Altria’s Investment In JUUL also ironically VAPORIZED. Spencer Platt/Getty Images News

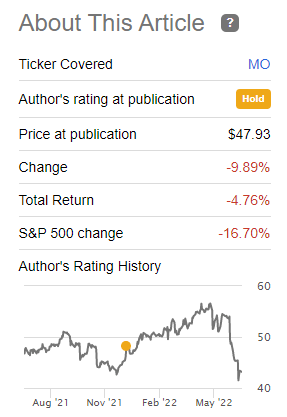

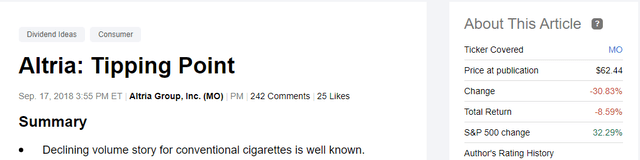

When we last covered Altria (NYSE:MO) we gave it a hold rating. Specifically, we said:

Some rotation from growth to value was inevitable and Altria was likely a beneficiary of that. With the public all-in on stocks likely to deliver abysmal returns, perhaps a new source of cigarette demand cropped up from “growth” investors (we are being facetious here). We would not get too excited over it and focus on the longer term fundamental picture. That does not look smoking hot by any stretch of the imagination.

Source: Altria Outperforms As Growth Investors Take Up Smoking

The returns from that point were not too shabby and Altria handily outperformed the S&P 500 (SPY).

Returns Since Last Article (Altria Outperforms As Growth Investors Take Up Smoking)

Of course, one cannot help but notice the near collapse on the right side of that chart as Altria cratered from $57.00 to $42.00. Is this an opportunity to pick up this giant dividend stream?

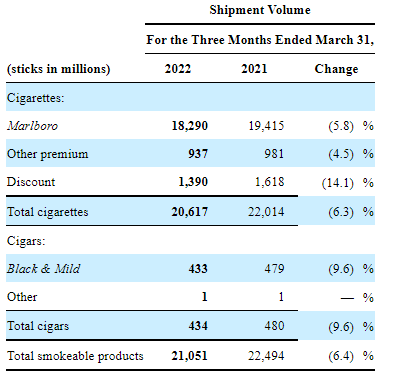

Q1-2022

The most recent results (10-Q) did not hold any major surprises, and Altria confirmed its guidance for 2022 at about $4.86 (midpoint) in earnings. Altria did have one of those rare revenue misses that might have surprised some, and there was one obvious red flag. What perhaps got investor concern was the fresh set of volume declines. Stick volumes dropped once again and came in 6.3% below 2021 levels. The discount segment had a very notable drop at 14.1%.

Altria 10-Q

As bad as those declines look, two things made it worse. The first being that inventory movements helped Altria, in other words, things would have been worse if retailers had not stocked up. The second notable item was that the adjusted 8% decline was below industry decline of 6.5%. Altria was losing market share.

Smokeable products segment reported domestic cigarette shipment volume decreased 6.3%, primarily driven by the industry’s decline rate and retail share losses, partially offset by trade inventory movements.

When adjusted for trade inventory movements and other factors, smokeable products segment domestic cigarette shipment volume decreased by an estimated 8%.

When adjusted for trade inventory movements and other factors, total estimated domestic cigarette industry volume decreased by an estimated 6.5%.

Source: Altria 10-Q

Altria did manage to mitigate the impact of these declines as it has in the past, via price hikes.

Effective January 9, 2022, Middleton increased various list prices across substantially all of its cigar brands resulting in a weighted-average increase of approximately $0.13 per five-pack.

Effective December 12, 2021, PM USA increased the list price of Marlboro, L&M and Chesterfield by $0.15 per pack. In addition, PM USA increased the list price of all of its other cigarette brands by $0.20 per pack.

Effective April 24, 2022, PM USA increased the list price of Marlboro, L&M, Basic and Chesterfield by $0.15 per pack. PM USA also increased the list price of all its other cigarette brands by $0.20 per pack.

Source: Altria 10-Q

Those are huge hikes considering they tend to happen 3-8 times a year. Hence, the melting ice cube concerns are always going to make a periodic comeback.

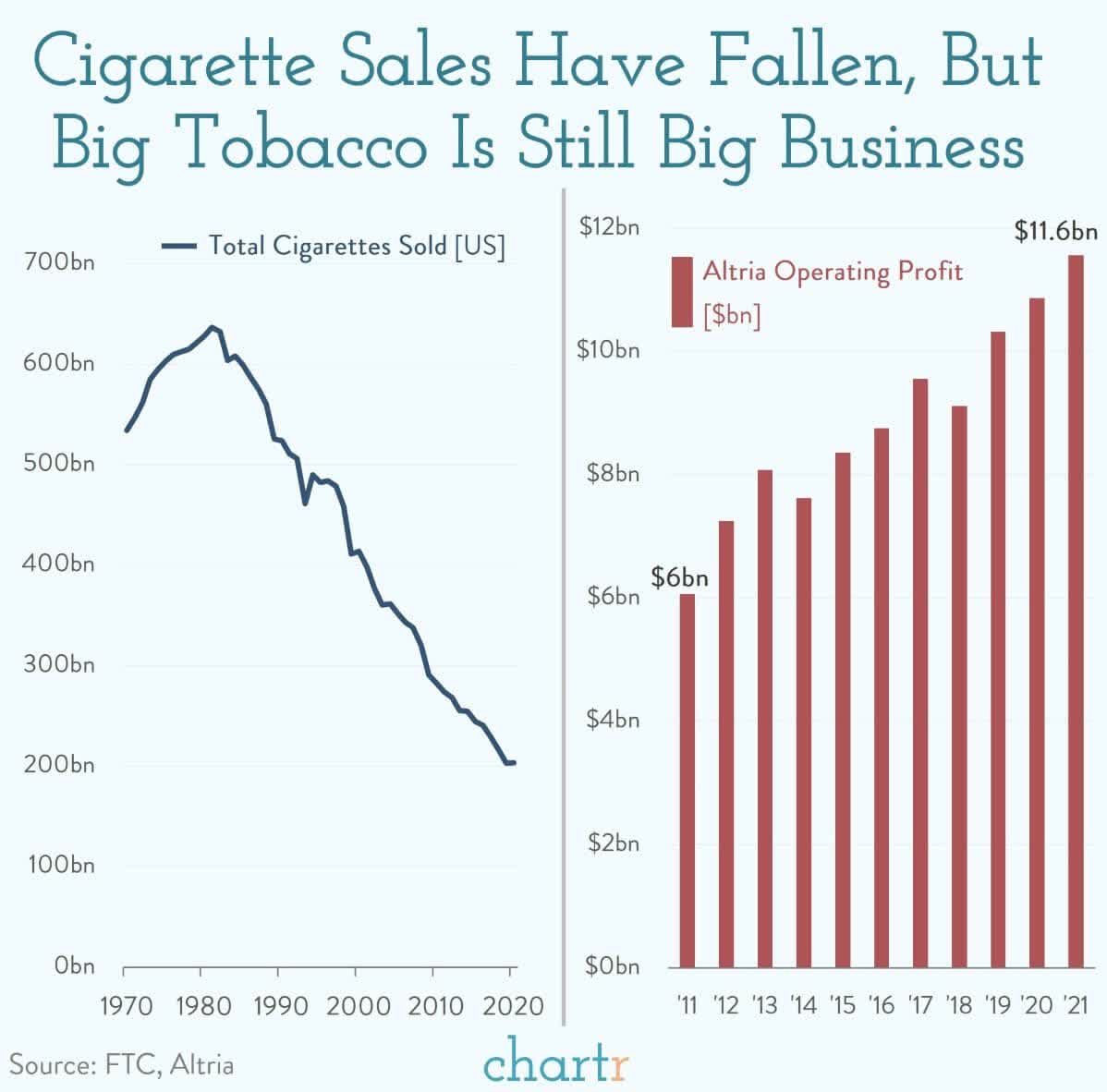

Where Are We With The Volume Story?

The chart below shows just how well Altria has navigated the fact that fewer and fewer people are smoking their lives away.

Chartr-Twitter

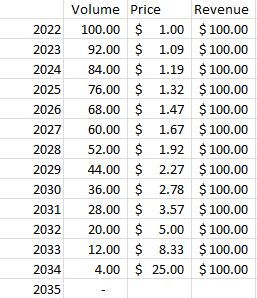

At the same time, it would be naïve to quote silly statistics about how well Altria has performed since 1925. Even its performance since 2000 is unlikely to be repeated. If cigarette sales fall the same amount in the next 22 years as they did in the last 22, Altria will have zero cigarette sales. That would be the ultimate irony for anyone using a dividend reinvestment calculator for Altria as the total return would then actually be zero. That factoid aside, we remain concerned by these decline rates. In 2018, Altria had predicted a 4-5% annual decline rate. It bumped it up to 4-6% in 2019.

To date, 18 states and the District of Colombia have enacted legislation raising the legal age to purchase tobacco products to 21, which covers over 50% of the U.S. population.

Based on the accelerated adult smoker movement across categories and strong national momentum behind raising the legal age to purchase tobacco products to 21, Altria also expands its estimated range for the compounded annual average rate of domestic cigarette industry volume declines through 2023 to 4% to 6% from a range of 4% to 5%.

Source: Altria 2019 10-Q

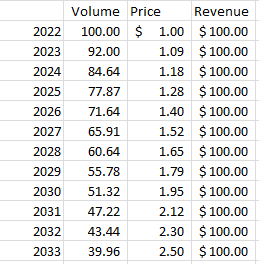

As we can see in the Q1-2022 report, we are now running at 8%. This is extremely problematic as Altria has to hike faster and faster just to keep revenues constant. With an 8% annual volume decline, prices have to rise by 150% just to keep revenues constant over the next decade.

Author’s Calculations

But volume declines are not based on existing volumes. We think there is an expanding pool of “quitters” as smoking becomes an increasingly isolated activity. What the bears are suggesting here is that perhaps you can lose 8% of the existing base (straight line, not declining balance, for the accountants out there) every year from here on out. In that case price increases have to become increasingly higher, and no amount can make up for this eventually.

Author’s Calculations

Verdict

We have left our discussion on JUUL (JUUL) as we have felt for a long time that Altria’s brazen blunder was worth a few cents on the dollar at best (See, I Pity The Fool, Who Paid $36 Billion For JUUL).

Hence, we have focused only on the base business. In all of this analysis, we have assumed a zero feedback loop from price hikes themselves. That is highly unlikely. Price hikes will likely accelerate declines themselves. We will hit a recession at some point, and you can expect states to levy a new armada of excise taxes. That too will accelerate declines. When the minority that smokes gets really small, you can expect legislation to attack smoking with even more vigor. All of this gets us to continue to value Altria as a declining stream of dividends. None of this is rocket science, and we told you this four years back. Altria still has a negative total return from then.

Returns Since First Article (Seeking Alpha)

We have traded Altria since then, and all trades have been profitable. We have focused on only selling cash-secured puts following steep declines. Today, we would consider selling cash-secured puts on Altria in the $35.00-$37.50 range. At that point, we think the net present value of the revenue stream is worth the risk. We stay out for now.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment