JHVEPhoto

In a lot of ways, the tech boom of the past few years closely echoed the dot-com run-up. And now it appears that we’re in the equivalent of the 2001 bust for tech stocks. Layoffs abound and everyone is slashing guidance and trying to reduce expenditures. It’s rough times out there for the former high-fliers.

Yet, amid the wreckage of the latest tech bubble, there must be some bargains that will come out stronger over the next few years. What’s the Amazon (AMZN) of the 2022 tech bear market?

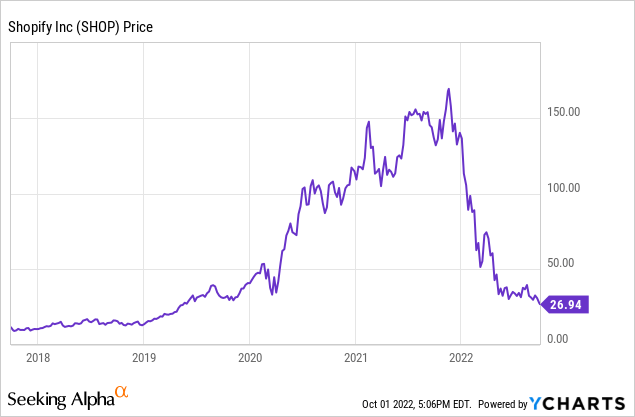

At first glance, Shopify (NYSE:NYSE:SHOP) might seem like an appealing answer. It is an e-commerce player, and it has an increasingly broad platform of services that span various parts of the online shopping ecosystem. And the stock has certainly gotten hammered over the past year:

So is it time to pile into SHOP stock and enjoy the rebound when e-commerce momentum picks back up?

Not so fast. It is my belief that Shopify more resembles a CMGI, Lucent, Nortel, or AOL of that era. That is to say a company whose stock price peak had no relation whatsoever to the business’ underlying fundamentals. And one whose operations never subsequently came close to recapturing the enthusiasm seen at the bubble’s peak.

That is to say that if Shopify were just another random e-commerce company going public today, most people likely wouldn’t give it a second thought. The “buy the dip” appeal here is, in my opinion, primarily because the stock went up to $150 (split-adjusted) in the first place and is now giving folks the illusion of a discount given the large drop from the prior high. Look closer, however, and there’s nothing to indicate any intermediate-term turnaround for Shopify’s outlook.

Shopify: Earnings Are Weak And Getting Weaker

Like many online commerce companies, Shopify enjoyed a tremendous tailwind during 2020 and 2021 as people were stuck at home. It wasn’t just that general boost though; Shopify benefitted on both sides of the demand equation.

Given the specifics of Shopify’s platform, it saw a particular surge in growth as people couldn’t operate physical storefronts and had to turn to digital alternatives to keep revenue coming in. Entrepreneurship in general also rose as people had more time on their hands and a desire to find alternative income streams.

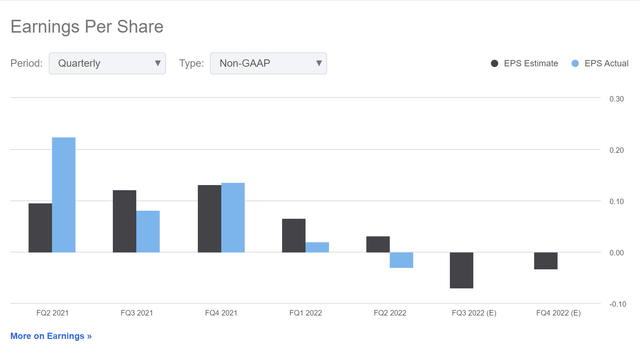

Conditions were ideal for Shopify and it was able to turn that into a brief burst of profitability, at least on a non-GAAP basis. As the above chart shows, however, Shopify’s earnings peaked in Q2 of 2021 and have now tipped back into outright loss-making:

Shopify EPS (Seeking Alpha)

Analysts currently see Shopify bottoming out around the end of this year and returning ever so slightly to profitability in 2023:

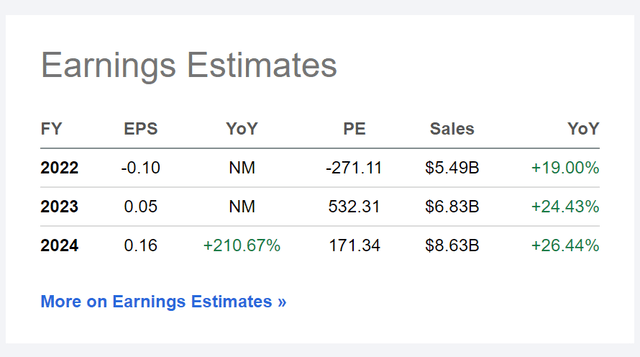

Shopify Earnings Estimates (Seeking Alpha)

Still, this is not a cheery outlook. Based on the current analyst forecasts, Shopify will earn just 5 cents per share in 2023 and 16 cents per share in 2024.

At those levels of earnings, Shopify would be trading at 532 times ’23 earnings and 171 times ’24 earnings. This still seems to be a bubble valuation for a company whose revenue growth has come down to below 20% per year going forward.

Sure SHOP stock is down 80% off the highs. And buying a stock at 532x projected forward earnings is slightly better than buying at a 2,000x forward P/E ratio last year. But both are still suboptimal financial decisions.

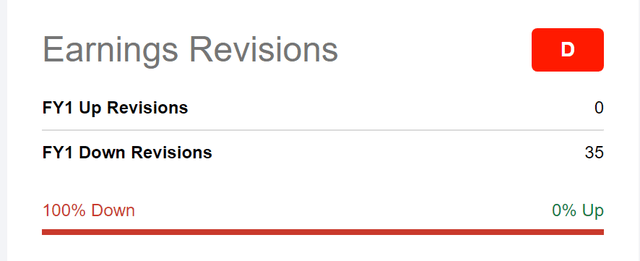

Unfortunately, there’s more bad news. The 2023 and 2024 analyst consensus shown above is likely too optimistic. We can see that because, out of the last 35 earnings revisions we’ve seen for Shopify, all 35 have been to the downside with not even a single analyst taking the view that things are improving:

Shopify earnings revisions (Seeking Alpha)

In other words, analysts are still in the process of revising down their outlook for Shopify. And with the economy slowing, inflation surging, and Shopify showing difficult controlling its costs, don’t be surprised if Shopify ends up losing money outright in 2023 and quite possibly 2024 as well.

The Worst Metric Of All

Bulls may dismiss any talk of earnings as premature. Shopify is (or was until recently anyway) a growth company, after all, and thus some people might not care if the company earns money anytime soon or not.

Even leaving profits aside, there is something that even the bulls will be hard-pressed to explain away.

That is looking at Shopify’s gross profit as compared to its R&D + Sales and marketing expenses. Thus, we’re only talking about costs related to attracting new clients and improving the platform. This calculation doesn’t include general overhead, interest, taxes, losses on bad transactions and so. Just R&D + marketing spend versus gross profit.

In Q2 of 2021, Shopify earned a total gross profit of $621 million. Against that, it had $385 million of R&D + sales and marketing expenses, leaving almost $250 million to the good to take care of Shopify’s other costs.

In Q2 of 2022, the picture dramatically darkened. Gross profit rose a paltry 6% to $656 million. Meanwhile, R&D and sales and marketing expenses absolutely exploded to $673 million. This left Shopify running at a loss even before getting to basic overhead, taxes, and other such matters.

Needless to say, when you increase your sales and marketing budget 62% year-over-year and R&D expenses surge soar 89%, it’s utterly inexplicable and unacceptable to get a mere 6% increase in gross profits as a result in my opinion. This is some of the worst unit economic growth I’ve seen at a major technology company, and that’s saying a lot in the year 2022.

What happens when a company has a seemingly unlimited budget for sales and marketing but fails to generate any operating traction with said spending? Massive shareholder value destruction often ensues.

I used a similar line of reasoning when labeling Peloton (PTON) a sell this spring at $21/share. At the time, I wrote that:

Peloton’s cost base is way too high relative to its gross profits, putting management in a difficult position as it navigates industry headwinds.

Some people suggested I was beating a dead horse with a negative opinion on Peloton stock after it was down from the triple digits to $21/share. Surely the stock was a bargain since it had already crashed.

And yet, fast forward a few months and Peloton shares are now down to $7. And, as I predicted, the company’s terrible unit economics have forced Peloton to dramatically slash costs and overhaul its entire business model. Peloton has gone from a slowing growth story to a struggling to stay afloat story rather quickly.

Shopify faces a similar, albeit not quite as dire, situation. Its gross profit is surprisingly small and yet management has been spending with seemingly no limits for years. If the top-line grew fast enough, perhaps this carefree spending wouldn’t matter. But now, the tech industry downturn is here and Shopify is spending far in excess of what its business results would warrant. Look for dramatic overhauls and belt-tightening at Shopify over the next year, as the current fiscal path is unsustainable.

At the beginning of this year, analysts were projecting that Shopify would produce roughly $12 billion of revenues in fiscal year 2024. Fast forward and this forecast is down to just $8.6 billion today. As fellow author Trapping Value rightly noted, Shopify’s sales forecasts were way too high and are still being slashed.

Trapping Value predicts Shopify will earn just $6.2 billion in 2024 revenues. I believe projections will continue to come down toward that figure as the company continues to struggle operationally. Shopify has spent a small fortune on sales and marketing and appears to have gotten virtually nothing to show for it over the past year. When times get tight, marketing budgets come down, and that will further slow Shopify’s already slumping growth rate.

What Would Change My Opinion?

My biggest concern with Shopify is the worsening economics of the business, namely how its costs are growing far more quickly than its gross profit.

There are two ways this problem could be resolved. One, Shopify could figure out a way to reignite top-line revenue growth and/or achieve higher gross margins on its existing revenues. I believe this will be difficult given the headwinds to e-commerce at the moment and the general macroeconomic picture. But if I’m wrong and Shopify can execute despite these challenges, it would disprove my thesis and cause me to become more upbeat about the company’s outlook.

The other possibility is that Shopify cuts expenses dramatically without significantly harming revenue growth. It’s possible that the company has a lot of excess spending that could be trimmed without affecting the firm’s core functions. If it can rightsize spending without disrupting its growth trajectory, that would greatly alleviate my concerns around its financial outlook.

SHOP Stock Verdict

A stock that was in a bubble isn’t necessarily cheap just because it has declined 80%. Shopify was only marginally profitable in 2021 during the best possible economic conditions for its business model. It has now fallen back into unprofitability as its additional spending greatly outpaces its revenue growth.

I believe the next shoe to drop will be the company slashing sales and R&D spend to limit its operating losses. This, in turn, will further hit the company’s operational momentum. With no profitability to fall back on, the valuation has a lot further left to come in.

If Shopify drops to three times sales, which is hardly unthinkable in the current market environment, SHOP stock has another 55% left to decline from here. As the old adage goes, a stock that is down 90% is one that was down 80% and then gets cut in half again.

Be the first to comment