Andreus/iStock via Getty Images

Intro & Thesis

I have been covering Apple Inc. (NASDAQ:AAPL) on Seeking Alpha since mid-December 2021 when the stock was trading at $181. At that time, I took the view that the stock was worth buying on the first 15-20% dip. At that moment, given the still fairly low discount rate, we could get a fair value of about $194 per share. But with each new article, I became convinced that we were going lower and lower in understanding what the fair value of the company should be.

So in my 2nd article, which came out after AAPL stock had fallen 16% following the publication of the 1st piece, I suggested not buying the stock’s drop, but waiting for another 15-17% decline before buying. At the time, my thesis caused a mixed reaction – many did not understand why they should wait any longer to buy a quality company after such a decline. In my last article, published on September 30, I analyzed an equity research report by Bank of America in which I disagreed with the analysts’ conclusions regarding the calculation of Apple’s fair value:

The only thing that confused me was the FY23/FY24 multiples that analysts use for their price target estimates.

Paying 25.5 times FY2023 net income and 19.4 times FY2023 EBITDA for a company whose volume is falling and whose prospects are probably bleak? No thanks. This is well above the median of the last 10 years, suggesting AAPL could fall many more basis points lower from where it’s at now.

Source: From my 3rd article on AAPL [September 30]

Today, I want to warn all investors and dip buyers once again that it is still too early to buy AAPL stock in the current environment, no matter how much you believe in this company. The risks continue to increase, especially given the recent developments at the Zhengzhou factory and the company’s still relatively high forwarding valuation multiples which don’t yet price in the gloomy outlook.

Why Do I Think So?

Let’s first take a look at the latest news about what is happening at the Zhengzhou facility, operated by Foxconn Technology Group. This facility is also known as iPhone City – it’s Apple’s main production hub for assembling Pro editions of its iPhones.

Just a few hours ago, Bloomberg published an article loudly titled “Apple Trims New iPhone Output by 3 Million Units as Demand Cools,” in which it disseminates quite interesting estimates of the impact of the Zhengzhou lockdown on prospect sales of the world’s largest company.

The Zhengzhou lockdown is not unique to China. Unlike other countries, China is still using lockdowns to combat the coronavirus. For the main industries, a “closed loop” is used, which means that the company’s employees live on the campus near the production site and cannot leave the permitted area. Under such conditions – namely, only working and sleeping near the plant – people are forced to live for several months, Bloomberg reports. But even these measures do not always help: at the Foxconn production complex in Zhengzhou, which specializes in the assembly of iPhones and is the largest in the world in its segment, an epidemic of coronavirus began in late October.

In another article, Bloomberg’s journalists recounted the story of a 20-year-old Foxconn worker who received no help from emergency services and was even left without food if not for the help of her colleagues. As a result, workers began to refuse such conditions en masse, and because of the site’s limited connection to the outside world, they must walk or take passing cars.

According to Ivan Lam, senior analyst at Counterpoint, Apple can handle 100% of orders for the iPhone 14 and older models through other locations in China but has only a handful of much smaller locations qualified to handle the iPhone Pro. As I mentioned in my last article, it was strong demand for Pro iPhones that enabled the company to meet market expectations for last quarter’s results and outlook – now this revenue segment is also suffering from the increasing risk of supply disruption. Apple has already lowered its sales forecasts for new devices, but in my now we are seeing the first signs that those lowered forecasts may be too optimistic.

Apple Inc. seems to be the last of the tech companies that is still holding up well in the current situation and – given its large weight in the indices – is supporting the entire market. I am sure you have all seen the news that Apple now has a larger capitalization than Amazon (AMZN), Microsoft (MSFT), and Meta (META) combined:

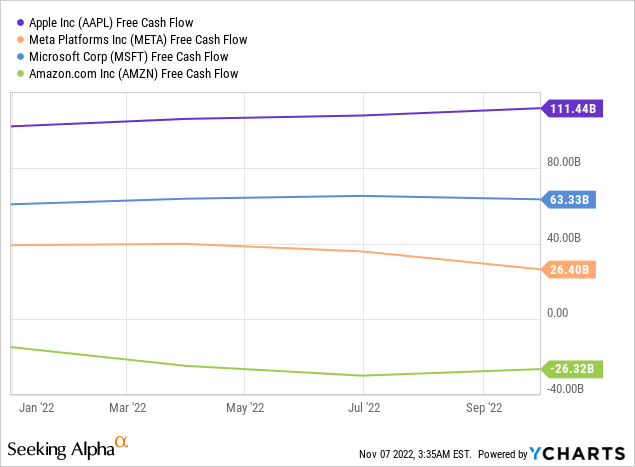

But has anyone seen how these market capitalizations correlate to the level of free cash flow generation of the selected companies?

Amazon’s problems in logistics definitely spoil the overall picture. Yes, based on free cash flow (“FCF”) numbers, Apple looks better than MSFT (EV/FCF multiple of 20.4x vs. 25.15x) but much worse than META (7.9x).

However, the fact that Apple is roughly fairly valued in terms of free cash flow compared to other large technology companies is quickly negated when we look at companies in related or completely different industries:

The only way to justify Apple’s valuation (by this EV/FCF criterion) is the potential growth in FCF and ongoing buybacks, which have already totaled about $549 billion over the past 10 years (which Charlie Bilello says is more than the market capitalization of 494 companies in the S&P 500 Index).

But what if Apple’s gross margin had peaked, as it did in 1990 and 2012?

Seeking Alpha’s charting, author’s notes

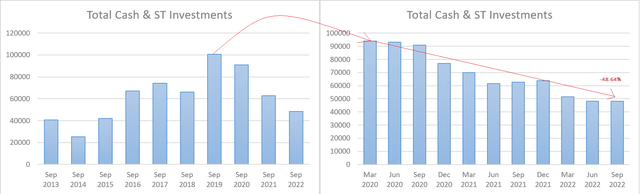

And what if Apple’s liquidity, which has been halved in recent quarters, at some point no longer flows into share buybacks, but into redirecting production from China to India?

Author’s calculations, Seeking Alpha data

The last question worries me the most. Given recent developments in China, it is clear to me that Apple, and American business in general, will be forced to look elsewhere for their manufacturing facilities – some of the production will return to the U.S., but more will likely relocate to India and other places with cheaper labor. It’s the relatively low labor costs that have helped Apple and other Western companies keep gross margins at the high levels we have become accustomed to in recent years. However, the relocation could not only incur one-time costs that impact FCF but also affect the long-term level of gross margins, because it is not certain that a company in a new location will be able to pay wages at the level of China.

And the company is already having problems with the relocation of production alone:

SA News

And now I challenge all Apple shareholders to ask themselves one question: amid all these risks, are you willing to pay 22.1 times next year’s earnings?

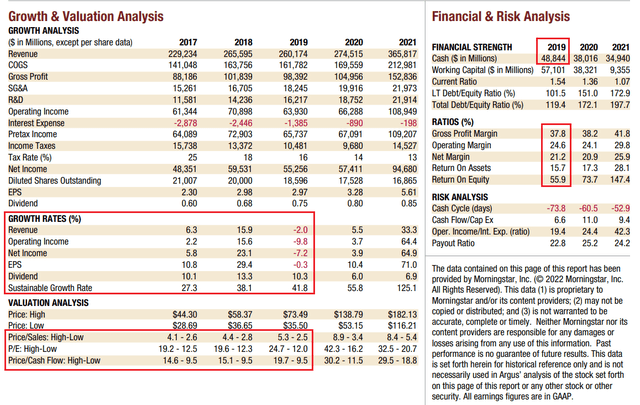

And before you answer that question, take a look at what multiples the company was trading at just a few years ago, when problems like today’s were not even on the horizon:

Argus Research, author’s notes

Analysts’ forecasts for the next couple of years imply a P/E ratio of >20x in 2024, while EPS growth is expected to be 2.6% and 8.12% in 2023 and 2024, respectively. Why should we pay so much today for such modest operational growth tomorrow? As I noted in the Argus Research table above, history remembers 2017-2019 when the company had much higher EPS growth (and not only that) and about the same cash balance as today, but at the same time, the average P/E multiple (in the mid-range) was only 16.7x, which is 26.2% lower than today.

Bottom Line

I remain neutral on Apple stock because, despite the obvious signs of a slowdown in the business and high valuation multiples, the company continues to buy its shares from the market and has tremendous support not only from retail investors but also from institutional investors who are willing to buy any dip in the stock, even ones that are logical in terms of the actual data.

Does this mean that everyone should follow the crowd and buy these same dips?

I do not think so. There are companies in the market that are much more understandable in terms of their prospects that a) are still cheap, b) have a small following among investors and therefore are not as crowded as the big tech companies like Apple, and c) will grow their EPS and not suffer a decline as in the case of the company I analyze in this article. We have already described many of these companies in detail in my premium Beyond the Wall Investing service including them in one of our model portfolios.

Thanks for reading!

![Twitter [@EconomyApp]](https://static.seekingalpha.com/uploads/2022/11/7/49513514-16678075894449503.jpg)

![Twitter [@Quartr_App]](https://static.seekingalpha.com/uploads/2022/11/7/49513514-16678077307070897.png)

Be the first to comment