IGphotography

This week, we use AAII’s A+ Investor Stock Grades to provide insight into three department store retail stocks. With the steady decline of traditional indoor mall popularity, should you consider these three department store retail stocks of Gap, Inc., Kohl’s Corp., and Macy’s Inc.?

Department Store Retailer Stocks Recent News

The global department stores market size was valued at $117.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2022 to 2028. A department store offers to sell all the necessary merchandise under one roof and the customers are not required to go from one store to another to purchase products. This factor provides great convenience to customers and also saves them time and energy, thus driving the overall market growth.

Department stores are coming out of a tough period due to the coronavirus pandemic. At the beginning, many companies had to close stores indefinitely. From February to April 2020, department stores saw sales plunge 45%, with clothing and accessories stores seeing an 89% decline.

Recently, surging inflation, easing government stimulus and the rise of non-physical store retailers has dampened the outlook for department stores. Additionally, retailers continue to battle supply chain disruptions that began during the pandemic. These factors, combined with slowing demand, have led to retailers holding too much inventory. Many have started offering large discounts on products in order to shrink inventory levels.

Many department stores have shifted away from traditional indoor malls in favor of open-air shopping centers. Open-air shopping centers have been outperforming traditional malls recently. Additionally, indoor malls aren’t the hubs they used to be. Indoor malls have shifted to be more entertainment-based in order to attract a younger crowd and regain popularity. Despite their efforts, vacancy rates continue to rise. Companies such as Macy’s and Kohl’s have shifted their focus to opening smaller, open-air stores.

Overall, department store retailers are facing a pivotal few years. No longer propped up by government stimulus, companies must find ways to navigate an increasingly difficult economic environment. Attracting new customers will be vital. The strong attempts to shift away from traditional indoor malls and will likely continue over the next few years.

Grading Department Store Retail Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

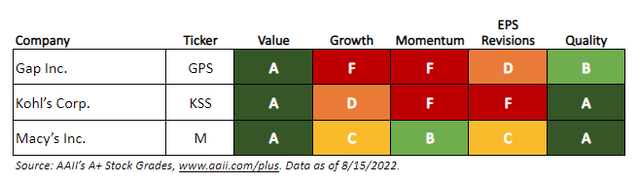

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three retail stocks—Gap, Kohl’s, and Macy’s—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Department Store Retail Stocks

American Association of Individual Investors

What the A+ Stock Grades Reveal

Gap, Inc. (GPS) is a specialty apparel company offering clothing, accessories and personal care products for women, men and children under the Old Navy, Gap, Banana Republic and Athleta brands. The company is an omnichannel retailer, with sales to customers both in stores and online, through company-operated and franchise stores, company-owned websites and third parties. It designs, develops, markets, and sells a range of apparel, footwear and accessories products reflecting a mix of basics and fashion items. It has company-operated stores in the U.S., Canada, Japan, Italy, China, Taiwan, and Mexico. It also has franchise agreements with unaffiliated franchisees to operate its stores throughout Asia, Europe, Latin America, the Middle East and Africa. Gap’s omnichannel services, including curbside pickup, buy online pickup in store, order-in-store, find-in-store, and ship-from-store are tailored across its collection of brands.

The company has a Value Grade of A, based on its Value Score of 7, which is considered deep value. Lower scores indicate a more attractive stock for value investors and, thus, a higher grade.

Gap’s Value Score ranking is based on several traditional valuation metrics. The company has a score of 9 for shareholder yield, 6 for the price-to-sales ratio and 48 for the price-to-book ratio (remember, the lower the score the better for value). The company has a shareholder yield of 7.2%, a price-to-sales ratio of 0.24 and a 1.61 price-to-book ratio.

The Value Grade is the percentile rank of the average of the percentile ranks of the valuation metrics mentioned above, along with the price-to-free-cash-flow ratio and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

Earnings estimate revisions offer an indication of how analysts view the short-term prospects of a firm. For example, Gap has an Earnings Estimate Revisions Grade of D, which is negative. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Gap reported a negative earnings surprise for first-quarter 2022 of 238.5%, and in the prior quarter reported a positive earnings surprise of 85.8%. Over the last month, the consensus earnings estimate for the second quarter of 2022 has increased from a loss of $0.032 to a loss of $0.054 per share due to 15 downward revisions. Over the last three months, the consensus earnings estimate for full-year 2022 has decreased 58.7% from $0.046 to $0.019 per share based on 15 downward revisions.

The company has a Quality Grade of B, based on its Quality Score of 71. Gap has a score of 87 for change in total liabilities to assets, 85 for gross income to assets and 83 for buyback yield. The company has a change in total liabilities to assets of negative 8.1%, gross income to assets of 49.8% and a buyback yield of 1.6%. The high scores are partially offset by a low return on invested capital (ROIC) of 0.6% and low return on assets (ROA) of negative 0.6%. In addition, Gap has a Growth Grade of F based on poor quarterly year-over-year earnings growth of negative 201.5% and a quarterly year-over-year operating cash flow growth rate of negative 206.5%.

Kohl’s Corp. (KSS) is an operator of department stores. The company operates approximately 1,165 stores, and www.kohls.com. Its Kohl’s stores and website sell private and national brand apparel, footwear, accessories, beauty, and home products. Its Kohl’s stores carry a merchandise assortment with differences attributable to local preferences, store size and Sephora. The company’s website includes merchandise available in its stores as well as merchandise only available online. Its merchandise mix includes both national brands and private brands that are available at Kohl’s. Its private portfolio includes various brands, such as Apt. 9, Croft & Barrow, Jumping Beans, SO and Sonoma Goods for Life, and brands that are developed and marketed through agreements with national brands, such as Food Network, LC Lauren Conrad, Nine West, and Simply Vera Wang.

Kohl’s has a Momentum Grade of F, based on its Momentum Score of 20. This means that it ranks poorly in terms of its weighted relative strength over the last four quarters. This score is derived from an above-average relative price strength of negative 5.8% in the second-most-recent quarter, 3.8% in the third-most-recent quarter and 2.1% in the fourth-most-recent quarter, offset by a below-average relative price strength of negative 37.4% in the most-recent quarter. The scores are 8, 44, 79 and 65 sequentially from the most recent quarter. The weighted four-quarter relative price strength is negative 14.9%, which translates to a score of 20. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weighting of 20%.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades over the period from 1998 through 2019.

Kohl’s has a Quality Grade of A with a score of 90. The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets, return on invested capital, gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

The company ranks strongly in terms of its F-Score and buyback yield. Kohl’s has an F-Score of 7 and a buyback yield of 17.5%. The sector median F-Score and buyback yield are 4 and negative 0.3%, respectively. The F-Score is a number between zero and nine that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity, and operating efficiency of a company. However, Kohl’s ranks poorly in terms of its return on invested capital, in the 28th percentile.

The company has a Value Grade of A, based on its Value Score of 2, which is in the deep value range. This is derived from a very low price-to-sales ratio of 0.22 and a high shareholder yield of 23.6%, while the sector median shareholder yield is 0.0%. In addition, Kohl’s has a Growth Grade of D based on weak quarterly year-over-year operating cash flow growth of negative 265.5% and a weak five-year sales growth rate of negative 0.3%.

Macy’s, Inc. (M) is an omnichannel retail company operating stores, websites, and mobile applications under three brands: Macy’s, Bloomingdale’s and Bluemercury. The company sells a range of merchandise, including apparel and accessories (men’s, women’s, and kids), cosmetics, home furnishings and other consumer goods. Its subsidiaries provide various support functions to its retail operations. Its bank subsidiary, FDS Bank, provides collections, customer service and credit marketing services in respect of all credit card accounts that are owned either by Department Stores National Bank, a subsidiary of Citibank N.A. Macy’s Systems and Technology Inc., a wholly owned subsidiary of the company, provides operational electronic data processing and management information services. Its subsidiaries Macy’s Merchandising Group Inc. and Macy’s Merchandising Group International LLC are engaged in the design and development of Macy’s private label brands and certain licensed brands.

Macy’s has a Quality Grade of A with a score of 99. The company ranks strongly in terms of its buyback yield, change in total liabilities to assets and F-Score. Macy’s has a buyback yield of 9.0%, a change in total liabilities to assets of negative 10.1% and an F-Score of 8. The industry average change in total liabilities to assets is 2.4%, significantly worse than Macy’s. Macy’s ranks above the industry median for all other Quality metrics.

Macy’s has a Momentum Grade of B, based on its Momentum Score of 70. This means that it is above average in terms of its weighted relative strength over the last four quarters. This score is derived from a relative price strength of negative 15.3% in the most-recent quarter, negative 3.3% in the second-most-recent quarter, negative 15.3% in the third-most-recent quarter and 56.1% in the fourth-most-recent quarter. The scores are 25, 49, 42 and 97 sequentially from the most recent quarter. The weighted four-quarter relative price strength is 1.4%, which translates to a score of 70.

Macy’s reported a positive earnings surprise for first-quarter 2022 of 31.1%, and in the prior quarter reported a positive earnings surprise of 22.8%. Over the last month, the consensus earnings estimate for the second quarter of 2022 has decreased from $0.876 to $0.862 per share due to four downward revisions. Over the last month, the consensus earnings estimate for full-year 2022 has decreased 2.0% from $4.642 to $4.550 per share, based on one upward and six downward revisions.

The company has a Value Grade of A, based on its Value Score of 2, which is considered to be deep value. This is derived from a very low price-to-sales ratio of 0.22 and a low price-earnings ratio of 3.8, which rank in the fifth and sixth percentile, respectively. Macy’s has a Growth Grade of C based on a score of 53. The company has strong quarterly year-over-year earnings growth of 204.1%. However, this is offset by a low five-year sales growth rate of negative 0.4%.

____

The stocks meeting the criteria of the approach do not represent a recommended” or “buy” list. It is important to perform due diligence.

Be the first to comment