onurdongel/E+ via Getty Images

The Williams Companies, Inc. (WMB) is one of the largest midstream companies in North America and it is by far the largest that is specifically focused on natural gas. The midstream sector was devastated by the outbreak of the coronavirus pandemic and the accompanying crash in energy prices, although the cash flows of these firms held up reasonably well. The Williams Companies’ stock price held up much better than most of its peers due to its focus on natural gas, which is probably why the stock is only up a meager 21.44 % over the past year. The stock’s dividend yield is also fairly mild compared to many other midstream companies as it is only 6.12% as of the time of writing. The company boasts an incredibly strong balance sheet and some significant growth prospects though, so it does still have a lot to offer an income-seeking midstream investor. The company has certainly showcased this quite well in the year that has passed since my last report on the company.

About The Williams Companies

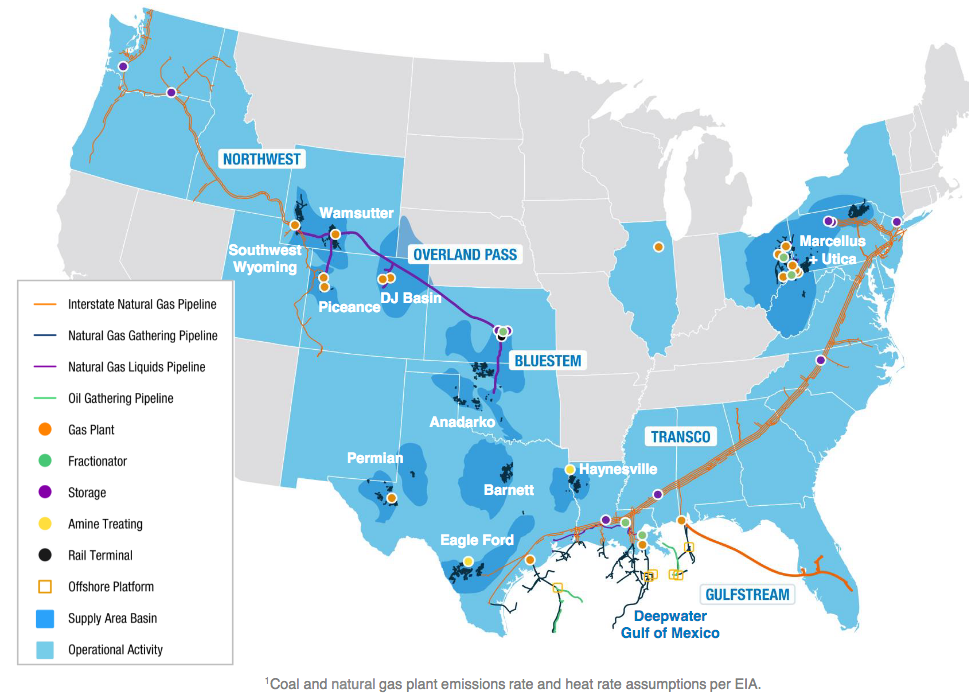

As mentioned in the introduction, The Williams Companies is one of the largest midstream companies in the United States. The company has a specific focus on natural gas, which could provide it with some advantages over other firms due to this compound’s strong fundamentals compared to other fossil fuels, as we will see later in this article. The company’s focus on the natural gas space is highlighted by the fact that it transports approximately 30% of the natural gas consumed in the United States:

Source: The Williams Companies

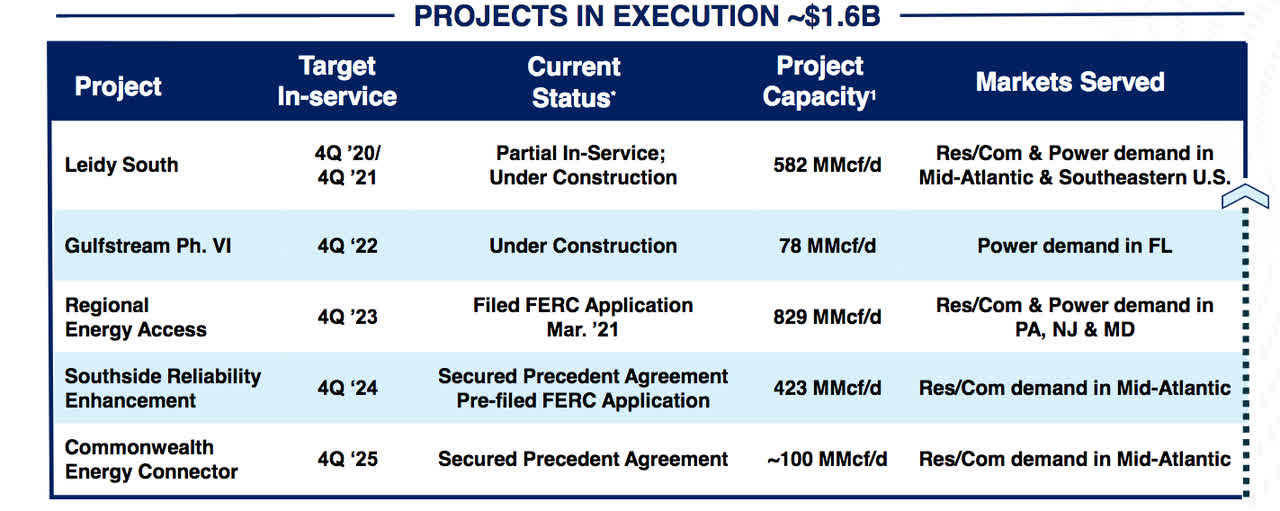

The company’s most important asset is the Transco pipeline system, which runs along the eastern seaboard from Texas to New York City. This system alone handles 15% of all of the natural gas consumed in the United States. The Williams Companies is not resting on its laurels, however, and is actively working to expand this system. This is in direct response to the growing demand for natural gas all along the East Coast, driven by various utilities replacing their old coal-fired power plants with natural gas ones. We will discuss this later. The company currently has $1.5 billion worth of growth projects under construction, all but one of which is directly intended to increase the capacity of the Transco system:

Source: The Williams Companies

Source: The Williams Companies

All of these projects together will increase the amount of natural gas that the company’s infrastructure can carry by 2.1 billion cubic feet per day. This is nice because of the business model that the company uses. In short, The Williams Companies enters into long-term contracts with its customers (primarily utilities) to transport natural gas and then these customers compensate the company based on the volume of resources that it transports, not on their value. Thus, if the company can transport more resources then it can make more money. Of course, there is no reason for the company to increase its capacity if nobody wants to use it. Fortunately, this is not the case. In fact, The Williams Companies has already secured contracts with customers for the use of this new infrastructure that it is constructing. There are two advantages to this. The first one is obviously ensuring that the company is not spending a great deal of money to construct new capacity that nobody wants to use. The second advantage is that it allows the company to know in advance how much the project will make before it constructs so the company can determine if the investment makes sense. In this case, the projects have a 6x EBITDA multiple on average, which is admittedly a bit low for a midstream project. Kinder Morgan’s (KMI) growth projects, for example, frequently achieve a 4x EBITDA multiple, which means that Kinder Morgan’s pay for themselves much faster and have a higher rate of return than The Williams Companies’. With that said though, the fact that The Williams Companies’ customers are mostly utilities and not upstream producers might mean that its cash flows are somewhat more secure. Overall, these projects should increase The Williams Companies’ EBITDA by about $250 million annually, which is reasonable and any growth is generally positive.

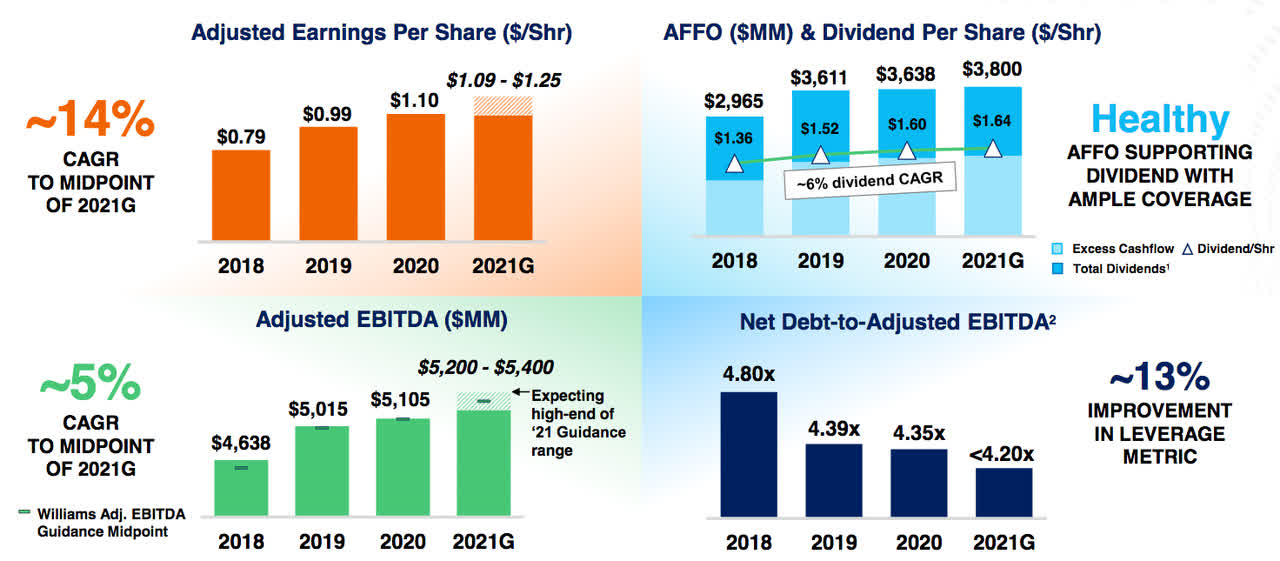

This represents a continuation of the company’s track record of delivering steady growth over time. In fact, The Williams Companies even managed to deliver EBITDA and cash flow growth in 2020 despite the troubles that the industry faced:

Source: The Williams Companies

Source: The Williams Companies

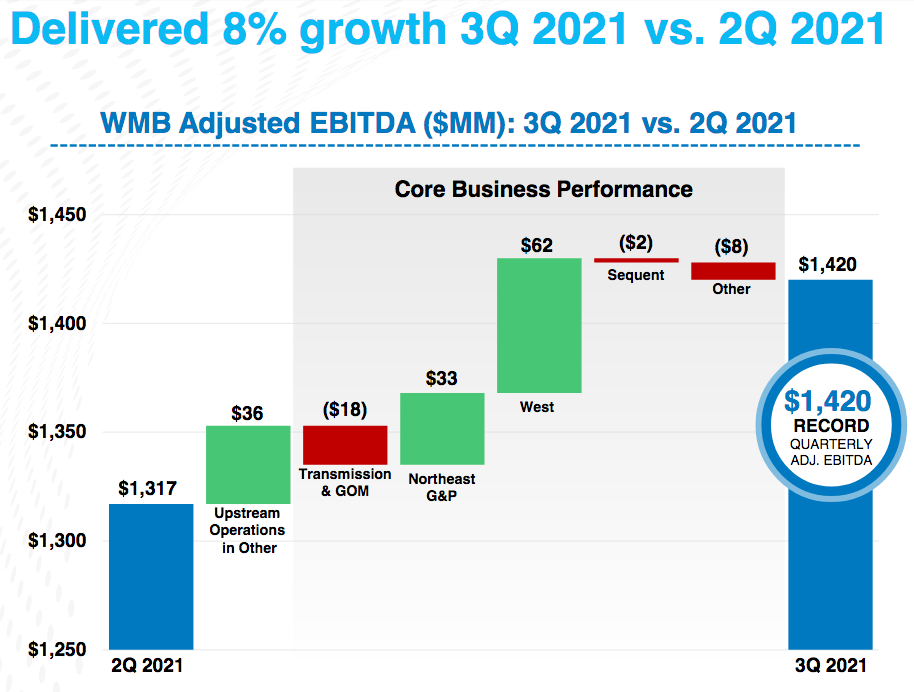

The company was able to continue this growth as of the third quarter 2021, posting a record quarterly adjusted EBITDA:

Source: The Williams Companies

This speaks well to the resiliency and strength of the company’s business. As noted earlier, the company’s cash flow comes from long-term contracts that should outlast any short-term economic problems. Of course, these contracts do not mean very much if the counterpart cannot honor them due to financial troubles. However, about 66% of the company’s cash flow comes from contracts with utility companies. As I have pointed out numerous times in recent articles, utility companies tend to enjoy incredibly stable revenues and cash flows no matter what happens in the broader economy. When we combine this with the fact that 86% of the company’s contracts are with financially stable investment-grade firms, we can see that The Williams Companies’ cash flows are remarkably insulated from anything that goes on in the broader economy. This is something that should appeal to any income-focused investor due to the security that this stability affords the dividend.

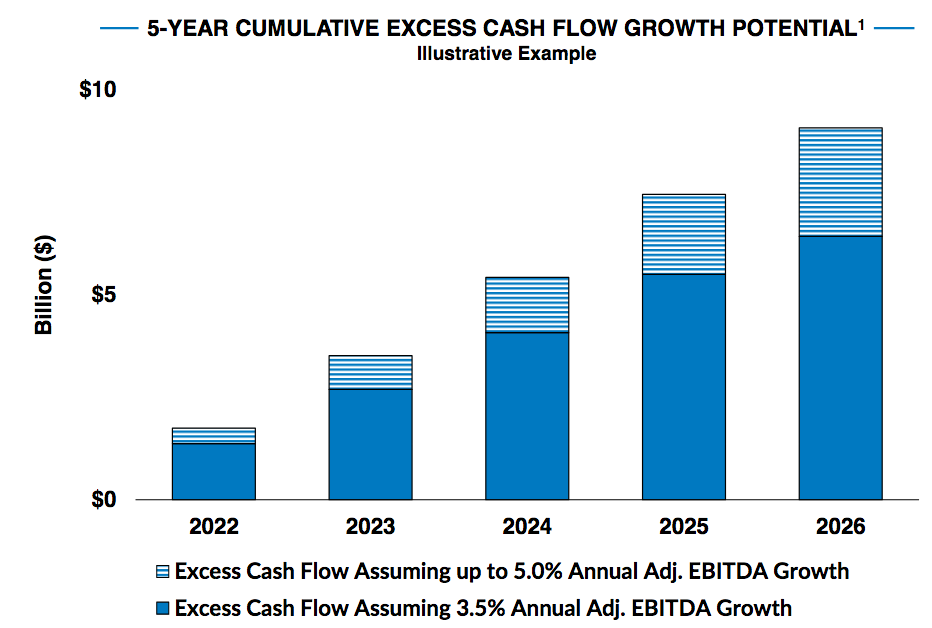

Prior to 2015 and the oil bear market, many midstream companies would pay out all of their cash flows to their investors in the form of dividends or distributions and then fund their growth by selling equity on the capital markets. The problem is that this does not work when nobody wants to buy the equity, as was the case at that time. This prompted most of these companies to change their business models into something that is more self-sufficient. Distributions were cut by many companies and they began to retain some of the cash that they generate with the intent of using that excess cash to finance their capital expenditures. The Williams Companies is no exception to this and in fact over the next five years, the company will have generated more than $5 billion in excess of its capital spending needs:

Source: The Williams Companies

The company has not stated what it will use this excess cash for. Although it could conceivably use it to pay a higher dividend, this calculation already assumes annual dividend hikes that are in line with cash flow growth. Thus, at the moment, it appears that this money will simply be sitting in the bank. This is not necessarily a bad thing though as it gives the company the flexibility to take advantage of opportunities that may present themselves at some point in the future but it cannot foresee now. This is certainly a much more desirable situation than having to seek out external financing for any future opportunity since the market may not be amenable to providing that financing at the desired time.

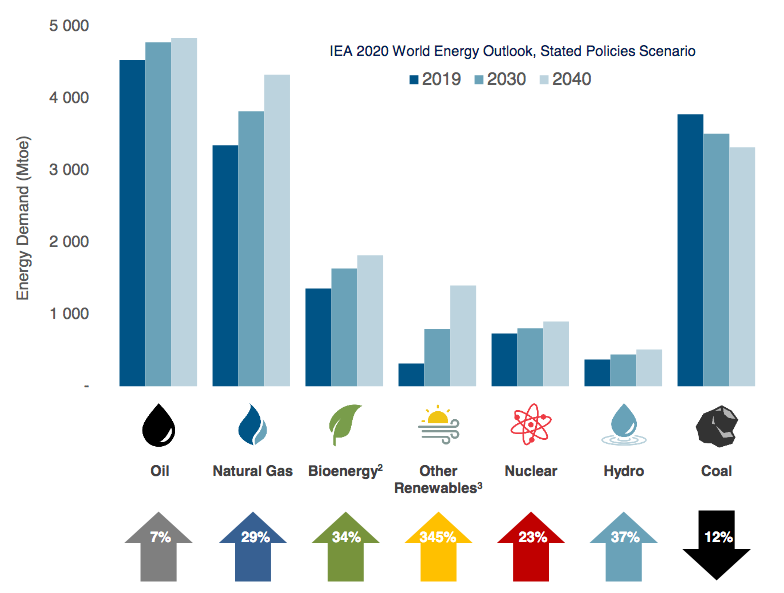

Fundamentals Of Natural Gas

As already mentioned, The Williams Companies is a midstream company focused on the transportation of natural gas. As such, it would make a certain amount of sense for us to look at the fundamentals of this particular hydrocarbon. Fortunately, these fundamentals are quite positive. According to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years:

Source: International Energy Agency, Pembina Pipeline (PBA)

Perhaps surprisingly, much of this demand growth is being driven by global concerns about climate change. These concerns have caused governments all over the world to impose a variety of policies that are intended to reduce the carbon emissions of their respective nations. One of the most popular of these strategies is to encourage the retirement of old coal-fired power plants, which are then placed with modern natural gas-burning ones. This is because natural gas burns much cleaner than other fossil fuels and is far more reliable than renewables given today’s technology.

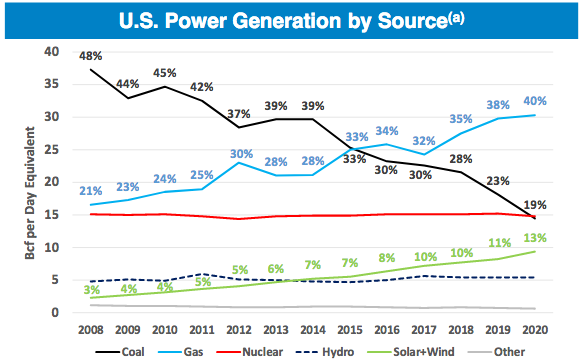

Although this is a global trend, we have certainly been seeing it in the United States. Over the past twelve years, natural gas has gone from providing 21% of the electricity consumed in the United States to providing 40%:

Source: U.S. Energy Information Administration, Range Resources (RRC)

This seems likely to continue as the nation’s utilities have already announced the retirement of 47 gigawatts of coal-fired generation capacity over the 2020-2025 period. It is highly unlikely that renewables alone will replace all of this since they do not have the necessary reliability. As such, at least some will likely be replaced with natural gas turbines, which will boost domestic natural gas consumption. In fact, the natural gas demand from domestic electric utilities increased by 3.0% in 2020 compared to 2019 levels.

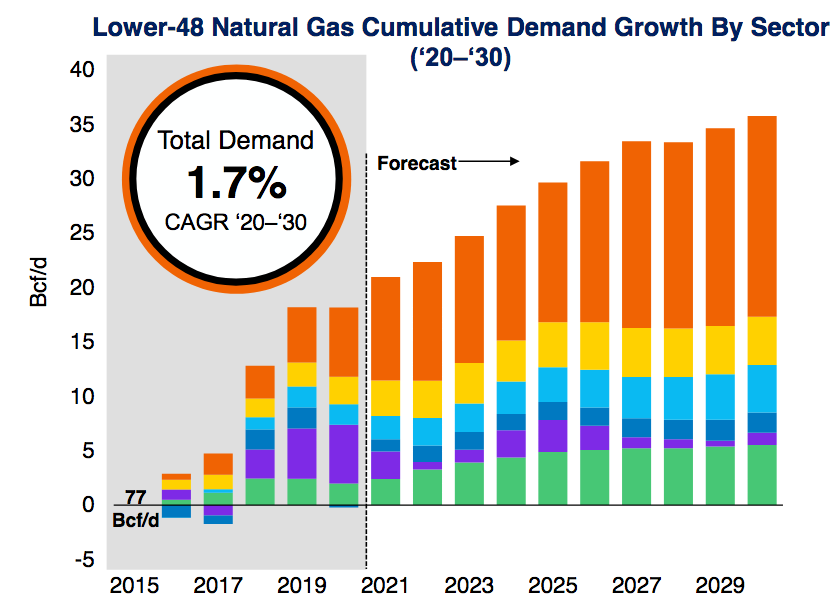

Another major source of demand for natural gas comes from the export sector. As already shown, the demand growth for the fuel is international. However, the United States is one of the only areas in the world that has the ability to significantly increase its production of natural gas. As such, it seems likely that the nation will increase its production in order to satisfy this demand and indeed numerous companies have announced their intent to do exactly this. When we take the growing export demand into account, the amount of natural gas that needs to be produced in the United States can be expected to grow at a 1.7% compound annual growth rate over the 2020-2030 period:

Source: Wood Mackenzie, The Williams Companies

The Williams Companies can be expected to benefit from this even though it does not actually produce any resources. This is because someone will need to transport the incrementally higher quantities of resources to the market where they can be sold and that is exactly what this company does. As The Williams Companies makes its money based on volumes, the resulting higher volumes will result in growing cash flows for the company and directly benefit us as investors.

Financial Considerations

As is always the case, it is critical to examine the way a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid. In addition, the company needs to make regular payments on its debt in order to remain solvent so should some event occur that causes its cash flows to decline, the company may be pushed into financial problems if its debt is too high. Although midstream companies typically have remarkably stable cash flows, bankruptcies have certainly happened in the sector before.

The usual way that we examine a company’s financial structure is to look at a metric known as the net debt-to-equity ratio. This ratio tells us to what proportion the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us to what degree the company’s equity will cover its debts in a bankruptcy or liquidation, which is arguably more important. As of September 30, 2021, The Williams Companies had $22.148 billion in net debt compared to $13.919 billion in total equity, which gives it a net debt-to-equity ratio of 1.59. This is admittedly higher than the 1.0 maximum that I like to see. It also looks to be a much more aggressive financial structure than most of its peers have:

|

Company |

Net Debt-to-Equity |

|

The Williams Companies |

1.59 |

|

Kinder Morgan |

1.03 |

|

Enterprise Products Partners (EPD) |

1.06 |

|

Energy Transfer (ET) |

1.27 |

|

Enbridge (ENB) |

1.09 |

The fact that the company’s net debt-to-equity ratio is significantly higher than that of its peers could be a sign that the company is using too much leverage. This is something that could pose a problem in the event of some sort of long-term adverse event.

With that said, the company’s ability to carry its debt is much more important than simply the raw amount of debt. The usual way that we judge this is by looking at the company’s leverage ratio, also known as the net debt-to-adjusted EBITDA ratio. The Williams Companies looks quite financially strong in this regard as its ratio at the end of the third quarter was 4.04x. Analysts generally consider anything under 5.0x to be reasonable and sustainable but I like to see the ratio at a much lower 4.0x in order to be comfortable with the investment. The Williams Companies expects its ratio to be down to 4.0x by the end of the fourth quarter as a result of its continual growth, which puts it in a very good position to carry its debt even if some reversal happens in its fortunes. This is quite nice to see.

Dividend Analysis

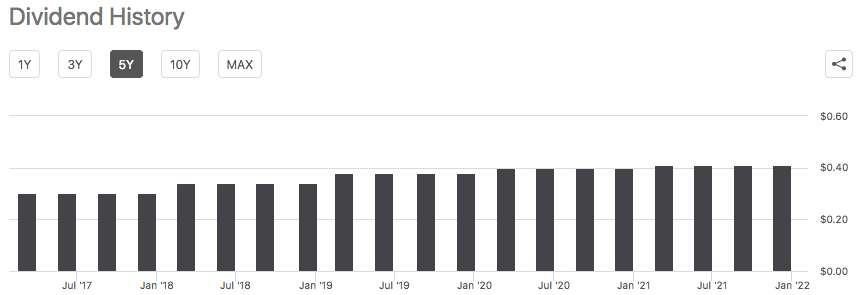

One of the reasons that investors like to purchase shares of midstream companies is that these firms tend to have fairly impressive dividend yields. The Williams Companies is no exception to this as the company currently yields 6.12%. As mentioned earlier, the company has a long track record of delivering growth and it has naturally grown its dividends over time as its cash flows grew:

Source: Seeking Alpha

A history of dividend growth is something that we like to see because it both allows us to be confident in the condition of the company’s finances as well as helps our incomes overcome the ravages of inflation. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut its dividend. This scenario would both reduce our incomes and likely cause the share price to decrease, which would deliver a double blow to investors.

One metric that we can use to determine the company’s ability to cover its dividend is looking at its available funds from operations. This is analogous to distributable cash flow, which is used by other midstream companies. It basically tells us the amount of cash that is generated by the company’s ordinary operations that is available for distribution to the common stockholders. In the third quarter of 2020, this figure was $1.080 billion but the company only paid out $498 million in common stock dividends, which gives it a 2.17x coverage ratio. Analysts generally consider any ratio above 1.20x to be sustainable but I like to see it at a higher 1.30x in order to add a margin of safety to the investment. As we can clearly see, The Williams Companies easily covers this requirement. It thus does appear that this dividend is reasonably safe.

Conclusion

In conclusion, The Williams Companies seems to have a great deal to offer anyone seeking a 6.12% yield with the potential for forward growth as the natural gas story continues to play out. The company did an excellent job weathering through the troubles that the sector faced in 2020 and is now well-positioned to prosper off of its renewed prosperity. Overall, the company appears to be a buy, despite the fact that it is a bit more levered than some of its peers.

Be the first to comment