1933bkk

GIC Juggles Various Factors

Global Industrial Company (NYSE:GIC) distributes industrial and MRO products in North America. My previous article discussed GIC’s marketing efforts and brand leveraging. Recently, it has forayed into the high-growth health care vertical to boost revenue growth. Apart from focusing on large enterprise accounts, it has enhanced the new digital e-commerce platform to improve customer experience.

The commodity price inflation has eased lately. As the supply chain reliability improves, GIC’s inventory level declines, leading to lower working capital requirements. As a result, its weak cash flows can turn over in 2H 2022. However, the build-out and transition operations related to the Canadian distribution network can weigh on the profit margin. It has low leverage and ample liquidity, so the financial risks are limited. Given my revenue and EBITDA estimates, I think investors might want to hold the stock, but with an expectation of a range-bound return.

Marketing Activity And Sales Strategies

One of the critical strategic changes in recent times has been its diversification into various end markets, including the large government and private sectors. GIC’s foray into the health care vertical is a case in point. Because the management emphasizes product availability for its customers, the supply chain disruption witnessed over the past few quarters resulted in higher inventory levels. Not only that, but it also came at a high cost following inflation in ocean freight.

As we enter 2H 2022, ocean cost pressure appears to moderate while the supply chain reliability improves. So, the inventory level is declining, leading to lower working capital requirements and a cash flow improvement. In the long term, sourcing material from higher-margin channels and optimizing the freight profile would pay off for the company.

The other aspect of GIC’s strategy is to enhance the new digital e-commerce platform. The platform focuses on mobile navigation, auto-reorder functionality, personalized recommendations, and faster checkout. Such features can improve customer experience and enhance its digital footprint.

SG&A Costs To Rise

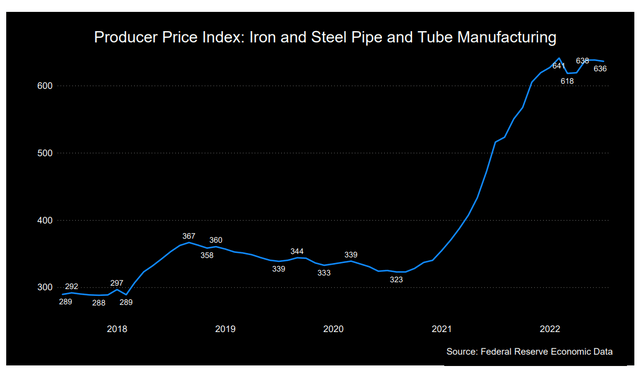

The Producer Price Index (iron & steel products) has increased by 23% in the past year until July 2022. However, it has stabilized over the past three months. The management sees the ocean freight costs starting to come down. Although the supply side is mixed, some price flexibility emerged on the domestic and international sides.

Also, during Q2, the company’s SG&A costs declined by 100 basis points over the past year as a percentage of net sales. The management expects higher levels of SG&A in 2H 2022 due to the Canadian distribution network expansion and its investments in e-commerce. The costs of build-out and transition operations in the new Canadian facility would happen in the second half, thus leading to excess charges. So, the SG&A costs would remain high in 2022. Nonetheless, I expect the margin growth to improve in the medium term.

Q2 Drivers And Margin Analysis

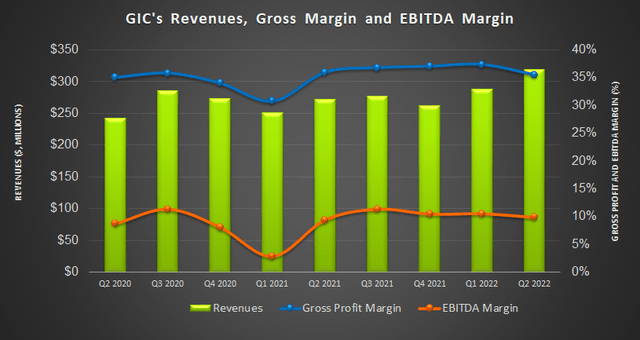

The company’s revenues increased by 10.4% in Q2 2022 compared to Q1. Much of the topline gain can be attributed to higher revenues from the US operation. The open order book, however, has remained flat since the start of the year. The management expects to fill back-order positions faster in 2H 2022.

The company’s gross profit increased by 4.8% quarter-over-quarter. Its adjusted EBITDA increased marginally (3.3% up) from Q1 to Q2. Higher freight fuel surcharges and excess promotional activities heightened operating costs in Q2. Also, higher-cost inventory flowed through from the previous quarter in Q2.

Cash Flows And Dividend

In 1H 2022, increased inventory balances, accounts receivable, and reduced accrued expenses led to higher working capital requirements. These factors pushed GIC’s cash flow from operations (or CFO) much lower to the negative territory compared to a positive CFO a year ago. So, free cash flow (or FCF) also turned negative in 1H 2022.

GIC currently pays an annual dividend of $0.72, which translates into a 2.42% dividend yield. Its debt-to-equity ratio was much lower (0.16x) than its peers (FAST, MSM, and MRC). Its liquidity was $64 million as of June 30, 2022. Since 2021, however, it has added debt to its balance sheet because it invested in inventory to support longer lead times.

Relative Valuation And Analyst Recommendations

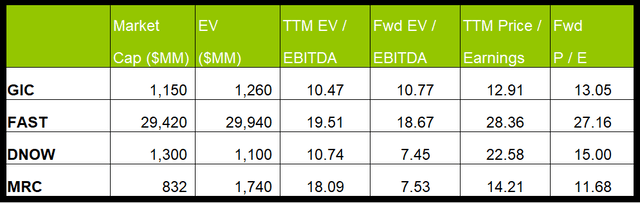

The company’s EV/EBITDA multiple (10.5x) is lower than its average peers’ (FAST, DNOW, and MRC). GIC’s forward EV/EBITDA multiple expansion is in contrast to its peers’ EV/EBITDA contraction. This typically results in a much lower EV/EBITDA multiple than peers. So, the stock is reasonably valued, with a negative bias, on a relative basis.

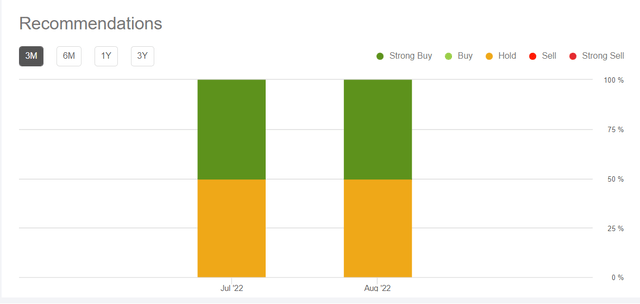

According to Seeking Alpha, only one sell-side analyst rated GIC a “buy” in the past 90 days (including “strong buy”), while one recommended a “hold.” None of the analysts rated it a “sell.” The Wall Street analysts’ estimates suggest an 82% upside at the current price.

Why Do I Keep My Rating Unchanged?

In my previous article, I discussed many positive factors while pointing out some challenges for GIC. At the end of 2021, I noticed that the company’s association with private brands was producing a high-profit margin, especially with its digital and multi-channel sales model for product category expansion. However, higher input costs and supply chain constraints led to increased variable selling expenses and delays in order fulfillment. In the article, I wrote:

The private brand remains a critical focus because of its high-profit margin. The company’s end-to-end purchase, service, and digital and multi-channel sales help improve operating margin. On the other hand, sales headwinds in Canada and commodity price inflation can mitigate a part of the expected profit gains.

By 2H 2022, the pressure of supply costs appears to moderate while the supply chain reliability improves. So, the inventory level is declining. However, the supply chain disruption and inflation in ocean freight will keep its cost structure high. Its open order book has remained flat, thus keeping the topline growth limited. Plus, cash flow concerns prevail. I do not see much upside, nor do I see any considerable risk at this level.

What’s The Take On GIC?

GIC’s selling and marketing approach will ensure that it keeps its market share if there is a downturn in the market. Apart from the traditional small and midsized customer base, it saw rapid growth in the larger enterprise accounts. The healthcare channel, which started in May, can become a significant growth driver.

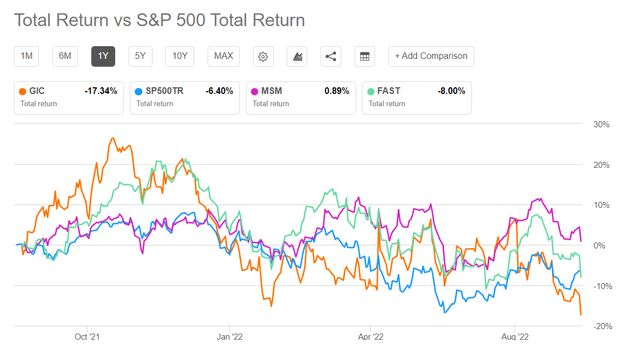

Commodity price inflation, as evidenced by the producer price index, seems to have diminished lately. Following the impact of high-cost inventory, the company undertook modest pricing hikes, which allowed it to drive some additional capacity. As cash flows turned negative, the stock underperformed the SPDR S&P 500 Trust ETF (SPY) in the past year. Working capital requirements, however, will likely decline in 2H 2022. Given the relative valuation multiples, I think the stock price will be shaky in the short term but can recover in the medium term.

Be the first to comment