primeimages/iStock via Getty Images

Investment Thesis

When we think about investing in growth stocks, several powerful compounder names come to our minds, such as Microsoft (MSFT), Google (GOOG) (GOOGL), or Amazon (AMZN). However, few investors think about companies located in Europe, Australasia, and the Far East (“EAFE”) when they want to acquire exposure to growth stocks. The iShares MSCI EAFE Growth ETF (BATS:EFG) provides access to a well-diversified basket of companies that exhibit growth characteristics. Although past returns are concerning, some investors may find this fund interesting for multiple reasons, especially if they want to diversify their US exposure. I personally believe that US growth stocks will deliver better returns over the long term than European and Japanese stocks for several reasons. Both Europe and Japan are confronted with modest GDP growth, poor demographic trends, and a high level of public and corporate leverage. For the reasons mentioned above, I think that the EAFE region will provide modest investment returns over the long term.

Strategy Details

The iShares MSCI EAFE Growth ETF tracks the investment results of the MSCI EAFE Growth Index. The index invests in a broad range of companies in Europe, Australia, Asia, and the Far East whose earnings are expected to grow at an above-average rate relative to the market.

If you want to learn more about the strategy, please click here.

Portfolio Composition

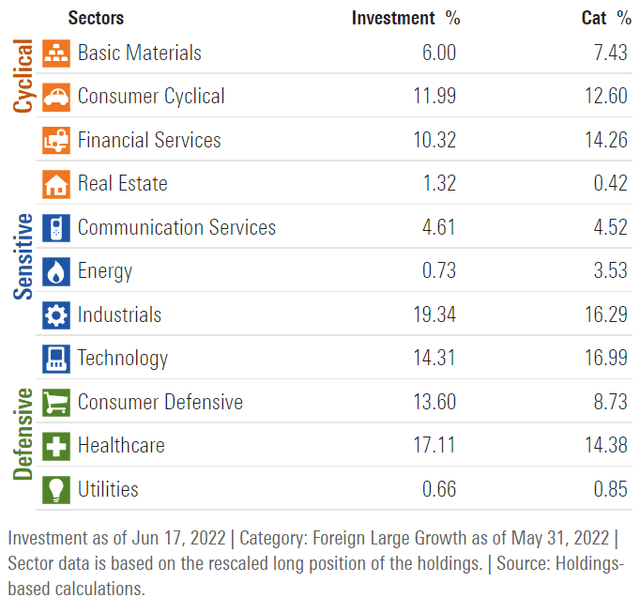

The index invests ~19% of total assets in Industrials, followed by the Healthcare sector (17%) and Technology (~14%). The largest three categories have a combined allocation of approximately 50.8%.

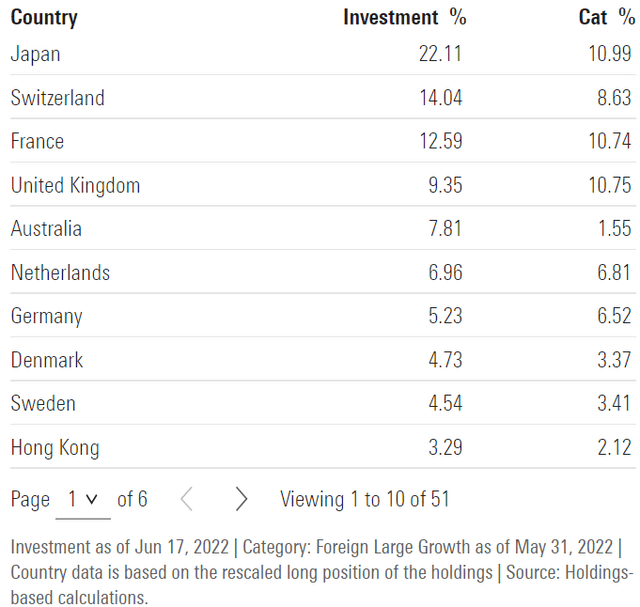

In terms of geographical allocation, the top 10 countries represent nearly 91% of the portfolio. Japan accounts for 22%, whereas other countries such as Sweden seem to be underrepresented given the low weight (only a ~4.5% allocation to Sweden).

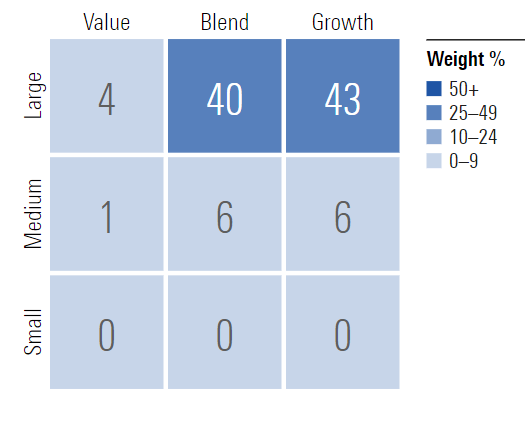

~43% of the portfolio is invested in large-cap growth stocks, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap “blend” stocks, which account for 40% of the portfolio. Only 5% of assets are invested in value stocks, which is unsurprising given the strategy’s objectives.

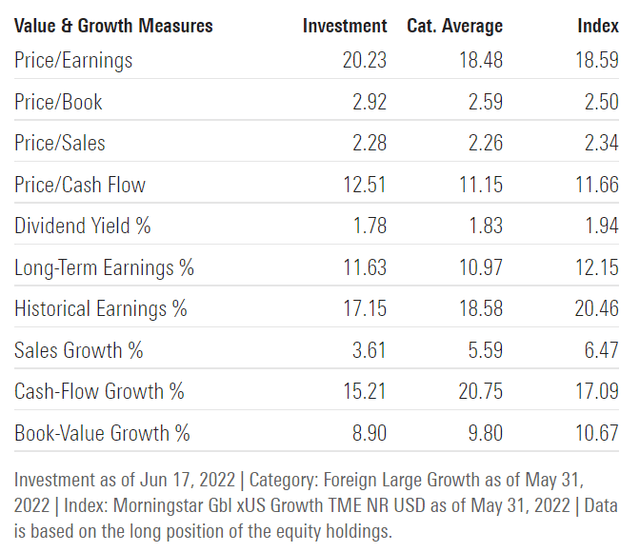

Morningstar

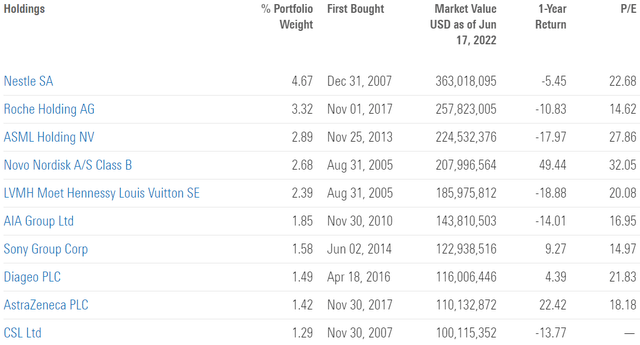

EFG is currently invested in 462 different stocks. The top 10 holdings account for ~24% of the portfolio, with no single stock weighting more than 5%. In my opinion, the fund is well-diversified and has a low level of unsystematic risk.

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, EFG trades at a ~3x book value and ~20x earnings. In a rising rate environment, I believe a multiple of 20x earnings is excessive and doesn’t provide a good margin of safety. On top of that, I personally think European and Japanese equities should trade at a discount compared to US equities. This comes from a higher risk premium since most of these countries have bleak economic prospects and their currencies risk depreciating further compared to the dollar.

Is This ETF Right for Me?

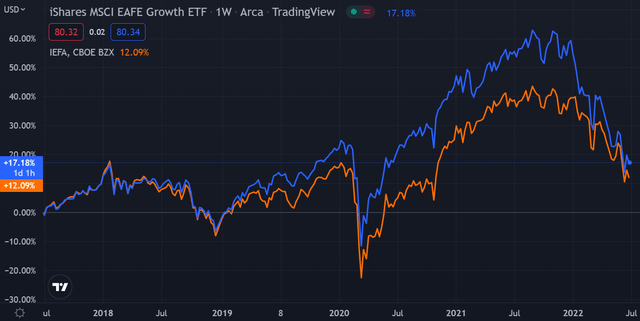

I have compared below EFG’s price performance against the iShares Core MSCI EAFE ETF (IEFA) over the last 5 years to assess which one was a better investment. Over that period, EFG turned out to be a superior investment, outperforming stocks in the same region by ~5.1 percentage points. That said, I believe the returns are modest for a strategy that is supposed to invest in growth stocks. To put EFG’s returns into perspective, a $100 investment in EFG 5 years ago would now be worth $117.18, including dividends. This represents a compound annual growth rate of ~3.2%, which is a terrible absolute real return if we assume a 2% annual inflation rate.

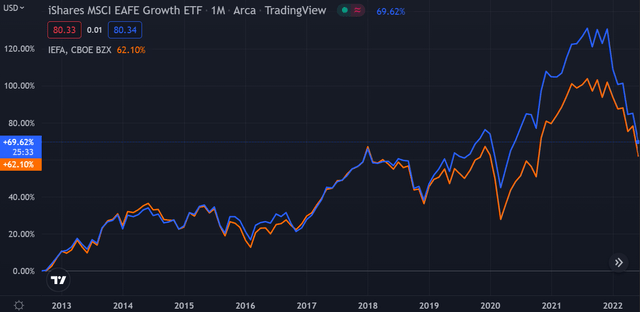

If we take a step back and look at the 10-year price returns, the results don’t change much. EFG came on top once again, outperforming IEFA since Q4 2018.

I suspect EFG’s past performance is a direct reflection of the state of the economies in the EAFE region. Investing in countries that exhibit a low GDP growth rate combined with high government spending and, in some cases, a negative trade balance should provide disappointing returns to shareholders in the long run. I personally don’t see any catalyst that will make Europe and Japan more competitive in both the short and long term. On the contrary, political fragmentation is likely to increase in these regions, potentially leading to a radical economic agenda that will weaken these countries in the long term.

Key Takeaways

EFG provides exposure to companies in Europe, Australia, Asia, and the Far East whose earnings are expected to grow at an above-average rate relative to the market. This ETF is well-diversified both across issuers and sectors and can be used as part of a broader strategy to diversify US exposure. That said, Europe and Japan are both dealing with slowing GDP growth, deteriorating demographic trends, and a high level of public and corporate leverage. The abovementioned factors are the main reason why the fund has underperformed in the past and why it’s likely to continue underperforming in the future. As a result, I believe growth investors would be better off sticking with US growth stocks over the long term.

Be the first to comment