kuriputosu/E+ via Getty Images

Introduction

Towards the middle of 2022 when last discussing Enbridge (NYSE:ENB), it seemed they were well-positioned to endure whatever the future may hold, regardless of high inflation or recession, as my previous article explored. Fast forward to the present day with less than two weeks remaining before the year ends and when looking ahead, it seems 2023 is looking good for Canadians, although lackluster for Americans as foreign currency exchange rates play a central role in their guidance for the year ahead.

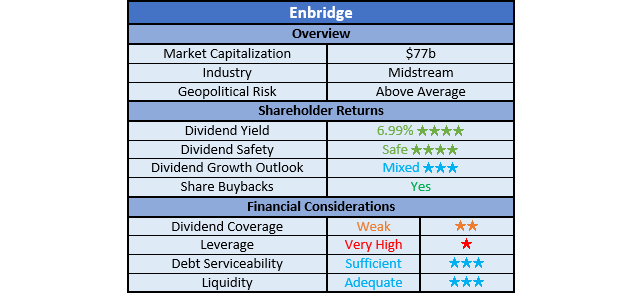

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

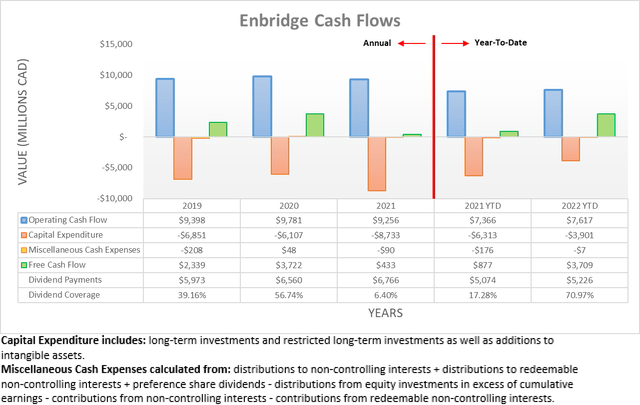

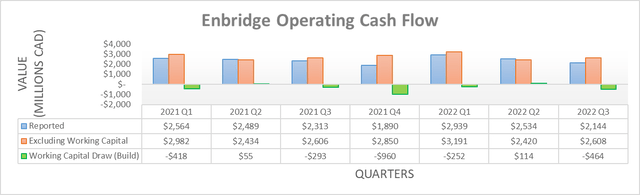

The first quarter of 2022 saw a strong start to the year, although since conducting my previous analysis, it seems this did not continue into the subsequent second and third quarters. Whilst their operating cash flow of C$7.617b during the first nine months is still higher than their previous result of C$7.366b during the first nine months of 2021, it only represents a small increase of less than 4% year-on-year, whereas, the first quarter of 2022 saw an increase of almost 15% year-on-year, as per my previously linked article.

Whilst working capital movements played a role in this comparison, it does not necessarily alter this situation, relatively speaking. If viewing their underlying operating cash flow that excludes working capital movements, their result of C$3.191b during the first quarter of 2022 was still far above their subsequent results of C$2.42b and C$2.608b during the second and third quarters, respectively. Even though this growth is less than hoped, at least it nevertheless remains steady with the latter two results still broadly matching their previous equivalent results of C$2.434b and C$2.606b during the second and third quarters of 2021, respectively.

Despite seeing lower capital expenditure during 2022 than in previous years, their free cash flow of C$3.709b during the first nine months still left a gap below their accompanying dividend payments of C$5.226b. Even without their accompanying working capital build of C$602m across this same period of time, their underlying free cash flow of C$4.311b would have still only provided weak coverage of circa 82% against their dividend payments.

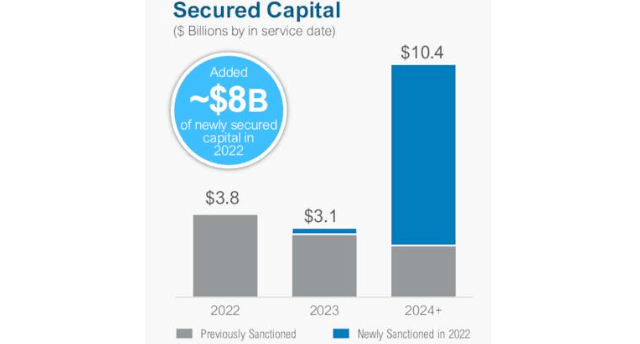

Thankfully, this situation is not necessarily concerning, as the majority of their capital expenditure relates to growth with the maintenance portion only forming C$466m during the first nine months of 2022, which equates to a mere circa 12% of their total of C$3.901b. Meanwhile, they also secured a further C$8b of organic projects during 2022, which apart from boosting their medium to long-term financial performance, will require sizeable capital expenditure into 2023 and quite likely, beyond into further years, especially as more projects will likely be added in the coming year.

Enbridge Third Quarter Of 2022 Results Presentation

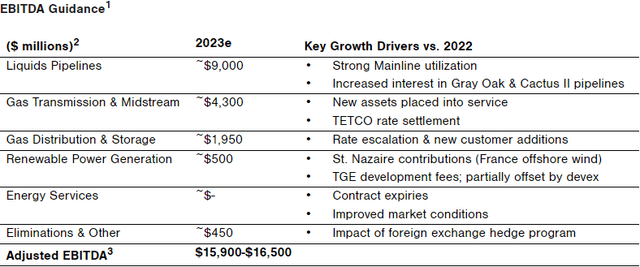

Following this outlook for their capital expenditure, it stands to reason the gap between their free cash flow and dividend payments will persist during 2023 and likely beyond. Elsewhere, their guidance for 2023 also sees their adjusted EBITDA increasing to C$16.2b at the midpoint, which if it comes to pass, would represent a C$900m increase year-on-year versus their accompanying forecast of C$15.3b at the midpoint for 2022. These impressive prospects of seeing a mid-to-high single-digit increase despite the likelihood of a recession highlights the quality of their company, although there are still more aspects to consider.

Interestingly, when forming this guidance for 2023, it was made with the assumption of a CAD to USD exchange rate of C$1.30. On the surface, this may not sound worth mentioning, although foreign currency exchange rates can play a meaningful role within the energy sector that is traditionally dominated by USD transactions. When looking at the historical CAD to USD exchange rate, throughout the past two years, it normally trades below C$1.30.

This means their guidance for 2023 is enjoying a boost simply from their local currency weakening versus the USD, thereby driving a portion of their higher forecast adjusted EBITDA. Naturally, this can be a two-way street but importantly, they have already taken measures to hedge the USD exposure within their distributable cash flow during 2023, as per the quote included below.

“To mitigate cash flow volatility, the Company has substantially hedged its budgeted 2023 USD DCF exposure.”

–Enbridge 2023 Guidance Announcement (previously linked).

Seeing as the CAD to USD exchange rate is historically strong, this is a smart and sensible move, at least in my eyes. If looking into the moving parts within their adjusted EBITDA guidance for 2023, it seems this should deliver a circa C$450m benefit, thereby representing roughly half of their forecast year-on-year increase during 2023. Even though this tarnishes the appearance of their recession-defying guidance, seeing any increase given the gloomy economic outlook is still impressive.

Enbridge Third Quarter Of 2022 Results Presentation

Since they do not list any other “key growth drivers” relating to their circa C$450m benefits pertaining to their “eliminations and other” line item, it should be reasonable to assume this overwhelmingly relates to their foreign currency exchange rate hedges. Whilst their adjusted EBITDA guidance is important, more important is their distributable cash flow guidance as this more closely relates to their actual operating cash flow and importantly in this era of tight monetary policy, it includes their interest expense, unlike EBITDA. On this front, their guidance for 2023 sees distributable cash flow of C$11.05b at the midpoint, which equates to C$5.45 per share and thus is only a tiny circa 2% higher year-on-year versus their accompanying forecast of C$5.35 per share for 2022.

Even though this guidance is still better than their closest peer Kinder Morgan (KMI), whom I recently criticized in my other article, there is nevertheless more to the story. Apart from boosting their adjusted EBITDA, the $450m boost from foreign currency exchange rates also flows through into their distributable cash flow. If not for this boost, their forecast of C$11.05b at the midpoint would otherwise be circa 4% lower, thereby sending it ever-so-slightly below their forecast for 2022.

When wrapped together, it appears the only reason they are forecasting higher distributable cash flow in 2023 stems solely from a weaker CAD. Whilst this is not necessarily a concern for their Canadian shareholders because they have already hedged their exposure to effectively lock in these more desirable foreign exchange rates, the same obviously cannot be said for their American shareholders.

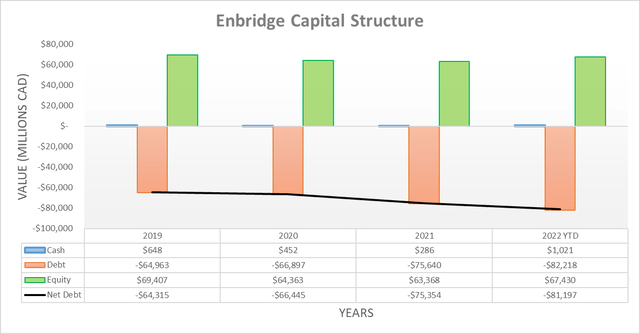

Even though their dividend payments continued outpacing their free cash flow during the second and third quarters of 2022, it was still initially surprising to see their net debt climbing to C$81.197b versus its previous level of C$76.06b, thereby making for a C$5.137b increase. Ironically, the reason is keeping with the same theme thus far, foreign currency exchange rates, as they carry a significant portion of their debt denominated in USD. Since the USD strengthened significantly against the CAD in September, the translated CAD value of their debt was enhanced, thereby sending their net debt higher than would have otherwise been expected given their accompanying cash flow performance.

Whilst they have hedged the USD exposure within their distributable cash flow in 2023, it does not automatically apply to their debt and cash balances. As a result, their net debt will continue to ebb and flow up and down as foreign currency exchange rates react to economic news and the evolving monetary policies of different countries.

Even though higher net debt is certainly not necessarily ideal, at least the USD cannot continue strengthening forever and if anything, it should revert lower in the future given it seldom trades any higher versus the CAD than presently, historically speaking. If, or hopefully when the USD reverts lower, it will see the translated CAD value of their net debt drop, thereby reversing this undesirable change, excluding the additional impact of structurally higher debt likely forthcoming given the capital expenditure requirements for their sizeable backlog of organic projects.

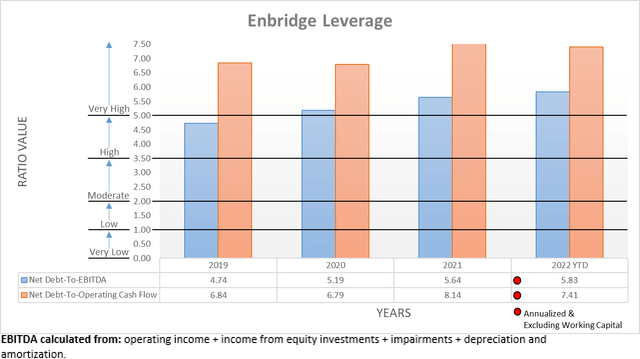

Due to their net debt climbing higher during the second and third quarters of 2022, it was not a surprise to see their leverage increase, especially because the first quarter saw particularly strong financial performance that did not carry forward. As a result, their net debt-to-EBITDA and net debt-to-operating cash flow are now 5.83 and 7.41 respectively, which marks a noticeable increase versus their previous results of 4.79 and 5.96, respectively. Whilst they were previously split between the high and very high territories, both of their results are now above the threshold of 5.01 for the very high territory.

The extent of this increase was amplified by the timing of the CAD weakening against the USD, which occurred rapidly during the final weeks of the third quarter in September. Unlike their cash and debt balances that are translated at the end of the quarter, their operating cash flow is done progressively throughout the quarter as payments are received and thus a result, there is a particularly noticeable mismatch in this instance. Whilst this is not ideal, this is mostly a short-term issue and thus, similar to their net debt, it should resolve itself going forwards and in the meantime, their steady cash flow performance negates most of the risks normally associated with very high leverage.

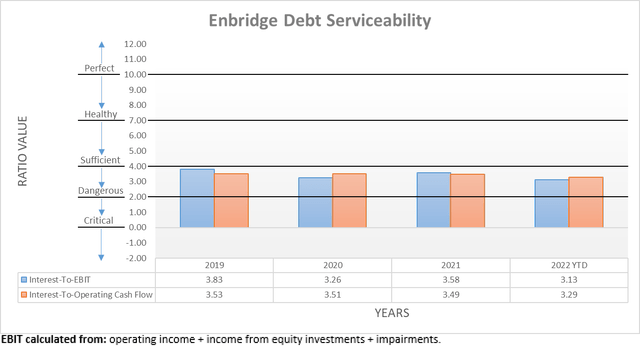

Similar to many companies, the rapidly tightening monetary policy of 2022 saw their interest expense during the first nine months of 2022 climb noticeably to C$2.316b versus their previous expense of C$1.923b during the first nine months of 2021. Unsurprisingly, this hurt their debt serviceability during the second and third quarters of 2022 with their EBIT-based interest coverage falling to 3.13 versus its previous result of 4.05 and whilst lower, it is still sufficient, similar to their accompanying operating cash flow-based interest coverage of 3.29. When looking ahead into 2023, they are reducing their exposure to variable interest rates and thus limiting further pain, as per the quote included below.

“Enbridge will continue to actively manage this exposure through its hedging program and expects to enter 2023 with below 10% of the debt portfolio exposed to floating interest rates.“

-Enbridge 2023 Guidance Announcement (previously linked).

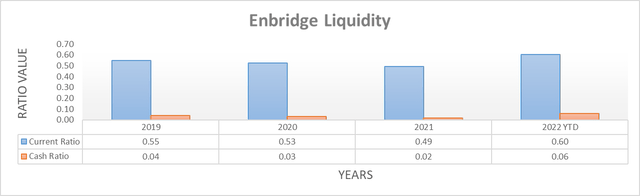

Even though their leverage suffered during 2022, thankfully their liquidity was not significantly impacted overall during the second and third quarters. Whilst their current ratio dropped to 0.60 versus its previous result of 0.68, it was broadly offset by their cash ratio increasing to 0.06 versus 0.03 in tandem. Regardless of where monetary policy heads, they should still maintain this adequate liquidity thanks to their very large operational size and resulting importance to the economy, which helps ensure access to debt markets as required to refinance any future debt maturities.

Conclusion

It seems 2023 will be good for shareholders living in Canada with their results in local currency terms forecast to climb higher, despite the prospects of a recession on the horizon. Alas, the same cannot be said for their shareholders in the United States because without the benefit of a weaker CAD, their guidance for 2023 is lackluster. Since their high 7% dividend yield remains desirable, I believe that a buy rating is appropriate but at the same time, I am downgrading from my previous strong buy rating due to their lack of distributable cash flow growth in USD terms.

Notes: Unless specified otherwise, all figures in this article were taken from Enbridge’s SEC filings, all calculated figures were performed by the author.

Be the first to comment