hatman12/iStock Editorial via Getty Images

After our last update on HSBC and our comment on UBS and Credit Suisse, today we are looking at Barclays (NYSE:BCS). It is the first time that we’re commenting on the British multinational bank. But it is a company that does not need any introduction, especially for those working in finance. Barclays is a global investment bank and financial services company headquartered in London.

Q1 Comment

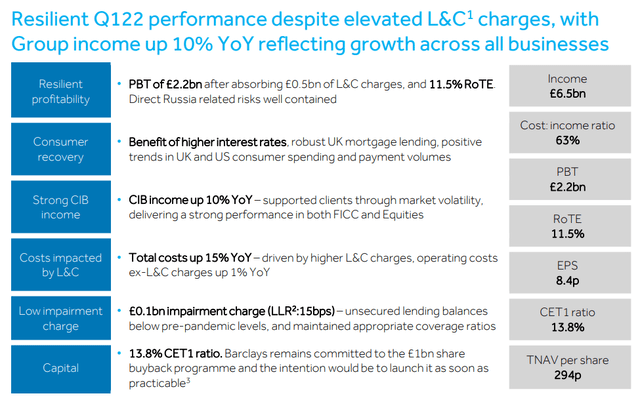

In the first quarter, the British institution recorded a net profit of £1.4 billion above market expectations which estimated £644 million. However, compared with the same period last year, the drop was 18%. Looking again at the top-line, revenues improved by 10% to £6.5 billion – this was driven by solid investment banking earnings despite peak market volatility. Operating expenses increased to £4.11 billion from £3.58 billion in the first quarter of 2021, this was due to higher expenses for the ongoing litigation in the United States.

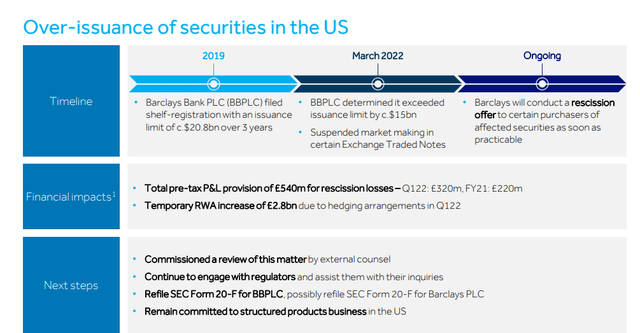

Going deeper into the investigation, last month, the UK bank announced it had sold $15.2 billion in more investment products than it was allowed. Following this, the bank set aside around £540 million which is currently under investigation by the SEC. Following the announcement, Barclays emphasized that was delaying the start of the buyback program, and it remained committed to the program with the intention to launch it as soon as possible after the termination of the deposit requirements reached with the SEC. This is exactly what happened, and the bank has recently appointed JPM to start the share repurchase.

Barclays Investigation (Q1 Results)

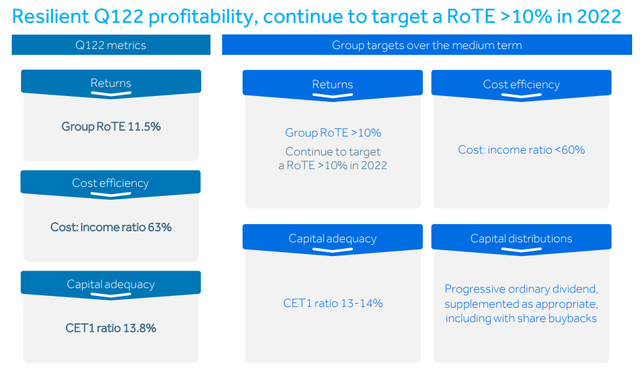

Looking at the other important financial metrics, Barclays’ CET1 ratio stood at 13.8%, down from 15.1% in the same period last year. Return on tangible equity was 11.5%, also down from 14.7% in the same quarter last year. The bank said it will continue to aim for a return on tangible equity of more than 10%. The findings come after a turbulent end to 2021, with longtime CEO Jes Staley stepping down in November following an investigation by regulators into his relationship with Jeffrey Epstein. His replacement stressed that earnings growth was driven by global markets which helped clients navigate the current market volatility caused by geopolitical and economic challenges including the devastating war in Ukraine and the impact of higher interest rates in the US and UK.

Why Are We Positive? And Our Conclusion

Having participated at the JPMorgan investor day, we understood that the Markets division is up by more than 15% in Q2 too. Our internal team believes that this is a positive catalyst for the British bank with the Markets division upgrades likely to more than offset Banking division downgrades. Our internal estimates are replicating Q1 performance with another £1.6bn results in 2Q despite the usual seasonality. We believe this can be achieved thanks to the higher increase in rates and implied market volatility. Barclays’ franchise is likely to benefit from the higher VIX environment supported by higher volumes and margins.

Secondly, the investment bank pipeline is pretty strong, and we believe that will drive upgrades. It is true that the current environment is not very favorable but the CFO seems pretty optimistic about the franchise.

For the above points, here at the Lab, we increment our 2022 EPS guidance by 5% with a forecast ROTE of 10% (higher than Wall Street consensus). With the share repurchase revival, we believe that Barclays’ underperformance will reverse thanks also to lower provisions and Markets 2022 higher guidance.

Be the first to comment