Robert Way

I have written an article on PVH Corp. (NYSE:PVH) in the last month, and since then, the stock has gone up 41%. I still find significant value in holding the stock. Although the recent quarter result seems disappointing, the company is well positioned, with low debt and considerable liquid assets, which provides significant stability to the business operations.

Recent quarter result

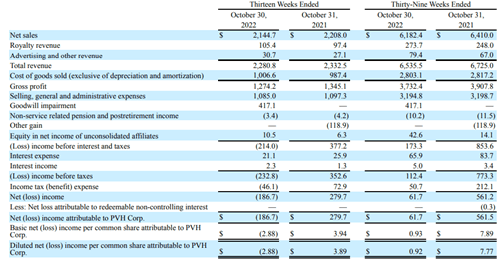

recent quarter results (recent quarter report)

It should be appreciated that, even in the adverse and recessionary economic environment, the company has maintained its gross margins at considerable levels. In the recent quarter, net sales dropped from $2.2 billion in the same quarter last year to $2.1 billion. Although the company has maintained gross profits, the net profits have turned negative due to significantly higher impairment charges of over $417 million.

Also, over the last nine-month period, the company has performed considerably well, but due to the impairment charges in the latest quarter, the overall performance remained subdued.

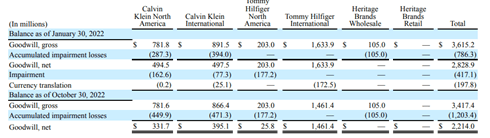

goodwill impairment (quarterly reports)

Significant goodwill impairment charges came from its two core businesses, Calvin Klein and Tommy Hilfiger. In my last article, I have explained about the stable and long-standing performance of these two businesses, and due to their consistent and high cash flow generating operations, I wasn’t expecting any goodwill impairment.

Although the company has incurred significant impairment charges, there is a significant value of these two brands in the marketplace, which has been helping the company to generate significant gross profits.

Also, due to supply chain issues, the inventory levels have increased significantly from $1.3 billion in the same quarter last year to about $1.8 billion. As a result of such a sharp rise in inventory levels, cash flow from operations has turned negative. In my view, as the supply chain stabilizes, the company could reduce its inventory to normal levels.

This was my first time returning to Korea after COVID where I could in person experience the strong execution of the PVH+ Plan and our Calvin Klein brand in the market. Calvin in Korea is a great example for how executing the PVH+ Plan will drive strong impacts over time across all regions and markets. In Korea, we have taken the key growth drivers of the PVH+ Plan and made them come to life in a uniquely strong way, driving year-to-date revenue growth of plus 22% in local currency. Source

As the management focuses relentlessly on the PVH plus plan, the strategies are expected to drive further business efficiency and operating performance. Based on the company’s performance, it seems that these initiatives are bearing fruit.

Furthermore, the company has refinanced its debt facility, providing the business model significant stability.

Risk factors

As the inventory levels are rising considerably, any weakness in managing working capital might hurt business performance. As the inventory levels have reached significantly higher levels, the company might require a substantial markdown to sell off the excess inventory; in such cases, gross margins might be affected for a considerable period. Also, the risk of inventory write-offs can be a big concern.

Furthermore, the company has been facing significant losses over the last few years due to goodwill impairment charges. As the company has significant goodwill assets, the risk of further impairment might persist.

From the above mentioned concerns, the stock price might suffer for upcoming quarters, but the long-term outlooks seem favorable due to the strong brand value.

Conclusion

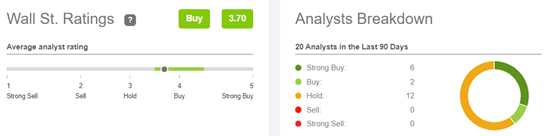

ratings (seeking alpha )

As the various investment firms are turning their ratings to buy, the stock price has been increasing consistently from the last few weeks.

Although the company has been facing significant backdrops due to short-term issues, the overall outlook for PVH remains very attractive. Also, the company has been trading for $4.8 billion. In contrast, it has produced over $417 million in net profits during fiscal 2019, which gives the company a P/E of 11. Historically the company had been trading for more than 20 times its earnings. Therefore, it seems that the stock has become significantly undervalued and provides considerable upside potential. I assign a buy rating to the stock.

Be the first to comment