relif

Earnings of ServisFirst Bancshares, Inc. (NYSE:SFBS) will likely continue to surge this year mostly on the back of strong loan growth. Further, a rising interest-rate environment and excess cash position will provide good opportunities to boost the topline. On the other hand, higher provisioning this year relative to last year will constrain earnings growth. Overall, I’m expecting ServisFirst to report earnings of $4.52 per share for 2022, up 19% year-over-year. Compared to my last report on the company, I’ve tweaked upwards my earnings estimate as I’ve revised upwards both my loan growth and margin estimates. The year-end target price suggests a sizable downside from the current market price. Based on the total expected return, I’m maintaining a hold rating on ServisFirst Bancshares.

Expansion Efforts, Regional Economies to Drive Loan Growth

ServisFirst Bancshares’ loan portfolio continued to grow strongly through the second quarter of 2022. Loan growth will likely slow down in the remainder of the year due to some scheduled construction paydowns, as mentioned in the conference call. As a result, loan payoffs are likely to accelerate in the third and fourth quarters, which will hamper overall loan growth.

However, the management’s expansion efforts will likely keep loan growth afloat. ServisFirst added 15 new bankers in the second quarter of 2022, as mentioned in the conference call. This is the largest ever hiring in a quarter. Moreover, the company has recently announced plans to expand into western North Carolina, which will further support loan growth.

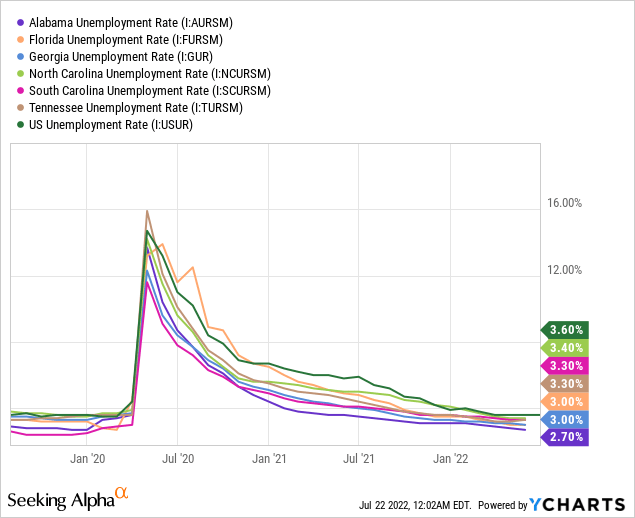

Moreover, strong job markets in ServisFirst Bancshares’ operating regions will likely help loan growth. The company operates in several southeastern states, including Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee. All these states currently have a stronger job market than the national average, which indicates good economic activity. This strength in the labor market should translate into loan growth.

The management mentioned in the conference call that it is expecting net loan growth of $150,000 a month. Considering the factors given above, I’m expecting the loan portfolio to grow by 6% in the second half of 2022, leading to full-year loan growth of 18%. In my last report on ServisFirst, I estimated loan growth of 13.5%. I have increased my loan growth estimate mostly due to the second quarter’s remarkable performance.

Meanwhile, other balance sheet items will likely grow more or less in line with loans for the remainder of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans | 5,792 | 6,465 | 7,185 | 8,378 | 9,416 | 11,128 | |

| Growth of Net Loans | 19.2% | 11.6% | 11.1% | 16.6% | 12.4% | 18.2% | |

| Other Earning Assets | 935 | 1,176 | 1,217 | 3,017 | 5,479 | 3,263 | |

| Deposits | 6,092 | 6,916 | 7,530 | 9,976 | 12,453 | 12,489 | |

| Borrowings and Sub-Debt | 367 | 353 | 535 | 916 | 1,776 | 1,513 | |

| Common equity | 607 | 715 | 842 | 992 | 1,152 | 1,313 | |

| Book Value Per Share ($) | 11.2 | 13.2 | 15.6 | 18.3 | 21.1 | 24.1 | |

| Tangible BVPS ($) | 10.9 | 12.9 | 15.3 | 18.0 | 20.9 | 23.8 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Excess Cash Presents a Good Opportunity

ServisFirst Bancshares’ balance sheet is slightly asset sensitive as more assets than liabilities will re-price this year. As mentioned in the 10-K filing, the asset-liability gap stood at 5.87% of interest-earning assets at the end of 2021. (ServisFirst Bancshares hasn’t provided quarterly updates on the gap or rate sensitivity.)

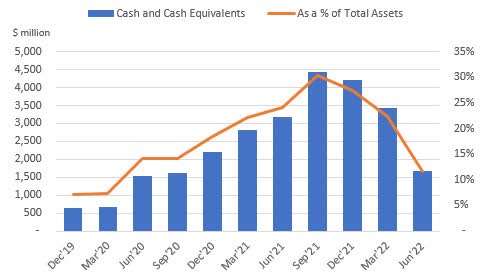

The company’s excess cash position also presents an opportunity for margin expansion. Cash balances have declined during the quarter as ServisFirst deployed the excess cash into higher-yielding assets. However, the cash balance is still high, which means there is still plenty of room to improve the asset mix and boost the margin.

SEC Filings

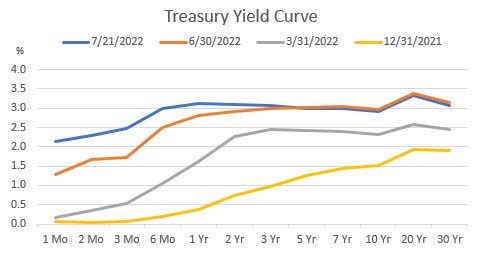

Even if ServisFirst is unable to improve its asset mix any further, the company can earn higher yields on its cash equivalents due to the upward shift in the short end of the yield curve.

The U.S. Treasury Department

Considering these factors, I’m expecting the net interest margin to increase by 20 basis points in the last two quarters of 2022 from 3.26% in the second quarter of the year. Compared to my last report on ServisFirst, I’ve tweaked upwards my margin estimate.

Large Reserve Level to Help in a Heightened Interest-Rate Environment

ServisFirst Bancshares’ nonperforming loans made up 0.15% of total loans, while allowances made up 1.21% of total loans at the end of June 2022, as mentioned in the earnings release. Therefore, the portfolio’s credit risk appears well covered. The last time the Federal Funds rate was above 2%, that is the third quarter of 2019, the nonperforming loans made up 0.58% of total loans. Even 0.58% is well covered by the existing allowance level. Therefore, I’m not too worried that heightened interest rates will increase nonperforming loans exponentially. ServisFirst’s existing reserves seem bulky enough to weather the storm without needing any significant reinforcements.

As a result, I’m expecting the provision expense to be near a normal level in the second half of 2022. Combined with the first half’s below-normal provisioning, the provisioning for full-year 2022 will likely be slightly below the historical average. Overall, I’m expecting ServisFirst to report a net provision expense of 0.31% for 2022. In comparison, the net provision expense averaged 0.35% of total loans from 2017 to 2019.

Expecting Earnings to Grow by 19%

The anticipated loan growth and margin expansion will likely be the chief contributors to an increase in earnings this year. On the other hand, higher provisioning and operating expenses relative to last year will drag earnings. Overall, I’m expecting ServisFirst to report earnings of $4.52 per share for 2022, up 19% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 227 | 263 | 288 | 338 | 385 | 466 | |

| Provision for loan losses | 23 | 21 | 23 | 42 | 32 | 35 | |

| Non-interest income | 17 | 19 | 24 | 30 | 33 | 37 | |

| Non-interest expense | 84 | 92 | 102 | 112 | 133 | 161 | |

| Net income – Common Sh. | 93 | 137 | 149 | 170 | 208 | 247 | |

| EPS – Diluted ($) | 1.72 | 2.53 | 2.76 | 3.13 | 3.82 | 4.52 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD millions unless otherwise specified) |

|||||||

In my last report on ServisFirst, I estimated earnings of $4.27 per share for 2022. I have now revised upwards my earnings estimate because I’ve increased both my loan growth and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

Current Market Price is Above the Target Price

ServisFirst Bancshares is offering a dividend yield of 1.1% at the current quarterly dividend rate of $0.23 per share. The earnings and dividend estimates suggest a payout ratio of 20.3% for 2022, which is close to the five-year average of 19.6%. Therefore, I’m not expecting an increase in the dividend level for the next two quarters.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value ServisFirst Bancshares. The stock has traded at an average P/TB ratio of 2.88x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 10.9 | 12.9 | 15.3 | 18.0 | 18.7 | |

| Average Market Price ($) | 38.0 | 40.8 | 33.9 | 35.7 | 67.4 | |

| Historical P/TB | 3.47x | 3.16x | 2.21x | 1.98x | 3.61x | 2.88x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.8 gives a target price of $68.7 for the end of 2022. This price target implies a 15.6% downside from the July 21 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.68x | 2.78x | 2.88x | 2.98x | 3.08x |

| TBVPS – Dec 2022 ($) | 23.8 | 23.8 | 23.8 | 23.8 | 23.8 |

| Target Price ($) | 64.0 | 66.3 | 68.7 | 71.1 | 73.5 |

| Market Price ($) | 81.4 | 81.4 | 81.4 | 81.4 | 81.4 |

| Upside/(Downside) | (21.4)% | (18.5)% | (15.6)% | (12.7)% | (9.7)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 15.9x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.72 | 2.53 | 2.76 | 3.13 | 3.82 | |

| Average Market Price ($) | 38.0 | 40.8 | 33.9 | 35.7 | 67.4 | |

| Historical P/E | 22.1x | 16.1x | 12.3x | 11.4x | 17.7x | 15.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.52 gives a target price of $72.0 for the end of 2022. This price target implies an 11.6% downside from the July 21 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 13.9x | 14.9x | 15.9x | 16.9x | 17.9x |

| EPS – 2022 ($) | 4.52 | 4.52 | 4.52 | 4.52 | 4.52 |

| Target Price ($) | 62.9 | 67.5 | 72.0 | 76.5 | 81.0 |

| Market Price ($) | 81.4 | 81.4 | 81.4 | 81.4 | 81.4 |

| Upside/(Downside) | (22.7)% | (17.1)% | (11.6)% | (6.0)% | (0.5)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $70.4, which implies a 13.6% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 12.5%. Hence, I’m adopting a hold rating on ServisFirst Bancshares.

Be the first to comment