MACRO PHOTO

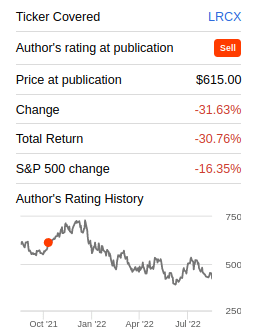

The last time we covered Lam Research (NASDAQ:NASDAQ:LRCX) we thought shares had gotten ahead of fundamentals, and since then shares have under-performed the market by a factor of almost 2x. Now with the share price about a third lower, and the company having grown during this period, we believe that fundamentals have caught on again with the valuation.

Seeking Alpha

Now, it is true that there is some softening of end market demand, even if it has yet to impact the Wafer Fabrication Equipment market. In fact, during a recent industry event CFO Doug Bettinger had the following to say to this respect:

[…] it’s not lost in us that some of the consumer-oriented end markets are softening, right? Smartphone units are down, PCs are weakening, perhaps. So it’s like a tale of two cities, frankly, right? The end markets are starting to soften a little bit. But at the same time, the equipment sector is completely sold out and will be for the foreseeable future, right.

All of the supply chain challenges that I’ve been talking about, I know it seems like forever now, but six, nine months, getting a little bit better, but still nowhere near where it needs to be, right. And you saw at the end of the June quarter, our deferred revenue balance grew again. Although the execution of the supply chain did get somewhat better, right.

So, while the end markets might be softening, there is still a significant backlog for Lam Research to deliver, which has grown significantly due to the supply chain issues. This should cushion potential weakness next year.

Customer Support Business Group

Another thing that should cushion weakness next year is the CSBG division. CSBG is the business Lam Research has from the installed base in the field. It is important to understand that these tools run for a really long time, often decades. Therefore, tool count basically grows every single year as more machines are sold. For example, at the end of 2018, the company had 56,000 chambers in the field. At the end of last year, they had 75,000 chambers in the field. That defines the opportunity for CSBG in a lot of ways because all of those tools require spare parts, need to be serviced, can be upgraded, etc. So those are three of the four components of CSBG; spares, service, and upgrades.

The fourth component is the Reliant product line, which is refurbished equipment sales. This business is very strong right now because almost everything is being utilized. So the company is selling new ‘old’ equipment.

One thing to retain about CSBG is that this is a great business, that is not very affected by industry cycles, has attractive profitability, and importantly is a business that should grow every single year because tool count in the field grows every year, and it’s going to grow quite nicely this year.

Lam Research Investor Presentation

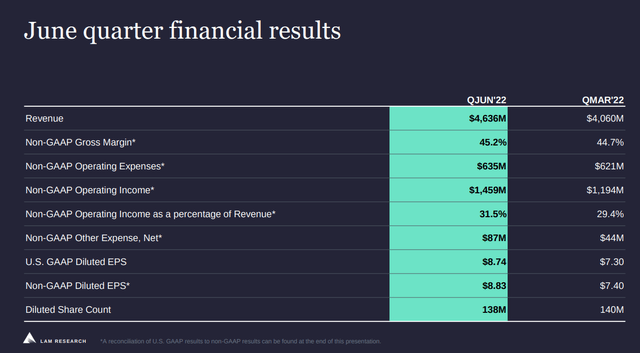

2Q 2022 Results

The company estimates that it is seeing a couple of hundred basis points of headwinds right now due to things like supply-chain issues and inflation, which it expects should get better next year. Despite this, Lam Research delivered an impressive quarter, with margins and earnings up meaningfully from the previous quarter. Non-GAAP diluted EPS were up an impressive ~20% compared to the March quarter.

Lam Research Investor Presentation

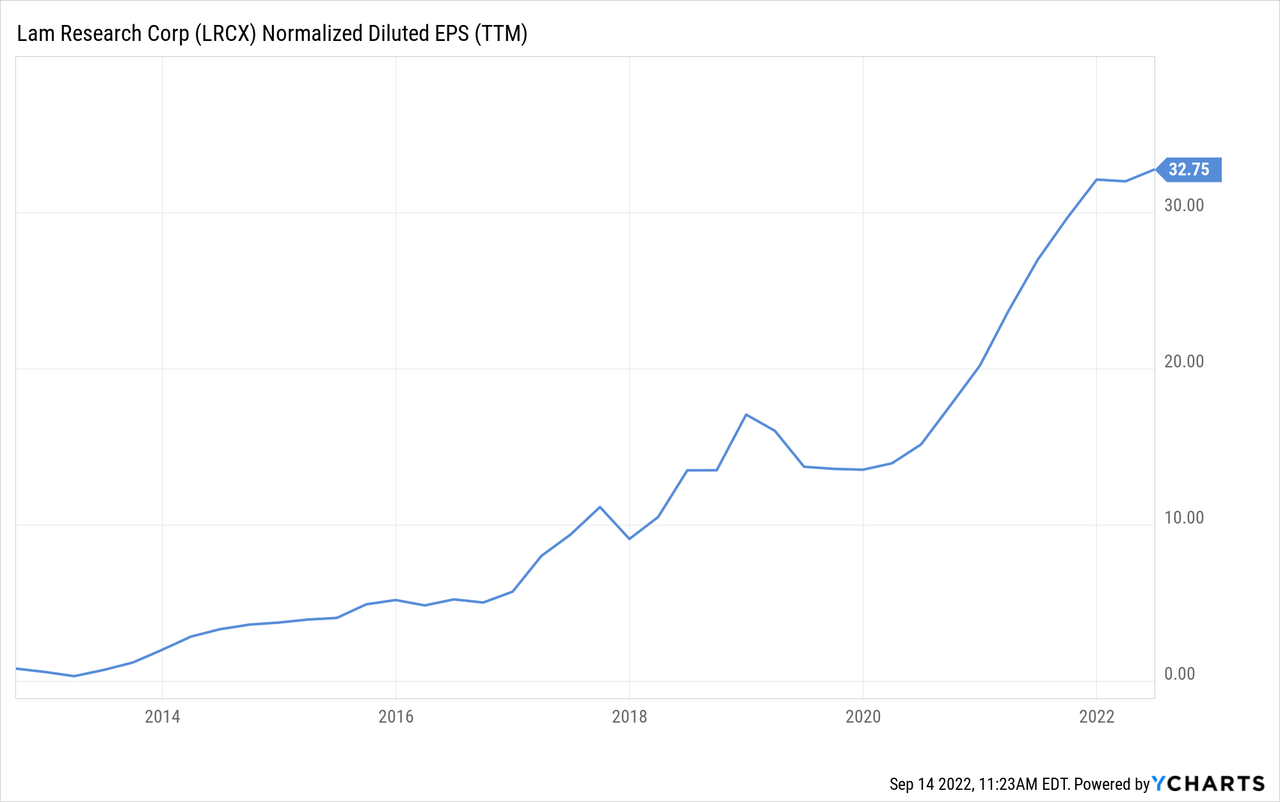

Looking at the normalized diluted EPS for the trailing twelve months, these have now reached an impressive $32.75 per share. This is one of the reasons why we say that fundamentals have caught on with the valuation, given that earnings growth has been very robust.

Financials

Even if next year is a down WFE year, the company expects some margin benefits from an improved supply-chain and inflation situation. Of course, there would be some scale effect of revenue coming down, given that the company does have some fixed costs. Still, the CFO sounded very confident that gross margins should grow in 2023:

C.J. Muse

Interesting, I guess, moving to gross margins, I think what’s interesting looking out to 2023 is that even in a correction year, it looks like your gross margins should grow, and here really kind of highlighting supply chain constraints move away or improve should…

Doug Bettinger

They should, yes.

I’ve suggested that’s a couple hundred basis points of headwind right now, and that one would think it gets better into next year, offset by the fact that if you think it’s a down WFE year, next year, then there is some scale effect of revenue coming down. And the fact that we do have some fixed costs, that will depress margins a little bit.

Balance Sheet

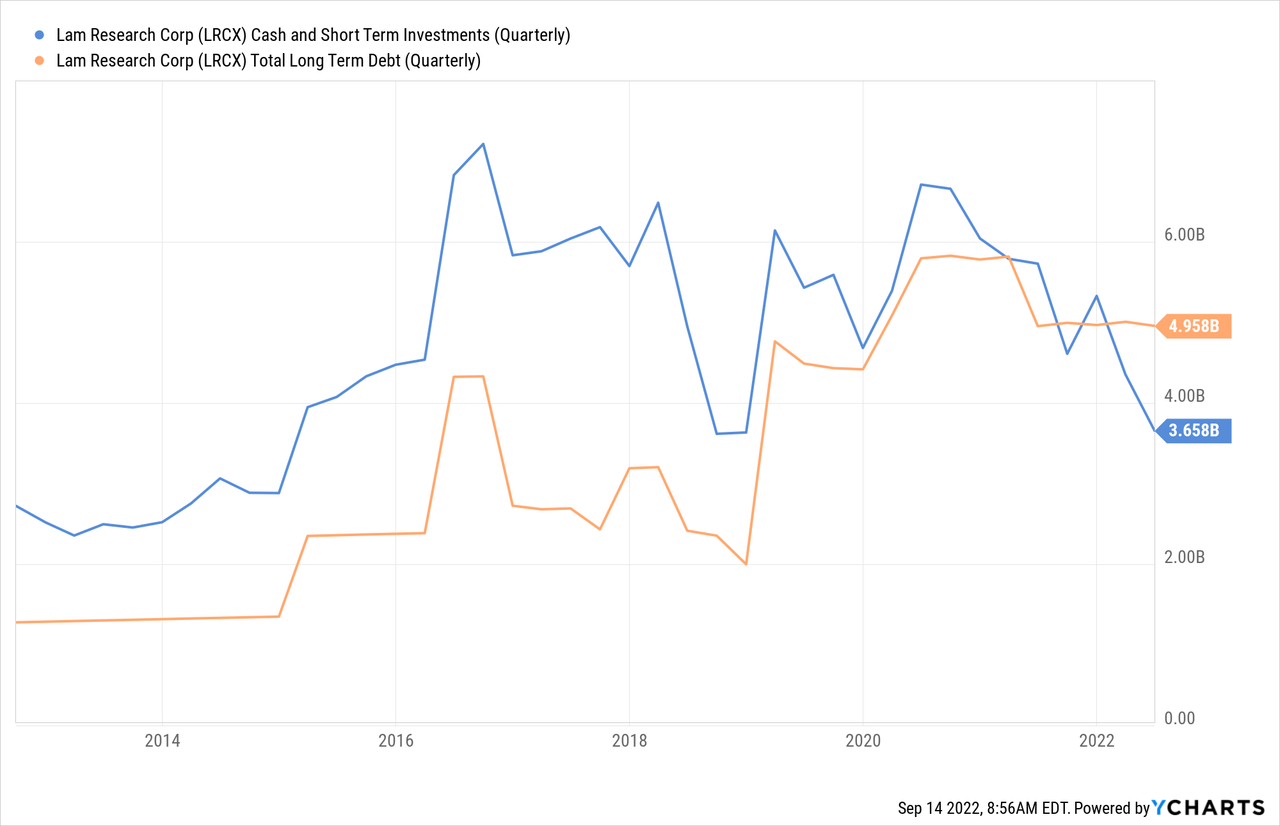

Lam Research continues to have a very strong balance sheet, even if it no longer has more cash and short-term investments than long-term debt, as used to be the case.

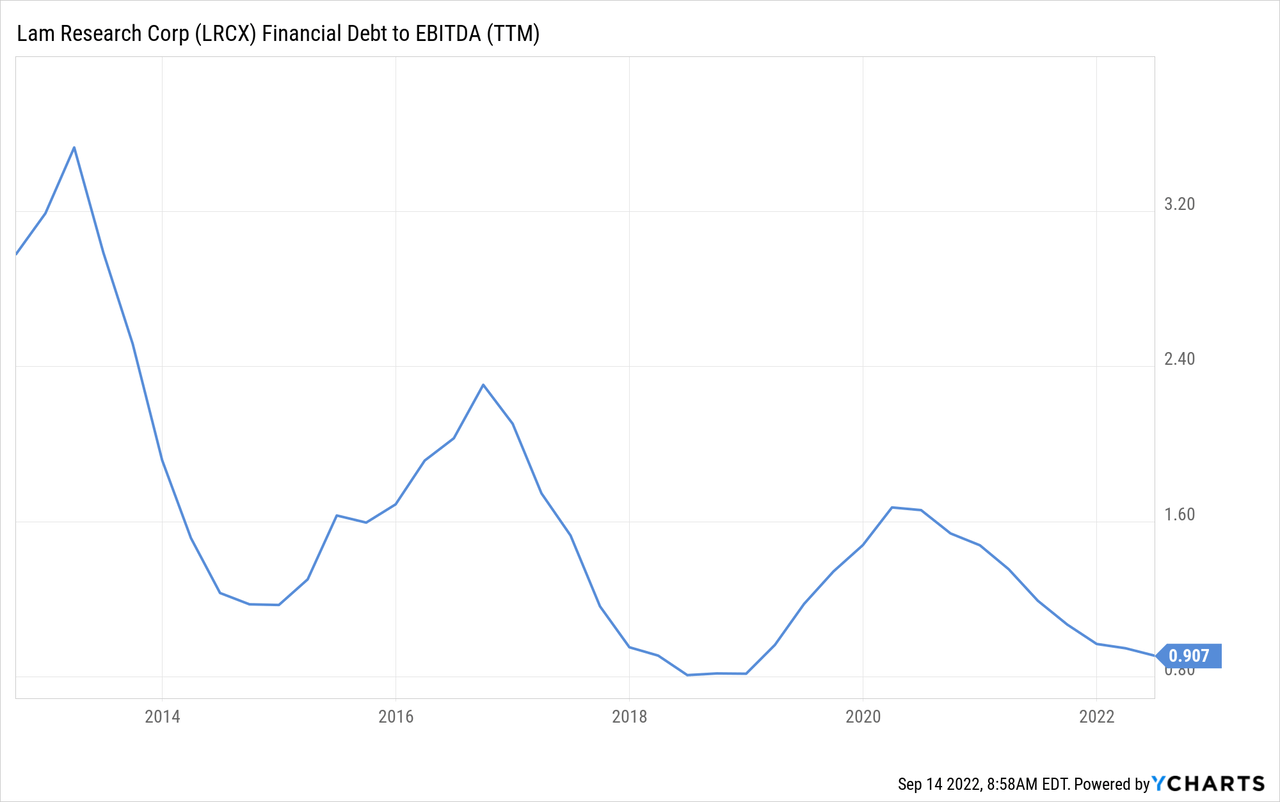

In any case, thanks to the strong profitability, leverage is a very reasonable 0.9x debt to EBITDA, so we are not concerned about the strength of the balance sheet.

Guidance

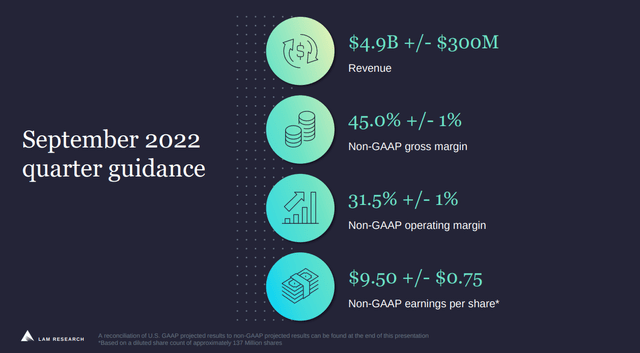

The company will be ramping a new factory location in Malaysia, which will have a benefit to the cost structure over time. Shorter-term, the company is guiding to a very strong quarter for the September quarter, with Non-GAAP earnings per share higher than the June quarter, and estimated at $9.50 +/- $0.75.

Lam Research Investor Presentation

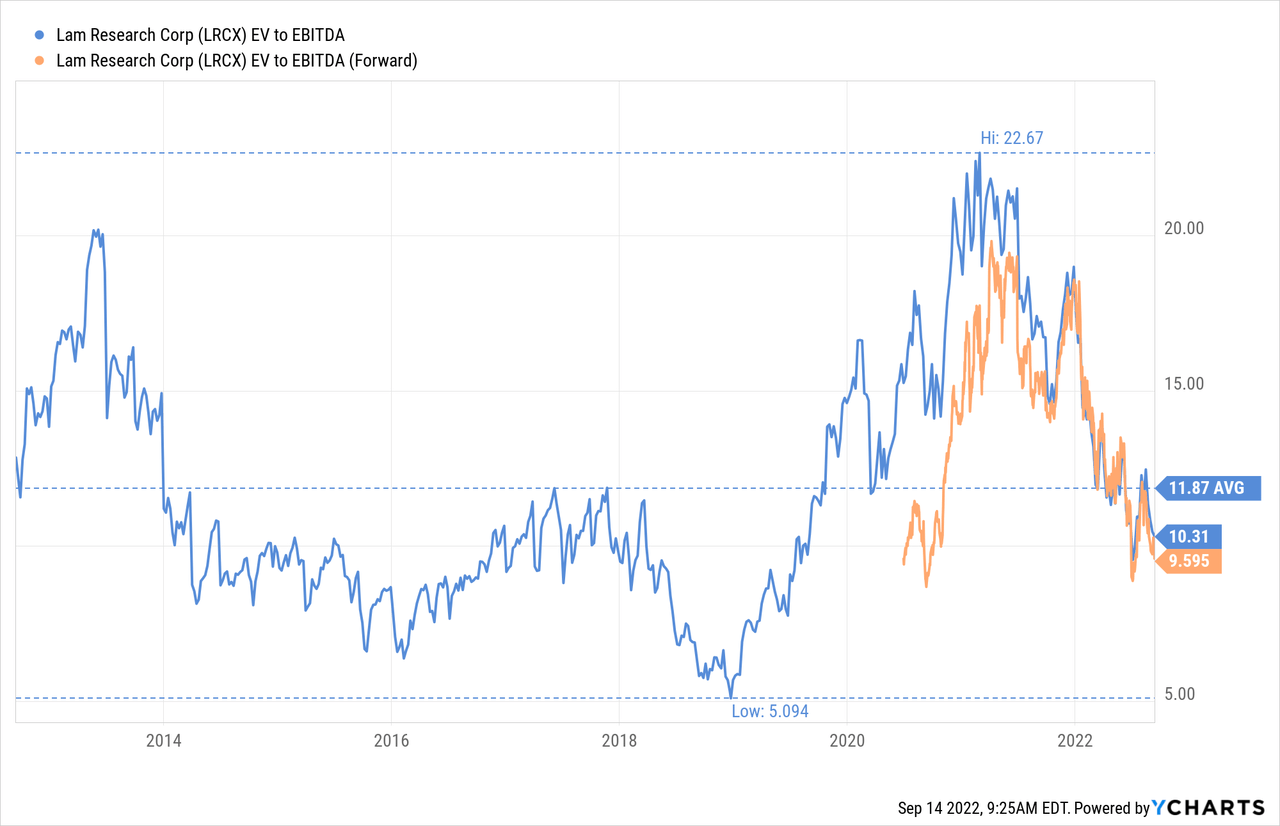

LRCX Stock’s Valuation

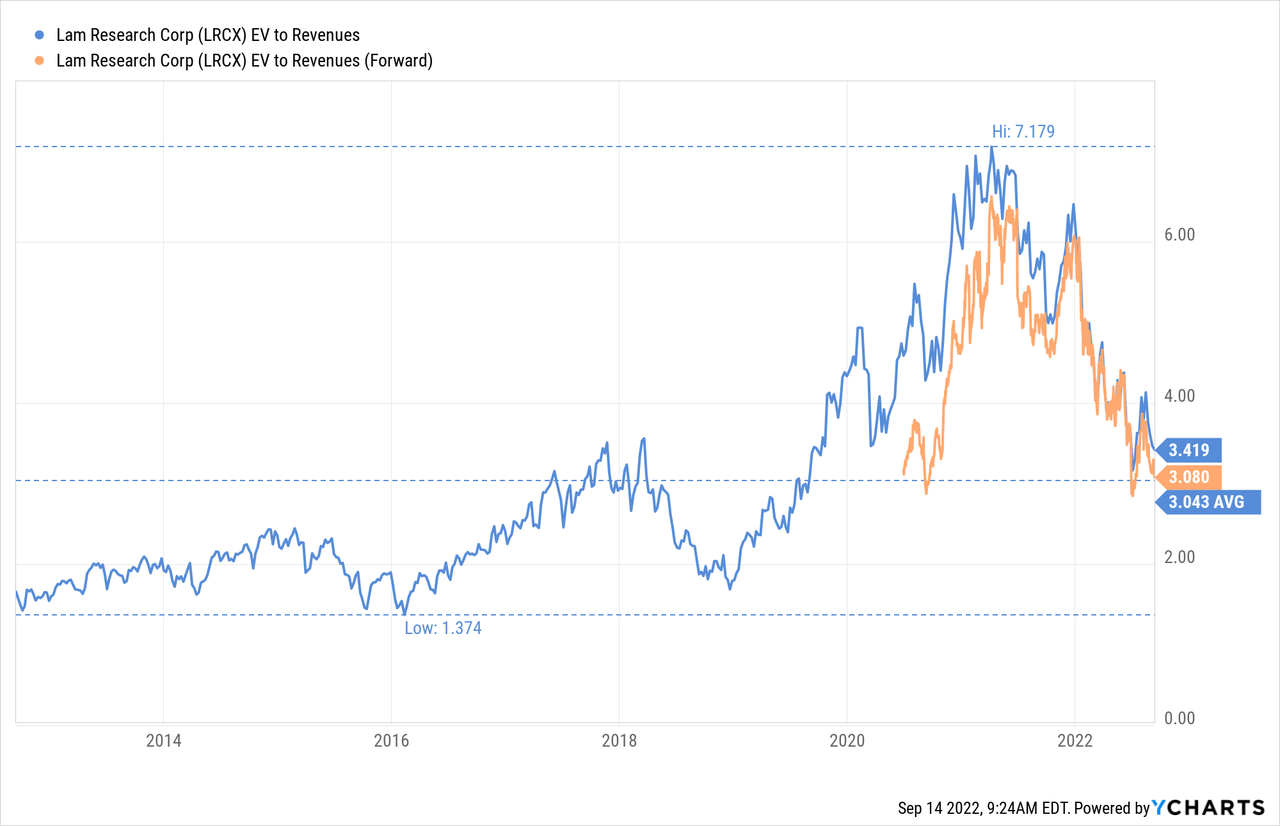

In our opinion, the valuation is once again attractive, with the EV/Revenues multiple close to the ten-year average of ~3x. Shares are no longer at the stretched valuation they reached of ~7x EV/Revenues.

The EV/EBITDA is looking attractive as well, at ~10.3x, and ~9.5x based on next year estimates. This is cheaper than the ten-year average of 11.8x, and we consider it cheap on an absolute basis too.

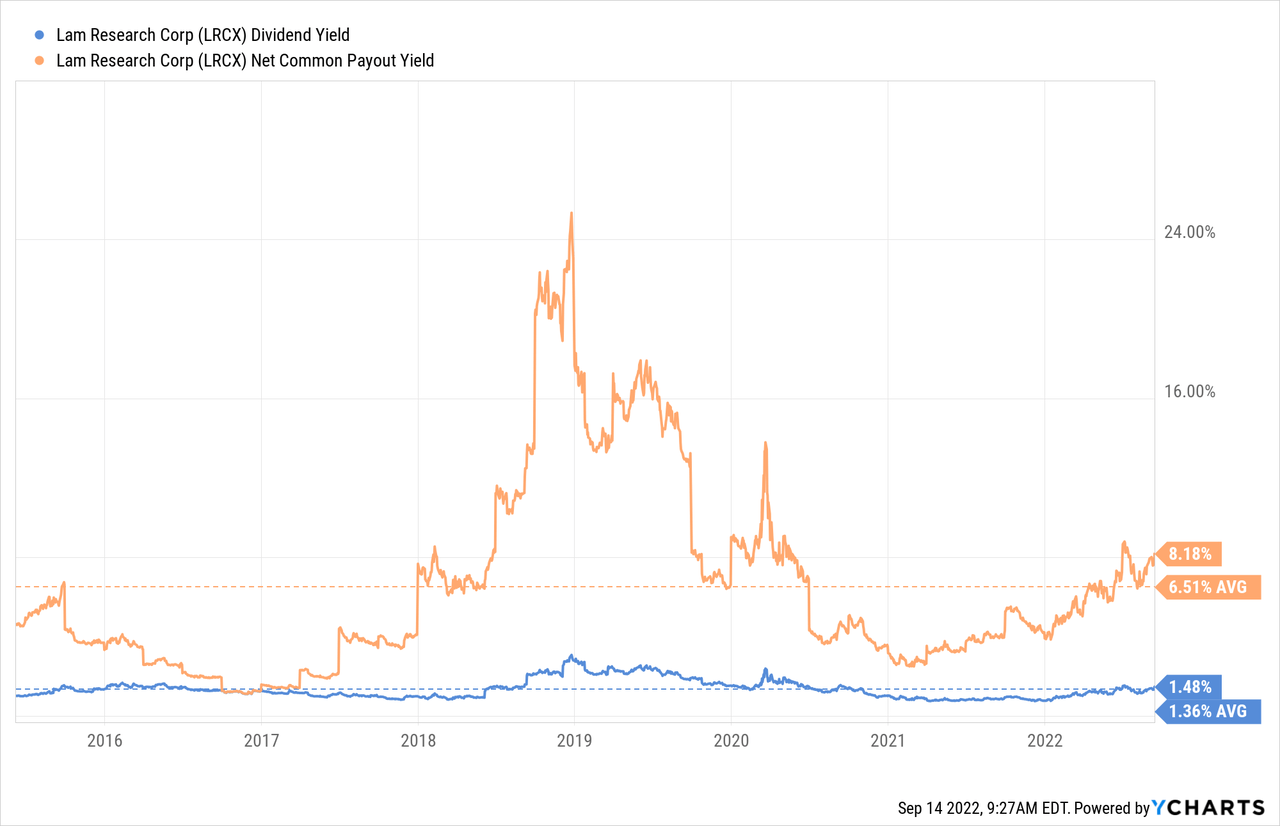

Similarly the dividend yield is a little above the ten-year average, also hinting at a level of undervaluation, and the net common payout yield, which includes buybacks, is also above the ten-year average.

Risks

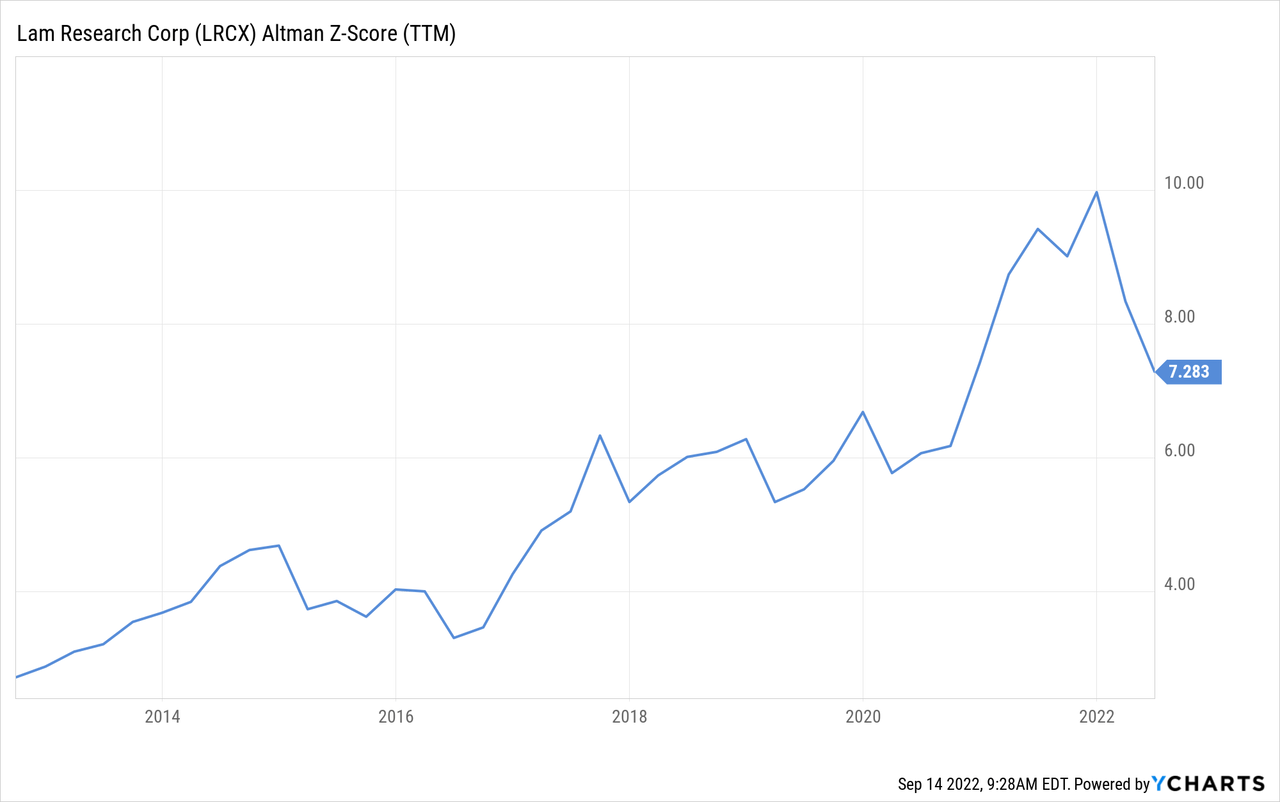

Many analysts expect next year to be a down year for the Wafer Fabrication Equipment market. While this may be the case, we believe the market is already discounting at least a mild cyclical downturn. We believe the company has the balance sheet and cost structure to come out on the other side even stronger, potentially gaining market share. The company has a very high Altman Z-score, reassuring us that it is nowhere close to being at risk of bankruptcy in the short/medium term. The biggest risk is probably technological risk, from a competitor finding a way to improve on the company’s tools.

Conclusion

A combination of a reduced share price and improved fundamentals have made Lam Research shares attractive once again, at least in our opinion. While there are expectations for a down WFE year for 2023, it should be cushioned by the growing CSBG division, and by gross margin improvements resulting from supply-chain and inflation issues improving. We find the current EV/EBITDA multiple of ~10x quite attractive, and we believe it already discounts a mild down cycle for the WFE industry. We believe Lam Research is a very well-managed company, and that its fundamentals have caught on again with the valuation. While shares can always get cheaper, they are at least attractive enough right now to deserve more attention, make sure you at least have them on your watch list. This is a wonderful company at a very reasonable price.

Be the first to comment