jetcityimage/iStock Editorial via Getty Images

Thesis

PepsiCo’s (NASDAQ:PEP) multi-year strategy to diversify its sources of income makes the company resilient to falling demand for a particular type of product or brand. PepsiCo continues to invest heavily in effective marketing and expanding its presence on store shelves, which should have a positive impact on the company’s profit growth in the future.

Product line expansion

The company aims to become the absolute global leader in the beverage and snacks industry through deep penetration into key markets, expanding the product line and thus increasing customer focus.

In recent years, PepsiCo has added production lines, thereby offloading the production of some products, and has also occupied a niche in the form of a variety of packaging. With a large number of brands, the company can package a variety of popular products and increase customer loyalty, which retailers love.

The company is also pushing its healthy offerings: a line of sugar-free, low-salt drinks and baked chips.

New products include Hard Mountain Dew, a joint venture with Boston Beer Company, Cheetos Mac and Cheese, and Baya Energy in a collaboration with Starbucks. Such products allow PepsiCo to sell goods to different categories of customers for different reasons, and therefore, to diversify the product offer and reduce the risks of a decrease in demand for a particular product line.

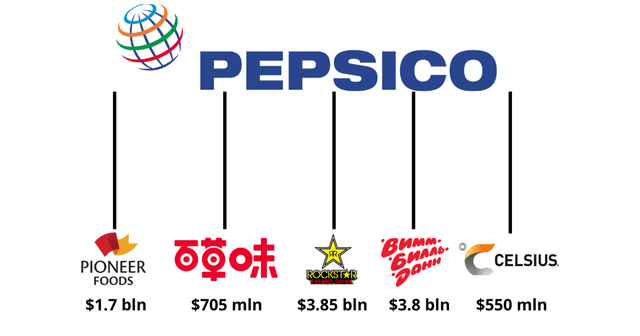

If the customers in the foreign market do not welcome PepsiCo brands, then the company expands geographically through M&A deals. In 2020, Be&Cheery was bought out, one of the largest DTC snack companies in China, which offers a wide range of products consisting of dried fruits, nuts, and meat snacks. In early 2021, a major stake in Senselet Food Processing, an Ethiopian company with a leading position with its Sun Chips brand, was also acquired. The corporation also entered the high-margin energy drink market with the acquisition of Rockstar Energy and Celsius Holdings. The company also made other strategic acquisitions. PepsiCo spent over $11 billion in total on M&As (author’s estimates) + less notable deals.

With the increase in production lines, the volume of production increases, and hence the amount of plastic used. For several years, the corporation has been tormented by the pressure of the environmental agenda. PepsiCo was named the second worst plastic polluter in 2020. Now the company is focusing on environmentally friendly packaging. By 2025, the company has set a goal of producing packaging that is recyclable, compostable, or biodegradable.

Comparison with the main competitor

PepsiCo’s more diversified product line is its main advantage over its main competitor, Coca-Cola (KO).

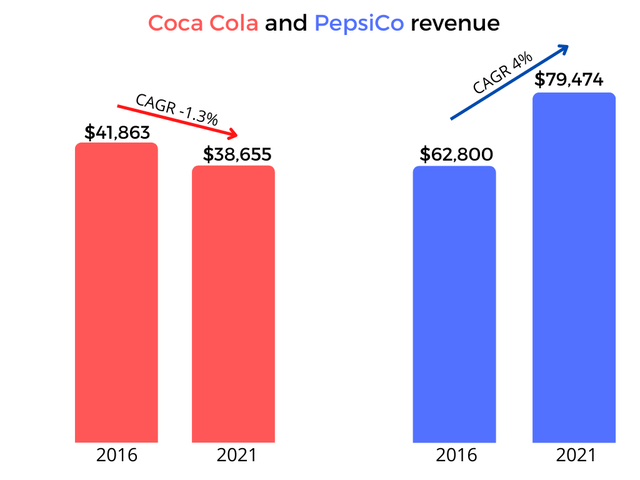

The company intends to continue to bring new products to the market in large volumes. PepsiCo’s strategy is riskier and this results in higher revenue growth.

The competitor has a more conservative approach, which, of course, allows the company to pay more attention to its own brand, but does not allow it to grow at a rapid pace.

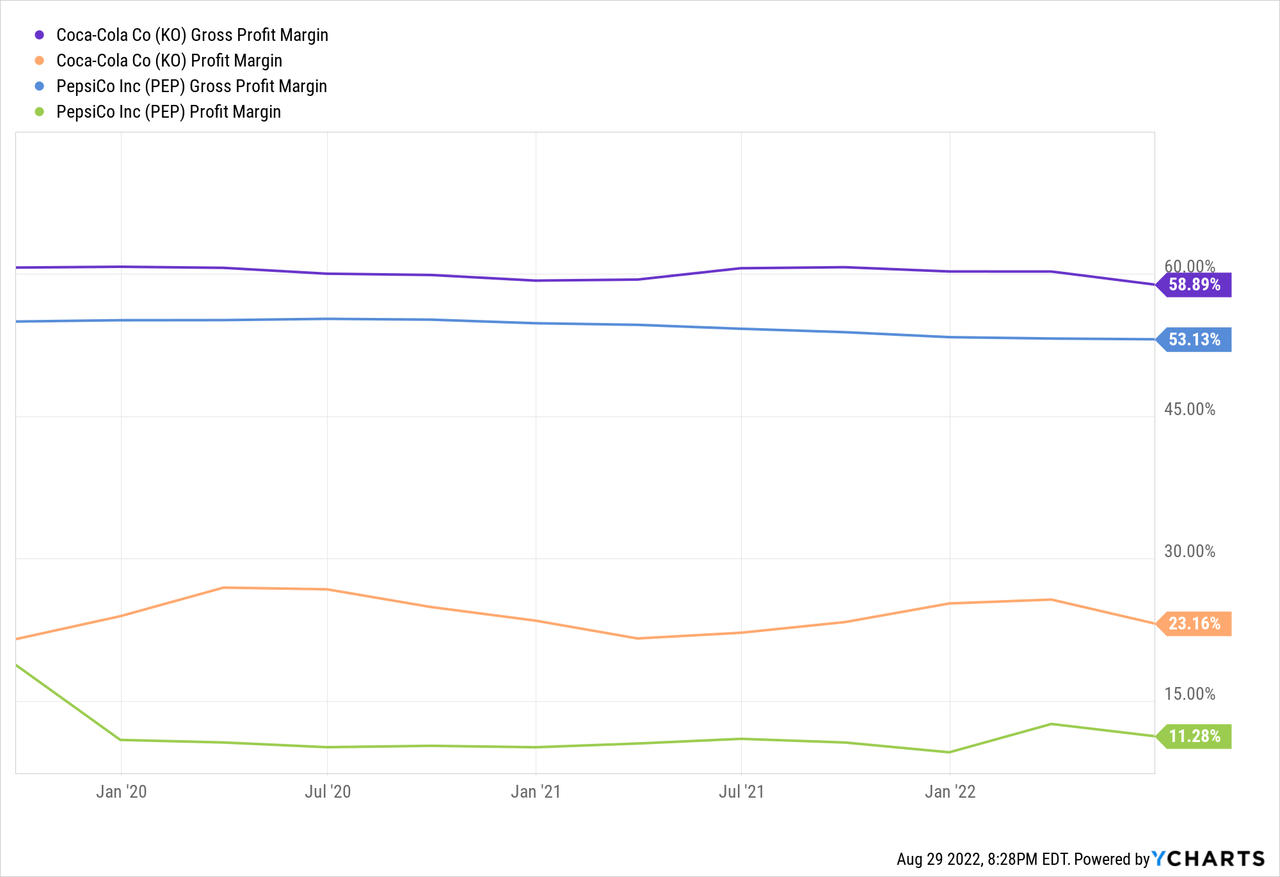

When it comes to profitability, Coca-Cola comes out ahead.

In many ways, PepsiCo currently lags behind key competitor Coca-Cola. But PepsiCo’s key advantage remains higher revenue growth, which could make the company an industry leader within 5-10 years. The company will then use its size to achieve organic growth across all of its brands through increased investment, greater customer focus, and cost optimization through the use of technology globally and locally.

Valuation & cost reduction plan

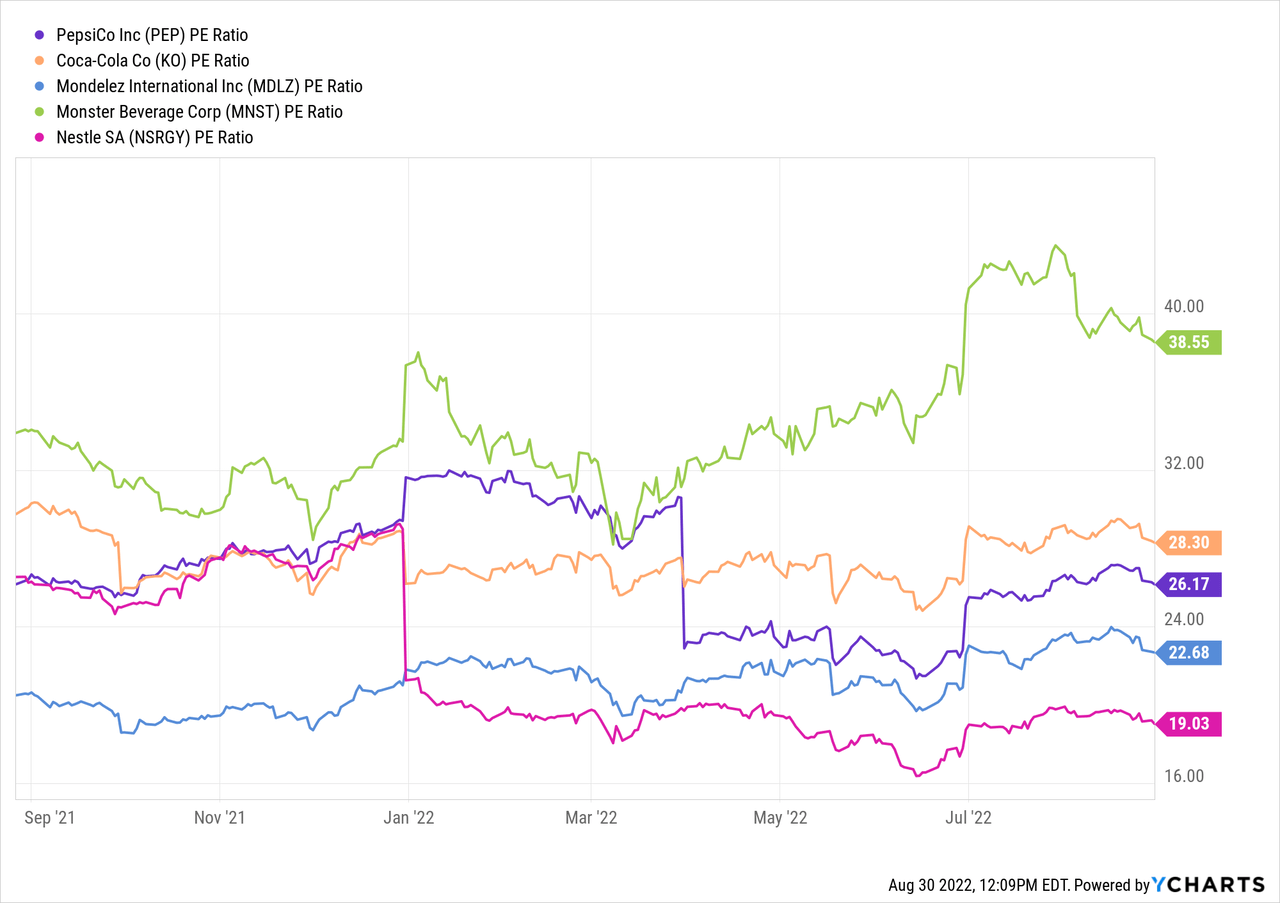

The company appears to be fairly valued in terms of P/E and is even valued almost as highly as its major competitor.

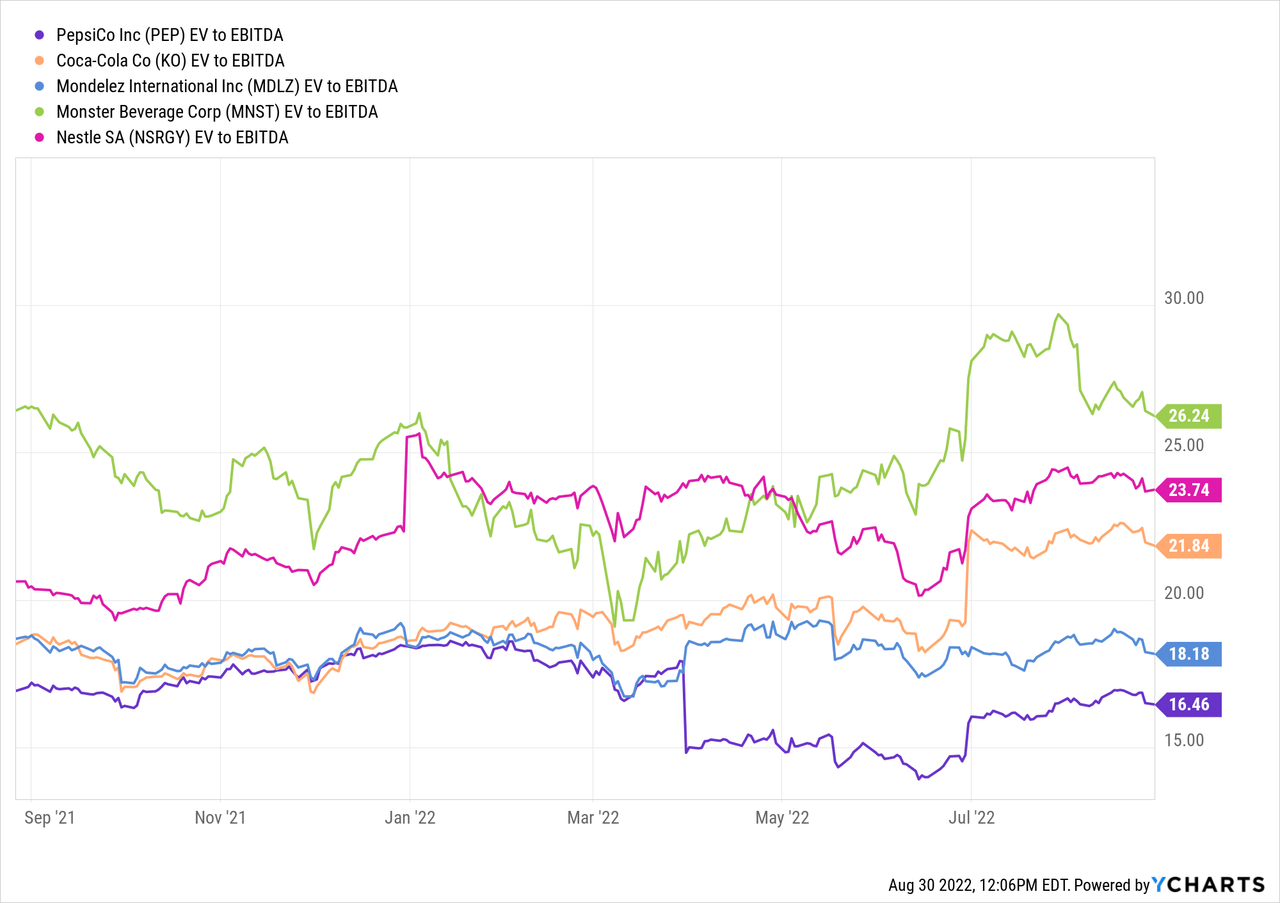

However, PepsiCo has historically been valued below competitors in terms of EV/EBITDA. But now the valuation has reached almost absurd values. The current multiple is 16.4x versus the industry average of 22.4x.

The company is actively reducing operating expenses. The manufacturer continues to automate and digitize logistics to reduce congestion and speed up delivery, increasing profits. A holistic cost management system, according to the company, will save $1 billion per year in costs through 2026. By cutting OpEx, the company raises EBITDA. This approach confirms the long-term view of the company’s shares. In terms of EV/EBITDA, the company looks undervalued by about 30%, which is a great upside potential.

Impact on dividends

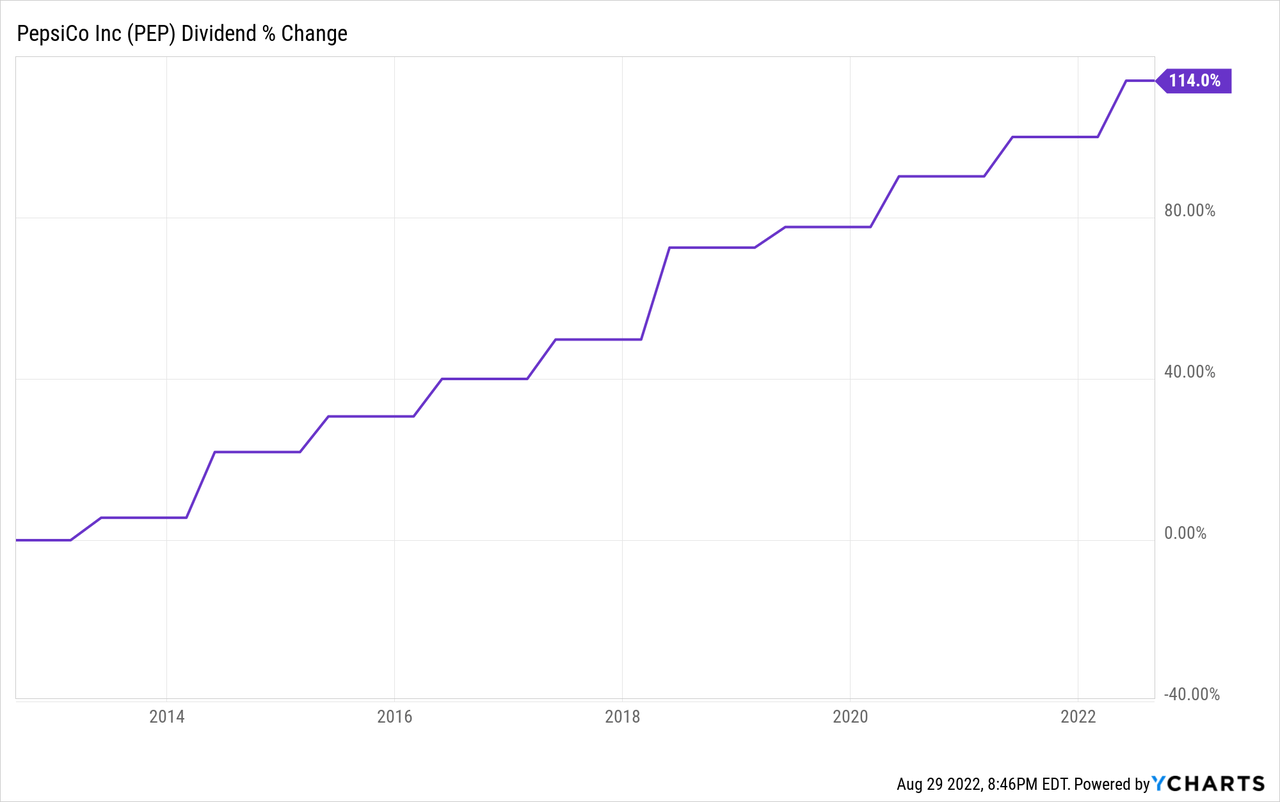

PepsiCo has officially become a dividend king, raising investor payouts for the fiftieth time.

I don’t see the risk of a slowdown in dividend payout growth. The strategy the company has chosen reduces exposure to the failure of individual products and declining interest in brands. However, one must understand that PepsiCo is a long-term story and one should not expect an incredible increase in margins in the coming years that would lead to higher dividend growth.

Risks

Among the structural market changes, the company notes the risks associated with the consolidation of retail in North and Latin America, as well as in Europe. For PepsiCo, this means reduced bargaining power. Small retailers may not be able to cope with increased competition and increasing costs, become insolvent or reduce purchases.

Regulators can put pressure on the company through the notorious tax on sugar. Governments are also influencing consumer trends through initiatives to mandate labeling for sugar content and limiting the legal age of sale. As of August 2022, there is no official consensus on the issue of the real harm of soda and its effect on children’s bodies. As far as I know, mandate soda labeling is almost impossible in the US as the first amendment protects the right of companies to speak commercially and a similar law was already overruled in 2019. However, this is more than possible in South American countries or some parts of the European area. For example, in Chile, after the introduction of mandatory labeling and the ban on sales to schools, sales of high-in beverages fell by 23.7%.

Conclusion

A wide market presence and diversified client offerings will allow the company to maintain a leading position in the market for carbonated drinks and snacks. The launch of new products allows PepsiCo to increase sales to new and existing customers, thereby increasing market share.

PepsiCo is a solid long-term story with a broad presence, a strong expansion strategy and it has great upside potential.

Be the first to comment