piranka

Thesis

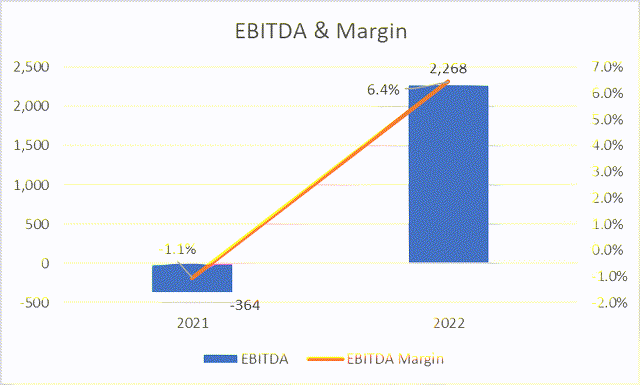

KVH Industries (NASDAQ:KVHI) has improved its cost structure and product mix over the past 3-month period compared to the year prior, leading to an improvement in the bottom line, where EBITDA is now positive. While these improvements have been reflected in the share price given recent performance, the stock remains undervalued compared to peers, with a 30% potential upside.

Intro

KVHI is a communications equipment company based in Rhode Island. A supplier of mobile connectivity, providing solutions for the maritime industry, military and government, and the auto sector, selling products and services in the US and abroad.

The share price has performed well over the past year, significantly outperforming the broader market with more than 4% return achieved over the past 12 months, despite the recent drop off below $10 per share.

Financial Analysis

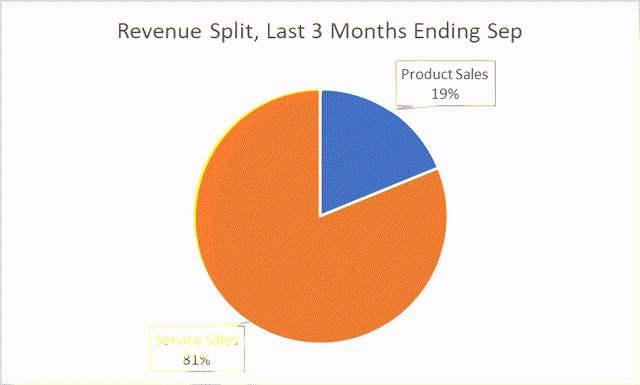

The company has two streams of revenue, product sales and service sales, where product sales account for almost 20% of total revenue, and service sales account for the rest.

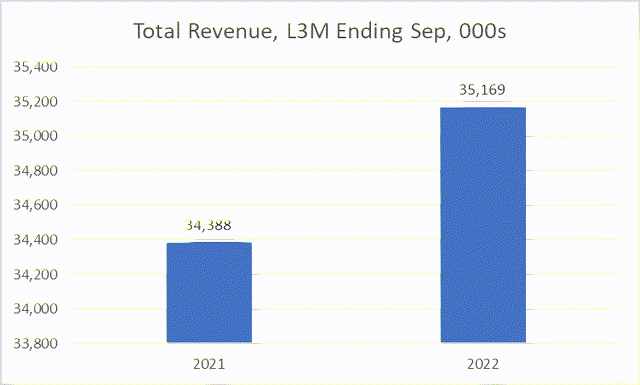

Sales performance in both areas has not been superb in the last 3 months ending September compared to the same period a year prior. Total sales grew by around 2%, achieving around $35m for the period.

While this is positive growth year on year, inflation is substantially higher, implying that volume sales got hit during the period. The sales growth was all driven by Service Sales which grew by around 4% for the period, compared to Product Sales which contracted by around -3%. The driver of the decrease in product sales was the $0.4m decrease in mini-VSAT Broadband sales and $0.2m decrease in land mobile connectivity sales. The growth in service sales was driven by an increase in service sales from mini-VSAT.

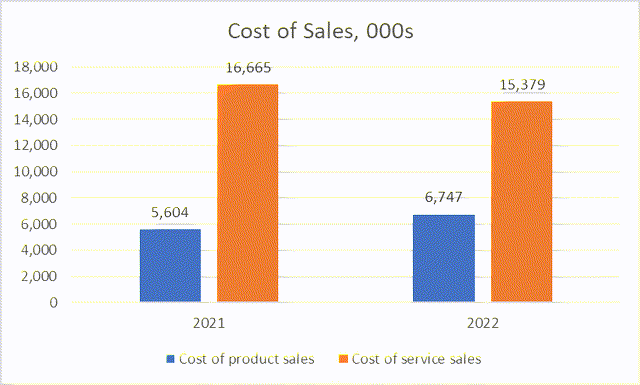

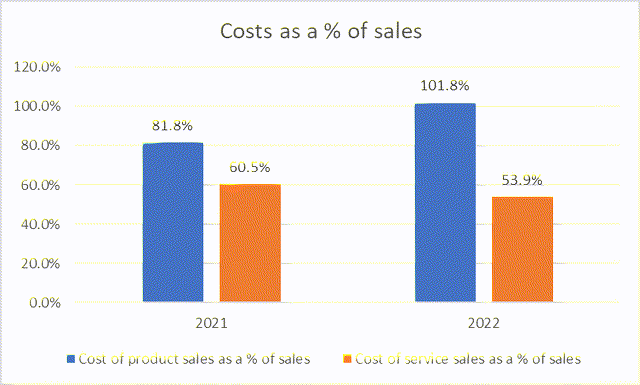

In regard to the cost of sales, the cost of product sales increase by around 20% for the period, while the cost of service sales decreased by around -8%.

The issue here is that as the gross margin was historically low for product sales (around 20%), the significant increase in the cost of product sales compared to a product sales contraction has led to the cost of product sales as a % of product sales increase above 100%, and so the segment is no longer profitable.

However, as service sales are more than 80% of the business today, the increase in the cost of sales for product sales was more than offset by the improvement in the cost of service sales. Therefore, the overall cost of sales ended up decreasing by around 1%, or $0.1m for the period compared to the same period a year prior. As the cost of service sales improved, it dropped from around 60% as a % of sales down to around 54%, which has led to a decrease in the overall cost of sales as a % of sales by 2 points, from 65% to 63%.

As a note, the driver of the increase in the cost of product sales was due to the marine costs, whereas the improvement in cost of service sales was due to a decrease in mini-VSAT airtime costs of service, driven by the shutdown of the company’s legacy Arclight network.

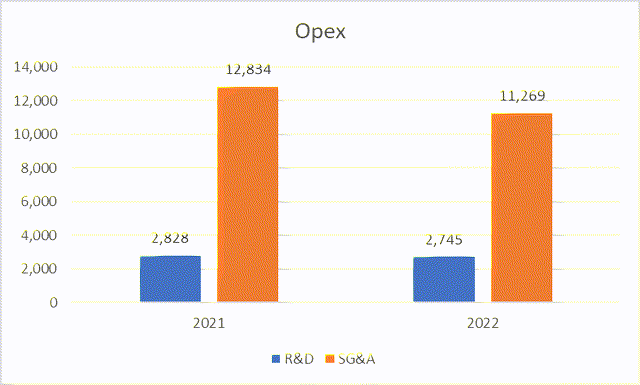

In terms of operating expenses, it consists of R&D and SG&A, where R&D costs decreased by around -3% for the period, and SG&A costs decreased by -12%.

This leads to R&D as a % of sales dropping from 8.2% to 7.8%, and SG&A as a % of sales dropping from around 37% in 2021 to 32% today. The decrease in costs was primarily driven by a decrease in professional fees (around $1.1m).

Fortunately, total expenses dropped by around -5% for the period, which added to the growth in sales and should lead to an improvement in the bottom line.

Now, adjusting for D&A, we can see that in the period for 2021, KVHI achieved a negative EBITDA figure, but in 2021, thanks to the sales growth plus the cost improvements, EBITDA is now positive and sits at above 6%, which investors have clearly accounted for, reflecting this improvement in the share price, given the strong performance over the past year.

Seeking Alpha

Valuation

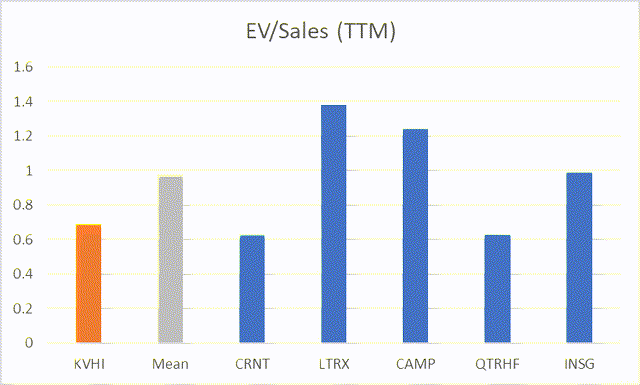

But if we collate a set of peers and compare valuations, we can understand if KVHI is potentially undervalued, overvalued, or even fair valued, given their recent improvement in financial performance.

First looking at EV/Revenue, KVHI is currently trading at around 0.69x, whereas peers, on average, are trading at approximately 0.88x, implying roughly a 30% upside in KVHI stock from current prices.

And looking at EV/EBITDA, we can see KVHI is trading at around 14x earnings, whereas peers are around 18x, again, indicating that there is around 30% potential upside in the price of KVHI stock.

Risks

- One risk to the thesis would be a continued decline in product sales for the company, coupled with a continued increase in the cost of product sales, which would lead to the cost of product sales as a % of product sales being at a significantly high level. These movements would lead to a decline in the bottom line (if service sales were held constant), leading to a lower valuation for the company and wiping out the potential upside. However, given that product sales are gradually becoming a smaller and smaller part of the business, and their costs are a small portion of total costs, then while it would still trickle down to lower earnings contribution, it would only have a negligible effect and potentially be offset by service sales growth.

- A second risk would be a slowdown in total sales. Sales for the period only grew 2% year on year, and given that inflation is substantially high as of now, this is a low figure, and very close to 0. If this rate were to taper down to 0% or even become negative, then we could see earnings gradually decrease and lead to a lower valuation for KVHI. This is a more likely scenario given volume sales are struggling at the moment.

Conclusion

Overall, while KVHI revenue growth is meager, product mix and cost improvements have led to an improved financial performance for the period of the last 3 months ending September compared to the year prior, where EBITDA is now positive, with a margin above 5%. While the improvement in financial performance has been reflected in the stock price, given it is up on the year and marginally higher than the broader market, the company’s share price remains undervalued compared to peers, with a potential upside of around 30% in my view.

Be the first to comment