Sundry Photography

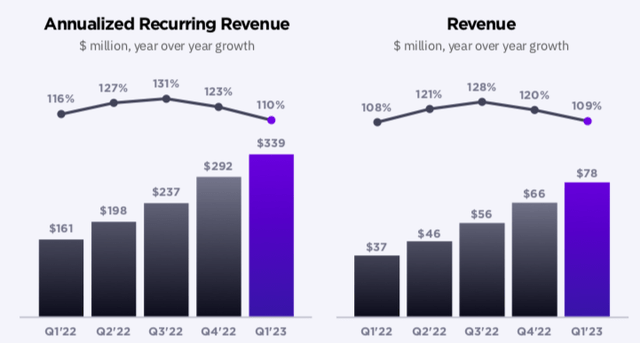

SentinelOne (NYSE:S), a cybersecurity company focusing on AI-powered prevention, detection, response, and hunting, recently reported a strong start to the year with revenue growing 109% yoy and beating consensus by almost 5%. On top of that, annualized recurring revenue, which is a great indicator of future revenue growth, grew 110% yoy to $339 million.

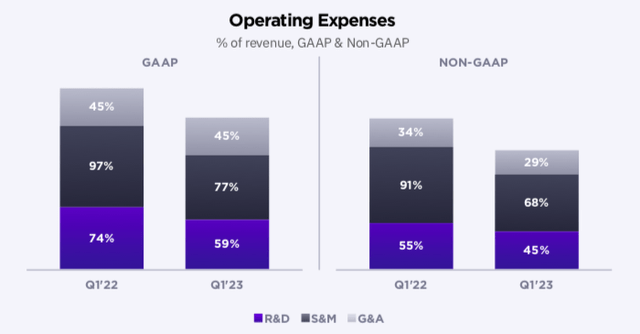

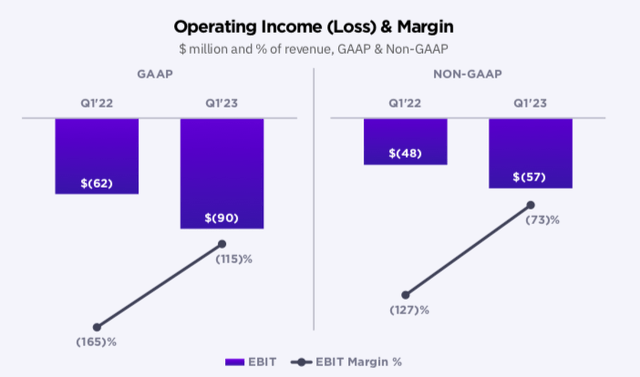

However, the company’s continued non-GAAP operating losses have weighed on the stock as many investors have rotated to more recession-proof companies given heightened fears around potential macro slowdown. With non-GAAP profitability still likely several years away, it’s no surprise this stock has been weak.

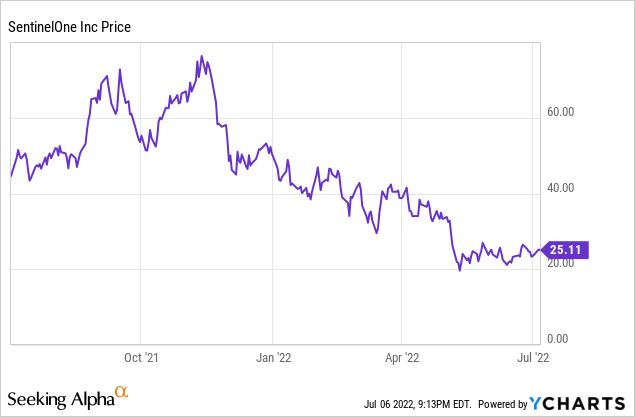

The stock down almost 50% year-to-date and despite a small 10% recovery in recent weeks, I believe valuation is still at risk. Yes, revenue growing over 100% is very healthy in any environment, but the combination of high stock-based compensation and lack of non-GAAP operating profitability far outweigh the strong top line trends.

Even when looking at a Rule of 40 score, management is guiding to right around that 40 level, and that’s including their revenue growth assumption of 97-99% yoy. Clearly, profitability is a longer-term focus for the company.

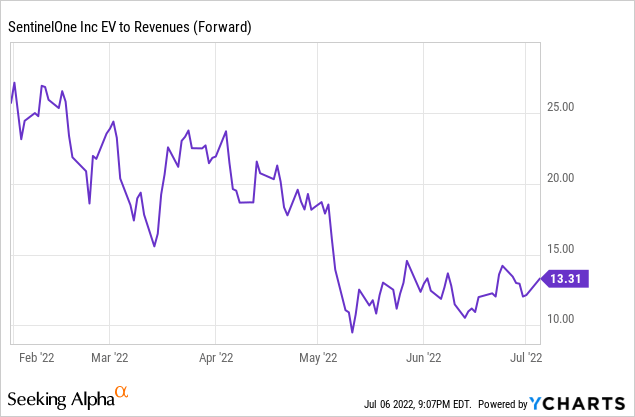

For now, I remain sidelines given valuation still is over 13x 2023 revenue and with sentiment pushing towards more profitable companies, I wouldn’t be surprised to see the stock weak over the coming months and quarters.

Financial Review and Guidance

During the company’s Q1, revenue grew 109% yoy to $78.3 million, which was above expectations for $75 million. On top of that, annualized recurring revenue grew an impressive 110% yoy to $339 million, which typically is a great leading indicator of future revenue growth.

Not surprisingly, non-GAAP gross margins continued to expand, coming in at 68% during the quarter, up from 53% in the year-ago period and up from 66% last quarter. Over time, non-GAAP gross margins have the potential to continue to expand higher as the company’s asset-light operating model typically leads to higher margins. In addition, the highly recurring revenue streams makes gross margin profitability a little more predictable.

From a profitability standpoint, operating expenses of $141 million were almost double that of revenue, meaning there is a long way to go before we actually see any profits. In fact, the company recorded $30 million of stock-based compensation during the quarter, or almost 50% of their total revenue.

While non-GAAP operating margin loss did improve to -73% during the quarter, the significant expense base makes it difficult to forecast profitability in the near-term. In a market where investors have turned their focus towards more stable, recession-proof companies, fast-growth tech companies with “uncontrolled” expenses creates an unfavorable sentiment headwind.

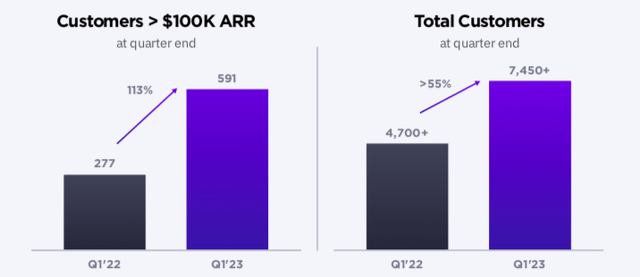

So what’s driving this significant growth? For starters, the company grew their total customer count by >55% yoy to 7,450 total customers. More specifically, SentinelOne has done a great job penetrating their larger customer base, with 591 customers generating >$100k of annual recurring revenue at the end of Q1, up from 277 customers in the year-ago period, representing 113% yoy growth.

The company has talked about their success winning with larger enterprises, strategic channel partners, and seeing customers increase module adoption.

We secured a number of marquee customer wins during the quarter, including a large federal agency, a mission critical communication enterprise, one of the most iconic news and media brands in the world, and several high profile cloud security footprints. Our total customer count grew by more than 55% year-over-year, exceeding 7,450 in our fiscal first quarter, as we continued to secure both large enterprises and medium-sized businesses.

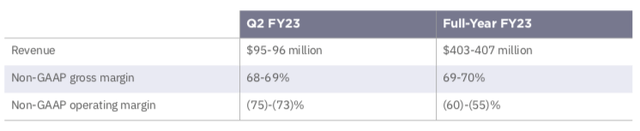

For Q2, the company is expecting revenue of $95-96 million, which reflects 107-110% yoy growth and is quite impressive. However, non-GAAP operating margins are expected to remain around negative -73-75%, similar to Q1.

For the full-year 2023, revenue is expected to be $403-407 million, or 97-99% yoy growth. While this does mean revenue growth is expected to decelerate throughout the year, it’s difficult to argue that doubling revenue in one year is a bad result.

However, non-GAAP operating margins are expected to be negative -55-60%, which does mean the company expects profitability to improve in Q3 and Q4. Yes, increased scale does help the company’s operating expense base, but even at these levels, the company is right around the coveted Rule of 40 level.

Valuation

Even with the stock pulling back almost 50% so far this year, valuation is not quite at the point where it’s viewed as attractive. Over the past several months, we have seen many fast-growth companies with high valuations pullback, and SentinelOne has not been immune.

The company has a current market cap of $7.0 billion and with net cash of $1.6 billion, enterprise value current sits at ~$5.4 billion.

Using the company 2023 revenue guidance of $403-407 million, this implies a 2023 revenue multiple just over 13x. To extrapolate that a little further, if revenue were to double again in 2024, which seems pretty bullish, we could see 2024 revenue of ~$800 million, implying a 2024 revenue multiple of under 7x.

While 7x revenue may not screen as aggressive relative to other fast-growth technology companies, let’s not forget that SentinelOne is many quarters (if not years) away from achieving breakeven profitability. Even for companies with 20%+ revenue growth and 20%+ margins, a 6x revenue multiple is still a little aggressive.

Yes, the backdrop of IT security spending remains very healthy, with management recently noting a positive macro environment.

Cyber security is a top priority for enterprise IT spending – a must-buy for the modern enterprise. The persistence of geopolitical tensions and potential for cyberwarfare is a concern shared by all of us. Risks and consequences of not being protected by a leading security solution are just too high. We’re encouraged by the broad-based demand across geographies, products, and customers. We delivered healthy growth across all geographies, including in EMEA – a testament to the resilience and durability of cybersecurity during all economic conditions.

However, valuation remains the biggest risk factor and until the company is able to significantly improve their profitability, and possibly clean up their stock-based compensation payments, I remain sidelined on this name.

Be the first to comment