gorodenkoff

Thesis

BlackRock Capital Allocation Trust (NYSE:BCAT) is a new multi-asset closed end fund from the BlackRock product suite and was launched in September 2020. The vehicle has total return and income as its main goals. As per the fund’s literature:

The Trust invests in a portfolio of equity and debt securities. Generally, the Trust’s portfolio will include both equity and debt securities. At any given time, however, the Trust may emphasize either debt securities or equity securities. The Trust utilizes an option writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

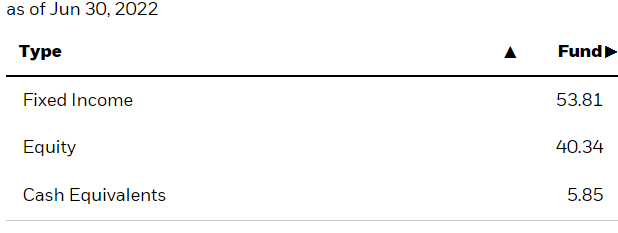

The fund is currently overweight Fixed Income (roughly 54% allocation) with a 40% Equities slice and an almost 6% cash allocation. The Fixed Income portion is mainly composed of junk debt with an even split between corporate credit and securitized products. The fund has a high fixed income allocation of 17% to non-rated fixed income debt. As a reminder, non-rated fixed income is not necessarily “B” or “CCC” debt (i.e., not the riskiest) but for size or cost reasons they do not have a public rating agency covering them. Not rated debt is however generally speaking more volatile and more illiquid.

BCAT can switch its Fixed Income/Equities/Cash allocation as it sees fit throughout time and does not have to stay overweight Fixed Income. An investor should think of BCAT as a leveraged one-stop-shop portfolio. Rather than have individual investors allocate between equities, bonds and cash, BlackRock does that for you with leverage on top. The fund is down -17% in 2022 and down almost -27% in the past year. The year-to-date performance mimics the S&P 500, but on a 1-year time-frame, BCAT severely underperforms the index. The reasons for that are two-fold: on one hand, you have the fund leverage that currently sits at 20%, and on the other hand, you have the “new CEF drawdown”.

If an investor looks at historic CEF performances, they will notice a funny commonality – they all tend to lose money in the first 1-2 years. A CEF usually prices at $20/share but usually ends up lower. Not all CEFs are created equal, of course, but since launch, the management team has a certain pressure to allocate capital, irrespective of timing, which might not be optimal for the ultimate investor. Reviewing very well-established managers such as PIMCO or BlackRock (BLK), especially on the fixed income side, gives a good glimpse into this incipient vehicle behavior. Again, our view here is that the manager experiences significant pressure to put cash to work in order to justify the charged fees, and in the process of doing so it invests at sub-optimal periods.

The fund is currently trading at a -12% discount to net asset value due to its poor performance since inception, but we expect this discount to narrow as the market rallies and the fund delivers. We view BCAT as a “one-stop shop” for portfolio management with leverage layered on top. An investor who does not want to perform a significant amount of research on fixed income or equity CEFs can just trust the BlackRock platform and its ability to deliver alpha long term. Because of its recent inception, the fund has underperformed, but its future is brighter. We feel 2023 is going to be an outstanding year for BCAT with both the underlying assets rallying in price and its discount to NAV narrowing. BCAT is most suitable for retail investors who do not want to perform a lot of research in the CEF space and want a large manager’s platform to allocate assets for them.

Holdings

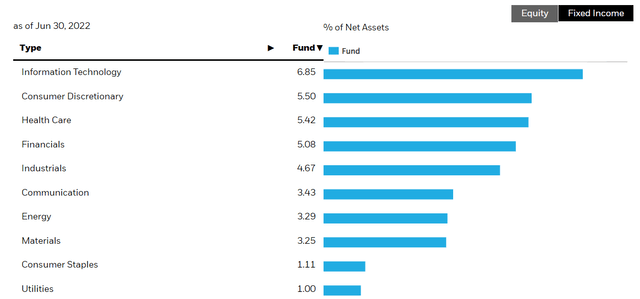

BCAT is a multi-asset CEF, hence it holds a mix of Fixed Income and Equities:

Allocation (Fund Website)

We can see that the fund is now overweight Fixed Income with a 53.81% slice, while the equity portion clocks in at 40.34%. On the equity side the fund is overweight Information Technology and Consumer Discretionary:

This equity allocation breakdown explains some of the underperformance in 2022, with the Nasdaq severely underperforming the S&P 500.

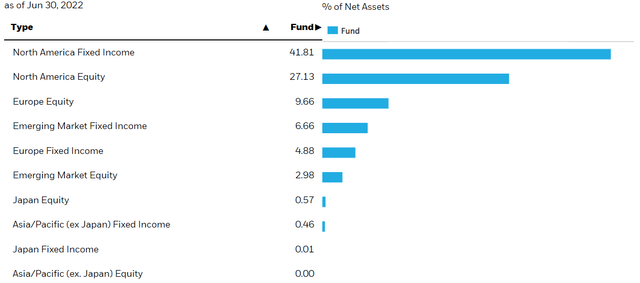

On both the Equity and Fixed Income side, the fund is North America centric:

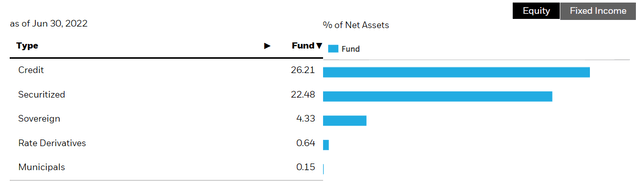

On the Fixed Income side, the fund has an even split between corporate credit and securitized products:

Fixed Income Split (Fund Website)

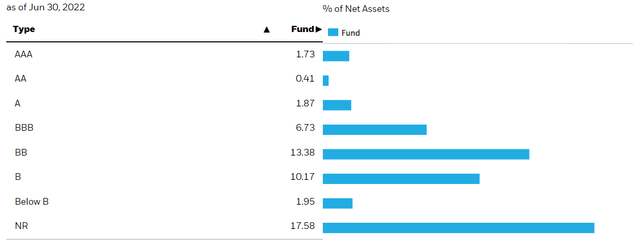

On both the corporate and securitized product side, the credit quality is overweight high yield:

We can see from the above table that the majority of the portfolio is concentrated in “BB”, “B” and “NR” names. NR stands for not rated, and it means that the large rating agencies such as Moody’s and S&P do not have a public rating outstanding for the respective credits. That does not mean that the credit does not have a private rating. A private rating is one that costs less and is only available for a requesting party that has to pay a fee for it.

Performance

The fund is down -17% year to date:

YTD Performance (Seeking Alpha)

The 2022 performance for BCAT is in line with the S&P 500 index. However, on a 1-year lookback period, the CEF severely underperforms:

1-Year Performance (Seeking Alpha)

We can see that on a 1-year lookback, BCAT is down more than -26% versus just -7% for the index.

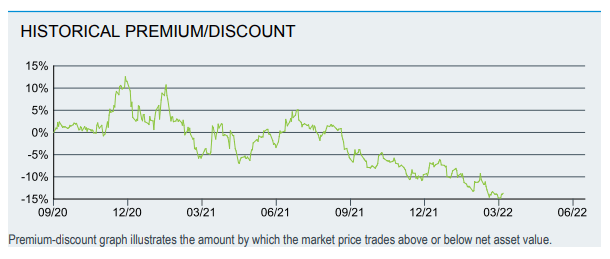

Premium/Discount to NAV

The fund is currently trading at a -12% discount to net asset value due to its poor performance since inception:

Premium/Discount to NAV (BlackRock)

We can see from the above table, courtesy of BlackRock, that the fund dipped into a negative discount to NAV territory as its performance deteriorated. Because it is a new fund, BCAT is now at a “historic” discount to NAV. We expect this discount to narrow in 2023.

Conclusion

BCAT is a multi-asset CEF offering from BlackRock. The vehicle was launched in 2020 and experienced a poor performance during its first year. In 2022 the fund exhibited a total return in line with the market and is set for a robust 2023 with signs of the fund bottoming out both on the underlying asset side as well as on a historic high discount to NAV. We view BCAT as a “one-stop shop” for CEF investors looking to utilize BlackRock as an asset allocator with leverage on top.

Be the first to comment