zhengzaishuru

SilverBow Resources, Inc. (NYSE:SBOW) recently acquired assets from other competitors, which pushed production expectations significantly up. Production is expected to grow approximately 30% y/y in 2022 and 2023. The company also expects double-digit FCF/Sales and growing net income thanks to recent increases in the oil and gas price. I believe that as soon as new production figures hit the trading tape, the demand for the stock will push the SBOW share price up. There are obviously some risks from failed geologic models and lower production than expected. However, under my discounted cash flow (“DCF”) models, I see upside potential in the valuation.

SilverBow Resources

With expertise accumulated for the last 30 years, SilverBow acquires and develops oil and gas assets in the Eagle Ford Shale and Austin Chalk in South Texas.

Going straight to SilverBow, I am writing about the company because of its recent M&A strategy. Management acquired the oil and gas assets of Sundance Energy, Inc. using a senior secured revolving credit facility. As a result, production, free cash flow (“FCF”), and net income are expected to increase significantly in the coming years.

In conjunction with closing the acquisition of substantially all of the oil and gas assets of Sundance Energy, Inc. and its affiliated entities, SilverBow’s borrowing base under its senior secured revolving credit facility increased to $775 million from $525 million on June 22, 2022. Source: Quarterly Press Release

In the last 10-Q, the company noted that production is expected to grow approximately 30% y/y in 2022 and 2023, with FCF/Sales close to 25%. The company also believes that free cash flow could increase by approximately 100% in 2022. If these figures are correct, I believe that the company’s stock price will most likely trend higher soon.

Production is estimated to grow approximately 30% per year in both 2022 and 2023 with a 2023 free cash flow yield exceeding 25%. FY22 oil production is expected to increase by 100% compared to 2021. Source: Quarterly Press Release

SilverBow was quite optimistic about future acquisitions and portfolio additions. Management believes that future cash flow will allow the company to launch new accretive acquisitions.

The increased liquidity from our upsized borrowing base and our strong cash flow outlook positions SilverBow to fund future growth and continue expanding its portfolio, both through the drill-bit and through accretive acquisitions. Source: Quarterly Press Release

Most Investment Analysts Are Quite Optimistic About The Years 2022 And 2023

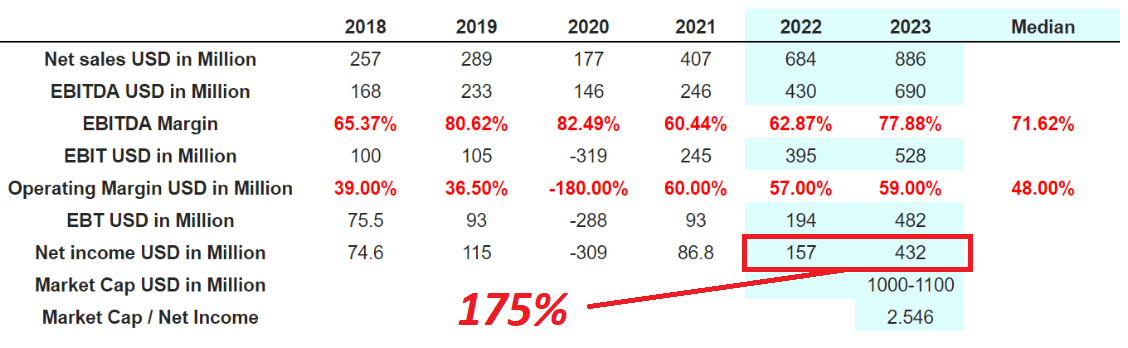

I am not the only investor having a look at the firm. Other equity researchers reviewed SilverBow’s future expectations, and included promising figures for the years 2022 and 2023. The most interesting is that the net income is expected to grow close to 175% from $175 million in 2022 to $432 million in 2023. Sales growth is also expected to increase from $684 million to close to $900 million in 2023.

marketscreener.com

In my view, the stock price will most likely trend higher if these figures are released. With this in mind, I decided to run my own financial model to understand the valuation of SilverBow once production figures commence to creep up.

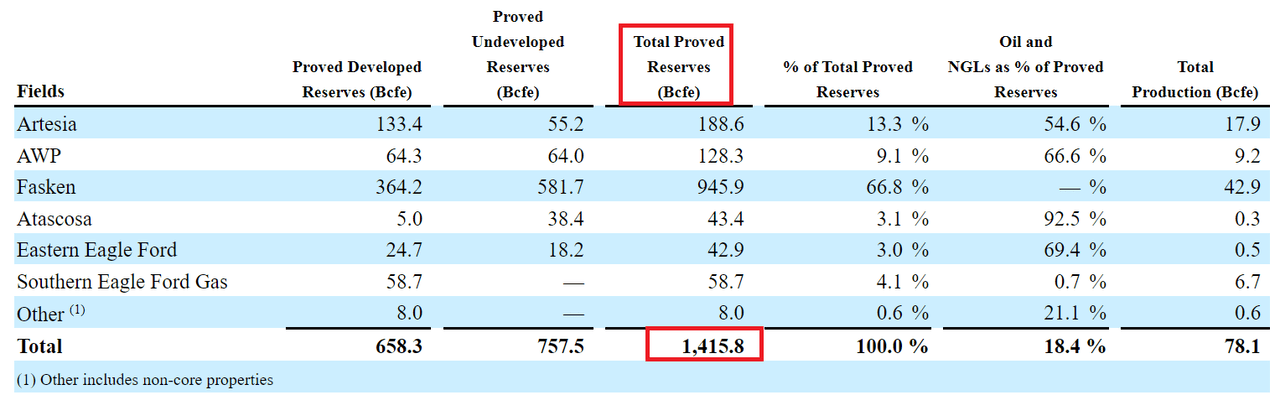

My Base Case Scenario With Increase In Production And Proved Reserves Of 1.415 Bcfe Would Imply A Price Of $69 Per Share

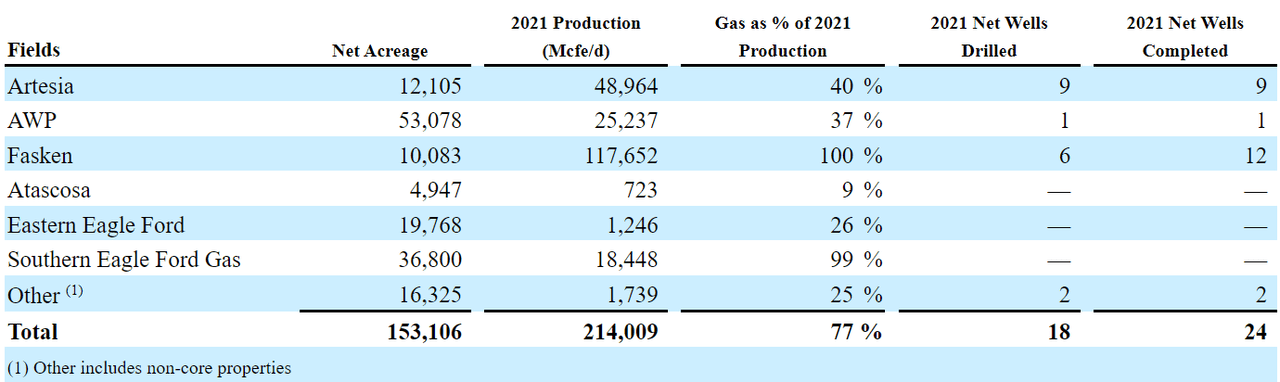

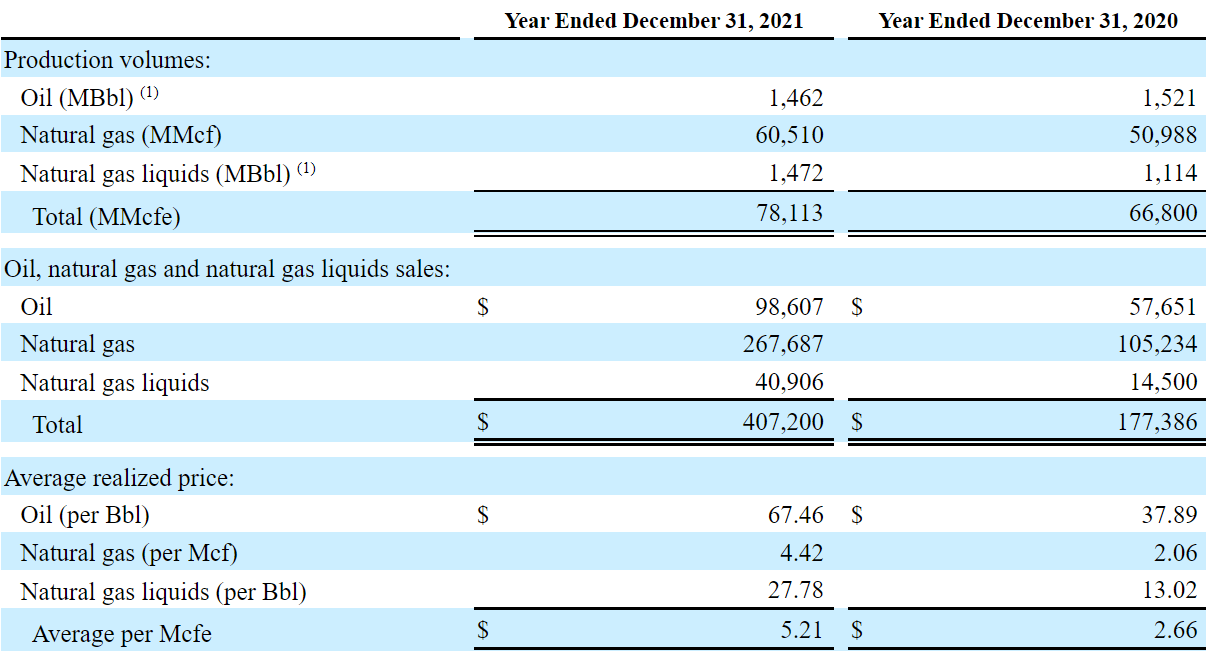

In the last 10-k, SilverBow reported production of 214,009 Mcfe/d in 2021. Under this case scenario, I assumed that the company would deliver significantly higher production figures after the recent acquisitions. In my view, management will try to accelerate production because oil and gas prices are at their highest price marks of the last few years.

10-k

10-k

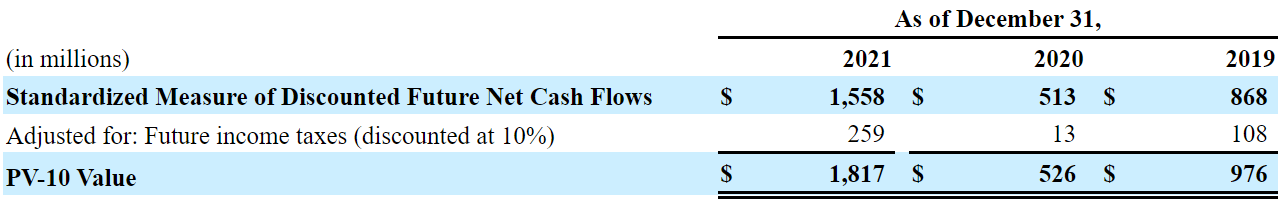

In the last annual report, SilverBow released information about year-end Standardized Measure and PV-10, but used price figures from 2021. Right now, the oil and gas price is close to 40% to 50% more than when SilverBow executed its financial model. Hence, under my DCF model, I used an average Mcfe of more than $6.7.

The following prices were used to estimate SilverBow’s SEC proved reserve volumes, year-end Standardized Measure and PV-10. The 12-month 2021 average adjusted prices after differentials were $3.75 per Mcf of natural gas, $63.98 per barrel of oil, and $25.29 per barrel of NGL, compared to $2.13 per Mcf of natural gas, $37.83 per barrel of oil, and $11.66 per barrel of NGL for 2020 and $2.62 per Mcf of natural gas, $58.37 per barrel of oil, and $16.83 per barrel of NGL for 2019. Source: 10-k

The average realized crude oil selling price in the second quarter of 2022, excluding hedging, was $109.94 per barrel compared to $63.62 per barrel in the second quarter of 2021. The average realized NGL selling price in the second quarter, excluding hedging, was $39.51 per barrel (36% of WTI benchmark) compared to $21.65 per barrel (33% of WTI benchmark) in the second quarter of 2021. Source: Quarterly Press Release

10-k

10-k

I took into account the guidance released by management, which included production of 380 MMcfe/d and close to $250 free cash flow in 2023. My numbers are not that optimistic, but they are not that far from that of management.

2023 average daily production is expected to increase more than 35% year-over-year to approximately 380 MMcfe/d. The Company expects to generate approximately $250 million of free cash flow in 2023 based on $90 WTI and $4.75 Henry Hub pricing. Source: Quarterly Release

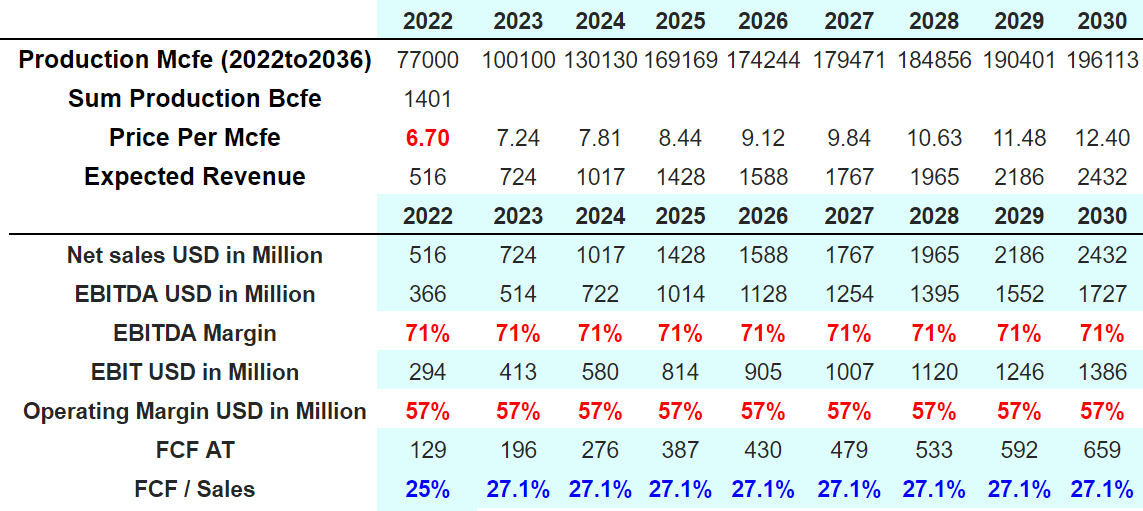

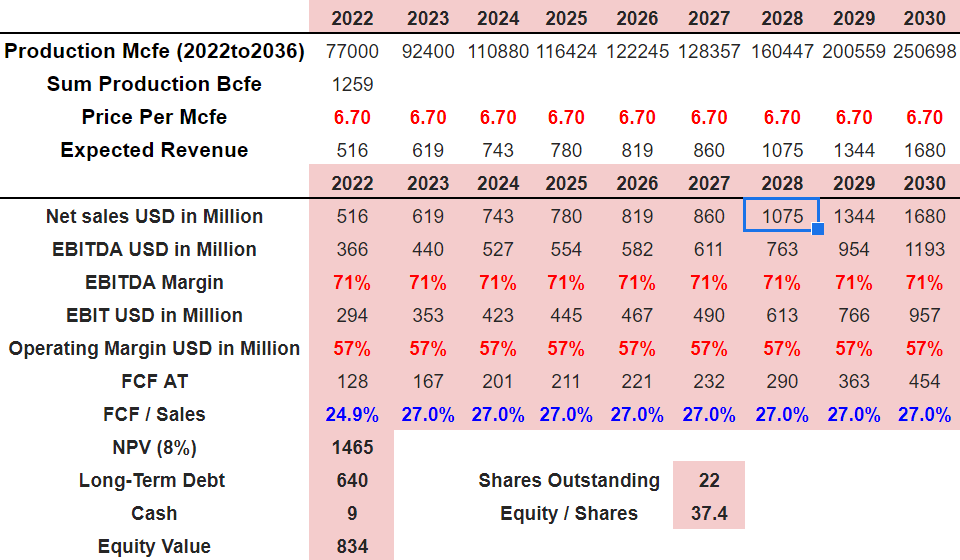

With growing production from 2022 to 2030 and a price between $6.7/Mcfe and $12.4/Mcfe, I obtained net sales between $515 million in 2022 and almost $2.5 billion in 2030. With FCF/Sales close to 25% in 2022 and constant at around 27.1% from 2023 to 2030, free cash flow would increase from $125 million in 2022 to more than $650 million in 2030.

My DCF Model

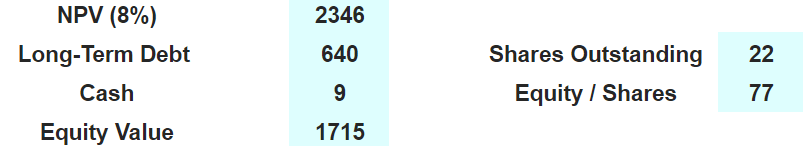

If we discount everything at 8%, the sum of future free cash flow would equal $2.3 billion. If we subtract the debt, add the cash in hand, and divide by the share count, the equity per share would stay at close to $75 and $80.

My DCF Model

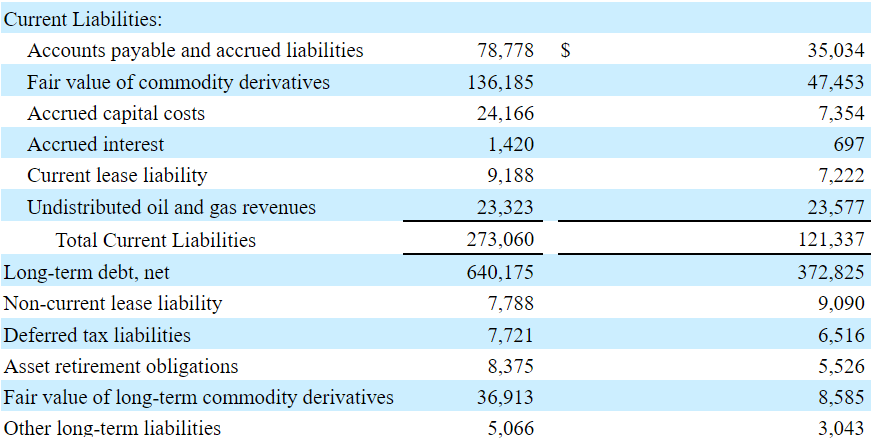

Balance Sheet

As of June 30, 2022, the company reported $9 million in cash, property and equipment worth $1.2 billion, and total assets worth $1.452 billion. The total amount of debt is significant, but I believe that the company’s balance sheet appears quite stable.

10-Q

Recently, the total amount of debt increased to $640 million. Management financed with the most recent acquisition of assets. In my view, if future free cash flow exceeds the increase in the total amount of debt, we should not be afraid of the debt.

10-Q

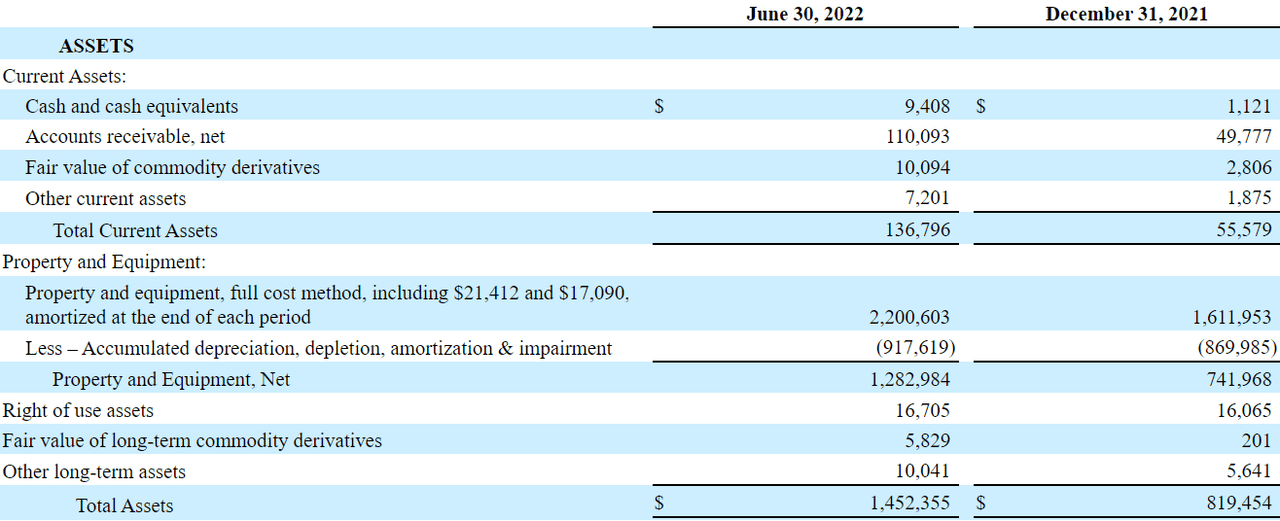

Risk Factors: My Worst Case Scenario With Constant Price Per Mcfe And Lower Production Would Lead To A Valuation Of $37.4 Per Share

There are several risks, which could lead SilverBow to produce less oil and gas than expected. First, geologists may fail to predict the total amount of gas or oil. Let’s keep in mind that making forecasts about what’s under the earth with geophysics, drilling, or any other exploration method is not that accurate. You only know what you have once you extract it. Lower production would lead to lower free cash flow.

In the future, SilverBow may also find less demand for its oil and gas. The price could also decline significantly or not grow as expected. In the worst case scenario, the company’s revenue line would decline significantly, which would affect the company’s free cash flow margins. If a sufficient number of equity analysts do research and reduce the company’s fair price, the stock price may fall.

Finally, the recent acquisition of assets may not be as profitable as expected. If the company realizes that there is less oil and gas than initially expected, it may lower its guidance, which would lead to a decrease in the share price.

Let’s imagine for a second that the company’s production does not grow as much from 2024 to 2030. I also assumed that from 2022 to 2030, the price per Mcfe remains constant at $6.7/Mcfe. Under these conditions, future revenue would not reach more than $1.6 billion in 2030. Finally, with FCF/Sales around 24.9% and 27%, the net present value would be close to $1.4 billion. Finally, if we subtract the debt of $640 million, add cash, and divide by the share count, the implied price would be $37.4 per share.

My DCF Model

Conclusion

With a new acquisition, production of oil and gas is expected to increase significantly. As a result, I believe that SilverBow’s stock price will likely reach higher levels. As soon as the company releases the new value of its proven reserves at new oil and gas prices, most market participants will react. Besides, if management continues to acquire other targets as promised, the free cash flow will trend north. Yes, I obviously see risks from failed geological models and less production than expected. However, there seems to exist upside potential in SilverBow’s current valuation.

Be the first to comment