Cylonphoto

Photronics, Inc. (NASDAQ:PLAB) is a super-high-margin photomask technology type business. Today the stock is getting absolutely clobbered following Q3 results that seemingly disappointed the Street. We believe this a gross overreaction to slightly more conservative Q4 guidance than the Street was hoping for.

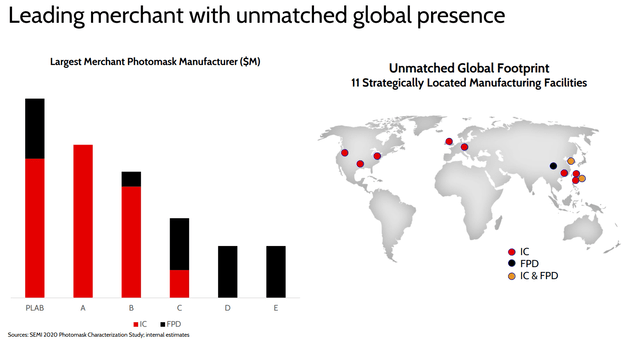

It is our opinion that this company is well-positioned for future growth and is continuing to benefit from a very strong pricing environment. While month-to-month chip demand will fluctuate, they are in everything. If chip shortages continue to be an issue, the sky is the limit. But this company is the world’s leading manufacturer of photomasks for semiconductor companies, and it is a sector that is so beaten down, we think you have to start being contrarian and buy.

Now, the company has a very compelling investment thesis if you ask me. It is in growth mode, despite chip demand somewhat suffering the past 6 months. The sector is in a bit of a mini downturn, but demand is only going to rise. We like buying this dip.

Future growth will continue to depend on international trends, so that is one major risk factor to be aware of. While international issues can impact investments in the short run, in the long run, we are seeing the demand globally skyrocketing as major companies continue to see increased demands for photomask and integrated circuit tech.

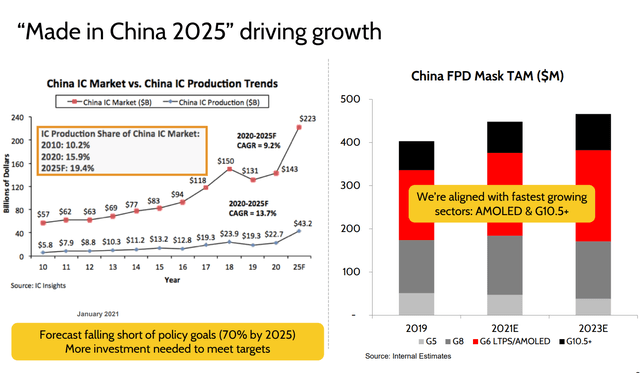

The global growth strategy has revolved around expansion into new markets and leveraging China’s Made in China 2025 initiative. This has paid off as the growth has been stellar. The 2025 Made in China is driving a larger addressable market while they are in the fastest-growing subsector demand.

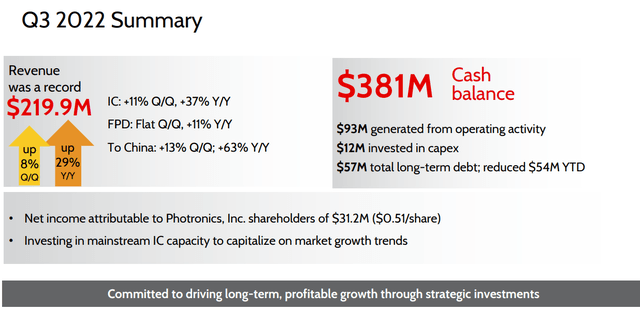

When we look at Q3 performance, we were impressed.

Revenue was $219.9 million, up 8% sequentially and 29% year-over-year.

Net income was $31.2 million, or $0.51 per share, up 82% over last year. This is so strong. Integrated circuit (or IC for short) revenue in Q3 was $161.3 million, up 11% sequentially and 37% compared with last year while flat panel display (or FPD) revenue was $58.7 million, flat from last quarter and up 11% over the same period last year.

The company is also very shareholder-friendly, buying back shares. The organic growth is also being funded by cash flows.

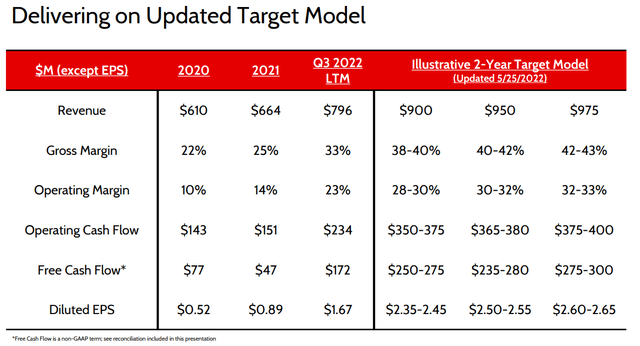

As we look ahead, the company is modelling some serious numbers. You have to love this growth.

This is some solid growth. For EPS to move to $0.52, to $0.89, to as LOW AS $2.35 in 2024, that is just impressive growth and means the stock is cheap because of this growth.

As you can see the growth metrics are impressive. Revenue growth of 20% is strong, while mid teens moving forward this year may seem light, it is expected we will see a ramp up.

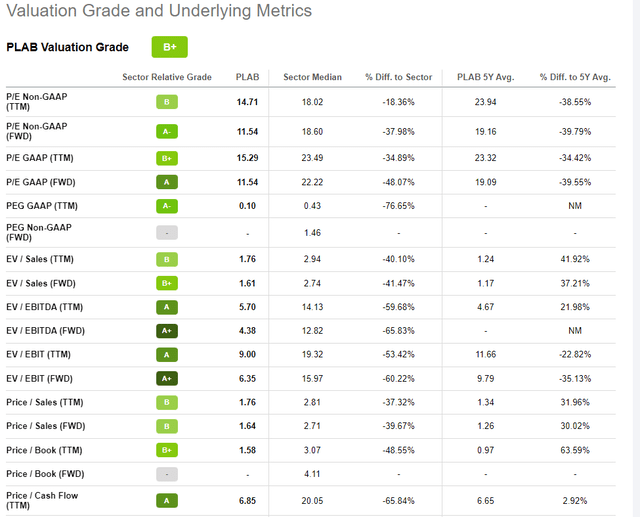

From a valuation standpoint, we have found another gem. A rare combination of value and growth. We love stocks like this.

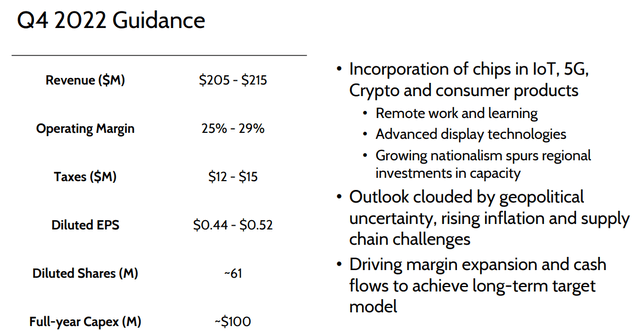

This is impressive. In the very near term, growth remains strong, but it is the Q4 guidance triggering this ridiculous selloff.

The CAPEX is funding organic growth, and the margins are strong. There remains inflation and uncertainty, but growth is pretty strongly evident here. But here is the problem, the guidance was less than consensus. And not by much. The Q4 guidance reduction in EPS suggests annual EPS could come in at worse 10 cents less than expected… and the stock has fallen off 24% at the time of this writing to $16.50. This is a buy. This is still a 45% increase from last year, and for the year a double in earnings.

Why was there concern? The conference call has the answers, as the CEO stated:

Recently there has been some slowdown in customer activities more in high end than mainstream; however, our experience has shown that customers will embrace mega trends in the market that drive development of new IC and FPD designs, such as the rollout of 5G telecommunications, the expansion of electronics in automotive applications, and of course the continued expanding need for consumer electronics. As a result, we believe the negative impact of any slowdown at Photronics will be minor, as reflected in our Q4 guidance… The supply chain impact on our output actually is very minimal. We do see some small shortage in FPD blank supply.. At this moment, the mainstream product, we don’t see any slowdown in customer [indiscernible] activities; however, we do see a little bit of push-out in the high end mass [indiscernible], not necessarily in all customers, but we do see some slowdown

So we think this provides color, that the Q4 may see some slowdown. We do not know if there is a prolonged slowdown, that could be a risk, but the company believes it will see ongoing demand and strong growth over the next three years. The company does not provide full-year guidance but quarter-to-quarter only due to the limited runway in backlog and customer purchases. That may make some investors nervous, in conjunction with the slight reduction.

The question you need to ask yourself is, when do you make the most profit? When you buy low and sell higher. This stock is getting crushed on a slight disappointment on Q4 guidance, despite said guidance suggesting massive growth from last year, while trading at about 9X FWD EPS. Seems a bit silly to us. Now, if the entire computing and auto industry and every other industry using chips suffers for a year or two in a massive recession, then PLAB stock won’t be the only one getting crushed. Based on the available news, we have bought heavily here today on this quarter news, which beat estimates on the top and bottom line, by the way.

Be the first to comment