georgeclerk

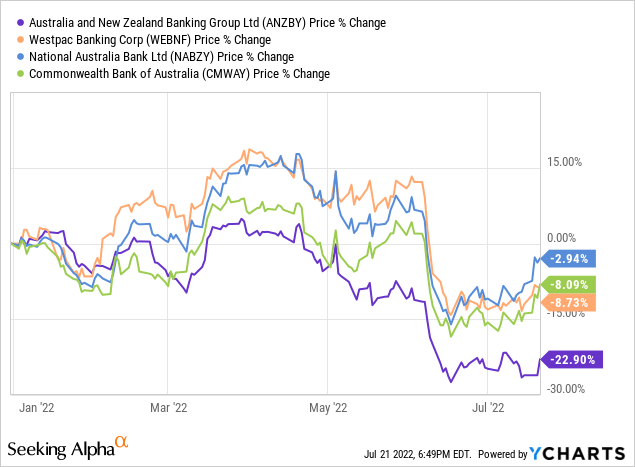

Concerns over stretched household incomes and a possible recession are starting to take their toll on Australia’s bank stocks. Australia and New Zealand Banking Group (OTCPK:ANZBY)(OTCPK:ANEWF), hereafter referred to as “ANZ”, has fared the worst so far, with its shares down a little over 20% year-to-date versus more modest single-digit declines in the other major bank stocks.

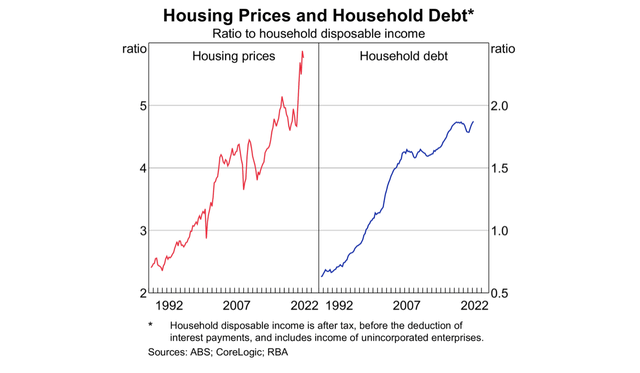

The increasingly pessimistic short-term outlook isn’t easy to overlook. Rising rates will lead to higher monthly mortgage repayments – a big concern here given the sheer size of outstanding Australian mortgage debt – while household incomes are being further squeezed by the sharply increasing cost of living, with prices for utilities, groceries, petrol and so on all heading up recently.

While that may mean that the banks will be in for a rougher time of things in the coming quarters, there is still quite a bit to like here. For one, the domestic banking landscape is one of the most attractive in the world and as such is conducive to outsized profitability. Moreover, the recent share price decline now naturally bakes in a degree of slowing growth and deteriorating credit quality, leaving the bank notably below my estimate of fair value. Buy.

An Attractive Domestic Banking Landscape

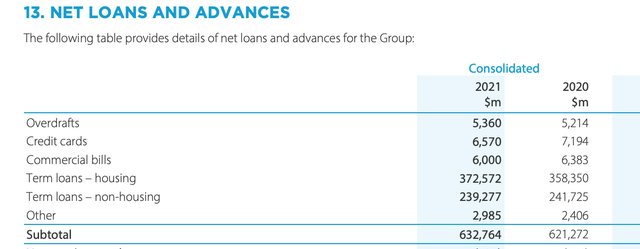

With just over AUD $1,000B (~$690B) in assets, ANZ is Australia’s second largest bank on that measure and fourth largest by market capitalization. Australian home loans (~AUD $278B) account for over 40% of gross loans, with a further ~AUD $85B in New Zealand home loans also sitting on its book. Australian & New Zealand mid-size and small business lending (~AUD $100B), plus institutional lending (~AUD $185B), makes up most of the remainder.

Source: ANZ FY 2021 Annual Report

The banking landscape in Australia and New Zealand is attractive to investors on account of its concentration, with the ‘big four’ (including their New Zealand subsidiaries) ultimately accounting for lending and deposit shares in the circa 80% area.

That endows the bank with a few advantages. For one, it reduces the chance of irrational pricing of loans. Secondly, the bank’s attractive deposit base (~AUD $620B, equal to 60% of total assets) leads to relatively low funding costs. Both help to support net interest margin – important here given ANZ’s dependence on interest income (around 80% of the top line). Finally, the big banks can spread their fixed costs over larger revenues, leading to industry-leading efficiency ratios. ANZ’s cost-to-income ratio has averaged around the 50% mark these past five years.

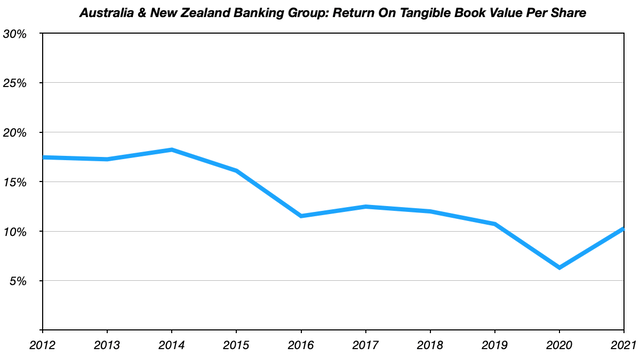

All told, the above does lead to attractive overall levels of profitability here, with ANZ averaging a double-digit return on tangible equity over the past ten years, notwithstanding a significant dip during COVID.

Data Source: ANZ Annual Reports

Lights Not Flashing Red Just Yet

The health of Australian households is coming firmly into focus now that elevated inflation figures, exacerbated by the war in Ukraine, have spurred the Reserve Bank of Australia into tightening mode. Although rates remain modest by historical standards – two sequential 50bps hikes brings the cash target rate to 1.35% – they need to be placed in the context of ballooning household debt levels, as increased leverage puts borrowers in a riskier position.

Source: Reserve Bank of Australia

At ANZ, around 65% of the home loan portfolio is variable rate, with borrowing costs for those mortgage holders naturally set to rise along with the cash rate. At the same time, household income is being squeezed by higher inflation, while both consumers and businesses are staring at a possible recession. Obviously the could negatively impact both asset quality and growth, with tightening lending standards also impacting the latter.

Source: ANZ Fiscal Q3 Trading Update Slides

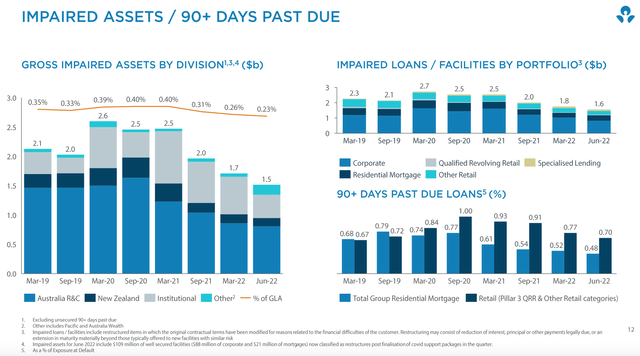

The good news is that so far credit quality remains robust, with loans 90+ days past due falling again sequentially in the bank’s fiscal third quarter. I do expect ANZ’s stage 3 ratio to rise in the coming quarters, but with around AUD $3.8B in collective loan loss provisions and over AUD $8.5B in annual PPOP generation the bank does sport significant firepower to absorb potentially higher bad debt charges.

Source: ANZ 1H 2022 Results Presentation

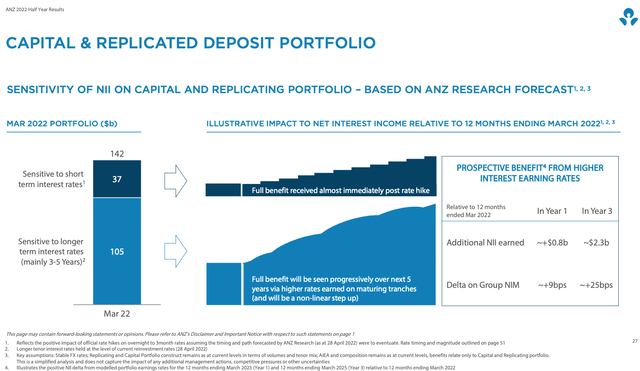

On the plus side, rising rates will help on the revenue side as loans reprice while the bank’s sticky deposit base affords it leeway on increased funding costs.

Upside To Fair Value

As mentioned in the introduction, ANZ has been hit harder by the deteriorating macro environment relative to peers, and at under AUD $22 per share in domestic trading it is down around 20% year-to-date.

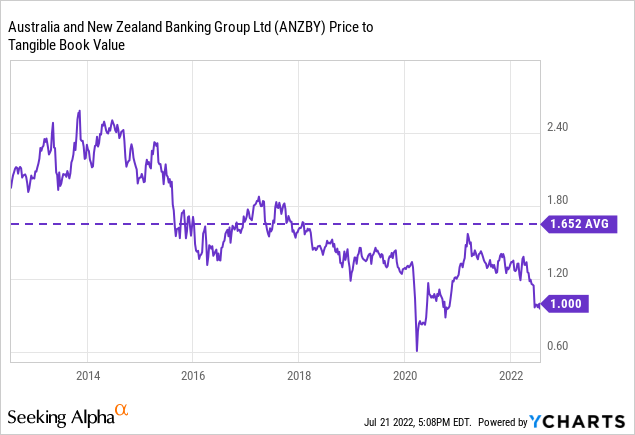

Notwithstanding the increasing near-term uncertainty, the current quote looks like an attractive entry point given it equates to just a shade over tangible book value. The P/E is circa 10x analyst estimates for fiscal 2022, while the dividend yield is over 6.5% based on the AUD $1.44 per share trailing-twelve-month payout.

Under my estimates for ‘across the cycle’ provision expenses (around 20bps, broadly in line with its historical average) and incorporating the impact of higher interest rates ahead, ANZ should be good for a low-teens return on tangible equity, which on a P/TBV basis would put fair value in the 1.4x to 1.5x area, close to its historical average. With that working out to around AUD $30 per share, the implied upside of ~50% looks attractive. Buy.

Be the first to comment