24K-Production

Executive Summary

-

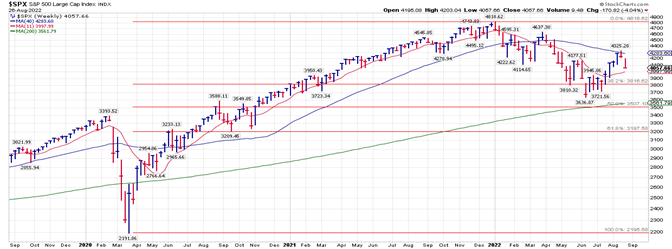

We believe the first leg of the bear market ended on June 16th because stocks were extremely oversold, and investors were fearful. We expected a sharp bear market rally through August and another decline into the fall, driven by a weakening economy and declining corporate profits.

-

The S&P 500 had a stout 18.9% bear market rally into August 16th. While the 18.9% (trough to peak) rally over eight weeks may seem extreme, it was a textbook bear market rally. According to BofA Securities, since 1929, there have been 43 bear market rallies which averaged 17.2% over 39 trading days. We believe the rally is over, and stocks are poised to move lower as the Fed tightens policy to combat inflation, and corporate profits disappoint as the economy slows.

-

Today, Fed Chair Powell resolutely refuted Wall Street’s “Fed Pivot” narrative that fueled the bear market rally at the Jackson Hole Economic Symposium. Powell stated, “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy,” Stocks fell sharply because of the Fed’s commitment to fighting inflation would lead to higher short-term interest rates, lower valuations, and disappointing corporate profits.

-

The first leg of the bear market ended in mid-June, and the eight-week 18.9% bear market rally is over. We believe stocks are poised to decline as the economy slows and corporate profits disappoint. In this recessionary environment (declining growth and inflation), we believe the market’s defensive sectors (healthcare, staples, utilities, and value) will outperform. Also, we expect long-term treasury bonds and gold to help hedge the portfolio’s equity exposure.

-

In this high-risk period, we will continue to focus on preserving capital and managing risk until market volatility declines, the economy stabilizes, and stocks offer a better risk reward

Market Review

As discussed last month, we believed the first leg of the bear market ended on June 16th because stocks were extremely oversold, and investors were fearful. We expected a sharp bear market rally through August and another decline into the fall, driven by a weakening economy and declining corporate profits.

We believe that the bear market rally peaked on August 16th. After rallying by 19.4% from its mid-June low, the S&P 500 was very overbought, and investors were optimistic that the Fed would orchestrate a “soft-landing.” Unfortunately, while stocks rallied and signs of euphoria were manifest, the bond and commodity markets continued to deteriorate — signaling that a recession was imminent.

Market Discussion:

As discussed previously, the Fed’s monetary mistakes led to asset bubbles and drove inflation to a 40-year high. To stabilize the economy during the pandemic, the Federal Reserve and the U.S. Government injected unprecedented monetary and fiscal stimulus into the economy. As the economy recovered and inflation surged, the Fed failed to reduce its emergency measures, which led to financial asset bubbles and the highest inflation rate since 1981.

Despite robust economic growth, and surging inflation, the Fed kept short-term interest rates at 0% (significantly below inflation), and they “printed” $120 billion each month to buy bonds and inflate asset values because they believed that inflation was “transitory.” In January, it was apparent that the Fed was wrong, so investors pushed interest rates sharply higher, which drove the S&P 500 into a bear market.

Although inflation was at a 40-year high and stocks were in a sharp selloff, the Fed waited until March to stop “printing” money, and it increased short-term interest rates by 0.25% to a yield of 0.50%, which was 8.1% below the inflation rate. The Fed continued to raise interest rates: +0.50% in May, +0.75% in June, and +0.75% in July to a yield of 2.5%.

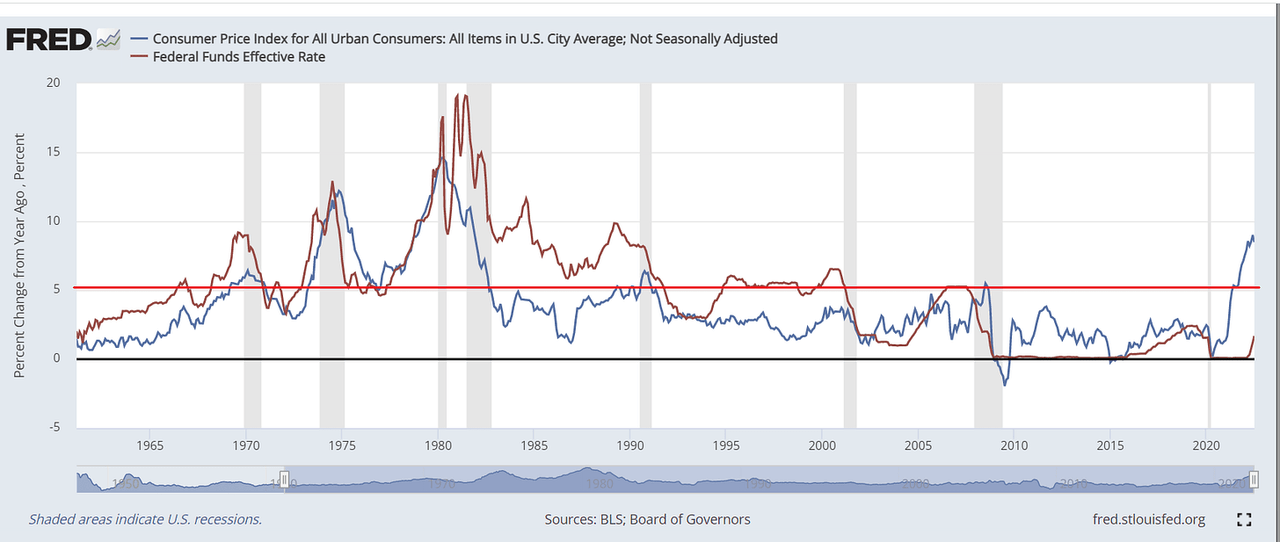

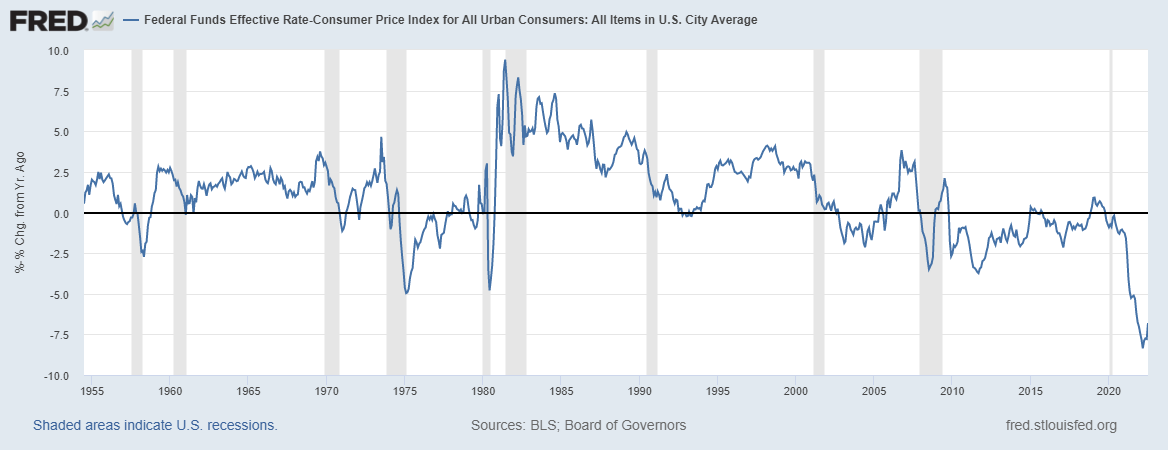

Historically, most Fed tightening cycles led to recession; every time inflation surged over 5%, a recession occurred. Also, most tightening cycles didn’t end until short-term interest rates exceeded inflation. Currently, short-term interest rates are 6.0% below the inflation rate, and inflation has been above 5% for more than a year. Since WWII, the Fed has never been this far behind the inflation-fighting curve, which makes a recession probable.

The Fed believed inflation was “transitory,” so it failed to remove its emergency measures, and inflation surged to a 40-year high. Historically, Fed tightening cycles don’t end until short-term interest rates exceed inflation.

fred.com

Currently, real short-term interest rates are -6.0% (interest rates are 2.5%, yet inflation is 8.5%). Since WWII, the Fed has never been this far behind the inflation-fighting curve, which makes a recession probable.

fred.com

On July 27th, the Federal Reserve raised short-term interest rates to 2.5%, and Chairman Powell stated that interest rates were at a neutral setting, which is neither stimulative nor restrictive. Stocks rallied sharply on the belief that the bulk of the rate hike was behind us, and the Fed would pivot and start cutting interest rates next year.

In our view, this bullish narrative ignored market history and the severity of our inflation problem. Recessions are awful, but they hurt relatively few people. In the 1990 and 2000 recessions, approximately 3.5 million people lost their job, and 8.2 million people lost their job during the financial crisis of 2007/2008. These job losses are terrible, yet unemployment insurance and government assistance help the unemployed so that they can retrain and/or wait for a new job during the economic recovery.

Unlike a recession, elevated inflation hurts everyone since their purchasing power declines as the cost of basic necessities surges higher. Currently, the unemployment rate is 3.5%, which is essentially the lowest level since WWII (the unemployment rate reached 3.4% in 1968/69). While the employment picture looks very healthy, inflation — which is a stealth tax — is pushing many households toward poverty. The U.S. Congress Joint Economic Committee estimates that inflation will cost the average American household $8,600 over the next 12 months — nearly 14% of the median household income. Since most households live paycheck to paycheck, this $8600 tax isn’t feasible and explains why 20 million households (16.7% of American households) are currently delinquent on their utility bills.

During the summer market rally, Wall Street speculated and bought stocks on the belief that Powell and the Fed wouldn’t be resolute in fighting inflation and would yield to the market’s demand for artificially low interest rates and excess liquidity.

Friday, Chair Powell gave a widely anticipated speech on monetary policy at the Jackson Hole Economic Symposium. Powell stressed that the Fed would not make another mistake after believing inflation was transitory and delaying the tightening cycle.

Powell stated, “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” Powell continued, “Restoring price stability will likely require maintaining a restrictive policy stance for some time,” and “the historical record cautions strongly against prematurely loosening policy.”

Since Wall Street expected the Fed to slow the pace of rate hikes and pivot to an easing cycle next year, Powell’s hawkish message sent stocks down sharply on Friday.

Our market view remains unchanged. We are in a bear market and headed toward a recession. The first leg of the bear market was driven by falling valuations (and rising interest rates); we expect that deteriorating fundamentals, recession fears, and declining earnings expectations will be the catalyst for the next leg of the bear market.

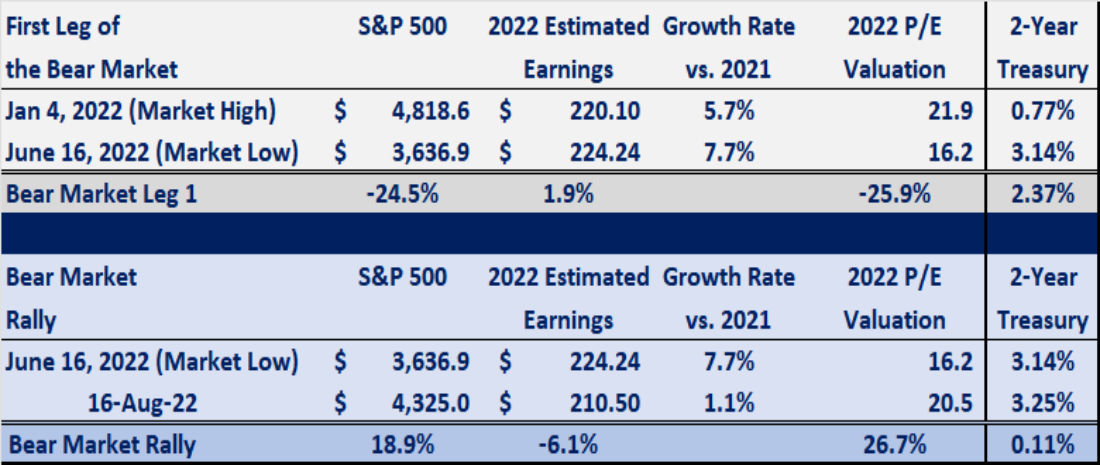

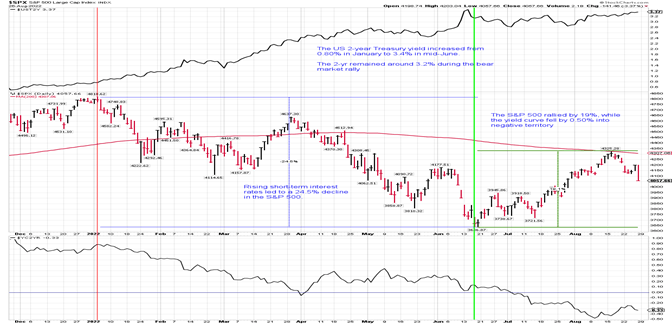

Stocks fell by 24.5% from January 4th through June 16th this year. The catalyst for the decline was the spike in interest rates (the U.S. 2-year Treasury jumped from 0.77% to 3.14%), which led to a falling market valuation — since companies are worth the present value of their future cash flows when interest rates rise, the company’s value declines.

During this first leg of the bear market, Wall Street analysts actually increased their earnings estimates by 1.9% for 2022, so while the S&P 500 dropped by 24.5%, its P/E multiple fell by 25.9% (see table below).

As discussed in our June letter, we believed stocks were extremely oversold, investors were fearful, and stocks were poised for a significant bear market rally through August. From June 16th through August 16th, the S&P 500 rallied by 18.9%, which retraced about 60% of the first leg of the bear market. Since Wall Street analysts cut their earnings forecast by 6.1% during the bear market rally, the S&P 500 P/E increased by 26.7%. Interestingly, the U.S. 2-year Treasury rose by 0.11% during the rally, which didn’t confirm the large increase in market valuations (see table below).

manley capital

Many investors and pundits believed that the market’s explosive 18.9% rally over eight weeks indicated that the bear market was over, and the economy was poised for a soft landing. Despite the stout market rally, there was no improvement in the fundamentals. In fact, during the rally, earnings expectations fell, and the yield curve became deeply inverted, which indicates economic stress and the increased likelihood of a recession. Also, while the 18.9% (trough to peak) rally over eight weeks may seem extreme, it was a textbook bear market rally. According to BofA Securities, since 1929, there have been 43 bear market rallies which averaged 17.2% over 39 trading days.

stockchart.com

In the middle of June, stocks were very oversold, and investors were fearful. We expected a rally into August, which would retrace 50 to 60% of the previous decline. Last month, we said, “once the market is overbought, and investors are complacent, we believe the bear market will resume. The market will be susceptible to another decline when approximately 70% of NYSE stocks exceed their 50-day moving average, and there are more AAII Bulls than Bears. Also, the VIX curve should be in steep contango”.

The S&P 500 rallied by 18.9% and retraced 58% of its previous decline by the middle of August. The market was very overbought, the VIX was in steep contango, and there were almost as many bulls as bears. In our view, the bear market rally is over.

stockcharts.com

In the short-term, markets are driven by emotions (fear and greed), and non-fundamental flows can accelerate these trends – i.e., passive investments (monthly 401k contributions, target date funds, and corporate buybacks), and quantitative funds (trend following, volatility targeting, risk parity, and delta hedging option exposure). We believe that these non-fundamental flows have changed the market’s structure and made it more susceptible to sharp rallies and declines, which are ultimately noise and do not discount a change in the fundamentals.

Instead of creating a fundamental narrative to fit and validate a short-term price movement, we believe it’s essential to focus on the long-term fundamentals which drive stock prices – i.e., earnings and interest rates. In our view, short-term interest rates will trend higher as the Fed fights inflation, and the rate of change in profit growth will continue to decline.

Stocks were overbought and poised for a selloff when Chairman Powell, at Jackson Hole this past week, ended the market’s false narrative that the Fed would pivot to an easing cycle next year. We believe the next leg of the bear market has begun, and we expect the S&P 500 to decline to 3200 this fall. A decline to 3200 would retrace 61.8% of the previous bull market and be in line with the average bear market decline of 34%. Additionally, the S&P would sell at a reasonable 15.6 times peak earnings at this level.

On an optimistic note, typically during mid-term election years, stocks decline sharply into the fall (around the election) and then rally on average 17.6% off their fourth-quarter low. We believe a strong year-end rally is possible if the country comes together post-election and the Congress forges a domestic energy policy that will increase supply and bring down the price of oil and natural gas.

As the Fed tightens financial conditions and the credit cycle turns down, we expect the S&P 500 to fall to 3200 this fall. A decline to 3200 would retrace 61.8% of the previous bull market and be in line with the average bear market decline of 34%. The S&P would sell at 15.6 times peak earnings at this level.

stockcharts.com

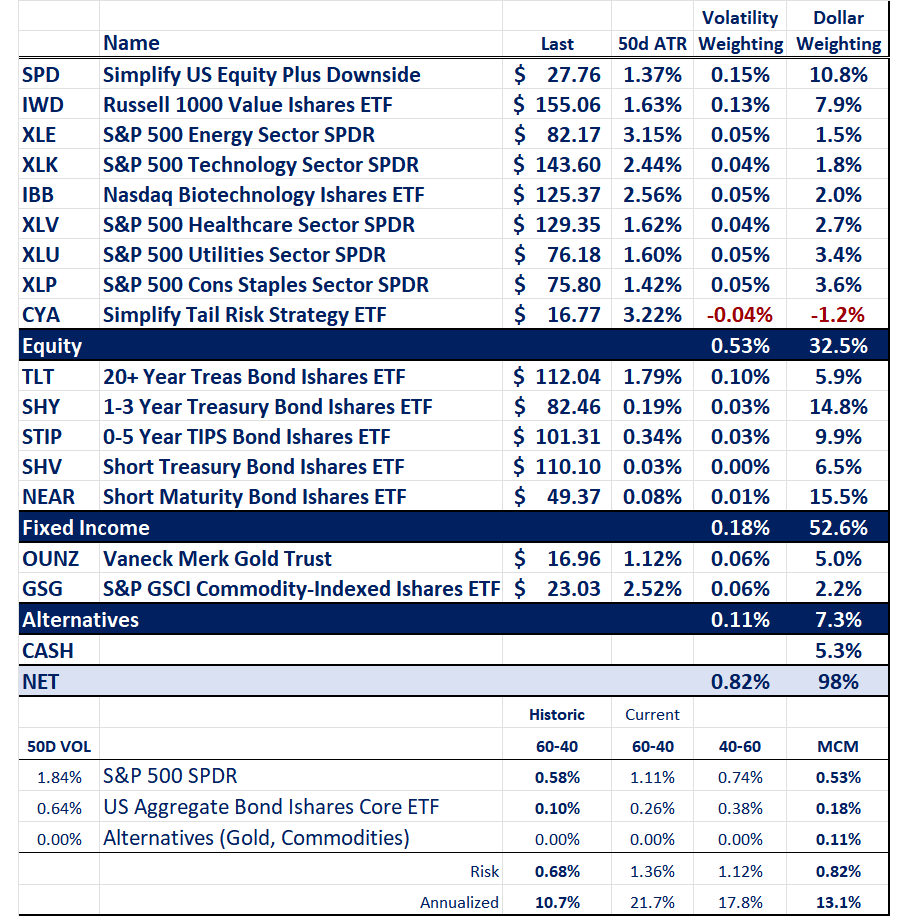

Our Model Portfolio:

The benchmark for our model portfolio is the Traditional Blend – 60% equity, 40% bonds. Our goal is to outperform the benchmark with less risk. To outperform, our investment portfolio is diversified and economically balanced. We eliminate laggards and tilt the portfolio toward our location in the business cycle. Finally, to manage risk, we volatility-weight our positions and set a volatility target equal to our benchmark’s historic risk level. When volatility increases, our asset allocation dynamically reduces our equity risk exposure.

Our portfolio remains positioned to perform well in a period of stagflation (high inflation and slowing economic growth). To perform well in this inflationary period, we are invested in: short-term TIPS (U.S. Treasury Inflation-Protected Securities), gold, the Goldman Sachs Commodity Index, the Russell 1000 value sector, and energy stocks. Additionally, to perform well in this period of slowing growth, we have investments in: healthcare, biotech, consumer staples, utilities, and long-term U.S. Treasury bonds.

Since we believe that the inflationary surge and the Fed’s tightening cycle will lead to a mild recession, we expect to increase our exposure to the market’s defensive sectors and reduce or eliminate our inflation hedges (commodities, energy, and TIPs), as the bear market resumes, and the economy weakens.

In sum, we are in a bear market, uncertainty and risk remain elevated, and we are headed toward a recession. To preserve capital in this challenging environment, we are underweight equities, overweight the defensive, non-cyclical sectors of the market and the safe havens (gold and long-term Treasury bonds), and maintain a large cash balance. We will continue to focus on preserving capital until the economy stabilizes and the market offers a better risk-reward.

manleycapital

Our portfolio’s risk level (annualized volatility) is 13.1%, which is significantly less than our benchmark’s risk level of 21.7%.

In summary:

-

The first leg of the bear market ended in mid-June, and the eight-week 18.9% bear market rally is over.

-

We believe stocks are poised to decline as the economy slows and corporate profits disappoint. We estimate the S&P 500 will fall to 3200, which is in line with the average bear market decline of 34%. Also, the S&P 500 would sell at a reasonable 15.6 times peak EPS.

-

In this recessionary environment (declining growth and inflation), we believe the market’s defensive sectors (healthcare, staples, utilities, and value) will outperform. Also, we expect long-term treasury bonds and gold to help hedge the portfolio’s equity exposure.

-

In this high-risk environment, we remain focused on preserving capital until market volatility wanes, the economy stabilizes, and stocks offer favorable risk-reward.

Disclaimer: The material in this newsletter is for educational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. This newsletter is not a substitute for professional investment services. Past performance is no guarantee of future results, and there is no assurance that investment objectives will be achieved. Information contained herein has been obtained from sources believed to be reliable but not guaranteed. All investments contain risk.

Be the first to comment