Eoneren/E+ via Getty Images

By The Valuentum Team

Philip Morris International Inc. (NYSE:PM) owns several of the top-selling cigarette brands worldwide including the Marlboro, L&M, Chesterfield, and Parliament brands along with its IQOS “smoke-free” tobacco product. It sells these products outside of the US after parting ways with Altria Group, Inc. (MO) in 2008. The company uses its pricing strength to offset headwinds arising from inflation and the secular decline in cigarette shipment volumes, to a degree, which supports its cash flow outlook as does its push into alternative tobacco products. We are big fans of Philip Morris’ stable cash flow profile, pricing power, and ongoing cost structure improvement initiatives. The firm is a stellar income generation idea with ample room to grow its dividend over the coming years, with shares of PM yielding ~5.0% as of this writing.

Investment Considerations

The company aims to generate over half of its revenues from smoke-free products by 2025, with heated tobacco unit sales leading the way. Sales of the firm’s IQOS offering have grown at a brisk pace over the past few years with ample room for upside. Recently, Philip Morris has utilized acquisitions to grow its exposure to the pharmaceutical and consumer health and wellness space. That includes acquiring OtiTopic, Fertin Pharma, and Vectura. By 2025, Philip Morris aims to generate at least $1.0 billion in net revenues from the sale of non-nicotine products.

We do not expect the company to alienate its income-minded investors in the foreseeable future and appreciate Philip Morris’ ‘A-rated’ investment-grade credit rating (A2/A/A). The firm has grown its annual dividend from $1.84 per share in 2008 to $5.00 per share on an annualized basis currently. Looking ahead, we see room for additional payout growth as Philip Morris forecasts that it will generate 4%-6% organic revenue growth (an adjusted non-GAAP figure) and 8%-11% currency-neutral adjusted diluted EPS growth (a non-GAAP figure) this year. The company’s growth outlook is bright.

Philip Morris benefits from its exposure to faster-growing regions of the world, including Asia and EMEA. Still, it remains exposed to regulatory risk and excise price shocks that may impact demand for tobacco in certain countries. Currency fluctuations can pose stiff earnings headwinds at times and should not be ignored. Philip Morris is scaling down its business in Russia in the wake of the Russian invasion of Ukraine and intends to exit the Russian market.

Using 2020 as a baseline, Philip Morris aims to generate ~$2.0 billion in annualized savings by 2023 with an eye towards reducing manufacturing costs and containing SG&A expenses. An improving cost structure supports the company’s outlook. In 2021, Philip Morris launched a three-year share buyback program expected to total around $5.0-$7.0 billion. The firm is targeting a long-term dividend payout ratio of ~75% of its adjusted diluted EPS.

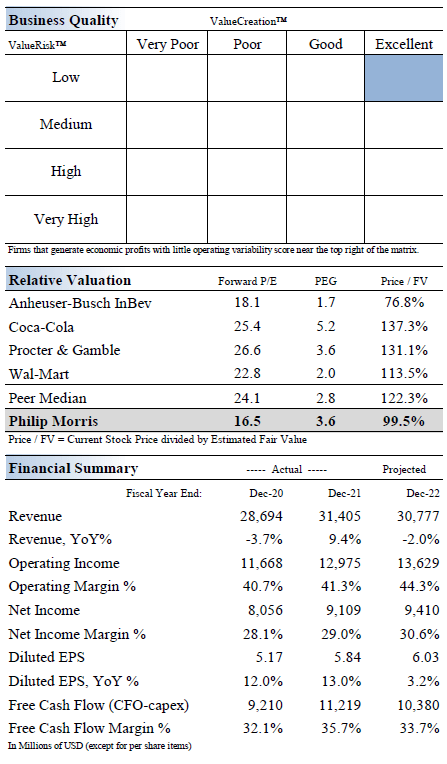

Philip Morris is a rock-solid enterprise. (Valuentum Securities, with data from Philip Morris)

Economic Profit Analysis

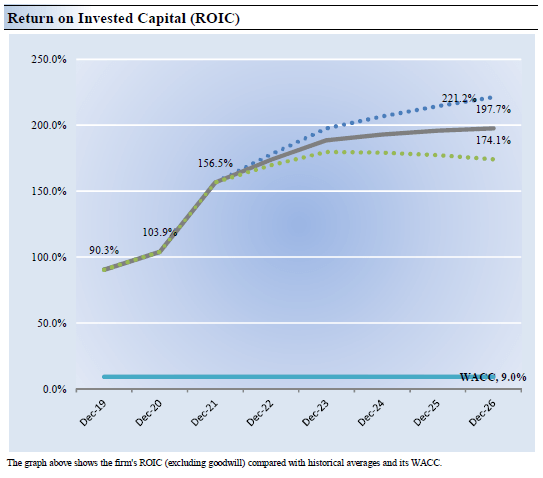

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Philip Morris’ 3-year historical return on invested capital (without goodwill) is 116.9%, which is way above the estimate of its cost of capital of 9%.

In the upcoming graphic down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion (the “base” case scenario), and represents the scenario that results in our fair value estimate (the blue dots represent the “bull” case scenario and the green dots represent the “bear” case scenario).

Philip Morris is a tremendous generator of shareholder value. (Valuentum Securities)

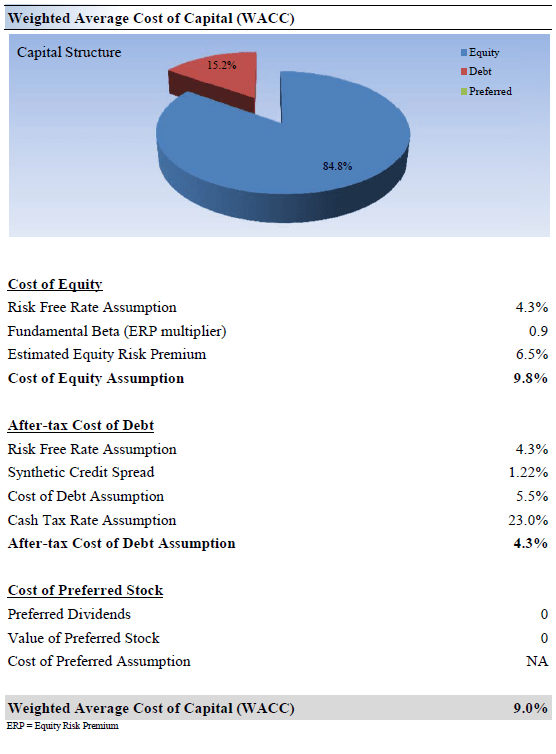

The upcoming graphic down below highlights how we calculated Philip Morris’ estimated WACC.

How we calculated Philip Morris’ estimated WACC. (Valuentum Securities)

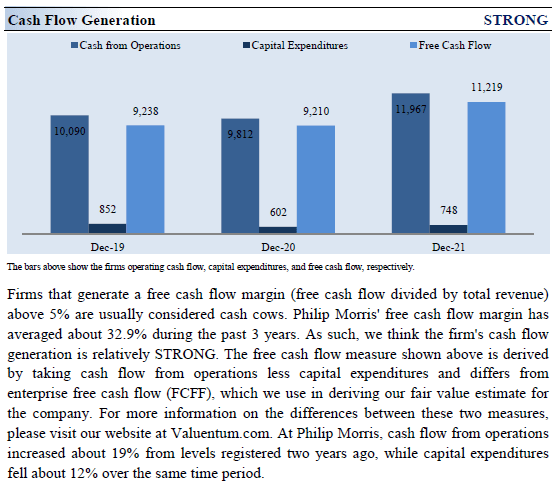

Cash Flow and Balance Sheet Analysis

Philip Morris is a stellar free cash flow generator, defining free cash flow as net operating cash flow less capital expenditures. It is its free cash flows that enable Philip Morris to sustainably pay out and grow its dividends, keeping its balance sheet considerations in mind.

From 2019-2021, Philip Morris generated ~$9.9 billion in free cash flow per year on average, and its run-rate dividend obligations stood at $7.6 billion last year. While Philip Morris has historically not repurchased meaningful amounts of its common stock, after launching its three-year buyback program it acquired $0.8 billion of its common stock in 2021.

However, we caution that Philip Morris had a net debt load of $23.3 billion at the end of December 2021. The company has ample liquidity as it exited 2021 with $4.5 billion in cash and cash equivalents on hand to meet its near-term funding needs.

We are big fans of Philip Morris’ stable cash flow profile. (Valuentum Securities, with data from Philip Morris)

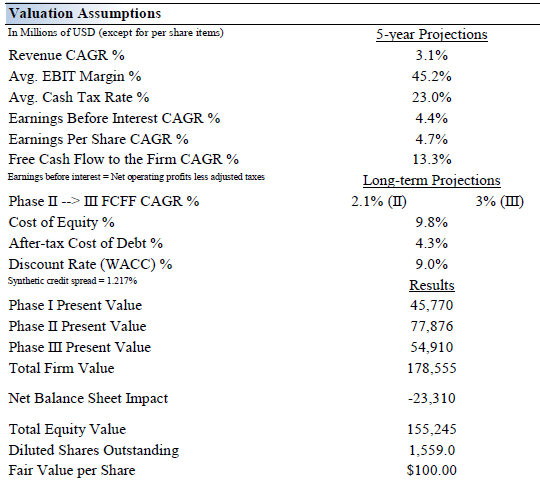

Valuation Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. We think Philip Morris is worth $100 per share with a fair value range of $80.00-$120.00. Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our cash flow model reflects a compound annual revenue growth rate of 3.1% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 2%. Our model reflects a 5-year projected average operating margin of 45.2%, which is above Philip Morris’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 2.1% for the next 15 years and 3% in perpetuity. For Philip Morris, we use a 9% weighted average cost of capital to discount future free cash flows.

Under our base-case scenario, we assign a fair value estimate of $100 per share of Philip Morris. (Valuentum Securities)

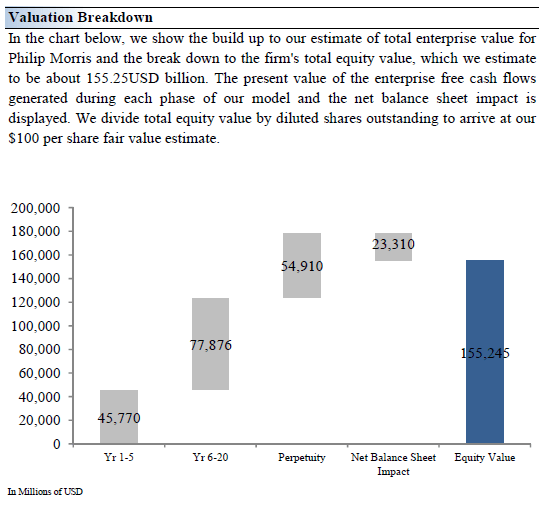

The upcoming graphic down below provides a visual deconstruction of Philip Morris’ intrinsic value broken down by the business cycle phase, including its net balance sheet considerations.

A visual deconstruction of Philip Morris’ intrinsic value by business cycle phase, taking its net balance sheet into consideration. (Valuentum Securities)

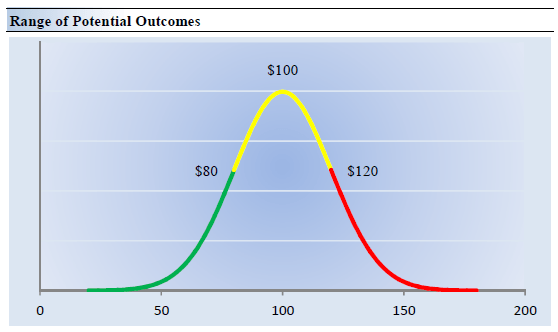

Although we estimate Philip Morris’ fair value at about $100 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the upcoming graphic down below, we show this probable range of fair values for Philip Morris. We think the firm is attractive below $80 per share (the green line), but quite expensive above $120 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

The top end of our fair value estimate range sits at $120 per share of Philip Morris. (Valuentum Securities)

Concluding Thoughts

We are big fans of Philip Morris’ income growth potential, and the company also has meaningful capital appreciation upside as well. Philip Morris’ push into alternative tobacco products and non-nicotine products along with its cost structure improvement initiatives supports its longer-term free cash flow growth outlook. To download our 16-page stock report of Philip Morris, please click here (pdf). There is a lot to like about Philip Morris, and we hope you continue to enjoy our work.

Be the first to comment