blackred/E+ via Getty Images

Thesis

Despite being down more than -50% year to date, the Direxion Daily S&P 500 Bull 3x Shares ETF (NYSEARCA:SPXL) could rally significantly once the market gets more clarity regarding the Fed neutral rate and we see a peak in inflation. Do not believe the siren songs that assert the bottom is in. There is another leg down in this bear market once the current rally is over. SPXL seeks daily investment results of 300% of the performance of the S&P 500 Index . The ETF sits in the leveraged products suite and provides an investor with a theoretical $100 in capital the equivalent daily returns of $300 of investments in the index. Leveraged products have provided outsized returns this year due to the significant moves we have seen in indices and they represent good trading tools where momentum can be pursued. Since the recent market bottom (temporary market bottom) on June 16, the ETF has rallied almost +9% with more room to go as the S&P 500 briefly consolidates around the 4,000 level. However, SPXL will not be able to escape a deteriorating corporate earnings picture and we will need to see further downward adjustments in the S&P 500 to reflect higher discount rates, lower earnings and normalized P/E ratios.

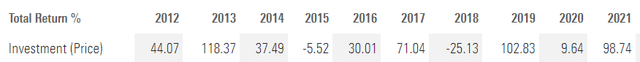

The ETF provided investors with returns exceeding 98% in 2021 and it represents a powerful tool to ride upswings in markets:

Like any leveraged product the ETF has a massive standard deviation of 51.54 (5-year lookback) versus 16.37 for the index and significant daily volatility. When portfolio composition is considered SPXL is not a buy and hold ETF but more of a trading tool, despite its positive 5-year total return. With a target of 3,400 for the underlying index we feel there is another -15% to go in this downturn for a non leveraged product. For SPXL, depending on the magnitude of the daily moves, this could translate into another -40% to -45% down from the current level. Once the bottom is in, and we have clarity on rates and earnings, we could see a furious rally in the S&P 500 with investors pricing in rate cuts in the upcoming years from the Fed. In that scenario SPXL could yet again provide magnified gains by capturing the leveraged upswing in the S&P 500 index.

Market Sentiment

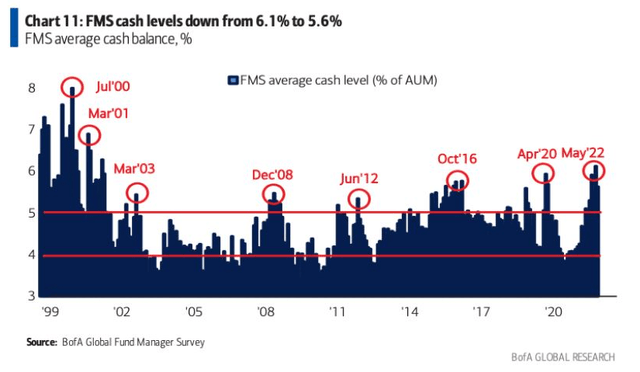

We are currently navigating an environment where investment managers are holding record amounts of cash in their portfolios:

Investment Managers Cash Levels (BofA)

We can see from the above chart that record levels of cash have marked the late innings of other bear markets / corrections.

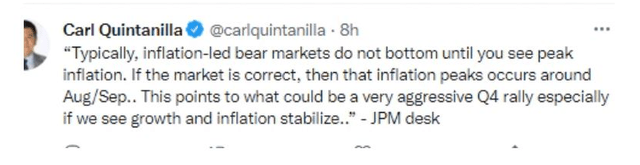

In order to be more confident we have reached some sort of significant bottom (nobody can outright call a bottom but there are several factors/flags than can trigger a “bottoming-out” process) we need to see inflation readings signal a downward trajectory in prices:

Once we have more confidence in the fact that peak inflation is behind us we can start firming up the ultimate Federal Funds rate and be more confident regarding the discount rate to be used in valuations. It is not the actual rate that matters that much (be it 3%, 3.5% or 4%) but clarity around what should be used and what can be considered as a top in rates. The market will aggressively price in cuts for the following years post a peak in rates.

Performance

The fund is down more than -50% year to date, achieving its stated goal of providing 3x the daily S&P 500 Index return:

What is interesting is that longer term (5-year lookback period) the ETF is still up:

5-Year Total Return (Seeking Alpha)

Given the fact that the ETF mirrors 3x the daily move in the Index its 5-year performance is going to be different than simply multiplying the index return by 3. Annual expense ratios also need to be factored in.

Holdings

The ETF mirrors the S&P 500 Index by providing a daily +300% return versus the index performance. As per the ETF’s literature:

Standard & Poor’s selects the stocks comprising the S&P 500 Index on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company’s shares outstanding. The Index is a float adjusted, market capitalization-weighted index. One cannot directly invest in an index.

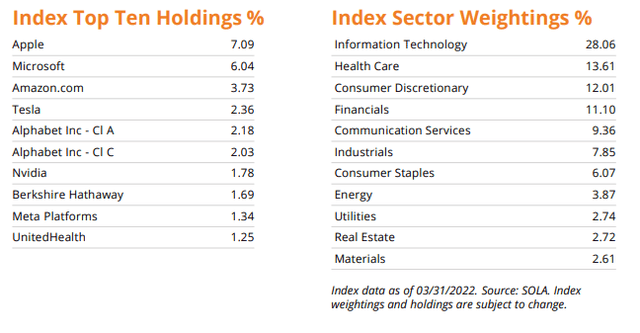

The current index composition is as follows:

Index Composition (Fund Fact Sheet)

The ETF’s performance is achieved via swaps with banks as the fund’s counterparts. The swaps are cleared via clearing-houses, hence eliminating the counterparty risk from the fund’s risk profile.

Conclusion

SPXL sits in the leveraged ETFs product suite, and provides 300% of the daily S&P 500 Index return. The ETF is down more than -50% year to date and we feel there is more to go after the current bear market rally is over. What makes the vehicle an interesting trading tool is its ability to capture a magnified upwards momentum in the underlying index, and we feel that once a bottoming process starts for the S&P 500, SPXL is a great tool to consider for more aggressive investors.

Be the first to comment