alexsl

Introduction

Realty Income Corporation (NYSE:O) is a real estate investment trust that invests in free-standing, single-tenant commercial properties in the United States, Spain, and the United Kingdom.

There are also claims on this company’s website of dependable monthly dividends that increase over time.

This company appears to struggle as real estate is not performing as well. This is due to the Federal Reserve needing to fight inflation with rising interest rates. As a result, there is lower demand for real estate in the space that Realty Income focuses on

Fundamentals show weak growth for the remainder of 2022

Earnings per share data show a steeply negative year in 2022 but improves next year.

|

EPS growth next Year |

-2.74% |

|

EPS this Year |

-24.30% |

Sources: FinViz

Ratios

The popular current ratio and cash ratio show a sudden weaker hit on Realty Income during the years of the pandemic. These ratios should improve starting next year.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Current ratio |

0.959 |

0.933 |

2.003 |

4.324 |

0.550 |

|

Cash ratio |

0.040 |

0.052 |

0.238 |

2.752 |

0.123 |

Source: Financial Modelling Prep

The latest catalyst shows no boost in real estate

Based on the metrics, it seems there will be no improvement in the real estate market until 2025. Real estate market demand declines as the Federal Reserve fights inflation with rising interest rates. This results in lower buying demand as businesses might not want to assume long-term mortgages with exorbitant interest rates.

The popular simple moving average periods have been strongly negative over the past few months. The outlook for real estate might continue to decline over the next few years.

|

SMA20 |

Value |

|

SMA20 |

-4.86% |

|

SMA50 |

-13.48% |

|

SMA200 |

-14.96% |

Source: FinViz

Technical analyses show a severe price drop

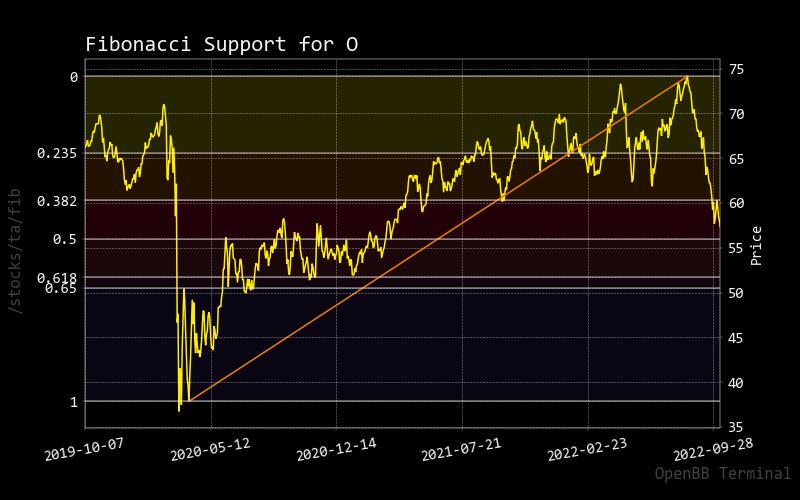

Fibonacci

August and September showed almost a 20% drop in stock value. It went from approximately $75 to $60, which is steep, all due to the aggressive Federal Reserve raising interest rates.

realty income fibonacci (custom platform)

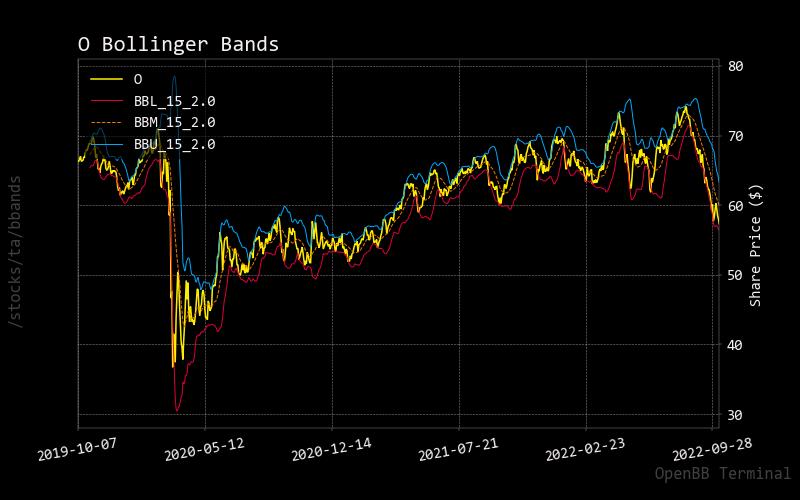

Bollinger Bands

Bollinger Bands have been pushed to the lower band, which suggests the potential short-term bottom is close. There are other factors mentioned that affect the price. Does this bottoming process potential have an actual reversal?

realty income bollinger bands (custom platform)

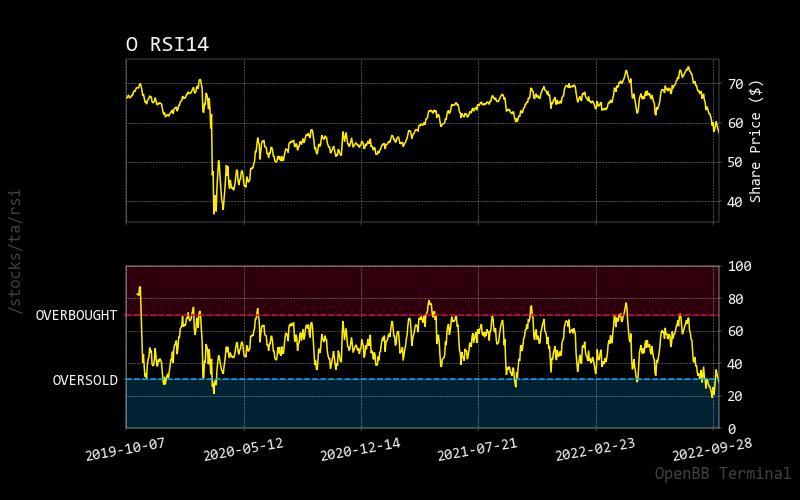

RSI

Relative strength indicators show an oversold condition, as other technical indicators show similar patterns in the stock price. This is not a time to buy this stock due to unpredictable high volatility, adverse solid forward-looking fundamentals, and unfavorable macroeconomic conditions.

realty income RSI (custom platform)

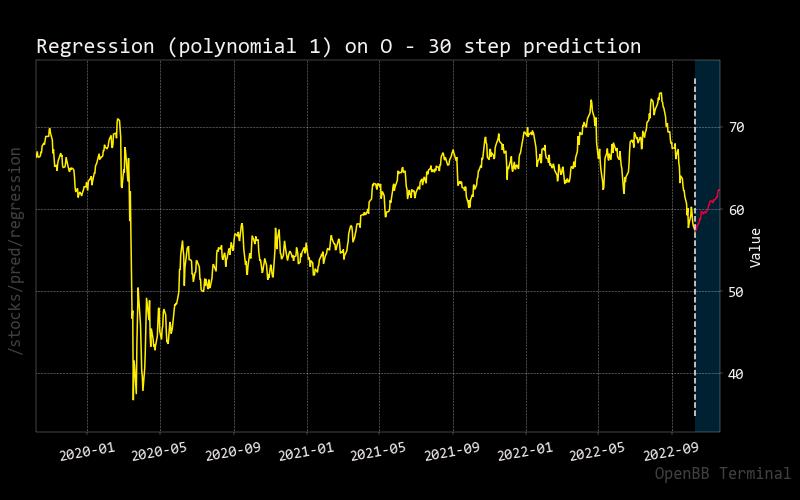

Regression artificial intelligence prediction

Short-term price shows upward stock price momentum, but this should be short-lived. This red line shows a 14-day estimation. One should never forget that fundamentals usually trump artificial indicator predictions. EBITDA and profit-forward guidance highlight this under the Fundamentals section.

regression outlook (custom platform)

Risk is high for long-term returns

Price vs. Short Volume

Shorts represent nearly 50% of the trading volume since the summer. This shows how high the selling pressure is currently on this stock. As a result, stock price declines could continue over the next few months.

Shorting volume needs to be significantly lower than 50% to have this company considered for long-term investment.

short vs total trading volume (custom platform)

Source: StockGrid

Insider Activity

In most recent insider activity, significant investors are selling stock in large amounts. No one seems to be buying since May 2022.

To consider this company for investment, one must see business insiders buying this stock more to show they are confident in the share price of the company they work for.

|

Date |

Shares Traded |

Shares Held |

Price |

Type |

Option |

Insider |

Trade |

|

2022-05-16 |

464.00 |

13,746.00 |

68.61 |

Sell |

No |

PFEIFFER MICHAEL R |

-464.0 |

|

2022-05-20 |

1,029.00 |

30,815.00 |

67.99 |

Sell |

No |

PFEIFFER MICHAEL R |

-1029.0 |

|

2022-08-31 |

7,000.00 |

10,090.00 |

67.97 |

Sell |

No |

PFEIFFER MICHAEL R |

-7000.0 |

Source: BusinessInsider

Sustainability or ESG Rating

It has been proven that Realty Income Corp has a low sustainability or ESG rating. This could hurt this stock as there is an underperforming rating. As these environmental metrics become more important as time passes, this will not help this company be selected by significant funds, which is an essential factor for potential institutional investors, including pension funds.

|

Value |

|

|

Social score |

5.46 |

|

Peer count |

104 |

|

Governance score |

4.75 |

|

Total ESG |

14.25 |

|

ESG performance |

UNDER_PERF |

|

Percentile |

8.7 |

|

Peer group |

Real Estate |

|

Environment score |

4.04 |

Realty Income would need to strive for better sustainability scores to be considered as a top pick for retail and institutional investors.

Conclusion

Forward-looking fundamental data shows expected underperformance as real estate does not perform well. After 2025, this stock could start getting an excellent return with higher profit from the highlighted fundamental metrics. The technical analysis shows a severe 20% drop from August to September; the stock of Realty Income Corp offers sideways performance at best. Significant technical and analytical shows steep declines with a questionable reversal. This indicates that this sideways movement could be extended for a few years. As for risk, half of the trading volume appears to be shorts, which is not positive momentum to drive up the stock price. This data shows a high percentage of sell recommendations in the past few months. Both fundamental, technical, and guidance put this stock as a sell recommendation. Stock value could improve come 2025 as real estate becomes a vital asset class.

Be the first to comment