tonaquatic/iStock via Getty Images

Today, we take a look at interesting company in a unique niche of the healthcare market that we have rarely explored. An analysis follows below.

Company Overview:

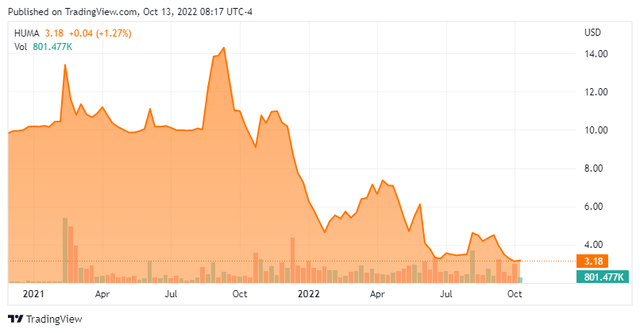

Humacyte, Inc. (NASDAQ:HUMA) is a Durham, North Carolina based clinical-stage life sciences concern focus on the development of bioengineered regenerative human tissues that can be implanted off-the-shelf into any patient without the need for immunosuppressive medication. The company currently has three vascular tissue constructs undergoing evaluation in the clinic, two of which are in Phase 3 trials. Humacyte was founded in 2004 and went public in August 2021 via a merger into special purpose acquisition company Alpha Healthcare Acquisition Corp with its first trade transacting at $10 a share post-merger. The stock trades just $3.00 a share, equating to a market cap of approximately $325 million.

Platform

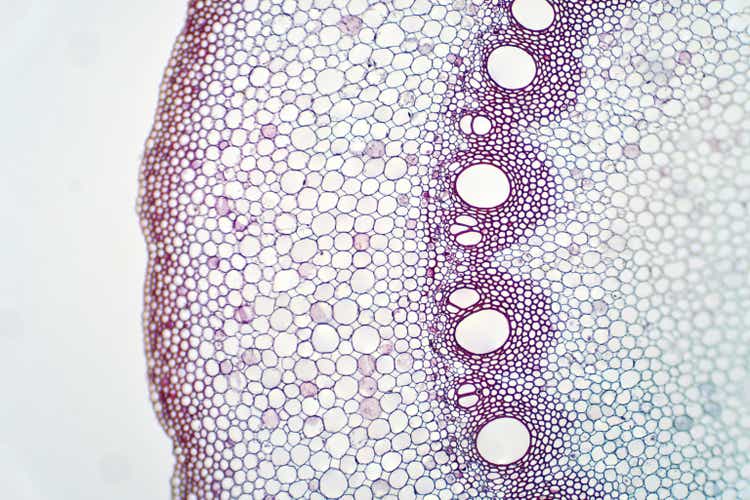

The company’s current pipeline consists of output from its novel development platform that employs human aortic vascular cells that are isolated from donor tissues and cryopreserved. The working cell stock is expanded using traditional cell culture techniques and then transferred onto a biocompatible, biodegradable polymer mesh in the shape of a blood vessel, all inside a bioreactor bag. The cells proliferate to form a bioengineered blood vessel as the polymer mesh degrades. It is then decellularized using a proprietary combination of solutions, producing a human acellular vessel [HAV] that will not induce immune rejection following implantation. All of these processes occur in the aforementioned bioreactor bag, which is then shipped to hospitals and other critical care facilities where it can be stored at refrigerated temperatures and opened when a patient needs HAV transplantation. This a potentially paradigm-changing alternative to autologous vein harvesting, which is a time-consuming and difficult procedure with a ~40% morbidity rate that includes wound infection, pain, and reduced patient mobility; or expanded polytetrafluoroethylene (ePTFE) grafts, which are effective but are dogged by high infection rates and lower efficacy after one year.

In theory, the company’s platform has applications beyond just vascular tissue constructs, including complex tissue constructs or complex organ systems such as the pancreas and lungs. Humacyte is pursuing some of these other opportunities in the preclinic.

HAV Pipeline

As for the company’s clinical portfolio of HAVs, they are being studied in late or mid-stage trials in three areas: trauma repair; arteriovenous [AV] access; and peripheral arterial disease (PAD).

Trauma. For vascular trauma, Humacyte’s HAV is undergoing evaluation in a single-arm, open-label, unblinded Phase 2/3 trial (V005) in ~75 patients with endpoints including 30 and 90-day patency – i.e., the HAV is still “open” and functioning – infection, and amputation relative to historical database comparators for saphenous vein harvesting and ePTFE grafts. According to management, results have been encouraging to date, with “low rates of amputation,” “low rates of HAV infection [<2%] despite multiple implants into contaminated wound beds,” and “zero instances of HAV rejection.” However, specifics have been lacking as trial enrollment, which initiated in 2018, has been slowed by the pandemic, the random nature of trauma occurrence, and the ability to find patients that are both acutely injured and not eligible for saphenous vein harvest or ePTFE grafts.

In fact, Humacyte is opening up additional sites in Israel to speed the process. It is also offering its HAV technology to wounded Ukrainian soldiers on a humanitarian basis – and not part of the trial. Management expects enrollment to complete by YE22 with top-line data and a BLA submission to follow shortly thereafter with the hope of approval in 2H23. However, with only 55 (of ~75) patients enrolled as of August 12, 2022, these timelines appear a bit shaky.

For the trauma indication, Humacyte’s HAV has received a priority designation from the Department of Defense.

If approved, the market would be significant with civilian central or peripheral vascular injuries afflicting ~75,000 Americans annually, accounting for more than 20% of the ~150,000 injury-related deaths in the U.S.

AV Access. Although the trauma indication may be the first to be approved, AV access for hemodialysis has been a focus of Humacyte clinical trials since 2012. For those unaware, AV access is a surgical procedure to create a direct connection between an artery and a vein, bypassing the capillaries. As it relates to hemodialysis, there are two types of ‘bypasses’. AV fistula uses a patient’s own vessels when the vein doesn’t have strong enough blood flow to accommodate the needles required for dialysis; the other is ePTFE grafts. AV fistulas, which are employed in ~64% of ongoing dialysis access procedures, have a 40% failure rate – i.e., they fail to mature (no patency) and are thus unusable for dialysis. ePTFE grafts, with their aforementioned issues, are used in ~17% of ongoing access procedures. Catheters, which are generally used to initiate dialysis, comprise the ~19% balance but are plagued by infection rates up to 200% per patient year. Humacyte believes its HAV, which has demonstrated <1% per patient year infection rates, can decrease both infections and dialysis access failures, which would improve outcomes for the 160,000 existing or new dialysis patients requiring a new AV access in the U.S. annually.

Over five trials comprising 372 total patients and more than 805 patient-years of exposure (as of December 31, 2021), Humacyte’s HAVs have demonstrated 95%-100% primary patency rates (i.e., patients without interventions) at 30 days and 84%-100% secondary patency rates (i.e., functioning with or without intervention) at six months. Furthermore, there have been zero clinical rejections of any HAV in any trial.

The only AV access trial that is still enrolling patients is a Phase 3 study (V007) that is evaluating Humacyte’s HAV versus AV fistula in ~240 end-stage renal disease sufferers. Endpoints will include patency and safety measures. Top-line readout will occur ~12 months after the last patient is enrolled, which should occur before YE22. If all goes to plan, a BLA will be filed before YE23.

It should be noted that in an earlier 355-patient Phase 3 trial (V006) versus ePTFE grafts, Humacyte’s HAVs demonstrated lower rates of infection (p=0.04) and slightly better secondary patency at six and twelve months but failed to demonstrate non-inferiority at 24 months (67% vs 74% for ePTFE).

This result derailed plans to file for FDA approval back in mid-2019. Prior to this setback, Humacyte had received a $150 million investment from Fresenius Medical Care (FMS), the largest provider of dialysis services in the U.S., as part of a larger agreement with the latter obtaining rights to develop HAVs (and subsequent modifications) outside of the U.S. and Europe and commercialize it ex-U.S. If approved, Humacyte would receive a profit share outside the U.S. while Fresenius would receive a share of the domestic net sales. If approved for trauma, management plans to onboard a national sales force of ~20.

Humacyte’s 6-millimeter HAV for use in AV access has received Fast Track (2014) and first-ever Regenerative Medicine Advanced Therapy designations from the FDA (2017).

PAD. A bit further down on the company’s priority list is PAD. In two Phase 2 studies (one of which began in 2013) involving 35 patients, the results were in line with other conduit modalities such as autologous saphenous vein harvest and ePTFE, while demonstrating no HAV-related infections or amputations in the patient population. Humacyte has been mum about next steps, although it is likely looking to partner up.

The same can be said regarding preclinical indications such as pediatric heart surgery, coronary artery bypass graft, and bio-vascular pancreas.

Humacyte Balance Sheet & Analyst Commentary:

To support its clinical endeavors, the company held cash and investments of $189 million against debt of $30 million. It also has an additional $20 million of borrowing capacity, providing it with a cash runway through 2024.

On the Street, there was a relatively recent fracture in the positive sentiment regarding Humacyte, with Piper Sadler downgrading its stock from an outperform to an underperform in May 2022. BTIG (BUY), as well as Cowen and Oppenheimer (outperforms) remain upbeat on the company’s prospects. Only Piper (at $3.50) and BTIG (at $10) have made any recent commentary regarding price targets.

Director Gordon Binder has become a fan of Humacyte’s technology, initiating a position of 110,000 shares between $4 and $4.40 on September 1-2, 2022.

Verdict:

Humacyte does not face any late-stage clinical competition for its HAV technology, instead trying to simply overcome established autologous vein harvests and synthetic grafts. This market dynamic will work in the company’s favor as its trials are slow to enroll. With HAVs implanted in ~500 patients with more than 1,000 patient-years of follow up across seven clinical trials, it is clear that they do not induce an immune response, resist infection, and perform as well (if not better) than the current treatment paradigms. The readouts set for late 2022 (in trauma) and late 2023 (in AV access) should confirm the company’s prior trial data and set a positive tone for Humacyte.

With production capacity supporting net sales of ~$1 billion already in place, there is significant upside potential. There are obvious clinical (binary) risks and uncertainty around the company’s first BLA submission, as its HAVs are essentially medical devices but regulated as biologics. However, the risk-reward is asymmetrical and supportive of mimicking the insider.

With little in terms of catalysts before year-end, and a very poor overall market environment, HUMA probably merits a small “watch item” holding at best for now. However, the company’s story is intriguing enough that we will probably circle back on it sometime in the first half of 2023.

Revenge, the sweetest morsel to the mouth that ever was cooked in hell.”― Walter Scott

Be the first to comment