Mishella

Introduction

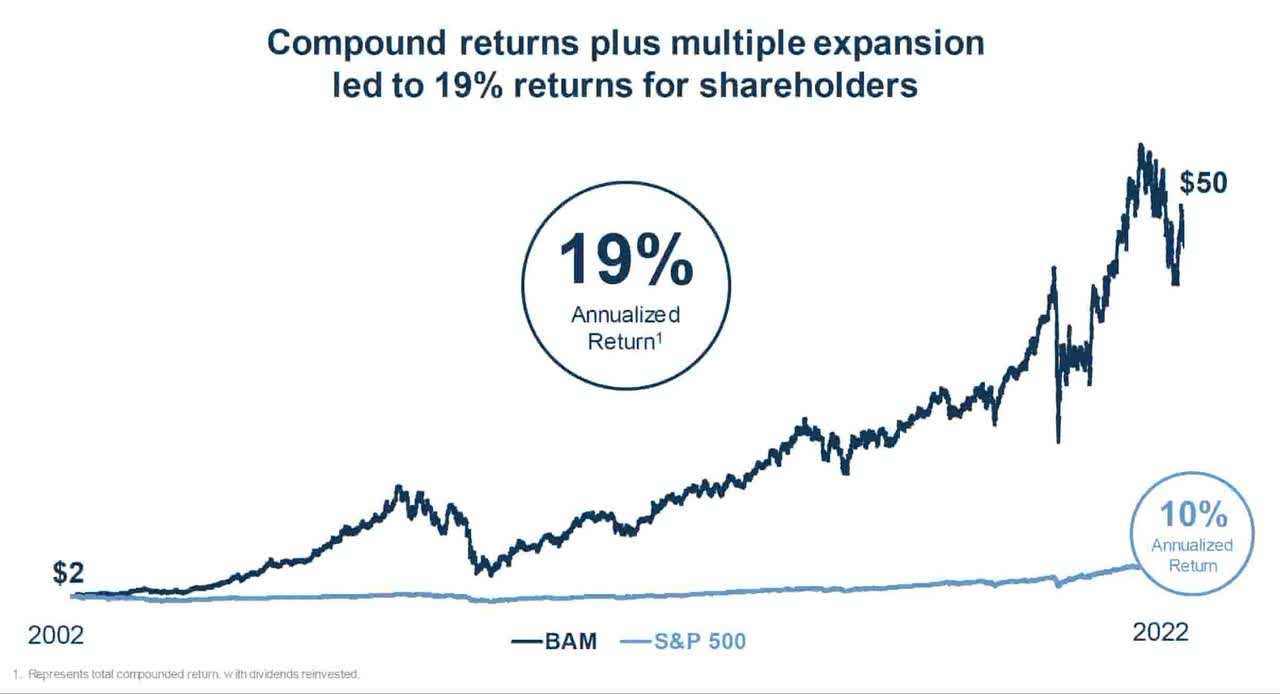

My thesis is that Brookfield (NYSE:BAM) has big plans for the future. I am optimistic that they can deliver on their vision given the success we’ve seen from them over the years. In order to put their vision into perspective, we need to understand how they value the company today and how they think this will change over time. This slide from their 2022 Investor Day shows that they have rewarded long-term shareholders:

19% Annualized Return (2022 Investor Day)

Investor Day Valuation

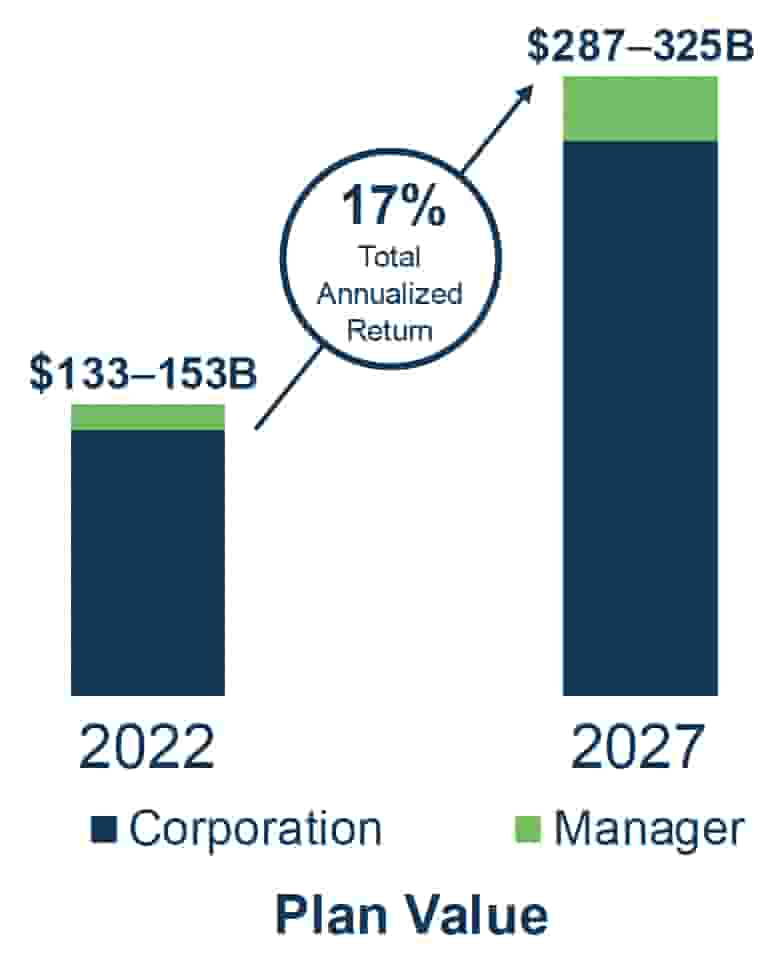

At the 2022 Investor Day, management said synergies from the asset manager pillar, the insurance solutions pillar and the capital pillar will accelerate growth. They show that today’s plan value is $133 to $153 billion and the plan value for 2027 is listed as $287 to $325 billion. It is noted that this is $82 to $94 per share today and $175 to $198 per share for 2027. A slide is shown that represents a great scenario for shareholders who hold their Corporation and Manager shares:

Plan Value (2022 Investor Day)

The first footnote for the above slide says plan value is based on:

(i) Annualized fee-related earnings and net generated carried interest, (ii) applying a market-based valuation multiple within a range of 25-35x to fee-related earnings, and a 10x multiple to net target carried interest, in each case as adopted by management in its business planning, and (iii) our accumulated unrealized carried interest balance.

The second footnote for the above slide goes over margins:

The value of the asset manager within our Plan Value assumes a 60% and 30% margin on annualized fee revenues and a 70% and 50% margin on gross generated carried interest for Brookfield and Oaktree respectively.

The Manager is shown separately in green in the slide above because of the upcoming special distribution. My read is that the existing Brookfield parent will be known as the Corporation and it will trade under the BN symbol. 25% of the asset management business will be distributed to existing shareholders and it will be known as the Manager under the BAM symbol. For every 4 shares of the parent held by shareholders, 1 share of the Manager will be received. Moving forward, the Manager will earn 100% of fee-related earnings (“FRE”) and it will have 2/3rds of gross carried interest earned on new funds.

2Q22 Valuation

Looking at the 2Q22 supplement, we can get close to the valuation range used by management in the above Investor Day presentation.

Slide 6 of the 2Q22 supplement shows $1,951 million in FRE such that the valuation for this component with a 25x multiple comes to $49 billion.

We see annualized carried interest of $2,415 million on the same slide and this valuation comes to $24 billion with a 10x multiple. Net accumulated unrealized carry on slide 17 is $5.4 billion such that the asset management valuation is $78.4 billion.

Per slide 7 of the 2Q22 supplement, invested capital, net is $51 billion.

Combining asset management & invested capital, the total valuation is $129.4 billion. The $129.4 billion figure is very close to the low end figure of $133 billion in the Investor Day presentation. I’m guessing the difference could be due to the fact that they now have more recent numbers and there could be some new ways of looking at things on the insurance side. The high end of the Investor Day range is $153 billion which is $20 billion more than the low end of their range because of a 35x multiplier on FRE instead of a 25x multiplier.

In today’s environment where interest rates and inflation are rising, I don’t use management’s FRE multiple range of 25 to 35x. Instead, I use a multiple of 20x for the high end. This is a difference of about $10 billion such that the high end of my valuation range is just under $120 billion. The low end of my range is 20% less such that my valuation range is about $96 to $120 billion. The 2Q22 supplement shows 1,638.1 million diluted shares at the end of June so this is a per-share range of about $59 to $73.

Closing Thoughts

CEO Bruce Flatt’s erudition has been a big part of Brookfield’s success and I am optimistic for the future as long as he remains a part of Brookfield. My valuation range is not as rosy as the one used by management but even my range is above the September 16th stock price of $48.03. As such, I think BAM stock is undervalued for the long term.

Be the first to comment