Rawf8/iStock Editorial via Getty Images

Earnings of BOK Financial Corporation (NASDAQ:BOKF) will most probably plunge this year relative to last year on the back of provision normalization. Further, a decline in mortgage banking income and derivative losses suffered during the first quarter of the year will drag earnings in 2022. On the other hand, strong margin expansion and significant loan growth will likely provide some relief. Overall, I’m expecting BOK Financial to report earnings of $6.54 per share for 2022, down 27% year-over-year. Compared to my last report on the company, I have revised downwards my earnings estimate mostly because of a downward revision in my non-interest income estimate. The year-end target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on BOK Financial.

Lower Fee Income to Hurt Earnings

BOK Financial’s non-interest income surprised me by almost halving during the first quarter of 2022 relative to the same period last year. The plunge was partly attributable to hefty losses recorded on derivatives and fair value option securities. I’m not expecting these losses to recur in the year ahead; therefore, non-interest income will most probably improve from the first quarter’s level in the year ahead.

Further, I’m expecting the mortgage banking income to stabilize at the first quarter’s level. After falling by 55% year-over-year in the first quarter of 2022, I believe mortgage banking income has reached a level where there is limited room for further decline.

As a result, I’m expecting total non-interest income for the remainder of the year to increase from the first quarter’s level. Despite the sequential improvement, non-interest income for 2022 will most probably remain much below last year’s levels. The management mentioned in the latest investor presentation that it expects the total fee revenue to be around 35% of total revenue for 2022.

Considering the factors mentioned above I’m expecting BOK Financial to report non-interest income of $589 million for 2022, down 22% year-over-year, and representing 33% of total revenues. In my last report on BOK Financial, I estimated a non-interest income of $649 million for 2022. I have now revised downwards my non-interest income estimate for the year mostly because of the first quarter’s surprise.

Economic Factors to Keep the Loan Portfolio Growing

After six consecutive quarters of decline, the loan portfolio grew by a remarkable 2.4% in the first quarter of 2022. This growth was partly attributable to a reduction in the real estate segment’s previously heightened payoffs, as mentioned in the conference call.

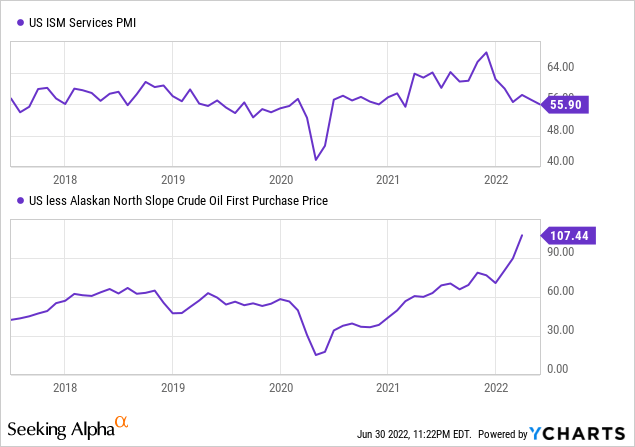

The management expects loan growth for the full year to be in the upper-single-digit range, as mentioned in the presentation. This target appears achievable given the first quarter’s performance. Further, economic factors bode well for loan growth. BOK Financial focuses on commercial and industrial loans, especially in the energy, services, and health care segments. Therefore, the US PMI services index and energy prices are good gauges of future loan demand. Both these metrics currently favor loan growth.

Considering these factors, I’m expecting the loan portfolio to increase by 7.1% by the end of December 2022 from the end of 2021. On the other hand, deposits will most probably decline for the full year of 2022 due to the sharp plunge in the deposit book during the first quarter of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 16,923 | 21,449 | 21,540 | 22,619 | 19,949 | 21,361 | |||

| Growth of Net Loans | 1.1% | 26.7% | 0.4% | 5.0% | (11.8)% | 7.1% | |||

| Other Earning Assets | 12,257 | 12,348 | 15,451 | 18,924 | 24,950 | 19,001 | |||

| Deposits | 22,061 | 25,264 | 27,621 | 36,144 | 41,242 | 39,663 | |||

| Borrowings and Sub-Debt | 5,855 | 7,419 | 8,621 | 3,821 | 2,494 | 1,311 | |||

| Common equity | 3,495 | 4,432 | 4,856 | 5,266 | 5,364 | 5,123 | |||

| Book Value Per Share ($) | 53.9 | 66.5 | 68.2 | 75.8 | 78.2 | 75.5 | |||

| Tangible BVPS ($) | 46.6 | 48.7 | 51.7 | 59.1 | 61.6 | 58.8 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Loan Mix Makes the Margin Highly Rate-Sensitive

BOK Financial’s interest income is highly sensitive to interest rate hikes due to the loan mix. As mentioned in the presentation, around 77% of commercial and commercial real estate portfolios are either variable-rate loans or fixed-rate loans that reprice within a year.

Further, BOK Financial’s average deposit cost is somewhat sticky. The company’s deposit betas were only around 30% in the previous up-rate cycle, as mentioned in the presentation.

The management’s interest-rate sensitivity analysis given in the presentation shows that a 200-basis points increase in interest rates can boost the net interest income by 7.53% over twelve months. Further, the net interest income can increase by 16.36% in the second year of the rate hike.

Considering these factors, I’m expecting the net interest margin to surge by 60 basis points in the last nine months of 2022 from 2.44% in the first quarter of the year.

Economic Factors, Loan Additions to Drive Provision Normalization

After last year’s significant provision reversals, provisioning for loan losses will most probably return to a normal level this year. Higher interest rates will likely be the chief driver of provisioning in the year ahead. The Federal Reserve projects the fed funds rate to reach a level of around 3.5% this year, which is bound to hurt the portfolio’s credit quality and increase the rate of delinquencies. Moreover, the anticipated loan additions mentioned above will require additional provisioning for expected loan losses. Further, BOK Financial may want to buttress its loan loss reserves ahead of a possible recession.

Overall, I’m expecting the provision expense, net of reversals, to make up around 0.07% of total loans in 2022, which is the same as the average from 2017 to 2019.

Expecting Earnings to Decline by 27%

The anticipated provision normalization and reduction in non-interest income will most probably lead to an earnings decline this year. On the other hand, significant margin expansion and decent loan growth will likely support the bottom line. Overall, I’m expecting BOK Financial to report earnings of $6.54 per share for 2022, down 27% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 842 | 985 | 1,113 | 1,108 | 1,118 | 1,179 | |||

| Provision for loan losses | (7) | 8 | 44 | 223 | (100) | 15 | |||

| Non-interest income | 695 | 617 | 694 | 844 | 756 | 589 | |||

| Non-interest expense | 1,026 | 1,028 | 1,132 | 1,166 | 1,178 | 1,182 | |||

| Net income – Common Sh. | 335 | 446 | 501 | 432 | 614 | 443 | |||

| EPS – Diluted ($) | 5.11 | 6.63 | 7.03 | 6.19 | 8.95 | 6.54 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on BOK Financial, I estimated earnings of $7.02 per share for 2022. I have now reduced my earnings estimate mostly because I’ve revised downwards my non-interest income estimate for the year following the first quarter’s surprise.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

Maintaining a Hold Rating

BOK Financial is offering a dividend yield of 2.8% at the current quarterly dividend rate of $0.53 per share. The earnings and dividend estimates suggest a payout ratio of 32% for 2022, which is in line with the five-year average of 30%. Therefore, the dividend level is secure despite the earnings outlook.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value BOK Financial. The stock has traded at an average P/TB ratio of 1.50x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 48.7 | 52.1 | 59.1 | 61.6 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/TB | 1.96x | 1.56x | 1.02x | 1.47x | 1.50x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $58.8 gives a target price of $88.5 for the end of 2022. This price target implies a 17.0% upside from the June 30 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.30x | 1.40x | 1.50x | 1.60x | 1.70x |

| TBVPS – Dec 2022 ($) | 58.8 | 58.8 | 58.8 | 58.8 | 58.8 |

| Target Price ($) | 76.7 | 82.6 | 88.5 | 94.3 | 100.2 |

| Market Price ($) | 75.6 | 75.6 | 75.6 | 75.6 | 75.6 |

| Upside/(Downside) | 1.5% | 9.3% | 17.0% | 24.8% | 32.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.5x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 6.63 | 7.03 | 6.19 | 8.95 | ||

| Average Market Price ($) | 95.7 | 81.2 | 60.2 | 90.6 | ||

| Historical P/E | 14.4x | 11.5x | 9.7x | 10.1x | 11.5x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $6.54 gives a target price of $74.9 for the end of 2022. This price target implies a 0.9% downside from the June 30 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.5x | 10.5x | 11.5x | 12.5x | 13.5x |

| EPS 2022 ($) | 6.54 | 6.54 | 6.54 | 6.54 | 6.54 |

| Target Price ($) | 61.8 | 68.4 | 74.9 | 81.4 | 88.0 |

| Market Price ($) | 75.6 | 75.6 | 75.6 | 75.6 | 75.6 |

| Upside/(Downside) | (18.2)% | (9.6)% | (0.9)% | 7.7% | 16.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $81.7, which implies an 8.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.9%. As this total expected return is not high enough for me, I’m maintaining a hold rating on BOK Financial.

Be the first to comment