Zhuqin Chen/E+ via Getty Images

New York Community Bancorp (NYSE:NYCB) is back on my radar. The multi-family lending bank in the New York City area has long offered one of the highest dividend yields of the regional banks. I have also, on occasion, thought it was poised for share price gains as well. The yield remains solid, however, share price upside has been hard to come by.

The bank announced what should be a business-changing merger with Flagstar Bancorp (NYSE:FBC) in April of last year. However, it still hasn’t gotten regulatory approval as we near the one-year mark since that merger was announced. Normally, this would be a cause for concern.

However, as Stephen Simpson recently noted, many big bank mergers have gotten bogged down during the current administration. An executive order from President Biden has changed the FDIC’s process for evaluating mergers. This has led to delays, while slow confirmations of cabinet members further gummed up the works.

Big acquisitions from the likes of M&T Bank (MTB) and Toronto-Dominion (TD) have faced much longer than usual wait times before regulators finished up their diligence. As such, there’s no reason to think that NYCB’s deal with Flagstar is in any trouble. The combined entity will be much smaller than M&T or TD, after all, and there’s minimal geographic overlap between Flagstar and NYCB, so it seems the delay is simply due to the government working at its own pace.

That said, NYCB infamously tried to buy Astoria Financial back in 2016, and then had that deal break up after bank stocks shot up in November 2016, making NYCB’s offer inadequate by comparison. Shareholders with a long memory might be having a sense of deja vu, given that this is the second proposed acquisition by the bank that has failed to close in a timely manner.

Still, I see no reason why Flagstar would want to walk. Its share price is still tracking NYCB’s offer and it’s unlikely that anyone would pay more given the sell-off in bank shares more generally. So, for investors with patience, Flagstar will still be joining the NYCB family; it’s just taking a few quarters longer than we might have hoped.

Why Flagstar Matters

How does Flagstar change things for NYCB? The biggest difference is it gets them more cheap deposits. NYCB doesn’t have a strong deposit franchise, and lends significantly more money than is supported by its own core deposit base. This means it has to use higher-priced funds to fill out the difference, and that’s especially unpleasant during a rate hiking cycle where short-term liabilities reprice faster than longer-term commercial assets.

So getting Flagstar immediately lowers NYCB’s cost of funding, and to a rather dramatic degree at that. Flagstar also diversifies NYCB away from its primary focus of rent-stabilized apartments in New York City. This business has been exceptionally steady over the years, leading to the bank’s best-in-class loan loss ratios. However, the bank has stagnated since the financial crisis, and perhaps NYCB’s new CEO felt that adding Flagstar’s mortgage banking and warehousing business could give the overall company a boost.

Flagstar stock is now trading — incredibly enough — at just 4x trailing earnings and 70% of book value. That said, those earnings need to be discounted significantly, given that the mortgage boom will be abating as interest rates surge. That said, analysts still see Flagstar stock at less than 7x this year’s earnings, so NYCB is buying a well-priced asset, even penciling in a softer housing market.

I believe NYCB shares will trade significantly higher once the Flagstar deal closes and people start seeing the jump in quarterly earnings numbers. NYCB stock has disappointed people for so long that there’s a general air of skepticism around the company. Even with a new CEO and transformational merger on the way, folks just can’t help but expect the worst, I guess. I see it, however, as a chance to buy an incredibly safe high yielding stock that has some chance at improving sentiment later this year.

NYCB Stock: Slumping Along With Fixed Income

When you’re buying something that is primarily an income vehicle, the entry price matters a great deal. People may complain about something like NYCB stock not going up with the S&P 500, but if you bought it as an income play, the right comparison may be against bonds, not stocks.

Since the start of 2020, for example, NYCB stock has produced a total return of 0%, the Pimco Active Bond ETF (BOND) has returned -2%, and the iShares 20-Year Treasury Bond ETF (TLT) has returned -4%. Just as it wouldn’t make much sense to buy the Nasdaq QQQ (QQQ) for dividend income, a stock like New York Community isn’t designed to perform in-line with a high beta tech stock. If you buy a 7%-yielding stock, the central question is whether the dividend is safe and well-supported by earnings.

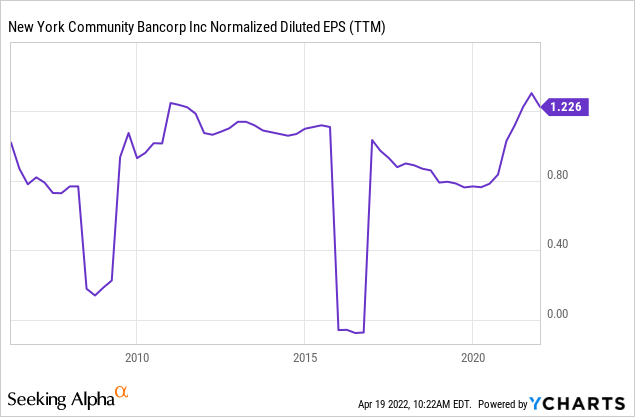

And for New York Community Bancorp, that answer is a resounding yes. During its business trough a few years ago, earnings bottomed out around 80 cents per share (excluding the one-off accounting charge in 2016), which was only modestly above the company’s 68 cents per share annual dividend. It was understandable why some people fretted about dividend safety.

Now, however, earnings per share are back up to their highs and are well above the pre-Covid levels. It’s clear that the company’s performance got a big boost from changes in economic conditions over the past 18 months:

And things are projected to get better, analysts have earnings growing to $1.36 this year and $1.53 next year, which would be considerable further growth on top of the already 50% increase in EPS since 2019.

So why has NYCB stock trended down again in recent months if the business has grown so much stronger?

For one, many investors treat NYCB as a quasi-fixed income instrument and thus demand a higher yield from NYCB stock to compensate for higher yields on alternative assets.

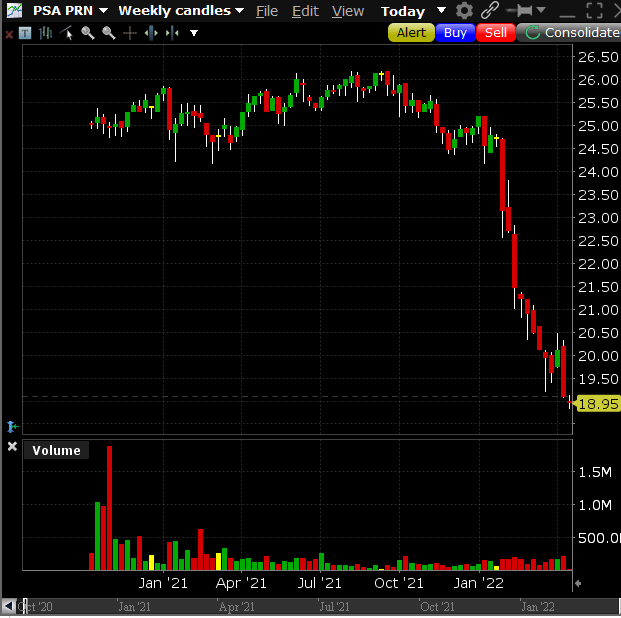

Here’s a best-in-class preferred stock, Public Storage’s Preferreds (PSA.PN) (Class N shown below for one example, but all their various preferred share classes have similar charts as of late). These N shares yield 3.875% at par and were trading above par ($25) last year, meaning the yield to maturity was even lower than 3.875%. Now they’re down dramatically:

Public Storage preferreds (Interactive Brokers)

At $19, these now yield 5.1% for one of the safest lowest-risk preferred shares in America. Presumably, at some point in the distant future, interest rates will go back down, the preferreds will get called at $25, and investors will have gotten a very safe yield in the interim while also exiting with a $6 per share capital gain.

It’s against that backdrop that many investors are looking at an income stock like NYCB. If top-tier preferreds are trading down more than 20% this year, you’ve got to mark down the bank stocks as well to garner those income investors’ attention.

NYCB Requires Patience But Things Can Improve Later In 2022

To be honest, I would have thought NYCB stock would rally at least a little as it grew earnings 50% between 2019 and 2022. That seems like a material improvement in the company’s outlook. And yet, the stock price is back at $10, just as it was then. It seems people are primarily just trading it as a bond alternative and only care about the yield rather than its underlying earnings or outlook.

Fundamentals have improved, however, and will improve a lot more once Flagstar joins the family. Meanwhile, the yield is back up to almost 7%, and even in a higher interest rate world, I’m still happy to hold a stock for a 7% yield and even modest capital appreciation.

And as it stands, I think the combined NYCB/Flagstar could get to 9x earnings projected 2023 earnings, which results in a price target of $13.77. That really speaks to how lousy sentiment is around this stock, even a middling 9x multiple gets you 35% share price upside. I’m content to own for the 6.8% dividend yield, even the stock somehow fails to rally as earnings further increase.

I’ve made my peace with the stock not reflecting the company’s fundamental value. It’s a cash alternative for me, and I like getting 7% on my money. That said, one day you wake up and sometimes your undervalued stock finally gets a lift. It’s been a fool’s errand to predict upside in NYCB’s stock price over the past few years. But at the risk of looking silly, I’m once again optimistic on the bank going forward.

Be the first to comment