Willie B. Thomas/DigitalVision via Getty Images

A relative newcomer to the ETF scene, the AdvisorShares Restaurant ETF (EATZ) is the only ETF to focus exclusively on the restaurant industry. Launched in April of 2021, the logic behind creating the ETF was to give investors broad exposure to an industry that has been steadily growing for decades.

My intent with today’s article is to look at the investment strategy of this actively managed fund and all things related thereto. Primarily, I want to provide insight into whether or not the ETF is worth the above-average expense ratio, and if investors would be better off selecting individual restaurants stocks for exposure to the food-not-made-at-home theme.

The Industry At Large

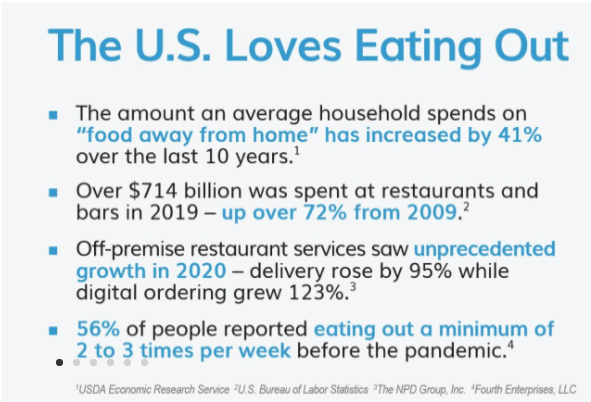

The home page for the EATZ ETF has a lot of information regarding both the historicity and projected growth of the restaurant industry. This slide summarizes things well as it relates to how the industry has grown and become a dominant part of our culture:

They even cite the pandemic as a reason to be BULLISH about restaurants:

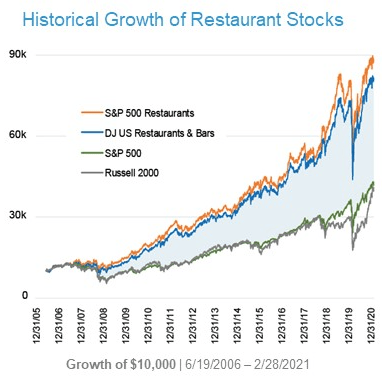

It would appear as though the market agreed with their assessment, as restaurant stocks ended 2020 higher than they started the year in spite of the pandemic lockdowns:

But even if these trends continue, even if restaurants continue to grow and their domestic and increasingly international share of the food dollar keeps going up, that doesn’t mean that EATZ is going to outperform. This is especially true in light of the fact that the expense ratio on the fund is .99%, well above the average of .69% for actively managed ETFs. That’s a significant hurdle.

Portfolio Strategy

The summary prospectus explains that the fund will aim to invest at least 80% of net assets in companies that derive at least 50% of their revenue from the restaurant business. Detail is added that the portfolio manager will select those companies he deems dominant within their particular realm and are uniquely positioned for growth. This includes enterprises like Papa John’s (PZZA) or Bloomin’ Brands (BLMN), the parent company of Outback Steakhouse, which each have a 5% and 4% weight in the index, respectively. There is also a value tilt, where “out-of-favor” stocks will occasionally be purchased if the manager thinks they are trading at “prices below their future potential value”. Furthermore,

The Fund may sell a security when the Advisor believes that the security is overvalued or better investment opportunities are available, or to limit position size within the Fund’s portfolio.

This trading activity notwithstanding, the portfolio manager is aiming to keep turnover relatively low at 25% a year. In 2020 the turnover was 26%. The fund aims to have approximately 50 stocks in it.

The fund currently is made up primarily of small-cap stocks, comprising almost 75% of holdings, with the other 25% split equally between mid and large-caps.

The man in charge of the ETF is Mr. Dan Ahrens. He oversees several ETFs at AdvisorShares, to include two cannabis-related ETFs (MSOS) (YOLO), a hotel ETF (BEDZ), and a “sin” stock ETF (VICE), alongside EATZ. None of the funds have had a good return since their inception, granted VICE is perhaps the only one that has been around long enough to fairly assess:

| Inception | Annualized Return | S&P 500 | |

| MSOS | 9/2020 | 5% | 24.8% |

| YOLO | 4/2019 | -16.5% | 21% |

| BEDZ | 4/2021 | -.86% | 11.4% |

| VICE | 12/2017 | 6.87% | 16.64% |

| EATZ | 4/2021 | -15.4% | 11.4% |

*Data compiled by author

This data is hardly conclusive about how EATZ is going to do, but also isn’t necessarily encouraging.

Components

My outlook is pretty simple. If the companies in the top ten by weight in the ETF aren’t all worth owning on a fundamental basis, it’s not worth owning the ETF. Let’s take a look at a few.

#1 by weight – RCI Hospitality at 8.44%

RCI Hospitality Holdings (RICK) perhaps shouldn’t even belong in the ETF in my opinion, and most certainly not in the #1 spot. The company’s primary business line is ownership and operation of gentlemen’s clubs, more commonly known as strip clubs. Yes, they sell food and drink at these establishments, but they aren’t restaurants.

They also own a restaurant line called Bombshells (similar to Hooters’), but that segment makes up only 28% of total company revenues. Their third and smallest segment makes money by selling a magazine publication serving the adult nightclubs and adult retail products industry, as well as hosting an industry trade show.

company-wide, the sale of food tallies up to only 21% of company revenue. Alcohol makes up 44%.

Beyond their questionable weighting given the nature of their business model, a survey of their fundamentals is vital.

– Their Return on Invested Capital leaves something to be desired, standing now at 13.47% on a TTM basis and averaging 11% over the last five years, leaving out 2020 due to pandemic anomalies. They have also had a pretty high weighted average cost of capital, averaging 8.15% over the same time frame. The relatively narrow spread between their ROIC and WACC leaves little room for error before value starts getting destroyed.

– Revenue has trended generally upward, averaging an increase of 7% annually in the five years leading up to pandemic anomalies. However, revenue on a same-store basis has been up and down, indicating a non-sticky business model:

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | |

| Same-store sales** | -2.1% | -9% | .6% | 5.8% | 5.1% | -2.3% | -.6% |

| Same-store sales** | 7.7% | 18.3% | -6.1% | -3.3% | 3.5% | 5.1% | N/A |

| Consolidated same-store | 1.5% | -4.4% | -.3% | 4.6% | 4.9% | -1.3% | -1.5% |

*Data compiled by author

**Excluding pandemic impacts

– The company has quite a bit of debt, and it isn’t at friendly interest rates. Interest expense divided by total debt is 8%. Annual interest expense in the most recent full fiscal year cost them $1.10 in EPS. EPS would have been 32% higher in 2021 were it not for interest payments!

– Capital allocation decisions are highly questionable. In spite of the burdensome debt load, RICK nonetheless is throwing money at stock-buybacks and paying a dividend. In my opinion, paying off debt should take absolute precedence. Worse yet, in 2020 when revenues dropped 27% and the company felt so apparently strapped for cash that they applied for and received a $5.4 million loan under the Paycheck Protection Program (for which loans they later applied for and were granted forgiveness), they spent $9.5 on share repurchases. This was a several-fold increase from 2019, where they spent $2.9 million on share repurchases.

I personally would not consider investing in RICK. How it ended up in the #1 spot by weight in an actively managed restaurant ETF is questionable. Not only would I not consider them a restaurant, I don’t trust management*. The company just doesn’t have very good fundamentals.

On the basis of this single company being included in EATZ, I wouldn’t consider an investment in the ETF.

That being said, there is a pretty convincing bull case being made for RICK. It is beyond the scope of this article to cover that, but if you are interested, I would direct you to Jussi Askola’s recent article where he pinned RICK as his highest conviction pick for 2022. In short, the company is hoping to grow FCF by 10%-15% in coming years on the basis of industry consolidation in which they will be the acquirer, opening a lot more of their “Bombshell” restaurants, and the potential for their adult-themed social media app to be a hit. In my eyes, there is plentiful execution risk here. A lot of things have to go right for that 10%-15% growth in FCF to materialize, and on the basis of history I am not confident they can get it done.

#5 by weight – Dave & Buster’s (PLAY) at 5%

Remember that bit in the portfolio strategy explanation where I mentioned how the fund aims to invest at least 80% of its net assets in companies that derive at least 50% of their revenue from restaurant business? Did it bother you that according to that explanation, the fund can invest 20% of net assets into companies that DON’T derive 50% of their revenue from restaurant business? Kind of peculiar for an ETF called “EATZ” and branded as a restaurant ETF.

Enter Dave & Buster’s, which is primarily an arcade company that also has a restaurant inside. 41.6% of their 2019 fiscal year revenue was from the restaurant. All other sales dollars came from the amusement segment, mostly their arcade games, with a small portion from bowling and billiards.

I understand Dave & Buster’s perhaps having a place in a restaurant ETF. But to have the fifth heaviest weighting could only be justified if their fundamentals are superb. But they aren’t:

– ROIC average in the four years preceding COVID 9.3%. WACC over the same period was 6.4%. Again, this spread is relatively small, owing to ROIC not being very high.

– Average revenue growth was exceptional in the five-year period preceding 2020, coming in at 12.6% a year. Unfortunately, that sales growth has only happened because of increased store openings. Here is a table showing comparable store-sales growth and total stores open in the four-year pre-COVID period:

| Fiscal year ending Feb…. | 2020 | 2019 | 2018 | 2017 |

| Comparable store change | -2.6% | -1.6% | -.9% | 3.3% |

| Total stores | 136 | 121 | 106 | 92 |

*Data compiled by author

It shows considerable weakness in the business model for their same-store sales to be decreasing so consistently. It means fewer people are going to their locations or people are spending less. Likely some of both.

– Capital allocation decisions were admirable to handle COVID. The share repurchase program and dividend were both halted. However, in my opinion, they shouldn’t have been buying back shares or paying a dividend in the first place. Their debt has been ballooning nearly every year, with a commensurate rise in interest expense owing to both higher debt balance and worse rates on borrowings. The effect on shareholder’s equity has been pronounced:

| Fiscal year ending Feb…. | 2021 | 2020 | 2019 | 2018 | 2017 |

| Debt | $596,388 | $647,689 | $393,469 | $366,249 | $264,128 |

| Interest Expense | $29,124 | $20,277 | $13,408 | $8,697 | $6,985 |

| Imputed Interest Rate | 4.8% | 3.1% | 3.4% | 2.3% | 2.6% |

| Equity | $153,232 | $169,650 | $387,837 | $421,646 | $439,452 |

*Data compiled by author

Don’t be impressed by debt coming down in the most recent fiscal year, as they were only able to do that by issuing tons of new shares. Dave & Buster’s had just over 30 million shares outstanding before COVID. Now they have almost 48.5 million outstanding. This is massive shareholder dilution.

These two examples are more than enough reasons for me to not invest in EATZ. Even if the other eight stocks in the top ten by weight are awesome, investing in EATZ would mean that for every $1,000 I put into the ETF, $134 would go into these companies that my analysis indicates are not suitable for investment. But it’s more than that. It’s a lack of trust in the portfolio manager who opted to include these stocks in the ETF at such a high weighting. If not a lack of trust, it is at least a lack of alignment with my personal strategy and risk tolerance. EATZ is not for me.

For the sake of being thorough, here is a table showing key metrics for the other eight companies in the top ten by weight, as of 2019, during a normal operating environment:

| 2019, by weight in EATZ | 5 yr. avg. rev. growth | ROIC | Op. Margin |

| Papa John’s (PZZA), 5.6% | .26% | 6.63% | 1.2% |

| Del Taco (TACO), 5.5% | 4.3% | 3.9% | 6% |

| Domino’s (DPZ), 5.2% | 12.6% | 61% | 17.4% |

| ONE Group (STKS), 4.75% | 19.6% | 13.6% | 6.3% |

| Wingstop (WING), 4.65% | 24% | 25% | 21.5% |

| Bloomin’ Brands (BLMN), 4.1% | -1.4% | 5.9% | 4.8% |

| Fiesta Restaurant (FRGI), 4.1% | 1.6% | 2.3% | 1.5% |

| Darden (DRI), 4% | 6.25% | 13.5% | 10% |

*Data compiled by author

You are welcome to draw your own conclusions from this. And of course, the pandemic changed the landscape drastically. So looking in the rear-view mirror at what was the case in 2019 may not indicate much for what the future will hold. Personally though, I don’t see much that is going to turn the likes of FRGI, for example, into a high-growth machine. Perhaps Mr. Ahren’s sees something I don’t.

Conclusion

My observation has been that ETFs are misunderstood. Many investors believe that ETFs are an effective way to get diversified exposure to a particular sector, industry, or theme, and will therefore buy an ETF based on what it claims to target without looking at the details. But details matter. Broad exposure does not equate to good exposure. It seems as though some investors while refusing to buy the stock of an individual company without first conducting due diligence, may buy an ETF with very little real research.

The purpose of this article was to pull back the layers on an ETF that seems straightforward but isn’t. There are problems with EATZ. From the above-average expense ratio to issues with how the portfolio is constructed to legitimate concerns regarding heavily weighted components of the portfolio, I believe that investors would be better served constructing their own portfolio of restaurants if they want exposure to the industry.

Perhaps most important, my research reveals serious concerns about the investing prowess of the portfolio manager, Mr. Ahrens. His track record isn’t very good, with every one of the ETFs he manages severely lagging benchmarks. I disagree strongly with his stock selection for the top ten by weight. For these reasons, I believe EATZ is a hard pass.

*An interesting bit from the 10K for RICK:

On September 21, 2020, as part of the settlement of a civil administrative proceeding with the SEC, the company, Mr. Langan and Phil Marshall (our former chief financial officer) agreed, without admitting or denying the findings, to a cease-and-desist order regarding certain sections of the Securities Exchange Act of 1934 and certain rules promulgated thereunder.

The SEC’s order as to the company, Mr. Langan and Mr. Marshall found that, from fiscal 2014 through 2019, the company failed to disclose a total of $615,000 in executive compensation in the form of perquisites. According to the order, these undisclosed perquisites included the cost of the personal use of the company’s aircraft and company-provided vehicles, reimbursements for personal airline flights, charitable corporate contributions to the school two of Mr. Langan’s children attended, and housing costs and meal allowance for Mr. Marshall. In addition, the order found that the company failed to disclose related party transactions involving Mr. Langan’s father and brother and a director’s brother. The order further found that the company failed to keep books and records that allowed it to report, and lacked sufficient internal controls concerning, these executive perquisites and related party transactions.

Be the first to comment