What’s The Terminal Fed Funds Rate Jamie? Drew Angerer/Getty Images News

When we last covered JPMorgan Chase & Co. (NYSE:JPM) we highlighted that the valuation was moving in the right direction, but we were not too excited about buying this gigantic bank. Specifically we said,

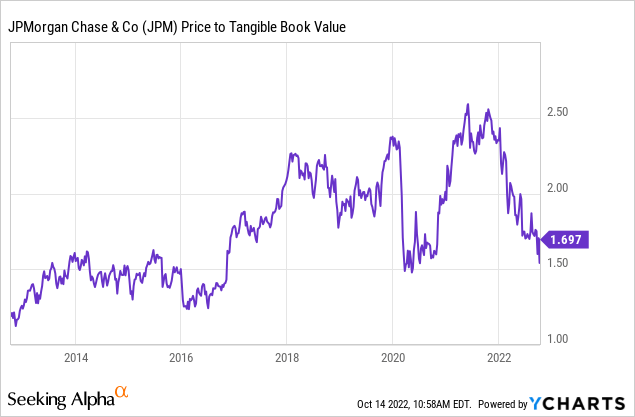

Some of this could reverse, but even without that, tangible book should rise to about $70 by year end. Our low point valuation would be about 1.4X tangible book value and that would be close to $100, versus the $110 we aimed for last time. Examining the landscape, we are not getting attractive option premiums for the $100 strikes so we are right now in a wait and see mode. We rate the bank a “hold” and will update after Q3-2022 results.

Source: Being Defensive Paid Off, Again

The stock has obliged and headed lower.

Returns Since Last Seeking Alpha Article

JPM just reported its Q3-2022 numbers and we decided to see whether numbers would help us move off the fence.

Q3-2022

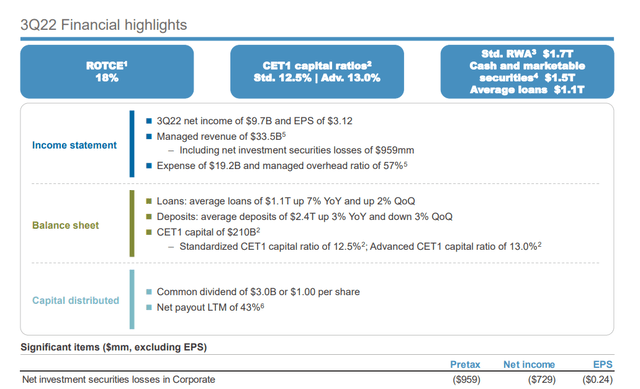

The results were quite strong in our opinion and the $3.12 in earnings per share handily beat estimates of $2.88. Revenue, which almost every analyst obsesses over, also came in a shade higher. This included individual segment beats (where data was available).

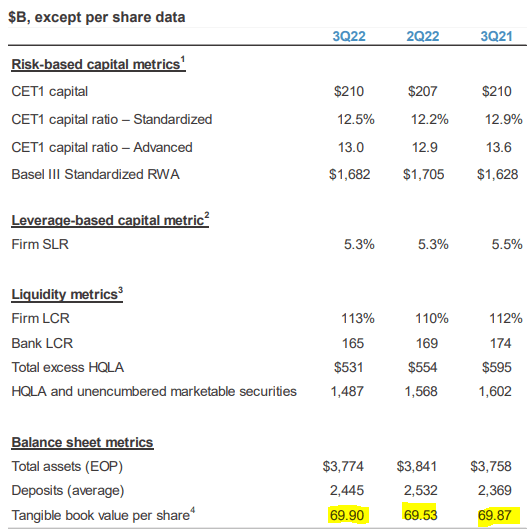

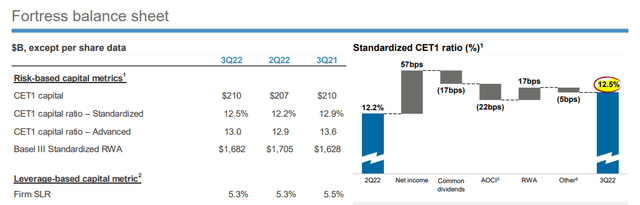

The numbers were lower versus last year, but that was to be expected with the big difference in net credit reserves. Net credit reserve build of $808 million compared was very different versus a net reserve release of $2.1 billion in the prior year. JPM continued to improve its balance sheet and CET1 ratio improved by 30 basis points to 12.5%.

This comes largely on the back of buybacks coming to a halt. In recent quarters JPM was adding a hefty amount of buybacks which worked to take capital surplus back down to previous levels. With the buybacks now on pause, CET1 is moving up just in time to fortify the balance sheet for a recession.

Tangible book value per share, our favorite measure, remained about flat quarter over quarter. In general, you expect tangible book value per share to rise by the difference in net income and dividends paid out. Of course, that is not all that impacts tangible book value and mark to market unrealized losses have an impact as well. You can see the small move in tangible book value per share which was lower than the difference between net income and dividends.

JPM Q3-2022 Presentation

This is actually a very good number as you might have expected a bigger hit with the amount of interest sensitive assets held.

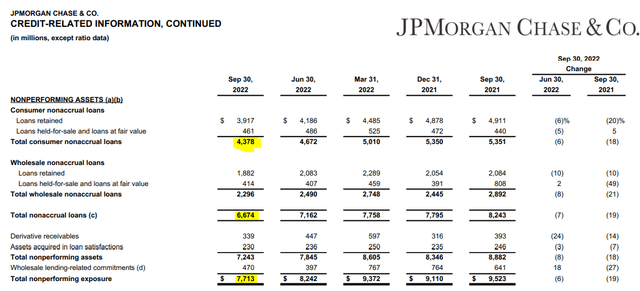

On the consumer and banking segment, net charge-offs remained extremely low. Loans in non-accrual status actually fell quarter over quarter.

If there is a credit stress rippling through the economy, and there certainly appears to be by most metrics, JPM has not felt it to date.

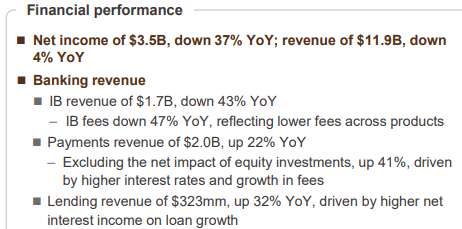

Corporate and investment banking showed a solid quarter as well, driven by tight expense control. While this was above expectations, do note the extremely sharp drop-off in net income year over year.

JPM Q3-2022 Presentation

We think this segment likely becomes weaker in the next two quarters as credit markets have frozen up.

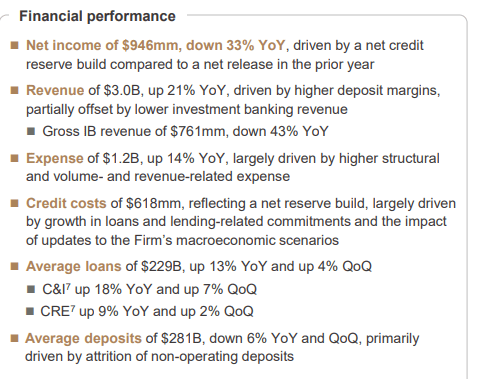

Commercial banking followed in a similar vein, with a 33% drop off in income.

JPM Q3-2022 Presentation

Overall, the quarter showed that the dizzying earnings of 2021 were an anomaly, but the rapidly rising net interest income saved the day.

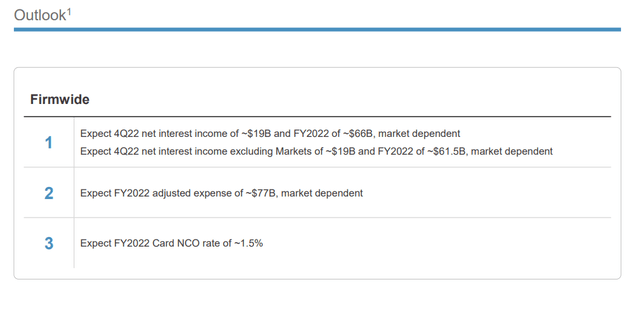

Outlook

JPM guided for net interest income of $19 billion in Q4-2022.

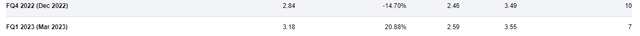

It also stated that it should be a position to resume buybacks next year. Analysts expect about $2.84 in earnings and that number likely gets lifted closer to $3.00-$3.15 after these results.

The commonly accepted negative here is that we are going into a recession and it will be rough. That is certainly possible as the exceptionally lax and irresponsible monetary policy in 2021 will require payment to the piper in 2023. The flip side here is that JPM has not had an environment of such rapidly rising rates in a long time and certainly not during a recession. Look at the guide for the net interest income. This $19 billion expected compares to $13 billion in Q1-2021 and $14 billion in Q1-2022. There is a huge lag in raising rates for deposits versus getting that benefit upfront due to these rate hikes. We could see a $22 billion run rate some time in 2023 and that is likely giving JPM confidence on the buybacks during a likely recession. Of course, the yield curve is inverted and eventually that net interest income margin will compress as JPM raises its deposit rates. Nonetheless, the bank remains in an enviable position to navigate the turmoil.

On a price to tangible book value JPM has not reached our 1.4X yet but it is becoming harder to remain confident that we will see that number.

The results were splendid and those rate hikes are flowing straight to JPM’s bottom line. We think this is a buy around here and remains a very safe play on the longer term health of the US economy.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment