shapecharge/E+ via Getty Images

Investment Thesis

MongoDB (NASDAQ:MDB) reported an earnings result and guidance that changes everything.

As we headed into its earnings results last week, I said,

I remain of the opinion that with investors so bearish, flooding in negative sentiment, there’s bound to be a bounce higher in MongoDB.

And that’s what happened here. MongoDB stated that not only it’s going to continue to grow fast, but it’s now going to be delivering profitable growth.

With that intro in mind, let’s jump into it.

What’s All This Usage About?

Atlas is the name of MongoDB’s cloud platform. The future of MongoDB is tied up to its Atlas business. It’s a public cloud, meaning that its customers are not tied down to one cloud provider. They can use Amazon’s AWS (AMZN) or Microsoft’s Azure (MSFT).

During the quarter, customer growth reached 26% y/y. That means that the bulk of this quarter’s revenue outperformance comes from customers’ usage. This implies that MongoDB’s business model is largely a consumption-based business model.

Personally, I’m not a fan of consumption-based business models. Because in these business models, when your customers use your platform a lot, they get left with a spike in their bills, as the bill typically comes in arrears.

In my opinion, this deters your own acquired customers from further using your own platform. Something to consider.

On yet the other hand, let’s keep something in mind. A significant proportion of those that use Atlas are large enterprises in the Fortune 500, as well as, companies in financial services. These businesses have the wherewithal to pay for any software that increases productivity and delivers ROI.

Revenue Growth Rates Come In Stronger Than Expected

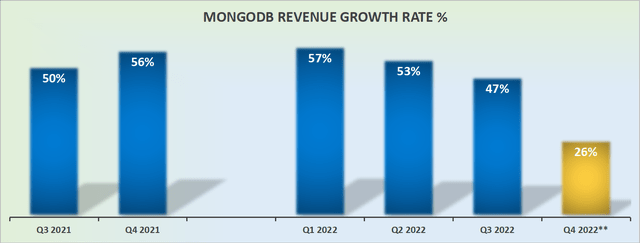

MDB revenue growth rates

As we headed into fiscal Q3 2023 earnings, MongoDB was guiding for 34% y/y revenue growth rates. That’s what investors had braced themselves for. It made sense in the context that we are in. Cloud migration stories across the sector had nearly all been exhibiting the same symptoms, that of a sales elongation cycle.

Getting large enterprises to spend more on cloud infrastructure was still happening. But it was taking longer. And if the business was an SMB, cloud companies had been discussing material weakness.

So, that’s the backdrop. And yet, when MongoDB actually reported results, it beat analysts’ estimates by more than 9 points!

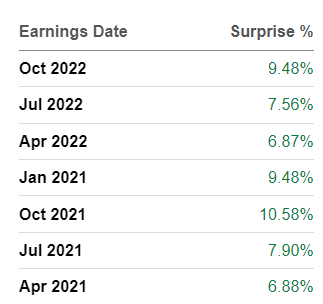

MDB revenue surprises

So, now, as we look ahead to Q4 2023, investors believe that when MongoDB ultimately reports its Q4 2023 results, its revenue growth rates will probably end up coming in at +30% y/y.

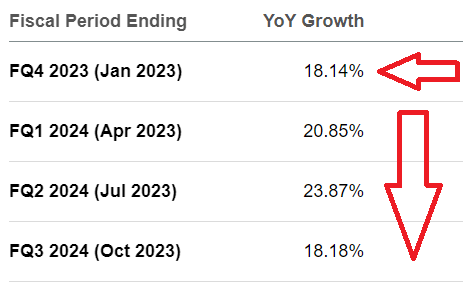

And if you think about the overall level of expectations, see below:

MDB revenue estimates

This is what analysts were expecting from MongoDB. For its revenue growth rates to have fizzled out. For MongoDB’s growth rates to be somewhere between sub 25% to sub 20%. And not for approximately 30% CAGR to potentially be on the cards.

And yet, that’s not where MongoDB shined best in this report. That’s what we’ll discuss next.

Profitability Profile Changes Dramatically

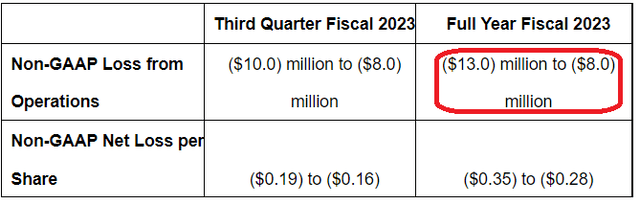

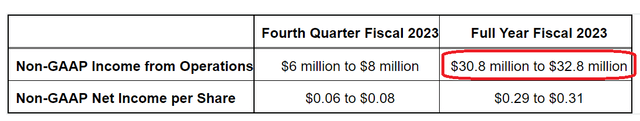

Headed into MongoDB’s Q3 results this is what the guidance was. The red box is what we need to pay attention to.

MDB Q2 2023

What you see is that the year’s non-GAAP operating profits were going to finish on the negative line. Nothing to get overly excited over.

And this is what MongoDB’s guidance for fiscal 2023 now looks like.

MDB Q3 2023

There’s a dramatic shift here in the story. We are now looking at a fast-growing company, that’s profitable. This meaningfully changes the investment thesis.

Particularly when we consider MongoDB’s valuation.

MDB Stock Valuation — ~600x P/E to 25x P/E

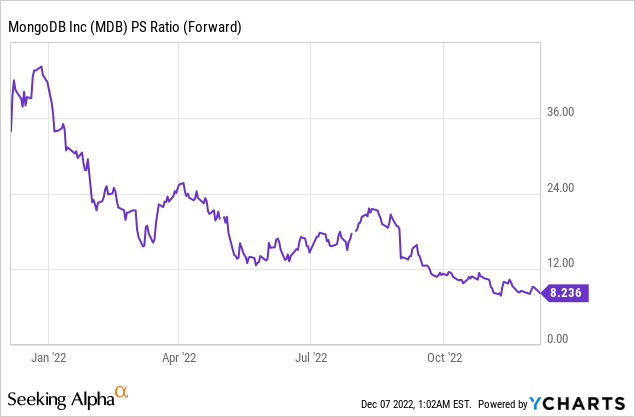

Before getting stuck into its valuation, allow me to share MongoDB’s historic valuation.

Approximately 1 year ago, MongoDB was priced more at roughly 38x forward sales. Wall Street loved the name. Yet, it had no near-term prospects to turn a profit.

Now that it’s down, including the after-hours bounce, more than 65% from its highs, management is utterly determined to turn on the profits spigot.

So, yes, thinking about MongoDB as +600x this year’s non-GAAP EPS will seem shocking to many investors.

But if you look ahead, and you think that MongoDB can probably continue growing at close to 25% CAGR for at least 5 years and reach $5 billion in revenues in about 5 years and that it could in time see about 10% operating margins, that would see MongoDB reporting about $0.5 billion of non-GAAP profits.

And at that point, paying around 25x non-GAAP operating earnings won’t seem excessive. Not at all.

The Bottom Line

Last week I said,

The main issue facing MongoDB, at its core, isn’t the lack of growth. It’s really the fact that the business remains unprofitable. But when management sees more than $1 billion worth of [their own] equity go up in smoke in 12 months, I can assure you that they are making all the necessary steps to get this business to be profitable, sooner, rather than later.

That paragraph above succinctly expresses everything that I’m saying. MongoDB is now going to be increasingly focused on profits over growth.

Be the first to comment