Chunumunu

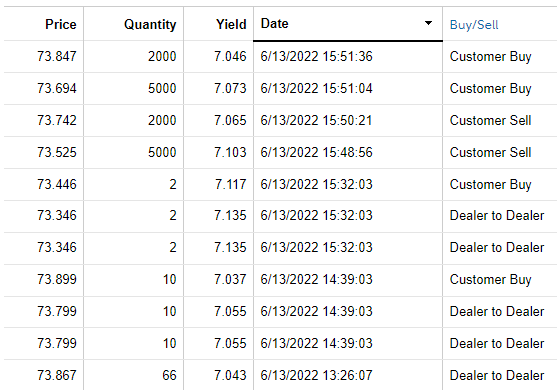

Quick Introduction To Business Development Companies (“BDCs”)

Business development companies (“BDCs”) invest shareholder capital in privately owned, small- and medium-sized U.S. companies. BDCs aim to generate income and capital gains when the companies they invest in are sold, much like venture capital or private equity funds. Anyone can invest in BDCs as they are public companies traded on major stock exchanges.

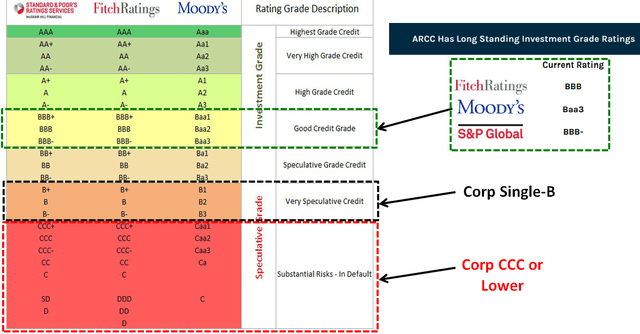

Investment Grade BDC Notes & Comparing Coverage Ratios

Many BDCs have investment grade (“IG”) notes for lower-risk investors that do not mind lower yields/returns. These notes were previously overpriced, but prices have declined and are now at attractive levels.

The following are some options that BDC management teams have before potentially defaulting on a debt obligation:

- Reducing leverage by not reinvesting repayments from portfolio companies

- Reducing the dividend to common shareholders

- Reducing or waiving management and incentive fees

- BDCs have permanent equity capital (no “runs on the bank” to force the liquidation of undervalued assets)

- Raising equity capital: common or preferred, even dilutive if absolutely necessary

- External manager/credit platform can provide additional capital if needed

For these reasons, no BDC has ever defaulted on a debt obligation.

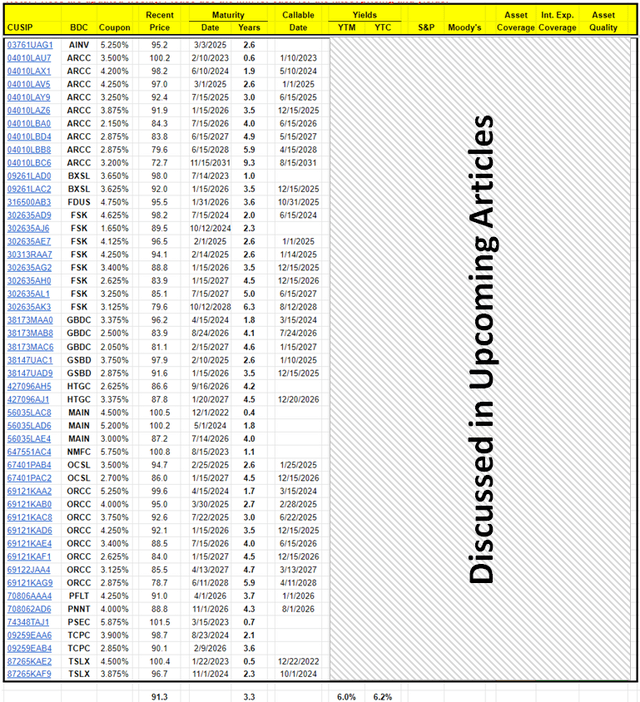

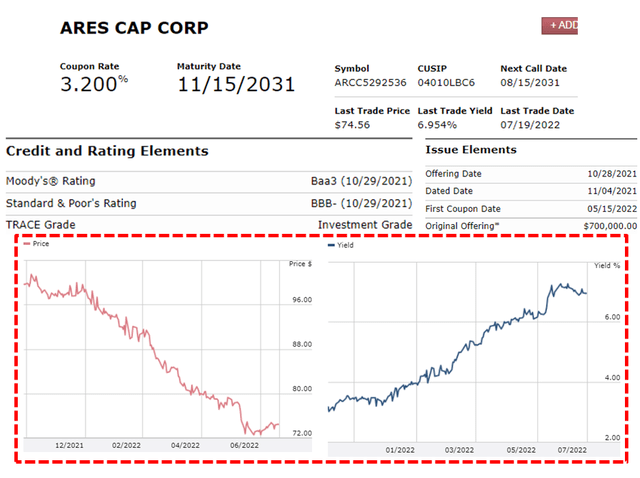

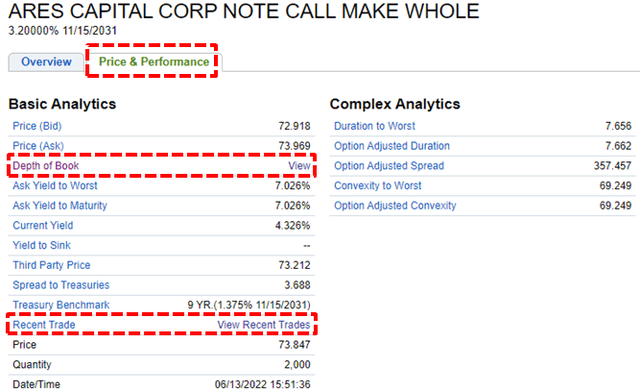

As shown below, the price of ARCC’s 2031 note has declined from $100 to under $74 during the last six months, driving the yield from 3.0% to over 7.0%.

- Please see “Example of How to Trade BDC Notes” section at the end using this note as an example.

Interest Expense Coverage Ratios

The “Interest Expense Coverage” ratio is used to see how well a company can pay the interest on outstanding debt. Also called the times-interest-earned ratio, this ratio is used by creditors and prospective lenders to assess the risk of lending capital to a firm. A higher coverage ratio is better, although the ideal ratio may vary by industry. When a company’s interest coverage ratio is only 1.5 times or lower, its ability to meet interest expenses may be questionable.

Please see the following link from Investopedia for more, including how it is calculated:

Asset Coverage Ratios and Asset Quality

The “Asset Coverage Ratio” is a financial metric that measures how well a company can repay its debts by selling or liquidating its assets. The higher the asset coverage ratio, the more times a company can cover its debt. Therefore, a company with a high asset coverage ratio is considered less risky than a company with a low asset coverage ratio.

Please see the following link from Investopedia for more, including how it is calculated:

I have ranked by “Portfolio Quality” and then by “Asset Coverage”. Portfolio quality takes into account many variables, including portfolio asset mix, vintage, quality of management, effective leverage ratios, portfolio diversification, rate sensitivity, historical performance, and sector exposure. There is nothing wrong with “Average” portfolio quality, especially if it produces higher returns.

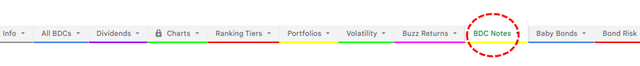

Tradable BDC Notes

The following is from the “BDC Notes” tab in the BDC Google Sheets, showing tradable Notes offered for many BDCs currently averaging around 6% yield. As you can see, we have included quite a few (currently 50) and we continue to add for each BDC along with the current yields, Asset Coverage and Interest Expense Coverage rankings for each that will be discussed in upcoming articles. I would suggest focusing on higher quality notes paying a higher yield relative to duration.

BDC Buzz BDC Buzz Google Sheets

Example of How to Trade BDC Notes Using Fidelity

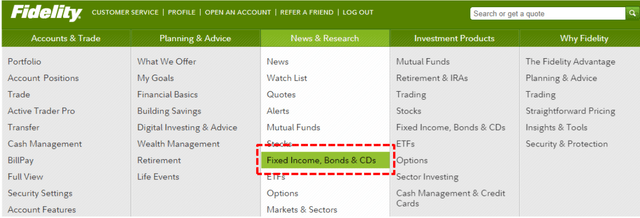

After you log into the Fidelity Home Page and look for the tab at the top for “News & Research” (or “Investment Products”) and then click on “Fixed Income, Bonds, CDs” as shown below:

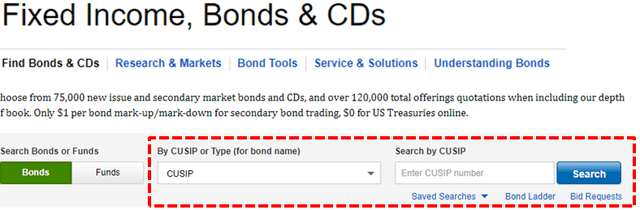

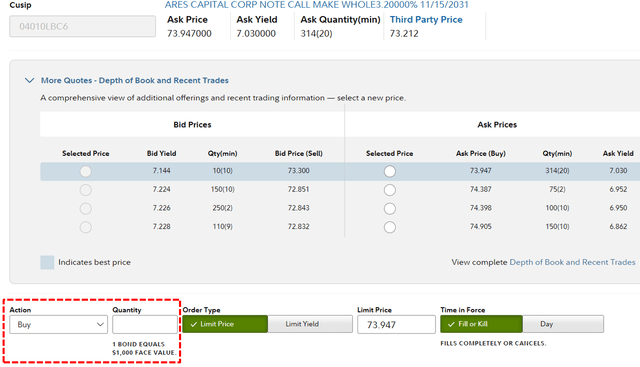

Enter the CUSIP of the Note/Bond that you want to buy. You can get the CUSIP from the “BDC Notes” tab in Google Sheets.

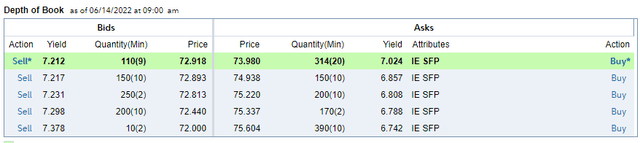

- Each bond has a detailed page showing its details (see the following images).

- Take a close look at “Depth of Book”, “Recent Trades”, “Issuer Events”.

- You do not have to take the listed BID/ASK; you can put in your own limit price or yield as shown below.

- Keep in mind that each BDC Note/Bond is $1,000.

Fidelity Investments

Keep in mind that each BDC Note/Bond is $1,000, and please use limit orders prices can swing quite a bit during the day.

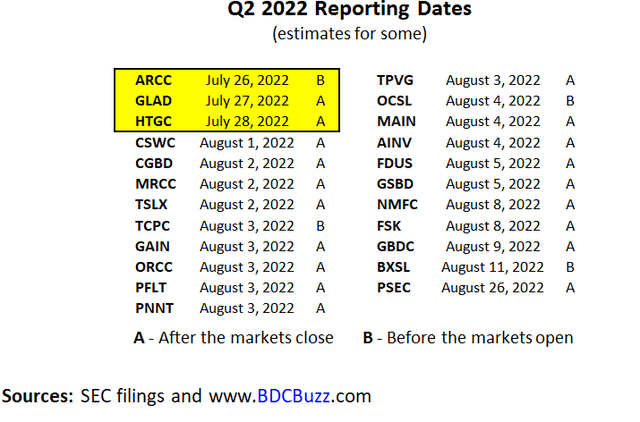

Upcoming BDC Reporting Dates

BDCs will begin reporting Q2 results next week, starting with ARCC, GLAD, and HTGC. I am expecting improved results relative to Q1 including higher dividend coverage and maintained credit quality but slightly lower NAVs (similar to Q1) simply due to widening credit spreads (not credit quality related). There is a good chance that many BDCs will be taking a cautious approach to new investments, letting repayments/prepayments come in and reducing leverage, waiting for better pricing (higher yields) on new investments. This was discussed on many of the Q1 calls for higher-quality BDCs. The good news is that most BDCs have excellent dividend coverage without the need for higher leverage/portfolio growth.

The Fed will likely increase rates by another 75 points next week, driving a significant improvement in the Interest Rate Sensitivity analysis for most BDCs (similar to the previous quarter). This means that projected earnings for Q3 and Q4 will probably need to be increased. Also, most BDCs have been positioning for a recession for a while now and COVID provided a portfolio stress test which most BDCs took advantage of the market rebound to rotate into more secured positions with higher cash flow coverage preparing for higher interest rates and/or an economic slowdown/recession.

Be the first to comment