alvarez/E+ via Getty Images

Biggest buyers of US LNG: South Korea, China, Japan, Brazil. But Mexico bought more US natural gas than all four combined.

There has been a lot of talk about the US supplying more liquefied natural gas (LNG) to Europe to replace a portion (a small portion) of pipeline natural gas from Russia. Tankers with US-produced LNG are already plying that route. But LNG export terminals along the Gulf Coast are running near capacity, and it takes time to build new liquefaction trains at existing export terminals and to build new export terminals and the pipeline infrastructure to supply them. So those ideas, as good as they may be, are getting complicated in a hurry.

The Status of US Natural Gas

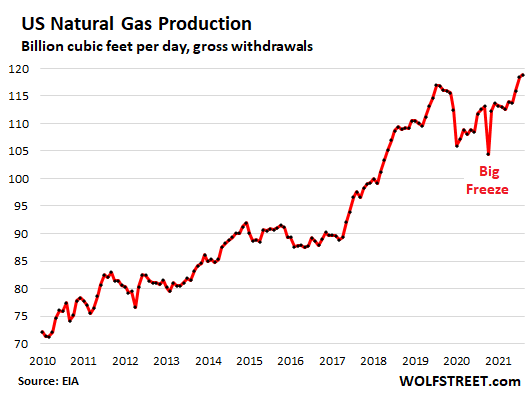

The US is the largest consumer of natural gas in the world. For decades, natural gas production in the US wasn’t enough to meet demand, and so the US imported natural gas via pipeline from Canada and via LNG from other countries. Fracking changed the equation, natural gas production began to soar, and along the way, the US became the largest producer of natural gas in the world. In December, US natural gas production hit a record 118.8 billion cubic feet per day, according to EIA data:

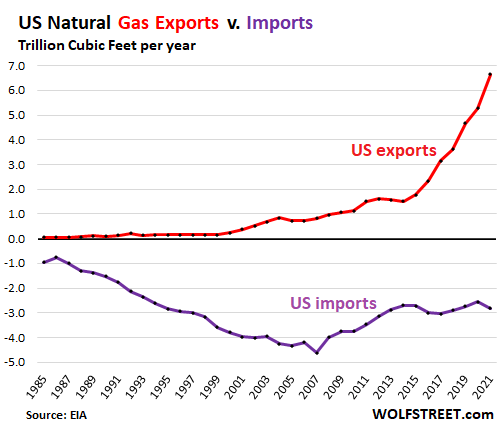

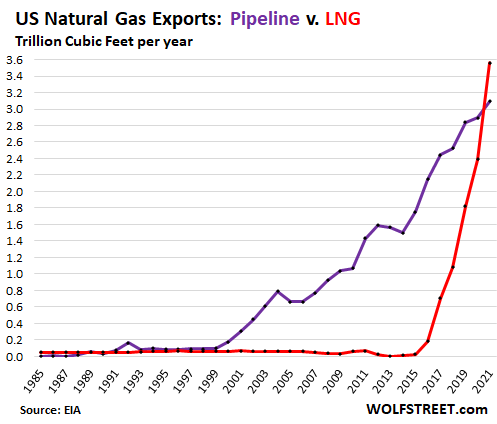

As the price of natural gas in the US collapsed in 2008 amid surging production from fracking, the industry tried to find an outlet. Companies invested in building more pipelines to Mexico, and exports of pipeline natural gas to Mexico rose. And companies invested in large-scale LNG export terminals along the Gulf Coast, and LNG exports from the first of those terminals took off in 2016.

Total exports of natural gas via pipeline and LNG (red line) spiked by 26% in 2021 to a new record of 6.65 trillion cubic feet for the year. Total imports of natural gas, denoted by a negative number (purple line), have remained in the same range since 2013.

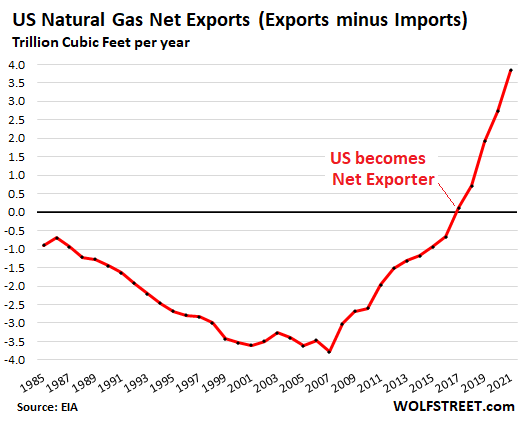

In 2017, the US became a “net exporter” of natural gas, exporting more natural gas to the rest of the world than it imported:

LNG imports essentially ceased, except during the coldest months in the winter in some New England regions that are not well connected via pipeline to producing regions in the US.

The Canada trade: The US exports natural gas to Canada and imports from Canada due to the regional pipeline infrastructure in place. About 30% of US pipeline exports go to Canada. On net, the US imports more from Canada than it exports to Canada.

The Mexico trade: The US does not import natural gas from Mexico; this is a one-way trade, with the US supplying Mexico with ever-larger amounts of pipeline natural gas. About 70% of US natural gas pipeline exports go to Mexico.

Exports via LNG (red line) in 2021 exceeded pipeline exports (purple line) for the first time:

Here is our look at The Huge Ships for the Booming LNG Trade: Designs, Technologies, and Challenges for liquefied natural gas carriers.

US LNG Exports By Country

The list below shows the largest 25 recipient countries in 2021, in billion cubic feet per year, according to EIA data. South Korea has been the largest buyer of US natural gas. China has now surpassed Japan as the second-largest buyer. China was a large buyer, but in 2019, essentially stopped as part of the trade war but recommenced in 2020. Brazil has emerged as the fourth largest buyer in 2021.

By comparison, in 2021, the US exported 2.16 trillion cubic feet of natural gas to Mexico via pipelines. This is about as much as the US exported in LNG to the top eight countries on this list combined.

Also, note the European countries that bought US LNG in 2021.

| US Export Volumes, by largest recipients in 2021, in billion cubic feet per year | ||||

| 2019 | 2020 | 2021 | ||

| 1 | South Korea | 270 | 316 | 453 |

| 2 | China | 7 | 214 | 450 |

| 3 | Japan | 201 | 288 | 355 |

| 4 | Brazil | 54 | 112 | 308 |

| 5 | Spain | 167 | 200 | 215 |

| 6 | India | 91 | 124 | 196 |

| 7 | United Kingdom | 118 | 160 | 195 |

| 8 | Turkey | 31 | 124 | 189 |

| 9 | Netherlands | 81 | 86 | 174 |

| 10 | France | 118 | 90 | 171 |

| 11 | Chile | 90 | 81 | 122 |

| 12 | Taiwan | 27 | 64 | 99 |

| 13 | Argentina | 39 | 15 | 83 |

| 14 | Portugal | 53 | 37 | 66 |

| 15 | Poland | 38 | 37 | 56 |

| 16 | Dominican Republic | 10 | 26 | 53 |

| 17 | Pakistan | 27 | 37 | 46 |

| 18 | Greece | 15 | 48 | 40 |

| 19 | Bangladesh | 3 | 11 | 38 |

| 20 | Croatia | 0 | 3 | 36 |

| 21 | Kuwait | 10 | 17 | 34 |

| 22 | Italy | 69 | 68 | 34 |

| 23 | Lithuania | 3 | 29 | 31 |

| 24 | Jamaica | 14 | 17 | 25 |

| 25 | Singapore | 31 | 28 | 25 |

In terms of the US as a bigger supplier of LNG to Europe, well, at the moment, there is not a lot of excess capacity left in the US to export more LNG to anywhere. Major additional LNG shipments from the US to Europe would largely be a shift away from other customers. LNG export capacity continues to be ramped up in the US, and even though it’s already in progress, it still takes time. And ramping up export capacity further than is already being planned will take even more time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment