see risks from forecasting failures, loss of contracts, and changes in raw materials. With that, Limbach Holdings stock does appear undervalued.

Be the first to comment