Bet_Noire

Introduction

Following a very strong rally during May and early June, the last month was brutal for the shareholders of Crescent Point Energy (NYSE:CPG) with their share price down around 40%, as investors began worrying about the possibility of a recession on the horizon. Even though their dividends have already reached their highest point in more than five years with a moderate yield of circa 4.00% depending upon exchange rates, when looking ahead, excitingly there are reasons to expect that higher dividends are coming, recession or not.

Executive Summary & Ratings

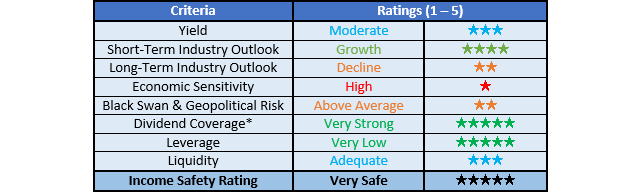

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

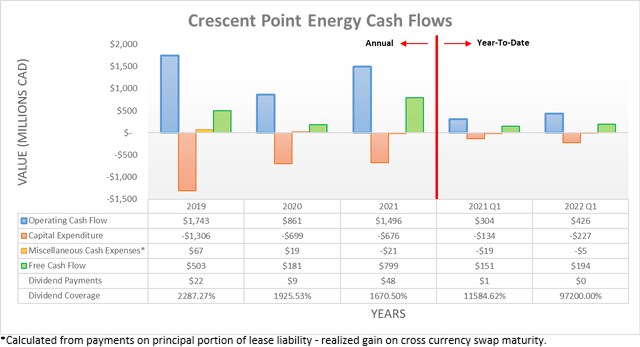

After seeing their cash flow performance suffer throughout 2020, similarly to every other oil and gas company, they enjoyed a recovery during 2021 with their operating cash flow almost doubling year-on-year from C$861m to C$1.496b respectively. Unsurprisingly, the booming oil and gas prices of 2022 following the Russia-Ukraine war have seen further gains with their operating cash flow during the first quarter increasing a very impressive 40.13% year-on-year from C$304m to C$426m respectively. This does not tell the entire story as this comparison was skewed unfavorably by temporary working capital movements, which if removed see their underlying operating cash flow for the first quarter of 2021 dropping slightly to C$268m, whilst their equivalent result for the first quarter of 2022 increases significantly to C$550m, thereby representing an increase of slightly more than 100% year-on-year. If this working capital build of C$124m during the first quarter of 2022 is also removed down the line from their free cash flow of C$194m, their underlying free cash flow would have been C$318m and thus ample to execute their capital allocation strategy, as the graphs included below display.

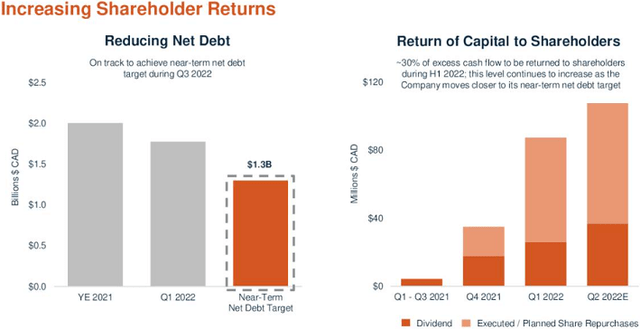

Crescent Point Energy May 2022 Corporate Presentation

It can be seen that management intends to ramp up their shareholder returns relatively higher as they deleverage with their near-term net debt target of C$1.3b quickly approaching, as subsequently discussed. Thankfully these were not merely empty words with management increasing their shareholder returns from 30% of their free cash flow to 50% whilst I was preparing this article, which also included their quarterly dividends being increased by circa 23% to C$0.08 per share.

This now marks the fourth consecutive double-digit increase and when looking ahead, shareholders still have reasons to expect higher dividends are coming. Their latest update also issued guidance for C$775m of free cash flow during the second half of 2022, which annualizes to C$1.55b, helped by their hedges rolling off, as per slide twenty-one of their May 2022 corporate presentation. Future oil and gas prices remain uncertain but given they are still trading around $100 per barrel even after the recent sell-off over recession fears, the evident and widely discussed tightness of supply should at least remain supportive during the remainder of 2022, if not longer. Given their latest outstanding share count of 572,649,763, their new dividends will only cost a mere C$183.2m per annum, thereby well below this free cash flow guidance. Whilst this already leaves ample scope for further dividend growth, they are also aggressively reducing their outstanding share count through share buybacks that aim to repurchase 10% of their float by early 2023, which puts further upwards pressure on their dividends as costs trend lower.

Given the recent fears of a recession putting an end to these booming oil and gas prices, I feel it especially prudent to consider the outlook for shareholders under middle-of-the-road operating conditions with 2021 providing a suitable basis. Whilst the year ended very strong with oil prices trading for over $80 per barrel, it started weak with them trading for less than $50 per barrel and thus in my eyes, averages to a reasonable basis. Despite seeing realized commodity hedge losses of C$347.5m during 2021 as the rally took them by surprise, they still produced operating cash flow of C$799m, which would have been C$1.147b if not for their hedges.

If they continue with a 50/50 split across shareholder returns and deleveraging, this free cash flow would see a shareholder yield of between circa high 8% and very high 12% on current cost given their market capitalization of approximately C$4.8b. Whilst this would already see desirable shareholder returns even without the booming oil and gas prices of 2022, when considering their financial position and the intention of management to ramp up their shareholder returns relatively higher as they deleverage, their shareholders could actually see even higher returns in 2023 and beyond.

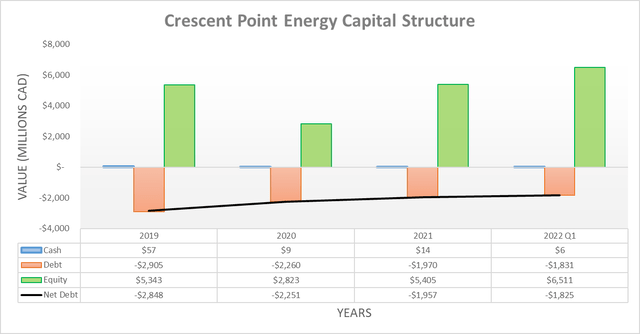

Despite their operating cash flow being held back by a sizeable working capital build during the first quarter of 2022, they still saw their net debt continue its downwards path to land at C$1.825b, which represents a solid decrease of C$132m or 6.75% versus its previous level of C$1.957b at the end of 2021. If not for their working capital build of C$124m, they would have seen a near twice as large decrease, which bodes very well to see materially lower net debt following their soon-to-be-released results for the second quarter of 2022, quite possibly down to between circa C$1.5b to C$1.6b.

When looking ahead into the second half of 2022, their guidance for C$775m of free cash flow and accompanying 50/50 split across shareholder returns and deleveraging should see their net debt ending the year at between circa C$1.1b and C$1.2b. This would easily surpass their near-term net debt target of C$1.3b and given their intention to keep ramping up their shareholder returns as they deleverage, it makes relatively higher shareholder returns likely in 2023 and beyond.

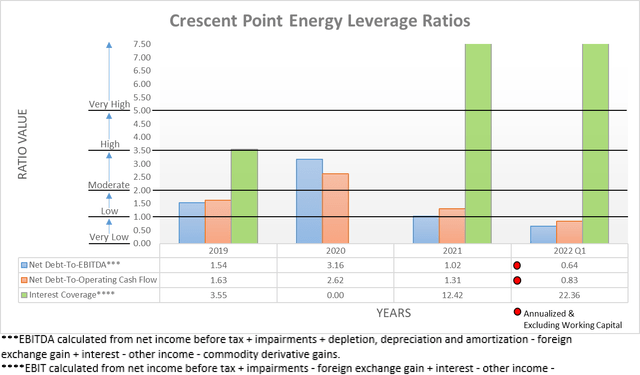

The combination of lower net debt and stronger financial performance has been a very powerful force for deleveraging, which now sees their net debt-to-EBITDA and net debt-to-operating cash flow down to only 0.64 and 0.83 respectively. Apart from both sitting beneath the threshold of 1.00 for the very low territory, they are also likely to continue trending lower as their net debt plunges throughout the remainder of 2022. This means that even if oil and gas prices soften on the back of weaker economic conditions, their leverage will remain relatively lower than otherwise would have been the case, which not only increases their medium to long-term fiscal stability but also increases their ability to safely push their dividends and share buybacks relatively higher in 2023 and beyond, recession or not.

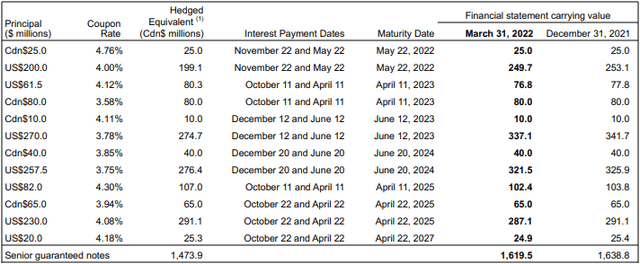

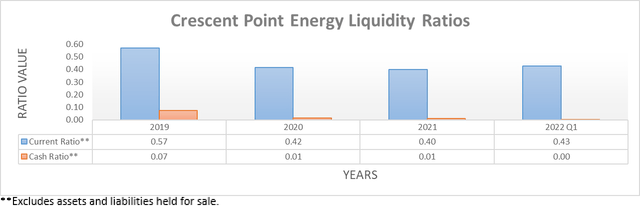

On the surface, their liquidity initially appears rather alarming with only a weak current ratio of 0.43 well below the more preferable adequate range of 0.70 to 1.00, especially given their cash ratio of 0.00 that arises from their virtually non-existent cash balance of only C$6m. Thankfully they have C$2.086b of availability remaining under their credit facilities and whilst these are not as good dollar-for-dollar as cash, considering their ample free cash flow and continued deleveraging, they are still sufficient to keep their liquidity adequate. Since these credit facilities do not mature until November 2025, they can help assist as required to repay and refinance their steady wave of debt maturities in the interim, thereby supporting their shareholder returns, as the table included below displays.

Crescent Point Energy First Quarter Of 2022 Results Announcement

Conclusion

When it comes to income investing, three big-ticket items often shed light on where a company is likely to take their dividends in the foreseeable future. Thankfully all three of these indicate that higher dividends are coming with very strong coverage supporting the consistent will of management to continue rewarding their shareholders and their steady deleveraging reducing demand for their free cash flow elsewhere. Even though oil and gas prices may soften during 2023 if these recession fears transpire, their lower net debt should see relatively more free cash flow directed towards shareholders. When combined with the minimal cost to fund their current dividend payments, higher dividends are coming, recession or not. Since this should see a very high double-digit shareholder yield on current cost even if operating conditions soften back to their middle-of-the-road level during 2021, I believe that assigning a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Crescent Point Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment